-

Binance to launch BNB restaking, but will it be enough to curb the TVL’s gradual decline?

A recap of BNB chain’s network performance and how it reflected on BNB demand.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by Binance Chain’s latest move to introduce BNB restaking. Having witnessed the ebb and flow of the market, I can’t help but wonder if this could be the game-changer Binance needs to halt the gradual decline in TVL.

As a researcher, I’ve observed that Binance Coin (BNB), the native token of BNB Chain, has recently dipped, potentially setting the stage for another upward trend within its mid-to long term trajectory. Yet, it’s crucial that it gathers and sustains bullish momentum to ensure a successful ascent.

The recent announcement showcases a shift that could generate immediate forward thrust. Moreover, it might gather sufficient force to propel beyond its present boundaries.

The network recently announced plans to introduce BNB restaking.

Restaking BNB implies that holders who have already staked their BNB in decentralized finance (DeFi) platforms can further stake their existing tokens to earn additional rewards. This action could potentially motivate more users to participate in BNB staking.

As a result, we may witness a surge in TVL in the coming months.

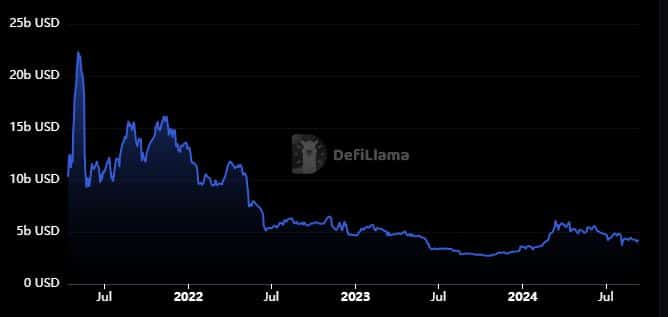

Since March, the total value locked (TVL) on the BNB Chain has been steadily decreasing. At the current moment, it stands at approximately $4.215 billion.

Restaking on BNB could be the recent strategy by BNB Chain to slow down the withdrawal of Total Value Locked (TVL). At its peak during the March rally, the network boasted a TVL of approximately $5.8 billion.

Over the past few months, my own confidence in the crypto market has been dwindling along with the general sentiment. The market’s condition, as I’ve observed, has been facing a significant loss of trust.

As a researcher examining Binance Smart Chain (BNB), I posit that enabling BNB re-staking could facilitate the TVL’s (Total Value Locked) recovery process. Furthermore, such a move might motivate increased BNB accumulation among users, thereby potentially boosting the cryptocurrency’s growth trajectory.

These outcomes would particularly be pronounced if the overall crypto market condition improves.

BNB chain transaction count reflects…

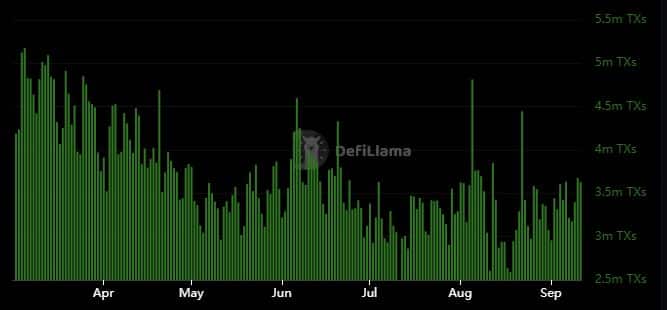

In simpler terms, it seems that Binance Coin (BNB) has seen a decrease in its natural, on-chain usage over the past five months, likely due to the overall market cooling off during this period.

It’s clear that there was a significant decrease in the number of transactions on the BSC network from March to August.

BSC has, so far, registered a significant uptick in network transactions from August lows.

On the 18th of August, daily on-chain transactions dipped to approximately 2.59 million, but they’ve since rebounded and are now over 3 million as we speak.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

At the moment of reporting, Binance Coin (BNB) was traded at approximately $512, showing a deceleration in its previously strong upward trend.

Before the Relative Strength Index (RSI) managed to climb above the 50% mark, it became evident that the initial bullish push showed signs of weakness, suggesting a somewhat shaky start.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-12 03:03