- Bitcoin bulls defied bearish odds, triggering a short-squeeze.

- However, the surge lacked momentum, leaving room for the next “dip” to spark renewed hope.

As a seasoned analyst with over two decades of market experience under my belt, I have witnessed numerous market cycles and trends. The recent Bitcoin rally defying bearish odds is reminiscent of the 2017 bull run, albeit with a twist – a short-squeeze-driven surge that left many long positions unscathed.

Bitcoin [BTC] kicked off the second week of September with bullish momentum, defying bearish expectations and closing above $57K. However, the rally was short-lived, with BTC trading at $56,407 at the time of writing.

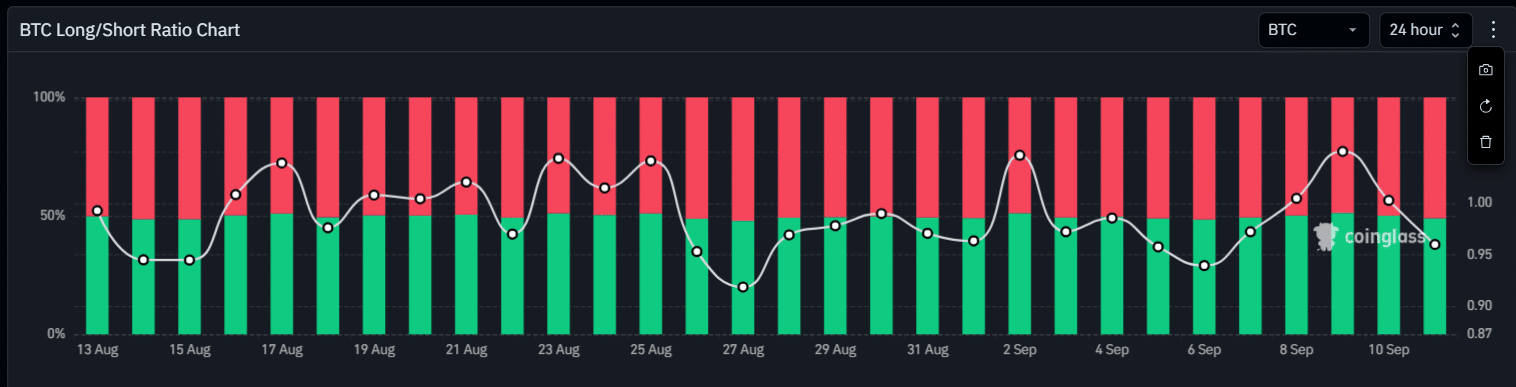

It’s interesting to note that the decrease in price occurred after an increase in long positions, fueling discussions about a potential short squeeze frenzy.

As anticipated, longs outperformed shorts, remaining confident in an impending reversal.

Furthermore, an increase in investors taking long positions on Futures contracts corresponds with the price increase. To illustrate, during the August rally peaking at $64K, a dominant trend of long positions was observed, effectively limiting short positions.

Consequently, the price-to-$60K ratio has shown increased volatility, maintaining a steady state below this level. The $56K mark now serves as a significant support. Should market bearishness increase, the potential for a recovery could weaken.

LTH confidence alone may not suffice

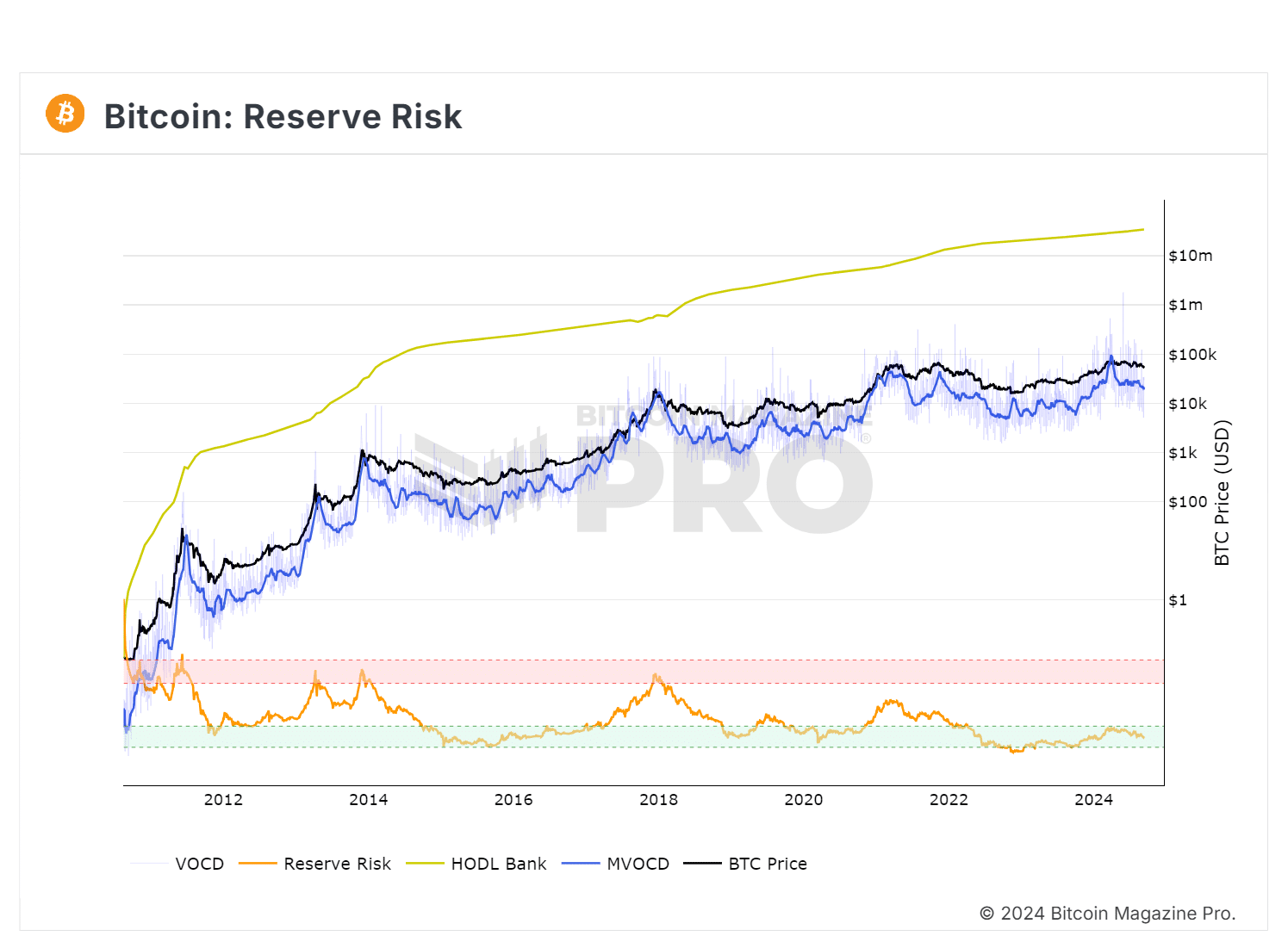

It seems that long-term investors, compared to the current price of Bitcoin, appear quite optimistic. Historically, investing during periods when the market is showing growth (often referred to as the ‘green zone’) has tended to bring higher than average returns.

In addition, when confidence is strong and the price is low, investing in Bitcoin becomes particularly appealing due to its promising risk-to-reward ratio.

As a crypto investor, I keep an eye on long-term holder (LTH) activity to get a sense of the market’s mood. When the mood appears optimistic, it can draw in even more traders.

Regardless of the low confidence demonstrated by short-term holders, as indicated by the $850 million Bitcoin sell-off, supports AMBCrypto’s comparison to a short squeeze scenario.

In short, with the market slipping into high fear, where is the price likely to settle?

Identifying BTC’s price bottom

Previously discussed, maintaining the $56K mark is vital. Keeping a close eye on this point will help us predict Bitcoin’s future movement.

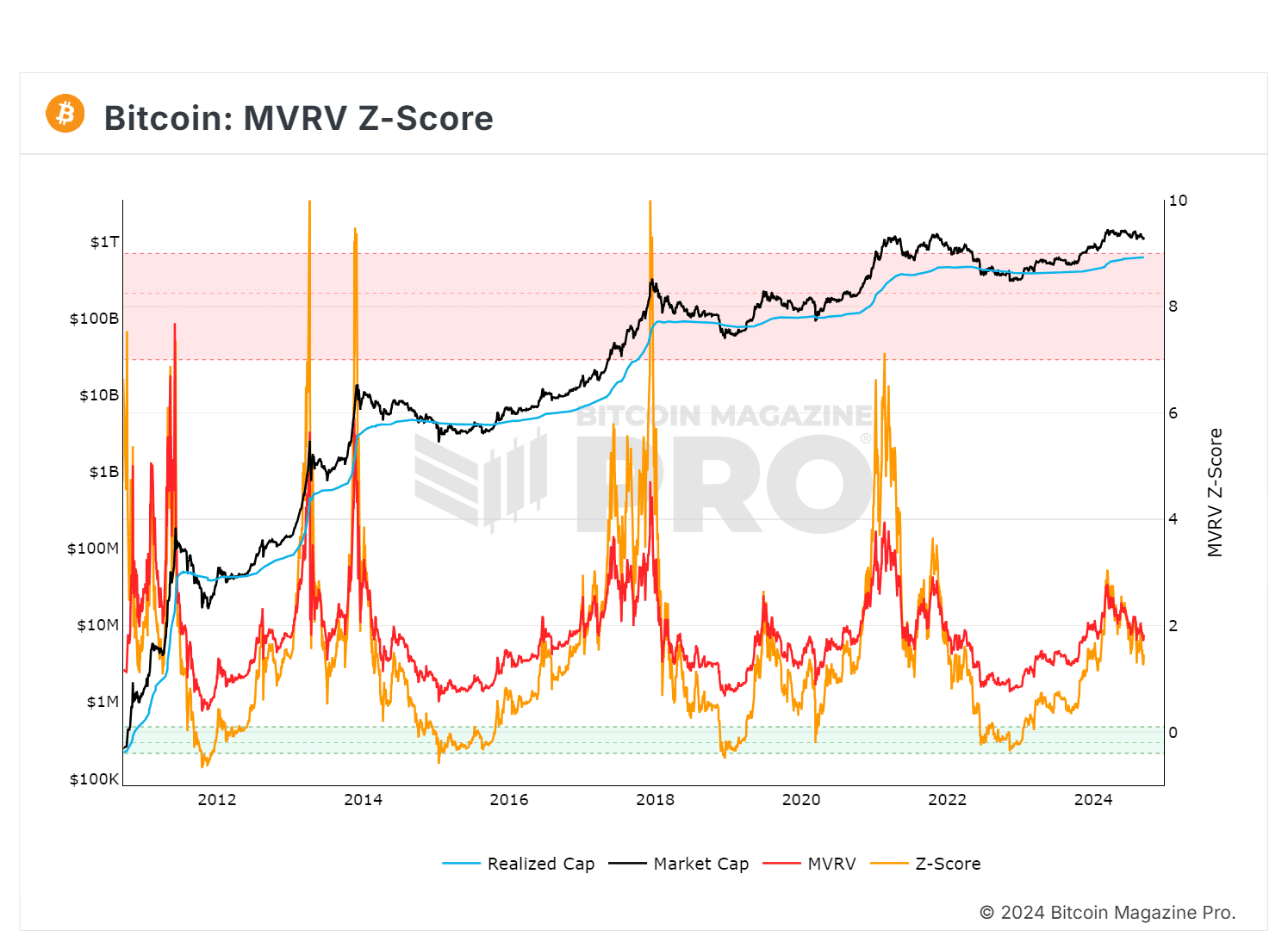

An MVRV ratio of 1.8 shows Bitcoin’s market value is 1.8x its realized value, indicating average holder profit. If realized, this could create selling pressure.

In other words, it seems highly improbable that the market will peak unless a reduction in interest rates by the Federal Reserve significantly devalues the U.S. Dollar Index, thereby triggering a strong upward trend (bullish momentum).

In simpler terms, if the market value drops below its true worth (realized value), it might indicate that sellers are giving up (capitulation) and paving the way for the next phase or cycle.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Based on AMBCrypto’s analysis, Bitcoin might drop down to approximately $40,000 before possibly recovering, as it requires a bearish decline first to set up a potential rebound.

Without this, consolidation could continue.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-11 19:03