-

BTC bounced back to $58k after slower August inflation data

Alameda/FTX unstaked over $23 million SOL as repayment for victims gets closer

As an experienced analyst with a knack for deciphering market trends and a sense of humor that keeps me grounded, let me share my take on this latest development.

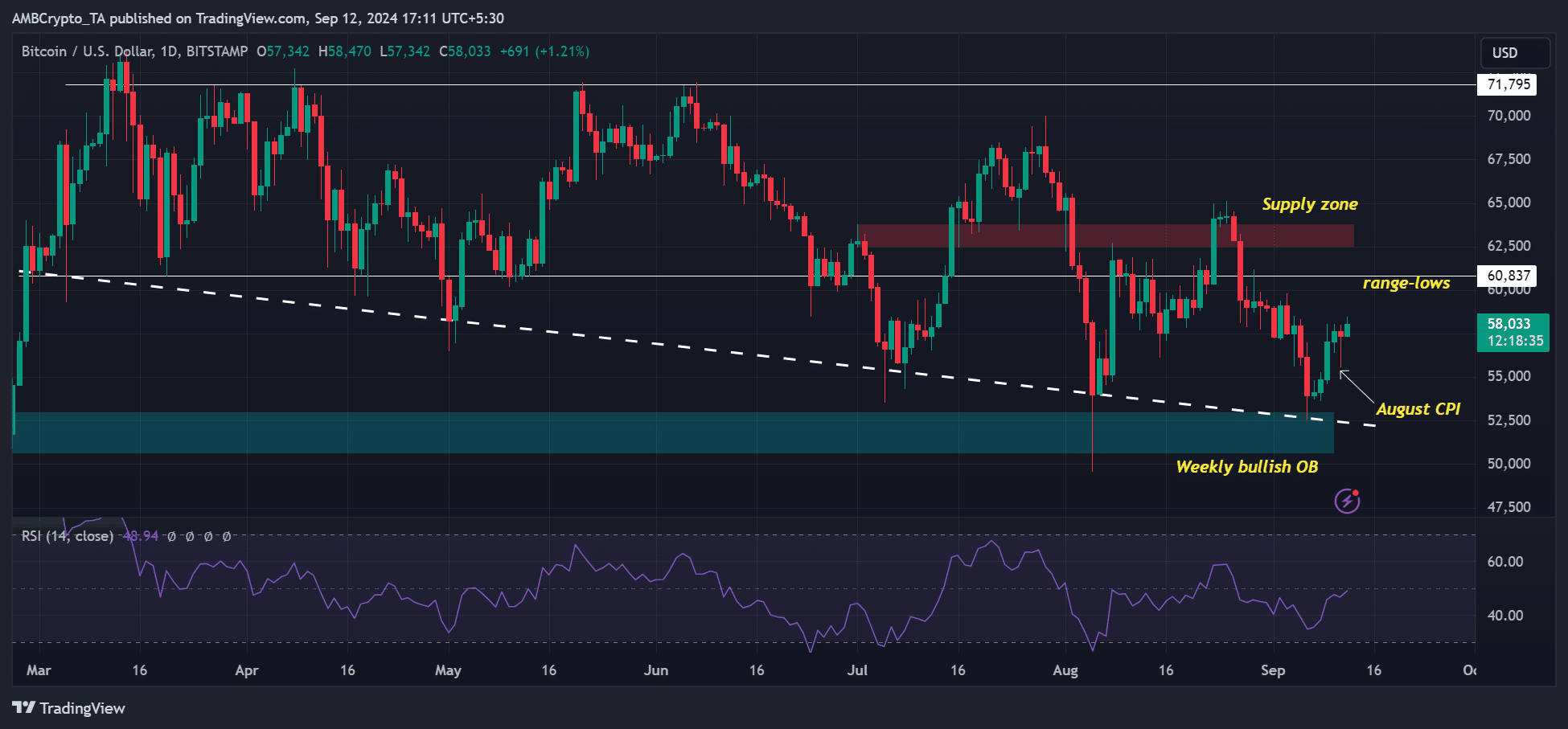

Bitcoin (BTC) rebounded on Thursday following a less severe inflation rate in August as indicated by the Consumer Price Index (CPI). Last month, the CPI increased by 0.2%, as predicted by analysts, but the core CPI, which excludes food and energy prices, was slightly higher at 0.3%, exceeding the projected 0.2%. This data caused Bitcoin’s value to dip to $55,500 on price charts.

10th September witnessed a significant outflow of approximately $750 million in Bitcoin (BTC) from exchanges, which occurred prior to the release of the Consumer Price Index (CPI) data. This decrease in BTC holdings on exchanges seems to have instigated investors’ shift towards a risk-averse stance, as it preceded their typical “risk-off mode.

However, the world’s largest digital asset reversed itself and was valued at $58k at press time. Reacting to the post-CPI move, Joshua Kang, Head of Trading at Mozaik Capital, noted that the market will focus on next week’s FOMC (Federal Open Market Committee) meeting. He said,

It seems reasonable to ascend gradually using the dips. There might be some market fluctuations around or following the FOMC meeting, but if trading volume remains strong, we could expect an extended upward trend during October.

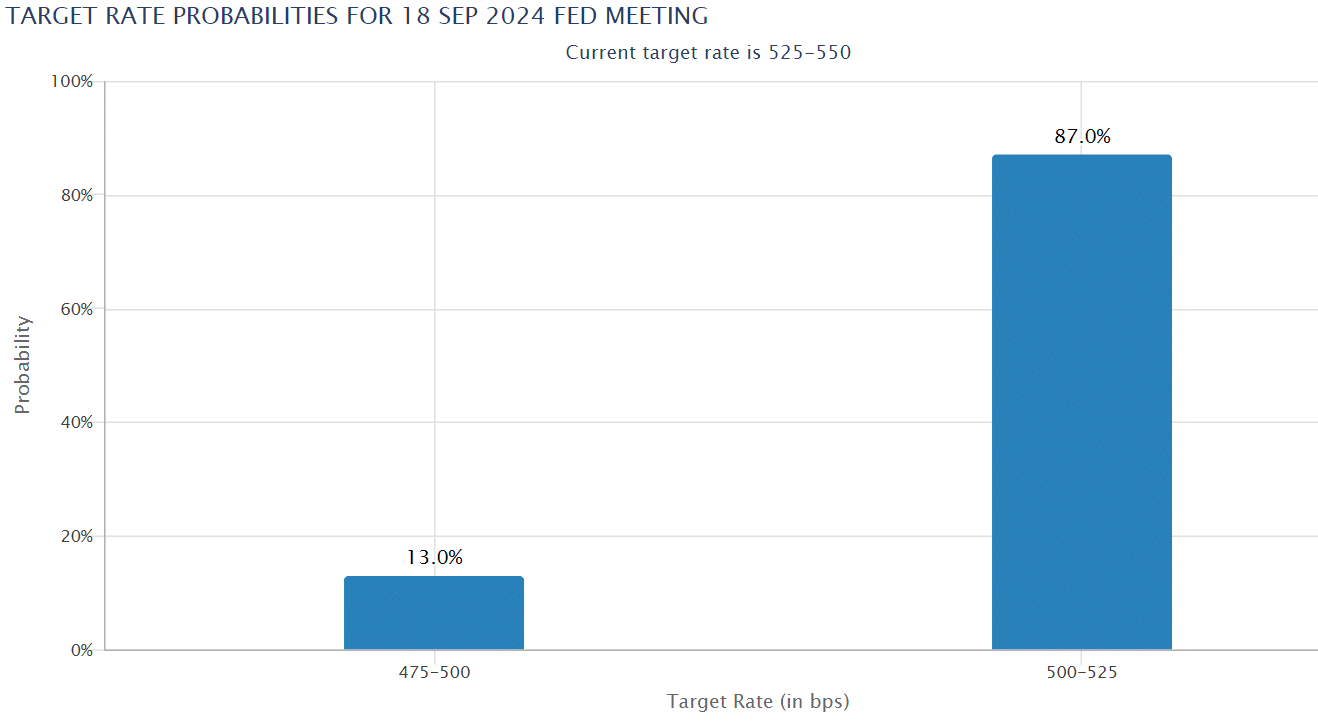

Based on the lower Consumer Price Index (CPI), it appears the market is predicting an approximately 85% likelihood that the Federal Reserve will reduce interest rates by 0.25% during the upcoming Federal Open Market Committee (FOMC) meeting.

Based on reports from cryptocurrency trading firm QCP Capital, there was a significant increase in the demand for Bitcoin following the release of CPI data, suggesting a positive trend for the last quarter of this year.

“Options activity reflects this, with growing demand for Calls with Oct-Dec expiries.”

Alameda/FTX unstake $23.75M SOL

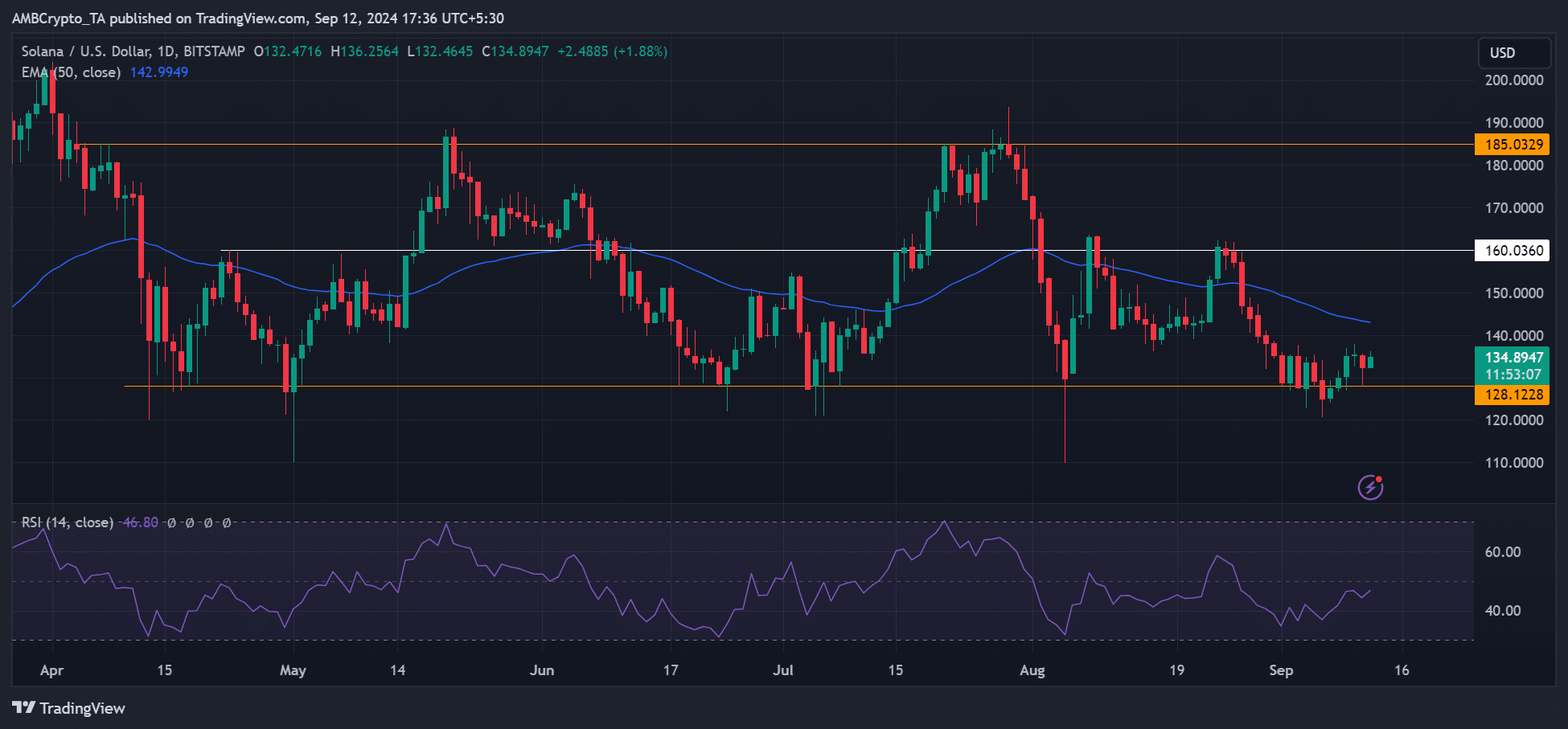

177,693 SOL from Solana’s Proof-of-Stake (PoS) were withdrawn from a wallet linked to Alameda/FTX, leaving $951 million SOL still staked. This action was taken as FTX moves towards repaying victims, bringing the process closer to completion.

Despite FTX apparently offloading much of its SOL via over-the-counter transactions, it’s been proposed by EmberCN, a market analyst, that the yet-to-be-unstaked SOL might make its way to mainstream exchanges in the near future.

If so, this could put downward pressure on SOL. At press time, the altcoin was trading at $134, slightly above its yearly support of $128.

Swift unveils support for digital asset transfers

Ultimately, Swift aims to facilitate secure transactions involving both digital and physical assets backed by tokens, in line with their global compatibility plan. As stated by the company, this is one of the strategies they are implementing.

We aim to empower our members with the flexibility to conduct transactions seamlessly, utilizing not only current assets and currencies but also upcoming ones through their Swift link.

As a researcher involved in the project, I’m excited to share that our latest development is an extension of the blockchain payment trials conducted last year with Chainlink, Ethereum, and various banks, including BNY Mellon. This progress paves the way for real-time settlement and exchange of tokenized assets via the Swift network, empowering buyers like myself to participate in seamless, swift transactions.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-12 22:47