-

Grayscale has announced the creation of Grayscale XRP Trust

XRP’s price surged by 9.8% following the update

As a seasoned researcher with years of experience tracking digital assets, I must say the recent development of Grayscale XRP Trust has added a new layer of excitement to my radar. Having closely followed Ripple’s legal battles and their impact on the community, it’s fascinating to see the optimism this move has generated.

For the last month, the XRP community has experienced a prolonged period of tranquility, with Ripple‘s legal issues appearing to dissipate bit by bit. The community is now buoyed by their recent legal victories against the SEC, which have fueled optimism for a brighter tomorrow.

This optimism is now evidenced by the entry of crypto asset manager Grayscale.

XRP Trust is here!

As reported by Grayscale, the crypto asset management company has now made available the Grayscale XRP Trust. This trust aims to offer investors a chance to engage with and experience the digital token that underpins the XRP Ledger. By doing so, investors can tap into a decentralized, peer-to-peer network specifically designed for executing cross-border financial transactions.

As per the latest update from the asset manager, the fund can be accessed by qualified accredited investors via a private offering.

Significantly, Grayscale’s involvement aligns with Ripple’s aim to concentrate on enterprise-level solutions, differing from the focus on individual XRP holders in the retail market. As stated by Jake Claver, Ripple’s business approach primarily revolves around creating large-scale payment systems, contrasting with other blockchain projects that prioritize retail adoption.

In contrast to Exchange-Traded Funds (ETFs) which can have fluctuating numbers of shares due to creation and redemption, closed-end trusts have a set amount of shares, making them potentially less flexible in terms of trading volume.

How did the market react?

As an analyst, I observed a swift and favorable market response after the launch of the Grayscale XRP Trust. For example, the price of XRP spiked by 9.8%, peaking at $0.588, while its trading volume skyrocketed by 105.54% to an impressive $1.7 billion. Consequently, the market capitalization of XRP also increased by 6%, reaching a new high of $32.2 billion.

At the time of writing, the altcoin was valued at $0.57.

Can XRP rally from here?

Over the course of the last month, I’ve observed a consistent upward trend in the price action of XRP. On a daily basis, this altcoin has managed to register gains, and interestingly, these increases have been reflected even on the weekly charts. Specifically, there was an uptick of 5.07% over this period.

Prevailing market conditions could allow the altcoin to register further gains on the price charts.

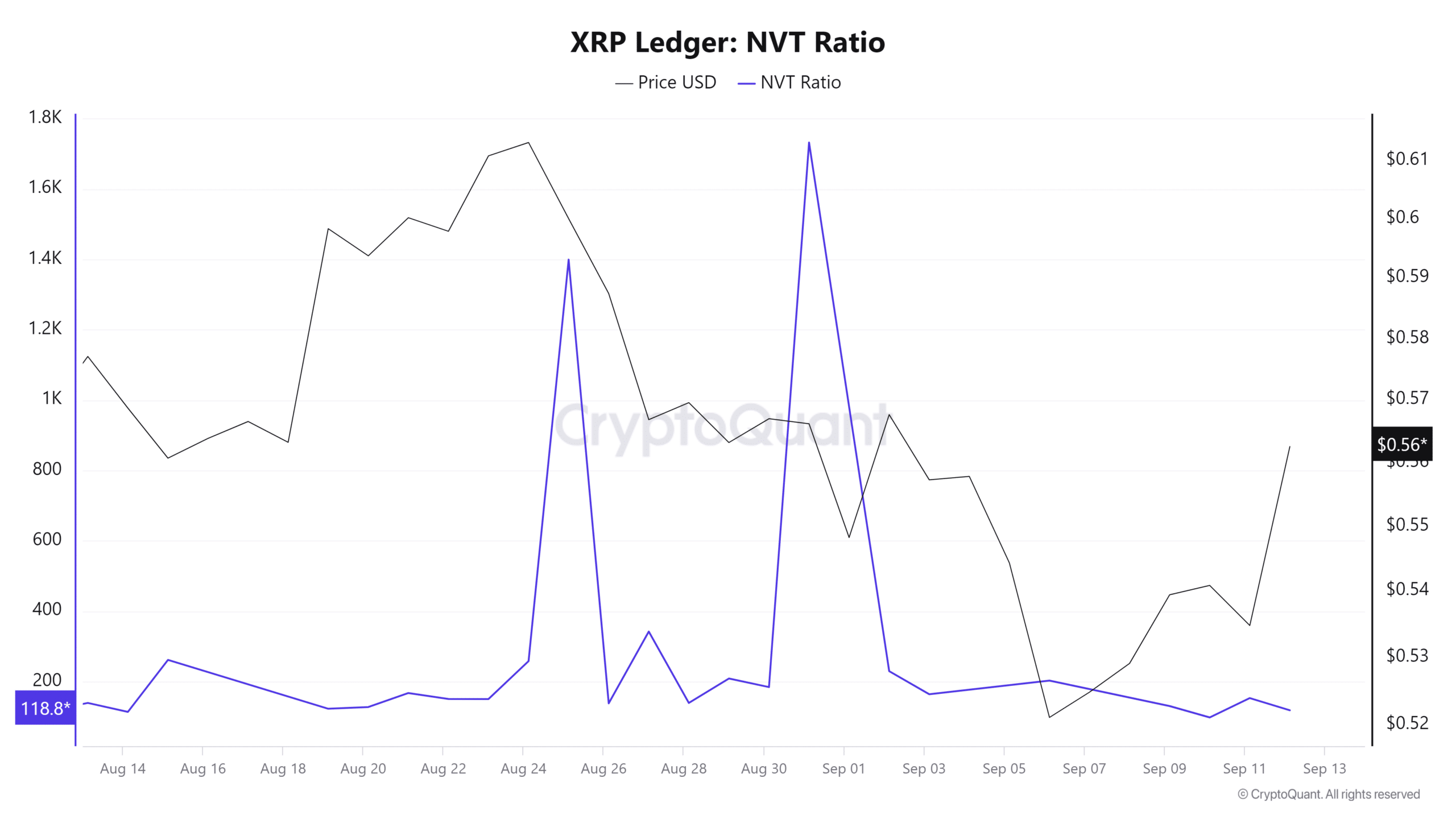

To put it simply, since August 31st, the Network Value to Transactions (NVT) Ratio for this altcoin has been decreasing. As I’m writing this, it stands at 118, down from its initial 1732. This decrease in the NVT Ratio implies that the altcoin could be underpriced, suggesting that the market may not yet fully appreciate the value of the network’s transaction volume.

When an asset is configured in this manner, it suggests a lasting belief in the network’s value, as an increasing number of users engage in transactions using the blockchain. This optimistic indication, or “bullish signal,” suggests that the market will eventually follow suit, leading to price increases.

Furthermore, the accumulated funding rate for XRP across exchanges has predominantly remained positive over the last week. In simpler terms, this indicates that those who hold long positions are effectively compensating short sellers. This is a bullish indicator since it suggests that investors expect the price to increase and are even prepared to pay extra during market declines.

In simpler terms, XRP is currently receiving positive attention from investors, particularly institutions, suggesting a favorable market reception. If this bullish trend persists, it’s likely that XRP will aim to break through its immediate resistance at around $0.611 in the near future.

If market conditions are optimistic, it may surpass the previously challenging $0.64 price barrier that has historically held it back.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-09-13 17:12