-

DOT struggles to secure bullish momentum and we explore why.

Polkadot dominance slides to 12-month lows but fee-paying transactions underscore life signs.

As a seasoned analyst with years of experience in the cryptocurrency market, I have seen bull runs and bear markets come and go. The current state of Polkadot [DOT] is particularly intriguing, given its struggle to secure bullish momentum.

Over the past five months, the value of Polkadot (DOT) has been steadily declining. Despite several optimistic efforts and indications that the buyers might regain control, the price trend has continued to drop instead.

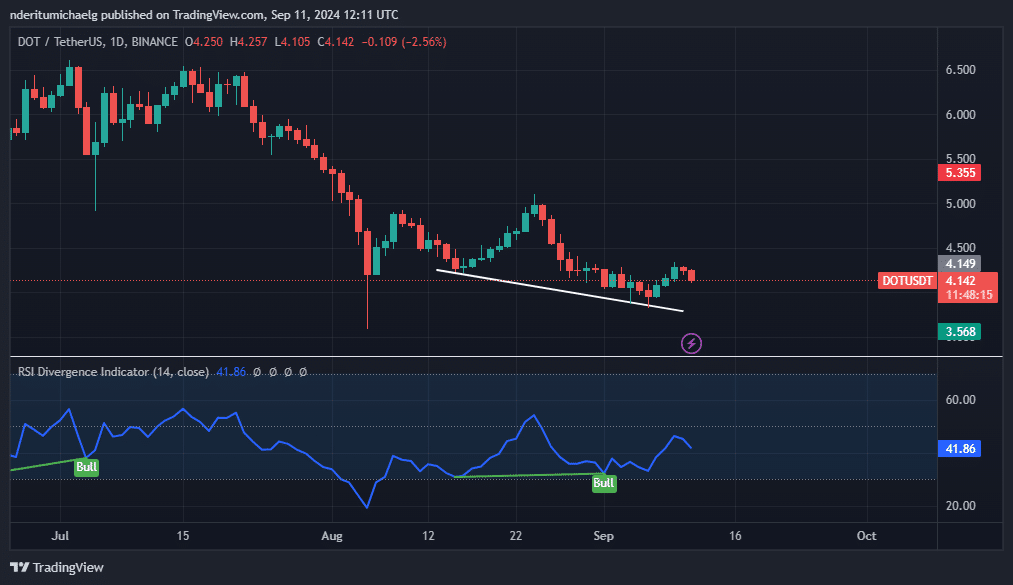

At the moment of reporting, DOT was being traded at $4.14, representing approximately a 27% price increase compared to its peak in August. Notably, the digital currency started this week with optimistic forecasts following a series of bullish RSI divergences observed over the past few weeks.

Despite the latest upward movement of DOT, it’s premature to make a definitive assessment. However, this week, DOT seems to be grappling with the same issue due to relatively low demand for the cryptocurrency, which has hindered its ability to recover from its recent upswing.

Why DOT has been struggling to find a bullish footing

In simpler terms, many successful cryptocurrencies are in line with significant stories that have dominated recently. Regrettably, the Polkadot network didn’t benefit from this movement. This shift in liquidity has led it to move elsewhere instead.

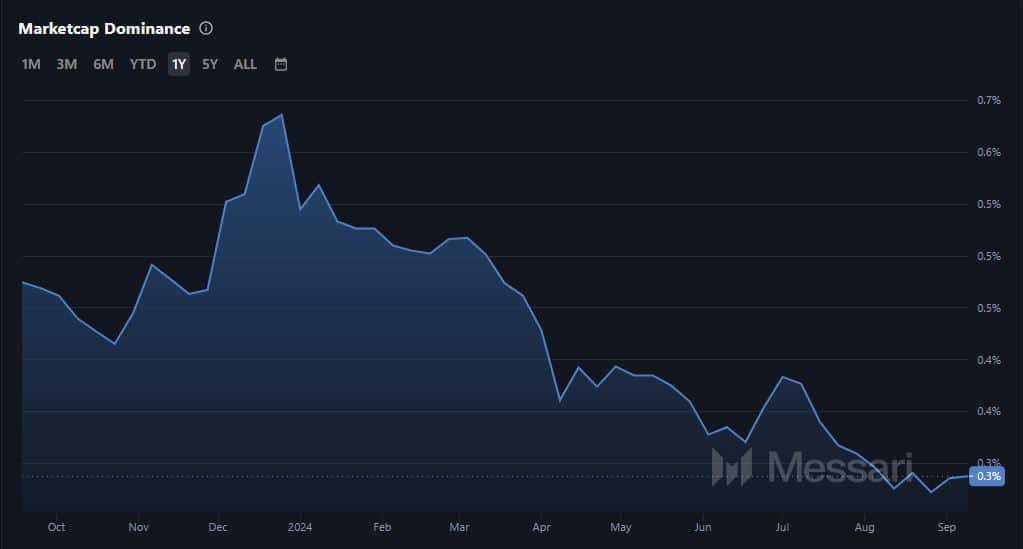

The above explanation coincides with Polkadot’s dominance performance. For example, the network demonstrated a surge in dominance between October and December last year.

During this period, the market saw a strong surge in prices (price rally). Since then, Polkadot’s dominance has significantly decreased from 0.63% to 0%.

At the close of August, Polkadot’s influence reached a low point of 0.27%. This decline corresponds to the noticeable drop in the value trend associated with DOT, and it was similarly reflected in the network’s overall performance.

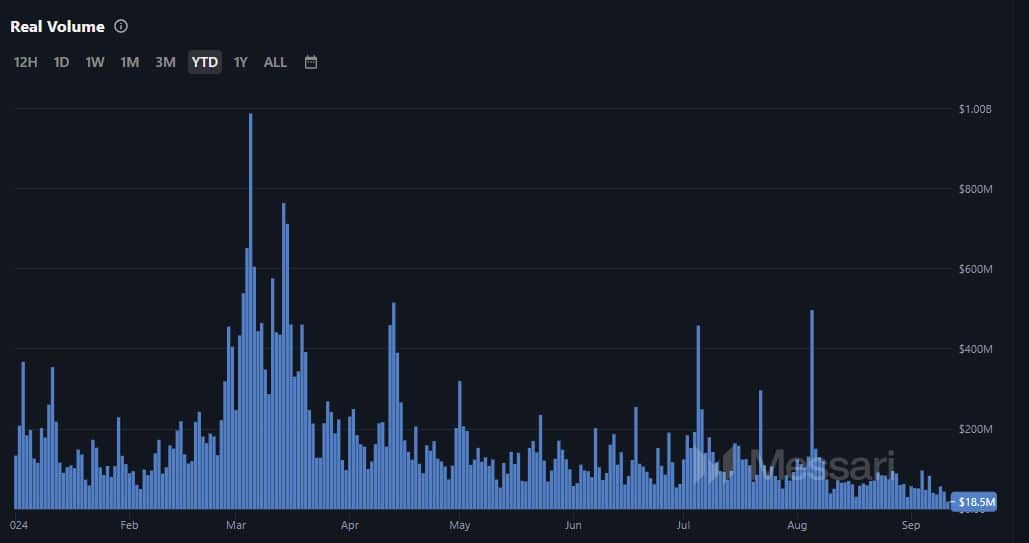

In a setting where liquidity is decreasing and accessing stories becomes challenging, this situation in turn affects the amount of transactions occurring on the blockchain.

This year, the maximum 12-month trading volume recorded on Polkadot’s blockchain occurred in March. The highest real trading volume reached an impressive $988.1 million.

Over the past few days, Polkadot’s daily trading volume has been kept under the $50 million mark, indicating a potential decrease in the network’s activity. This downturn in usage over the last couple of months seems to have had an impact on DOT as well.

Will there be redemption for Polkadot and DOT?

Despite the prevailing negative circumstances, there’s a silver lining to be found in the Polkadot ecosystem. This year, it has shown a fair amount of activity. Notably, the network announced that the number of transactions running on Polkadot rollups has more than doubled over the past 12 months.

Read Polkadot [DOT] Price Prediction 2024-2025

Currently, the value of DOT is approaching the low points it reached in October 2023. Notably, a significant surge in demand was observed around these levels, triggering a robust rally that culminated in March.

Investors may see this as an opportunity to jump in at discounted prices.

Read More

2024-09-12 08:07