-

SUI was leading the crypto market recovery with a 16% rise in 24 hours.

High market interest could see SUI break out of an ascending triangle pattern as open interest reached a five-month high.

As an experienced crypto investor with a knack for spotting promising altcoins, I find myself intrigued by the current surge of SUI Network [SUI]. With a 16% rise in just 24 hours, it’s hard not to take notice! The high market interest is palpable, and the open interest reaching a five-month high suggests that we could be witnessing a significant breakout from an ascending triangle pattern.

As an analyst, I observed a resurgence in the cryptocurrency market on Thursday. Pushing past the $58,000 mark, Bitcoin [BTC] was propelled higher due to traders’ reactions to the news of moderating US inflation. Notably, Sui Network [SUI] spearheaded the rally, surging by 16% and trading at $1.03 at the moment of writing.

SUI’s gains came amid high market interest in the altcoin. Data from CoinMarketCap showed that trading volumes have soared by 53% as of press time.

SUI’s bullish breakout

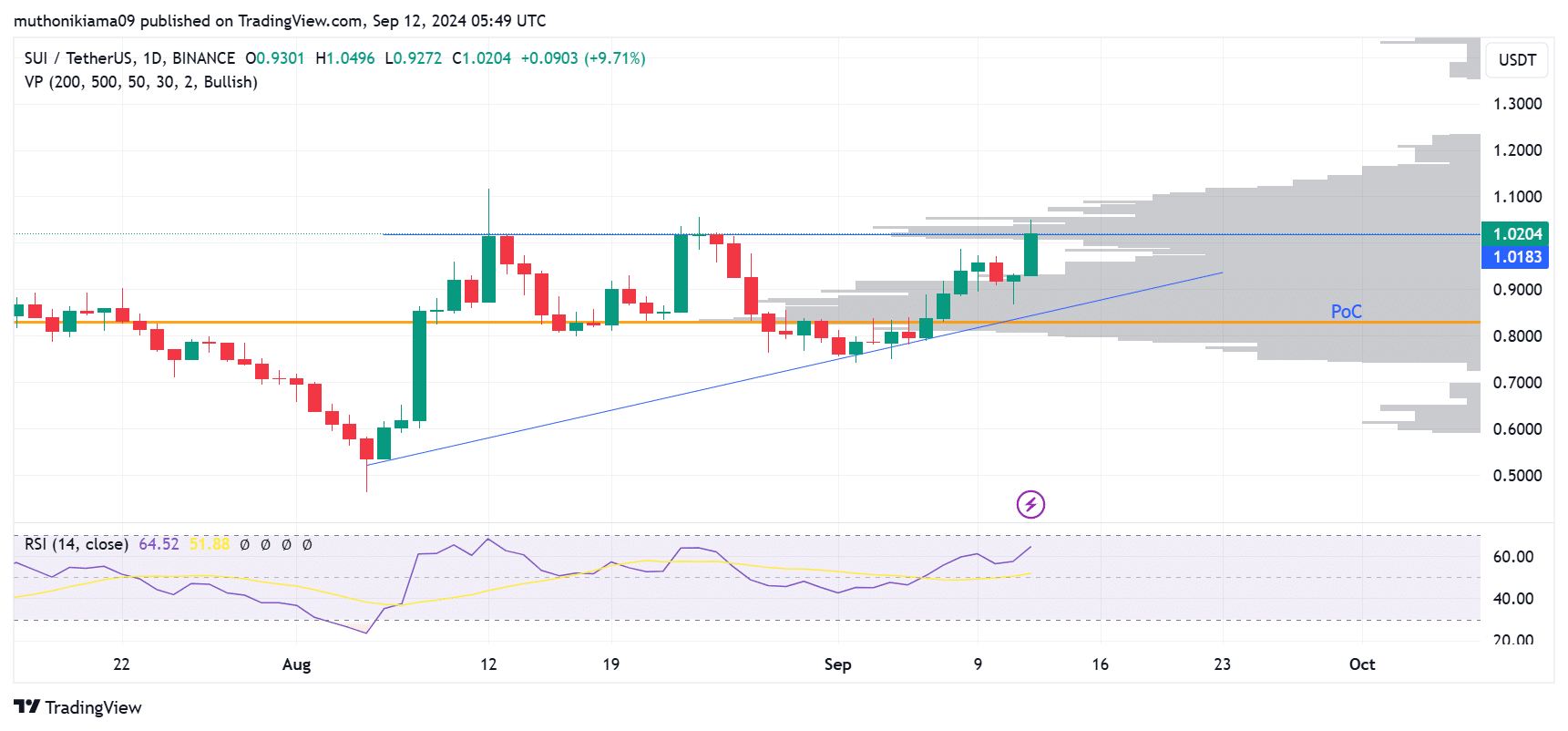

The increase in SUI trading activity occurred when its price reached the highest point of an upward sloping triangle shape observed on the daily chart.

The Volume Profile Indicator demonstrates a concentration of trading activity occurring at the price point where the breakout took place, which coincidentally is a significant level of resistance. This implies that investors are ready to purchase SUI above its market value, showcasing their belief in the continuation of the uptrend.

The price of SUI was additionally higher than the Point of Control (POC) line, reinforcing the bullish argument since buyers are in control within this price range.

In simpler terms, even though many buyers have come in, the Stock Under Investment (SUI) isn’t yet overly bought based on the Relative Strength Index reading of 64. This suggests that there may still be potential for more growth.

At the price point of $1.17, the current upward trend may encounter possible resistance due to reduced trader activity in that area. The data suggests that fewer traders are grouped around this price level, potentially leading to a period of sideways movement or consolidation.

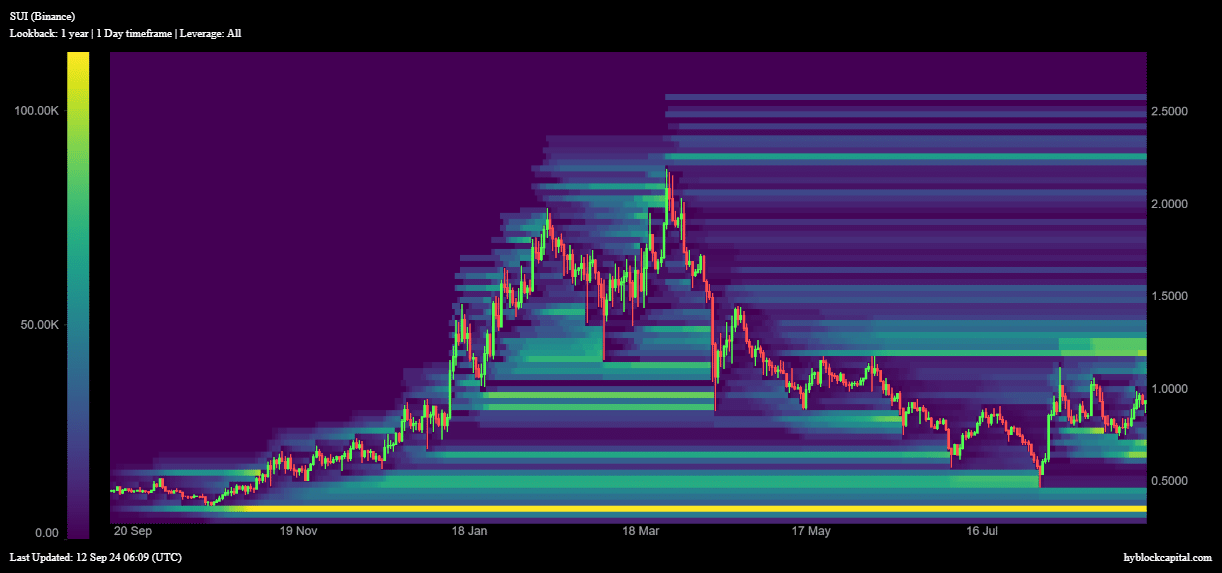

Individually, the figure of $1.17 served as a formidable resistance, as per data from Hyblock Capital, it demonstrated a surge in liquidation orders at this point. Should SUI reach this price range, the upward trend might lose strength unless the purchasing drive maintains its force.

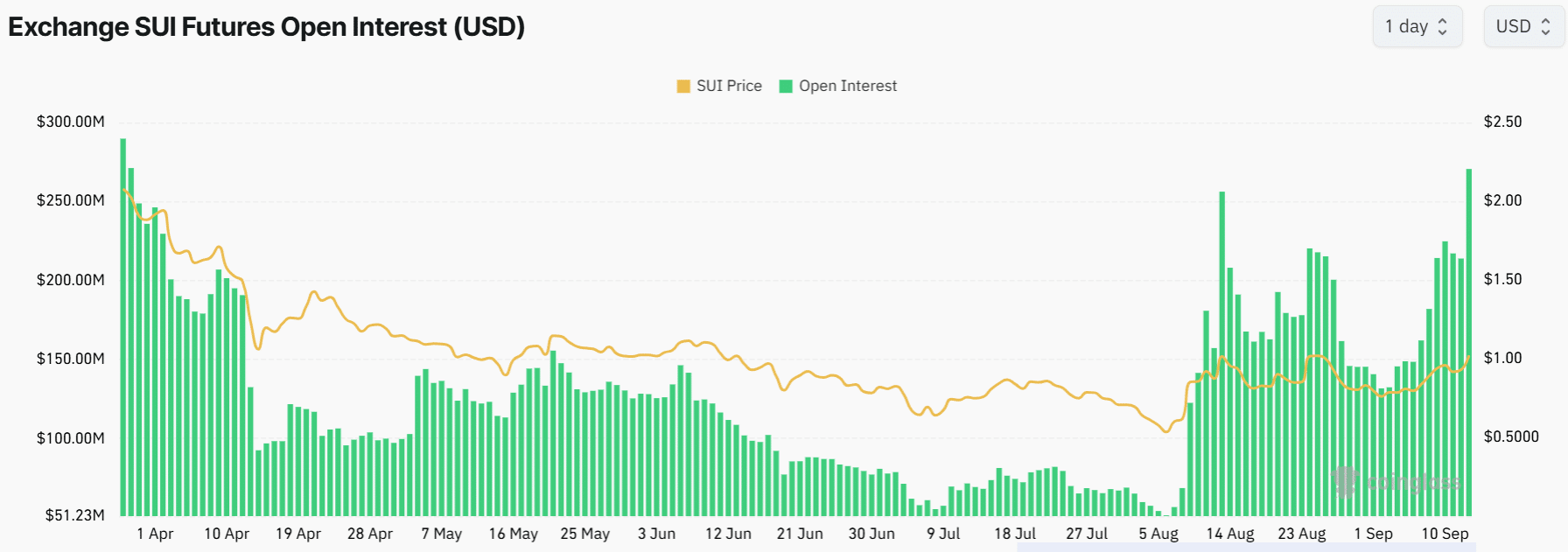

Open interest hits highest level since March

There’s been a surge of attention in the derivatives market for SUI, as indicated by data from Coinglass. In just 24 hours, open interest increased by over 30%, going from $217 million to $270 million as of now.

right now, SUI‘s open interest stands at its peak in the past five months. This suggests a rising trust among traders in the ongoing upward trend, as they are increasingly establishing fresh positions.

Realistic or not, here’s SUI market cap in BTC’s terms

If funding rates become positive, it means that traders are generally taking on more long positions in SUI. This trend indicates a growing bullish attitude towards the token, suggesting further price increases may be expected.

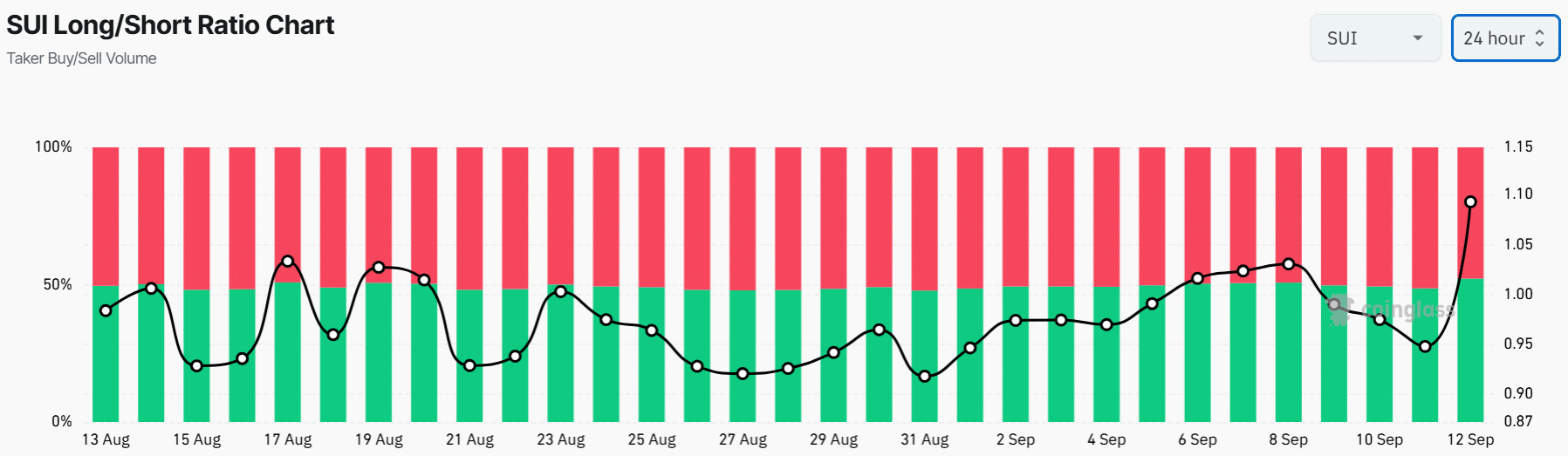

Additionally, the long/short ratio has spiked to its peak in recent weeks, suggesting that an increased number of traders are wagering on an upward trend in prices.

Read More

2024-09-12 15:37