-

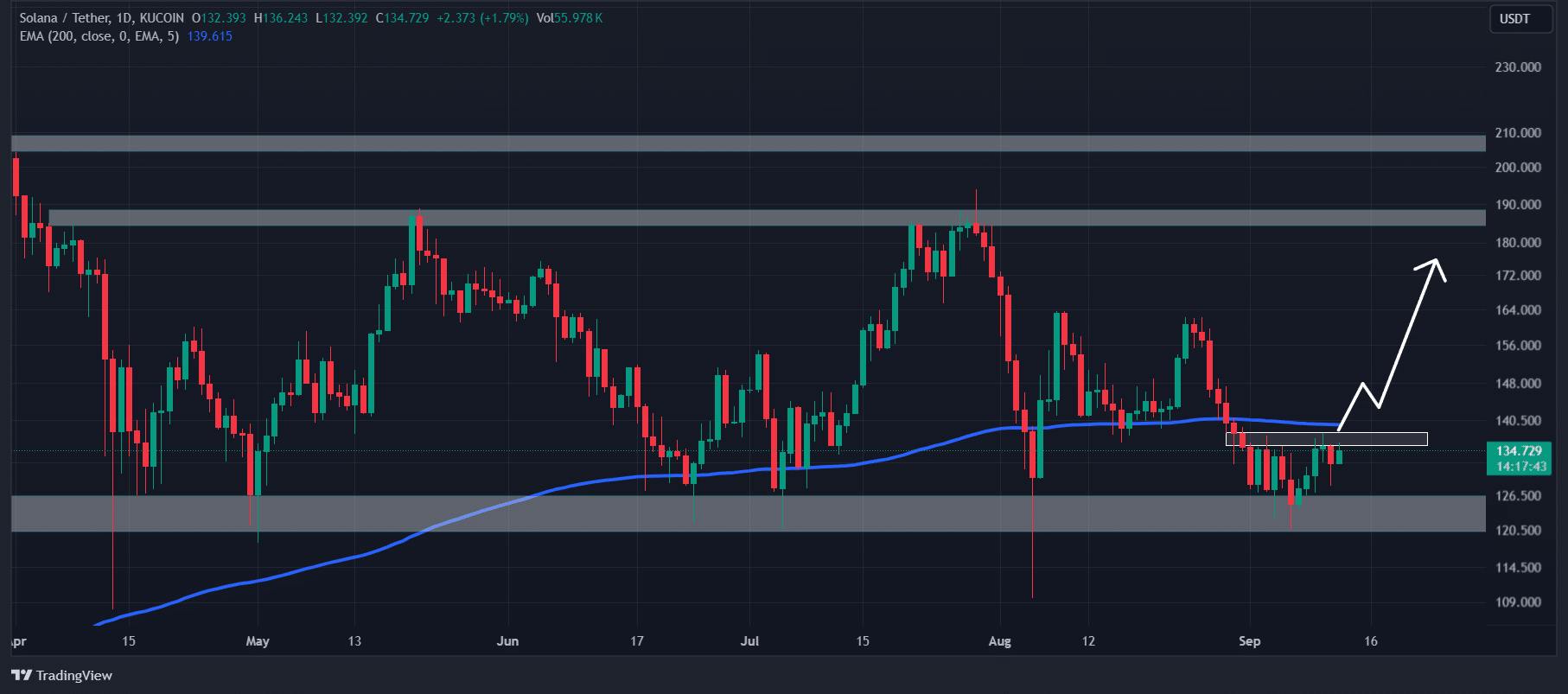

SOL appeared bullish at press time, on the verge of breaking out of the crucial level.

If SOL closes a daily candle above $138.2, it could experience a price surge of over 33% to the $185 level.

As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself intrigued by the current state of Solana (SOL). The token appears to be on the cusp of a significant breakout, with a potential price surge of over 33% if it manages to close above the crucial level of $138.2.

Despite the prevailing pessimistic outlook towards the market, many significant digital currencies seem to be bouncing back following a significant drop in their prices over the past few days.

On September 12th, the wallet address associated with FTX and Alameda, identified as “H4yiPh”, removed a substantial amount of 177,693 Solana tokens, which at that time were equivalent to approximately $23.75 million in value.

FTX/Alameda wallet unstakes SOL

According to Lookonchain’s analysis, the company has taken out significant tokens from Solana’s Proof of Stake (PoS) network. It’s quite likely that these tokens might end up on centralized exchanges at some point in the future.

The crypto community often considers unstaking as a bearish sentiment.

Typically, investors or institutions withdraw their tokens because they anticipate a price decrease or plan to sell. This action leads to heavy selling activity which can cause substantial price drops.

Current price momentum

From my perspective as a researcher, at the current moment, Solana hasn’t exhibited any immediate price changes following the recent unstaking event. As I’m writing this, Solana (SOL) is trading at $134.75, representing an increase of approximately 2.15% over the past 24 hours.

During that timeframe, I noticed a 10% surge in trading activity, suggesting that more traders are jumping into the market, even amidst the prevailing uncertainties.

Looking forward, it’s worth noting that SOL seemed optimistic in its price trends, even though it was trading below the 200 Daily Exponential Moving Average (EMA). In simpler terms, although SOL was going down according to the 200-day EMA, it showed signs of increasing value on the price charts.

Furthermore, the value of the token was nearly ready to exceed the significant resistance at $138.2. Should the token manage to surpass this threshold and conclude the day’s trading above it, there is potential for a substantial price increase of around 33%, potentially reaching the $185 mark.

If the wallet associated with FTX and Alameda transfers significant tokens to centralized exchanges (CEXes), the optimistic outlook for Solana’s daily price action might not be sustained.

SOL’s bullish on-chain data

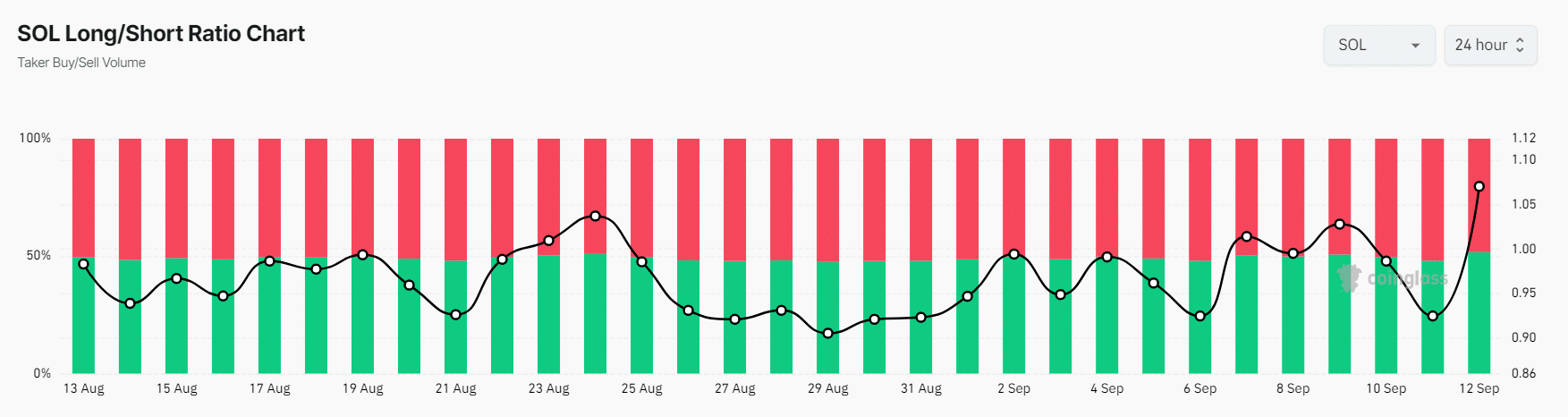

The optimistic viewpoint for Solana was reinforced by on-chain statistics. Specifically, the long/short ratio from Coinglass stood at 1.07 in the most recent update, which is the highest it’s been since early August 2024.

Additionally, 51.7% of top traders held long positions, while 48.3% held short positions.

At the same time, there was a 4% rise in open interest for SOL‘s futures contracts, indicating that traders held optimistic views and possibly expanded their long positions.

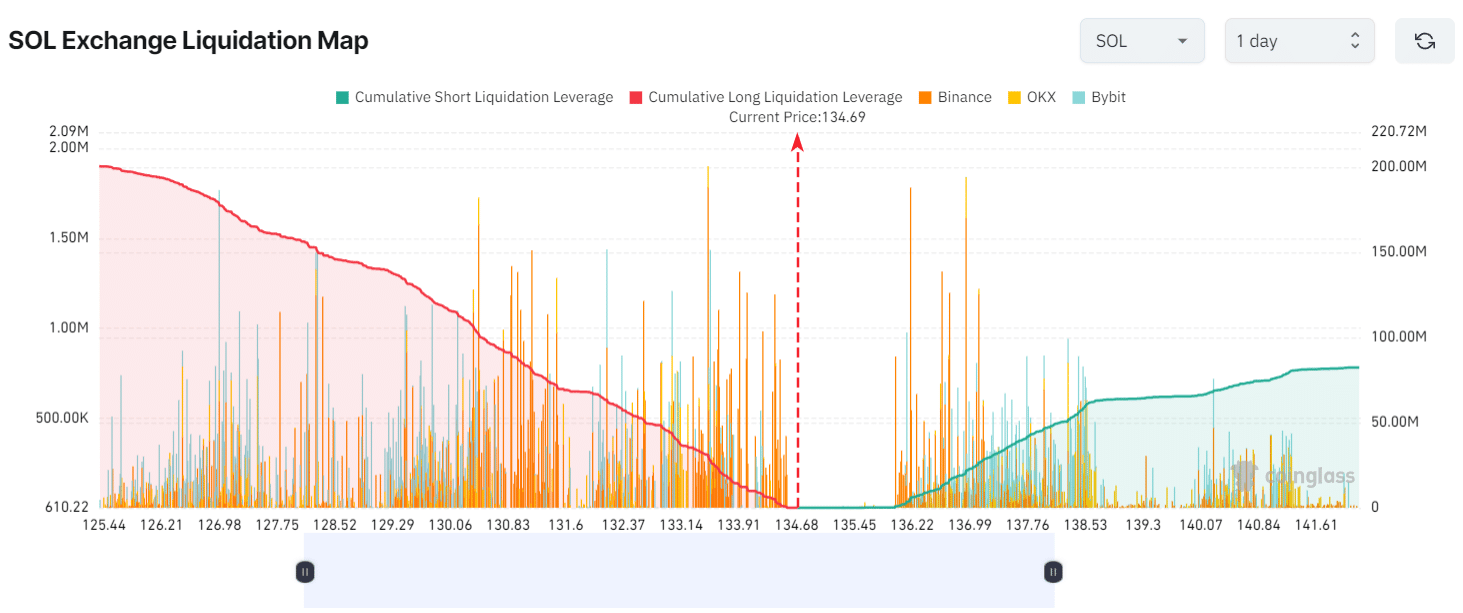

Currently, significant selling points are around the $133.5 mark on the downside and $136.95 on the upside, based on Coinglass data. Traders seem to have taken on too much leverage at these levels.

Read Solana’s [SOL] Price Prediction 2024–2025

Should the market’s overall optimism persist and Solana’s (SOL) price ascends to approximately $136.95, it could force a liquidation of around $22.03 million in short positions.

If the sentiment reverses and the price falls to around $133.5, it’s estimated that roughly $31.23 million in long positions will be closed out.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Lilo & Stitch & Mission: Impossible 8 Set to Break Major Box Office Record

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

2024-09-12 17:44