- India led global crypto adoption, despite regulatory challenges and high trading taxes

- Bitcoin ETF boosted institutional transfers, driving growth in high-income regions like North America

As a seasoned crypto investor with over a decade of experience, I’ve witnessed the evolution of digital assets from a niche curiosity to a global phenomenon. The Chainalysis Global Crypto Adoption Index has once again provided fascinating insights into this rapidly changing landscape.

As global curiosity about cryptocurrencies grows, the Chainalysis Global Crypto Adoption Index has revealed its latest report for the year. This report provides valuable data on the widespread use of cryptocurrencies worldwide.

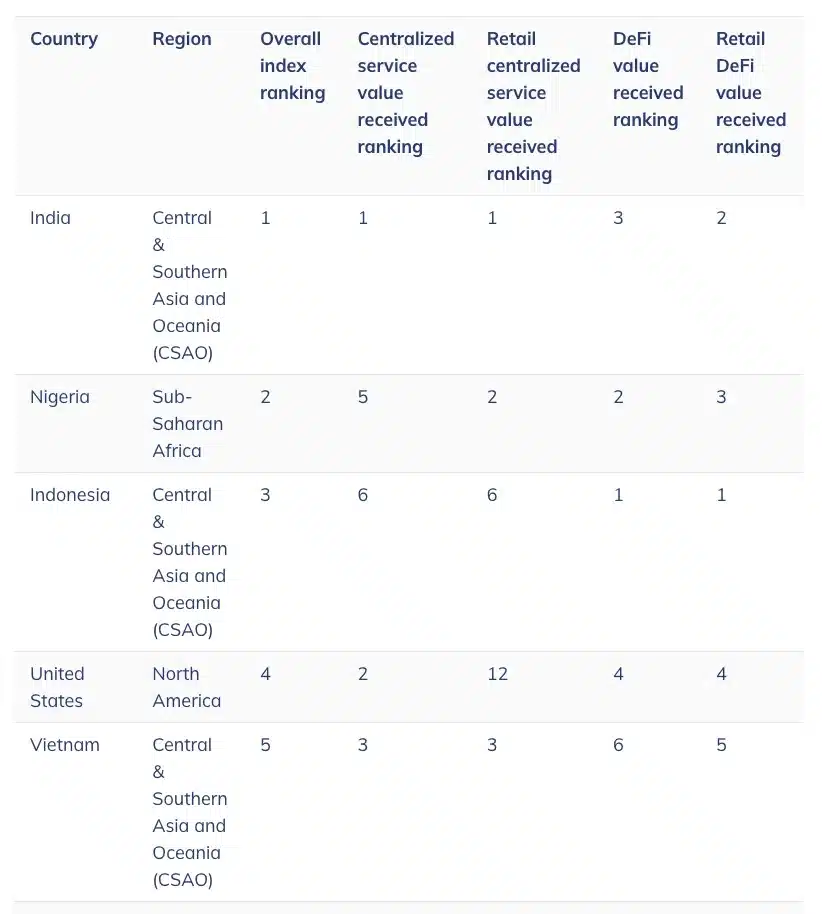

For this year’s analysis, which spans the period from Q3 2021 up until Q2 2024, we adopted an improved approach focusing on Decentralized Finance (DeFi) transactions. We intentionally omitted the trading volumes associated with Peer-to-Peer cryptocurrency exchange trades during this timeframe.

Furthermore, combining data from on-chain and off-chain sources allows Chainalysis to pinpoint the countries with the highest cryptocurrency usage and explain the reasons behind their growing interest in digital currencies.

Chainalysis crypto adoption report – Explained

As per recent reports, India and Nigeria continue to lead in worldwide cryptocurrency usage, and Indonesia is quickly becoming the most dynamic market for crypto investments.

In my role as an analyst, I can share that I’ve observed India maintaining its top position in global cryptocurrency adoption for two consecutive years. Despite a complex regulatory landscape and substantial trade tariffs, the country has managed to stay at the forefront of this digital revolution.

For those who may be new to this context, the country has maintained a strict regulatory stance since 2018. This was further evident in December 2023, when the Financial Intelligence Unit (FIU) took action against nine offshore cryptocurrency exchanges. These exchanges had allegedly disregarded local regulations, leading to the issuance of show-cause notices by the FIU.

Despite a strict regulatory landscape, Indian investors haven’t been discouraged. The figures presented above underscore India’s robustness and influential role in the international cryptocurrency sector.

Remarking on the same, Eric Jardine, Research Lead at Chainalysis noted,

In simple terms, “Despite certain restrictions, India has seen a broad acceptance of cryptocurrencies in various sectors. This suggests that new entrants into the crypto market might be using services that are not explicitly prohibited.

USA loses ground?

Contrary to popular belief fueled by extensive media coverage about cryptocurrencies within the U.S., particularly due to presidential candidate Donald Trump and ETF advancements, the nation was positioned fourth globally when it comes to crypto adoption.

In comparison to India, Nigeria, and Indonesia, the country found itself at a lower position in the ranking, indicating that important conversations and prominent events may not consistently lead to top positions in adoption rates.

Despite initial concerns, it’s clear that the introduction of the Spot Bitcoin [BTC] ETF in the U.S. has ignited a surge of BTC activity globally. In fact, there’s been substantial year-on-year increase in institutional transactions and marked upticks in high-income areas such as North America and Western Europe.

Diving deeper into adoption rates, Chainalysis’ report revealed,

From October 2023 to March 2024, the overall worth of worldwide cryptocurrency transactions experienced a significant surge, peaking at greater heights compared to the record highs of 2021 during the crypto boom period.

Bitcoin – The most adopted token

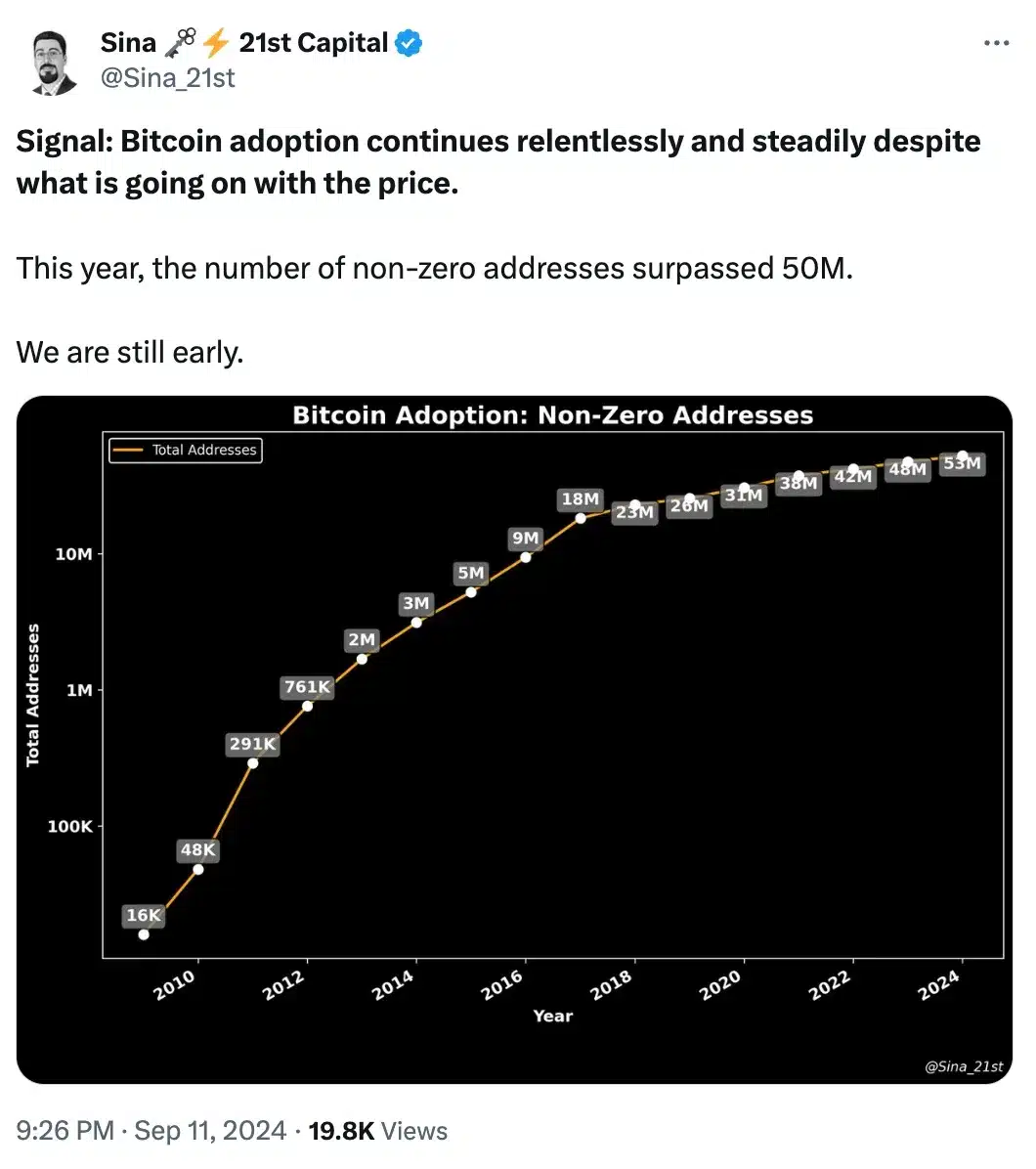

Just as anticipated, Bitcoin has become the hot topic of conversation and a significant catalyst for the widespread acceptance of digital currencies.

Regardless if it’s the rising curiosity towards Bitcoin ETFs or its significance in various conversations such as politics – be it elections or strategic planning by institutions – Bitcoin persistently captures interest.

This was further confirmed by a recent update from a user on X, highlighting its undeniable impact on the broader crypto market.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-09-13 03:04