-

FET could soar by 26% to the $1.95 level or even higher if it closes a daily candle above the $1.5 level.

FET’s Future Open Interest has skyrocketed by 25% in the last 24 hours.

As a seasoned analyst with over two decades of experience in the financial markets, I find myself increasingly intrigued by the bullish prospects of Artificial Superintelligence [FET]. The recent surge in its price and on-chain metrics paint an optimistic picture for this promising cryptocurrency.

The cutting-edge technology known as Artificial Superintelligence (FET) is expected to experience a substantial increase in value due to its robust on-chain indicators pointing towards optimism and the possibility of a major leap forward.

Contrary to the general pessimism surrounding the crypto market right now, FET has seen a remarkable increase of more than 28% over the past four days. Interestingly, it has outpaced prominent cryptocurrencies such as Bitcoin, Ethereum, and Solana during this timeframe.

Will FET remain bullish?

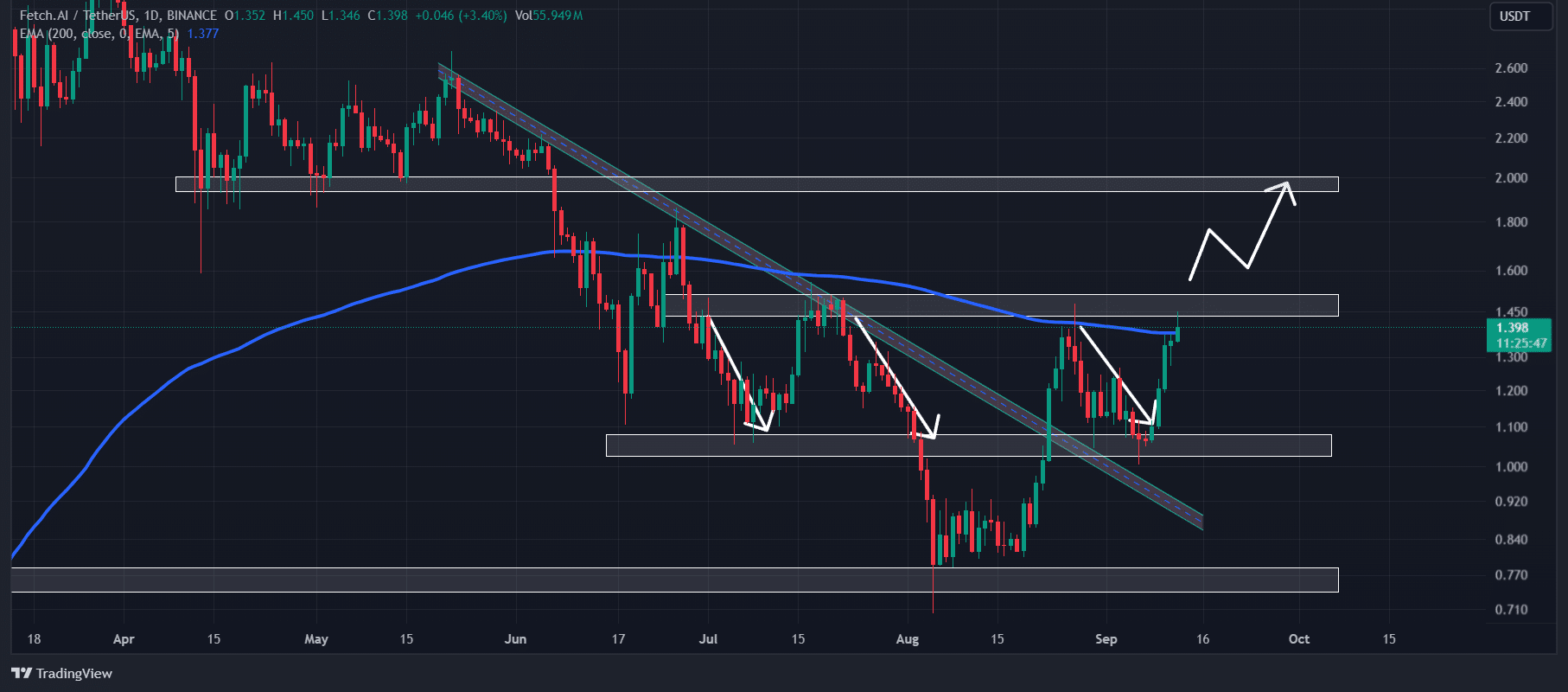

At the current moment, as observed by AMBCrypto’s analysis on TradingView, Fantom (FET) seemed to be experiencing a bullish trend. This is because FET was trading above its 200-day Exponential Moving Average (EMA).

Many investors and traders frequently employ this particular signal to discern if a given asset is experiencing an upward trend or a downward trend.

In addition to this, FET was also facing strong resistance near the $1.5 level.

Starting from July 2024, whenever the value of FET has hit a particular point, it’s consistently been met with selling activity. Contrarily, the present mood concerning FET appears distinct, as there seems to be a steadily growing curiosity among investors.

Given FET‘s past trend in pricing, if FET finishes the day trading above the $1.5 mark, it’s likely that its value might surge by approximately 26%, potentially reaching $1.95 or even exceeding this level.

On-chain data

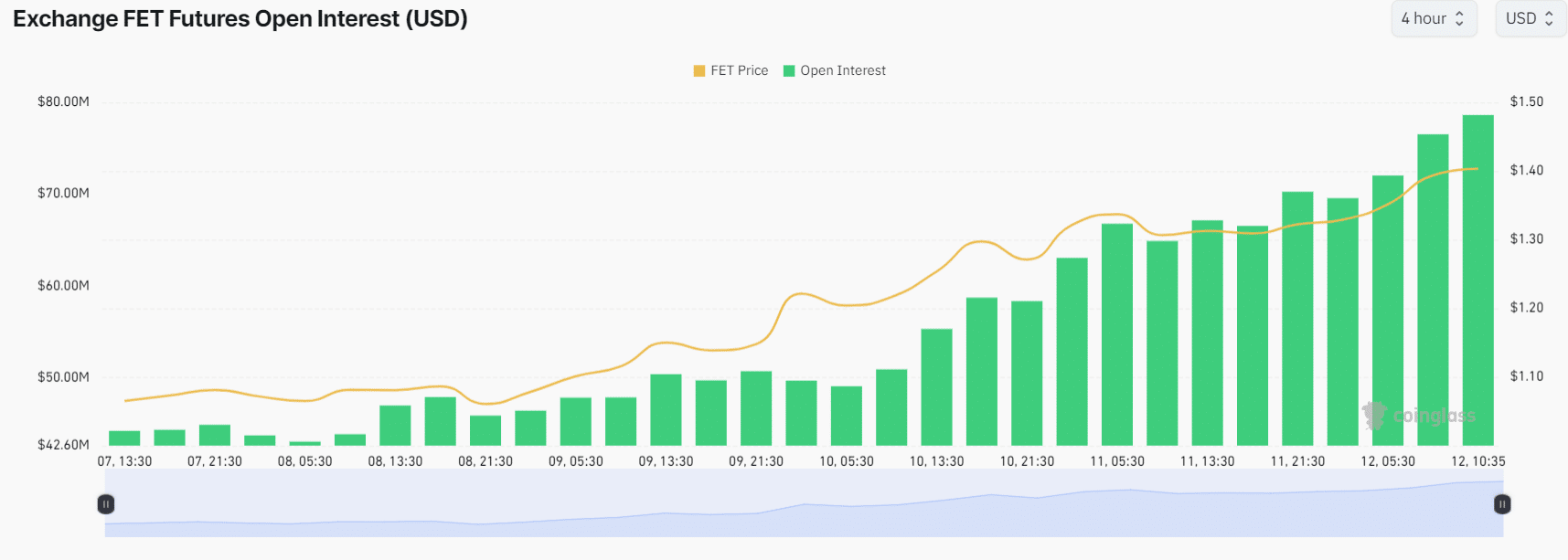

The optimistic view on FET‘s future performance was reinforced by data from the blockchain. Specifically, as reported by Coinglass, the Long/Short ratio for FET stood at 1.03 at the current moment, suggesting a predominantly bullish attitude among traders. In other words, this figure implies that more investors are currently betting on an increase in FET’s price.

Over the past day, the Futures Open Interest experienced a significant surge of 25%, and it’s been steadily climbing ever since September 6th.

In simpler terms, when both the Futures Open Interest is increasing and the Long/Short Ratio exceeds 1, it could indicate a possible moment for purchasing. Many traders and investors prefer using this arrangement to establish either their long or short trades.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

Currently, FET is close to the $1.40 mark, having experienced an increase of more than 8% in its value within the past day.

The trading volume has significantly increased by 40% within this timeframe, suggesting a greater involvement of traders as they take part in the current market rebound.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-09-13 03:35