- TIA has seen a 7.6% price increase over the past week, with analysts predicting a breakout at $4.6.

- Open interest and development activity show positive trends, suggesting further bullish potential for the token.

As a seasoned researcher with years of experience analyzing digital assets, I find myself intrigued by TIA’s recent performance and the mixed signals it presents. The token’s 7.6% price increase over the past week is undeniably impressive, especially considering that it has climbed another 7.4% in the last 24 hours to a current price of $4.32.

The token known as TIA, which is native to the Celestia network – a modular data storage system designed for blockchain deployment – has recently sparked interest due to its shifting price trends. Celestia’s objective is to streamline the process of launching blockchains, thereby making the technology easier and more approachable for developers, enhancing its overall usability.

In the last seven days, the value of TIA has significantly grown by approximately 7.6%, and this upward momentum persisted over the previous 24 hours. During that period, the token experienced an additional surge of 7.4% to reach a current price point of $4.32 at the moment this information was compiled.

Break above this key level spells further surge

Despite this upward momentum, prominent crypto analyst Micheal Van De Poppe has offered a cautious perspective on TIA’s price action.

On platform X, Van De Poppe recently shared his perspective that Time Is Money (TIA) might face a downward trend before it can achieve substantial growth. He pointed out this potential dip in its performance.

“TIA is going to make new lows before we can reverse. The trend remains to be downwards.”

Nevertheless, he mentioned that surpassing the $4.60 threshold might indicate a possible change in trend direction. This perspective implies that despite temporary difficulties faced by TIA, a crucial resistance level could act as a pivotal point for the token’s trajectory.

Fundamental analysis of TIA’s market performance

As a crypto investor, I find it crucial to delve into The Investor’s Advocate (TIA) token’s fundamental aspects, as per Van De Poppe’s technical analysis, to gauge if this token has the capability to surpass the $4.60 resistance barrier.

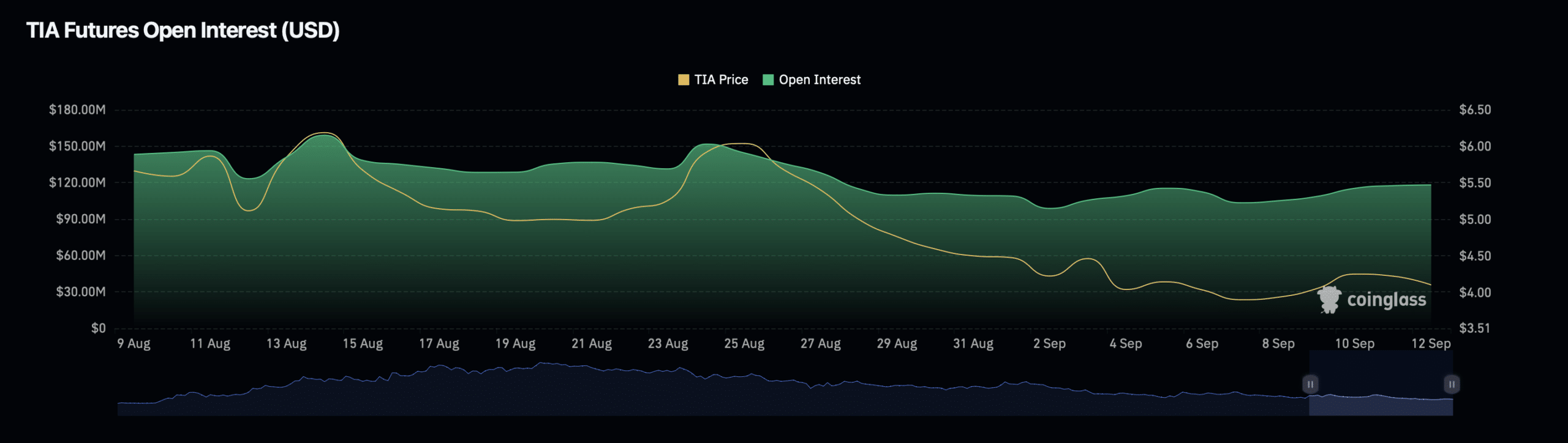

One key metric to examine is the token’s open interest, which refers to the total number of active contracts in the market. According to data from Coinglass, TIA’s open interest has increased by more than 15%, reaching a current valuation of $127.55 million.

This growth in open interest suggests that there is heightened interest in TIA among traders, which could provide the liquidity necessary to push the token’s price higher. Additionally, TIA’s open interest volume has surged by 38.84%, now standing at $249.65 million.

The rise in both open interest and trading activity suggests that a growing number of investors are getting involved with TIA, potentially leading to increased price fluctuations over the short term.

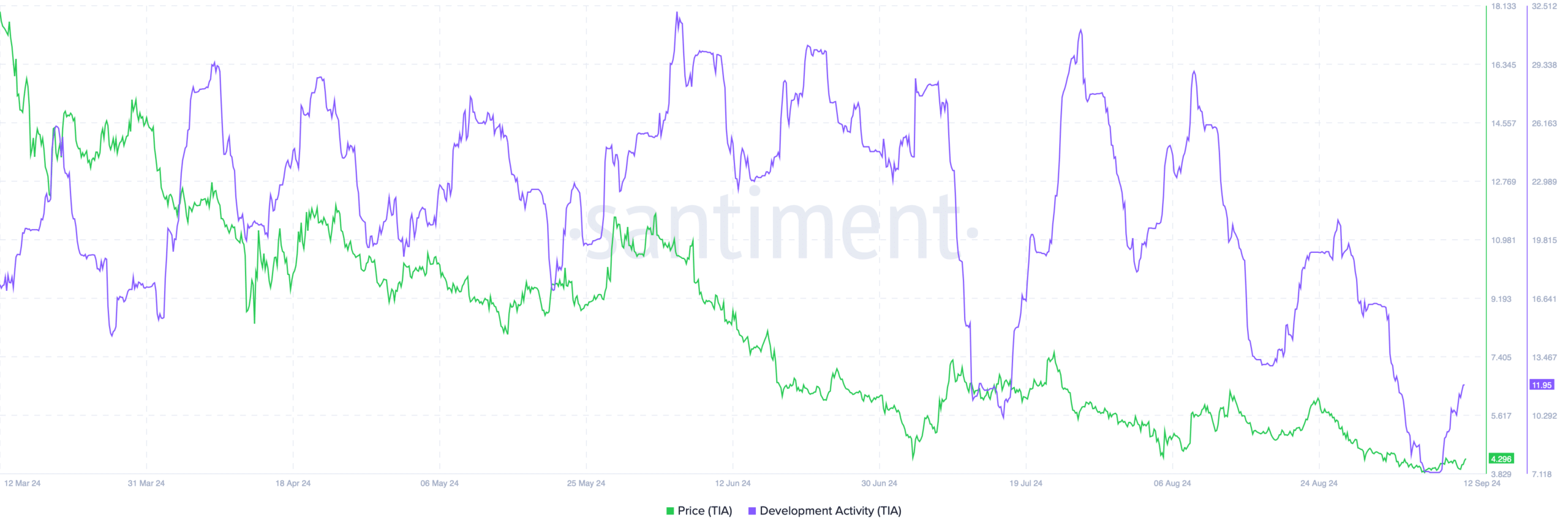

Another key factor to consider is TIA’s development activity, which can serve as an indicator of the ongoing efforts to improve the Celestia platform.

According to data from Santiment, the level of activity in TIA’s development decreased substantially in late August, falling from its highest point of 11 to 7.1 in early September.

However, this metric has recently seen a recovery, climbing to 11.95 as of today.

The surge in development work indicates that the Celestia team are busily improving their network, a move that might strengthen investor trust and possibly stimulate interest in the token, leading to increased demand.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-09-12 17:11