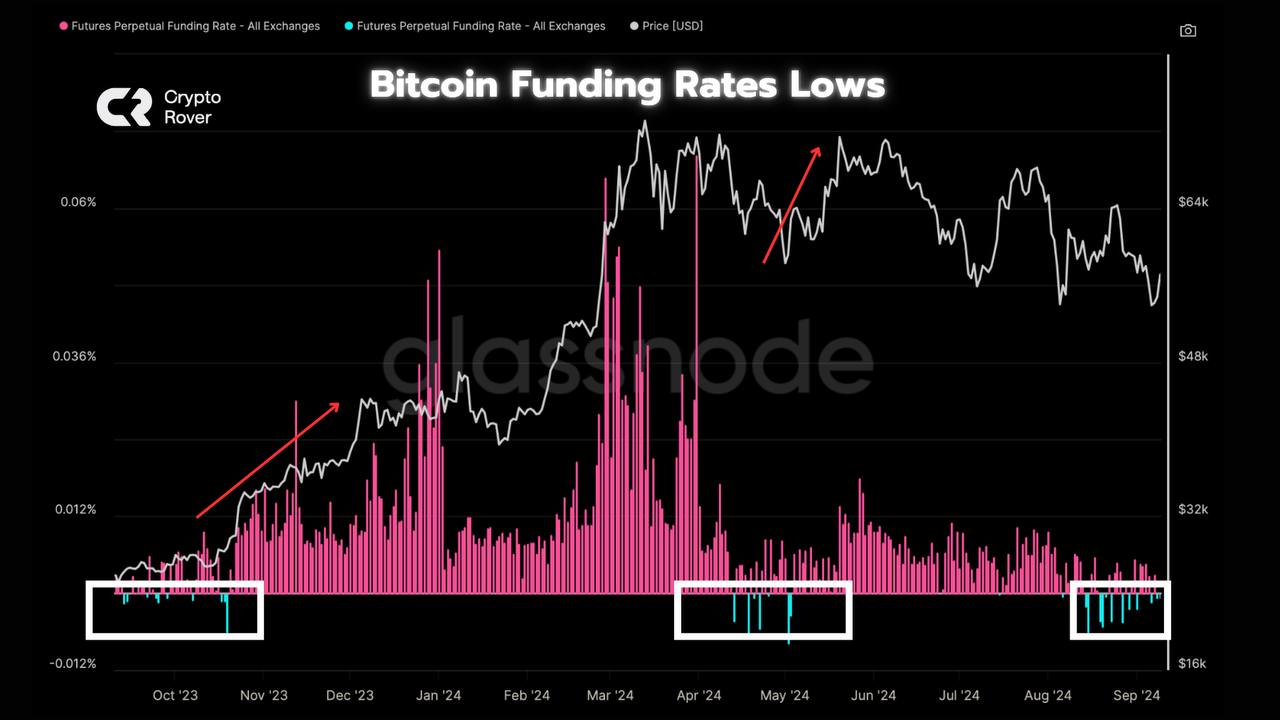

- The Bitcoin Funding Rates turned negative at press time — the sign of a potential reversal.

- Bitcoin is set to make new highs if it breaks through the $65K mark.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find the current state of Bitcoin (BTC) quite intriguing. The recent negative Funding Rate, while traditionally a sign of potential market reversals, could be hinting at an upcoming surge this time around.

The funding rate for Bitcoin (BTC) has dropped below zero, indicating a change in investor attitude. As a result, traders appear to be adopting a more conservative approach, as evidenced by the decrease in the long/short ratio to 1.61 at the current moment.

Current market trends indicate a stronger tendency towards selling, with the Contracts for Difference (CVD) standing at a level of -1.91 billion. Typically, when Funding Rates become negative, it can be a sign of market bottoms, suggesting potential recovery in the future.

Bitcoin Funding Rate drops hints

Starting from 2018, when the average daily funding rate for Bitcoin dipped below zero, it has typically yielded a return of approximately 79% over a 90-day period, as per data from K33 Research.

As a crypto investor, I’ve noticed that when negative funding rates kick in, it could potentially set off a short squeeze. This happens because the high cost of holding a short position encourages bears to cover their bets, which drives the price up due to the sudden increase in buying pressure, leading to a rebound.

Observing the fluctuations in Bitcoin’s value, specifically the Bitcoin-Tether (BTC/USDT) exchange rate, suggests that the market may be undergoing some shifts or adjustments.

At the moment of reporting, Bitcoin was close to a significant barrier of around $58,000. If Bitcoin manages to break through and maintain its position above this level, it might drive the price upwards towards approximately $65,000.

Historically, when there’s a Negative Funding Rate, it often indicates a significant price increase is imminent. The robust candles we’ve seen recently hint that this shift could occur quite soon.

If Bitcoin doesn’t manage to surpass the $58,000 mark, there’s a possibility it might return to previous price zones, possibly dipping down to the $50,000 area that holds significant psychological significance for traders.

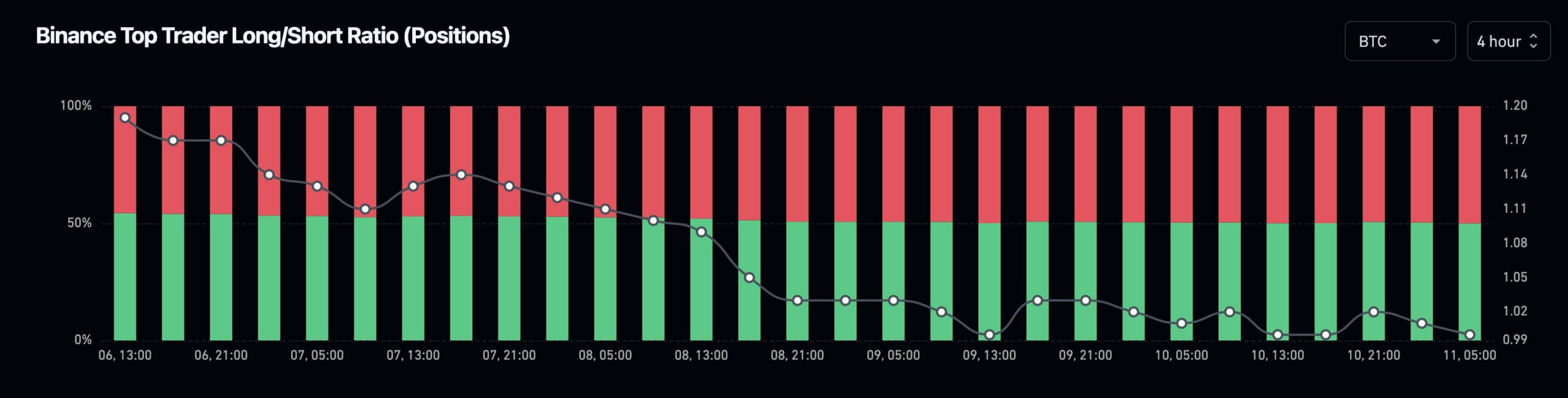

Exchanges’ top traders turn long

A closer examination uncovered that leading traders on platforms such as Binance [BNB] have moved towards holding long positions, indicating their optimism about an increase in Bitcoin’s value.

Leading investors, frequently referred to as ‘smart money’, are currently purchasing Bitcoin despite the prevailing fear in the market. This increase in long-term investments suggests that Bitcoin may be preparing for a significant price jump, as data points towards a positive or bullish forecast.

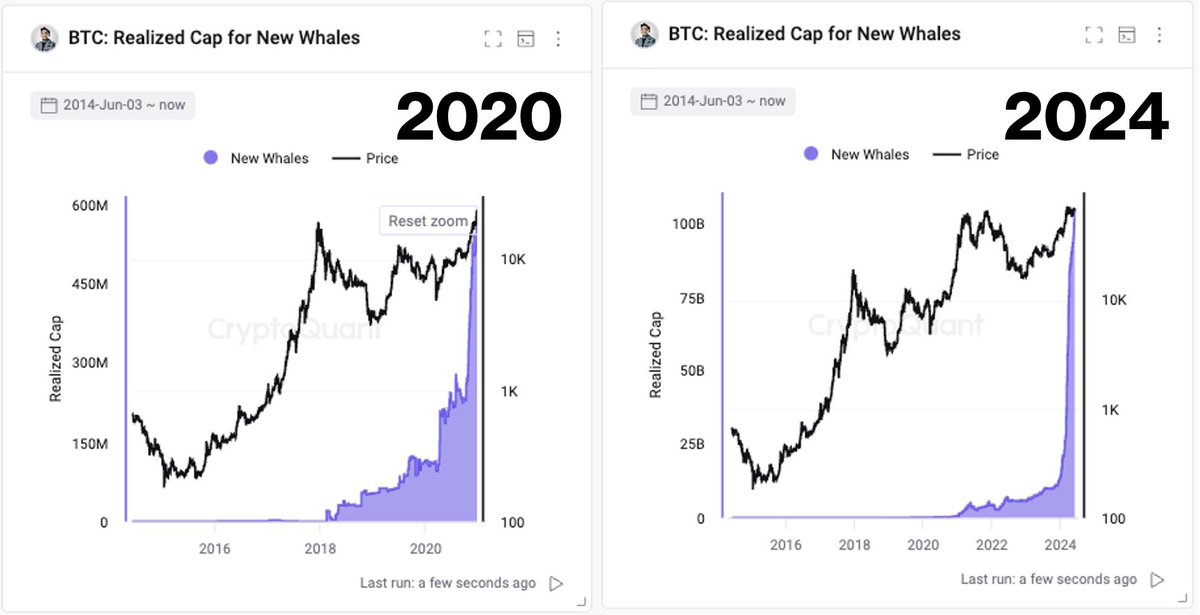

Whales buy aggressively

New Bitcoin whales were also making aggressive moves, further affirming the bullish sentiment.

2024’s new whale investors saw a dramatic increase of approximately 150-fold in their Bitcoin holdings compared to the period in 2020 when Bitcoin underwent a significant bull market surge.

The rise in whale activities suggests a more robust adoption of Bitcoin during this cycle as opposed to past ones.

The influx of new whale investments suggested that the negative Funding Rates may trigger a rally toward a new all-time high, possibly by the end of this year or early next year, as it did at the beginning of 2024.

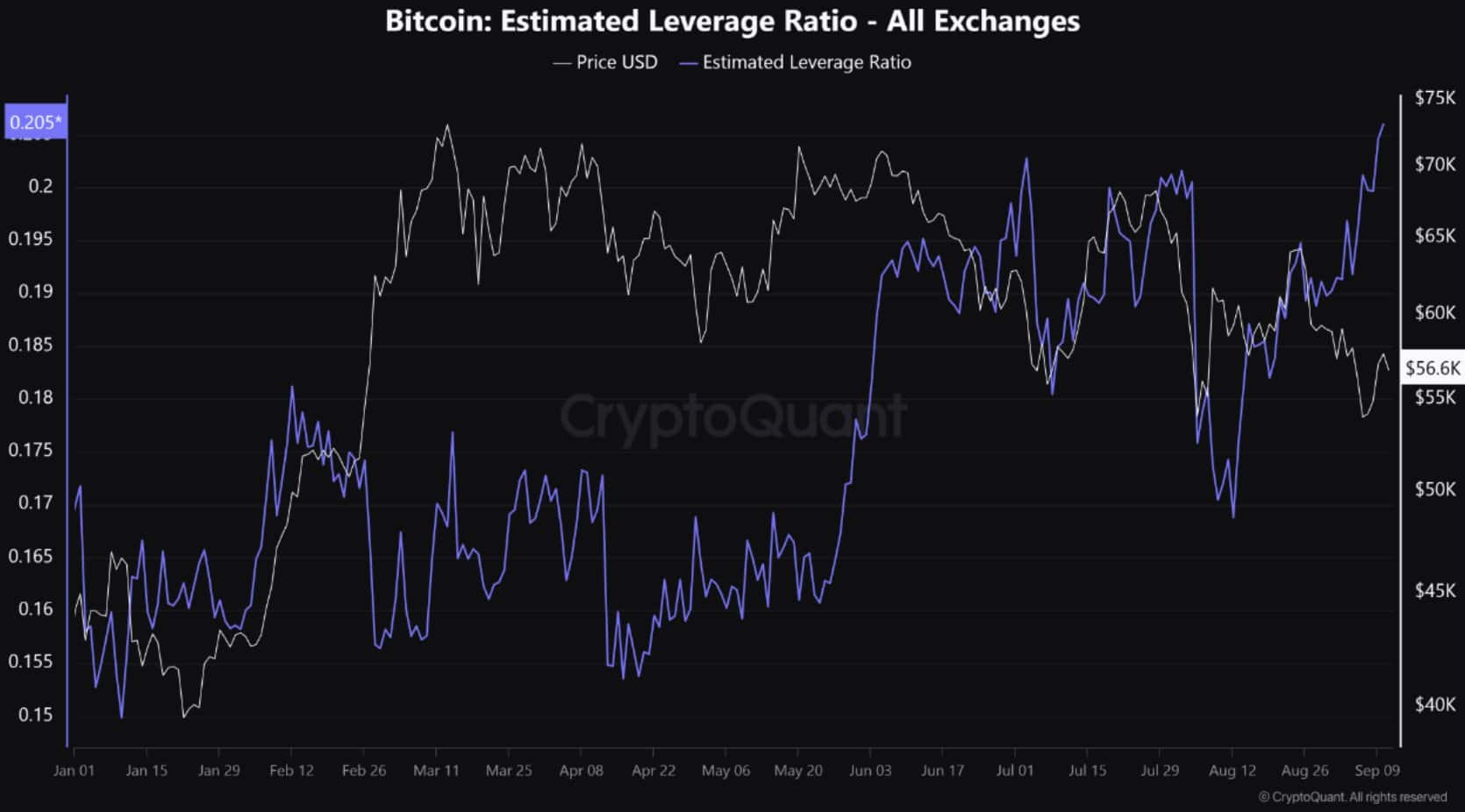

Estimated leverage ratio

To wrap things up, it’s worth noting that the Projected Bitcoin Leverage Ratio has hit a fresh peak for this year so far. The rise in leverage suggests that investors are showing heightened interest and activity in the derivatives market.

The growing engagement in derivatives is likely to boost Bitcoin’s price action over the long term.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Using more leverage by traders tends to heighten the possibility of substantial price fluctuations, potentially leading to an upward trend in Bitcoin’s price over the short term.

Given the present market situation and crucial factors falling into place, Bitcoin appears ready for further increases.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-12 18:16