-

PEPE struggling with weak demand, despite flashing bullish signs courtesy of a price-RSI divergence

Memecoin now failing to attract participation from whales too

As a seasoned crypto investor with a knack for deciphering market trends, I find myself intrigued by the enigma that is PEPE right now. The bullish divergence on its charts is undeniably enticing, yet the lack of participation from whales is concerning. It’s like inviting guests to a party but forgetting to send out invitations!

Recently, the well-known meme cryptocurrency, PEPE, experienced some positive movement following several days of downtrend. Yet, its price fluctuations suggest that bullish energy is still lacking. Could there be reasons why the market’s bullish investors remain hesitant at present?

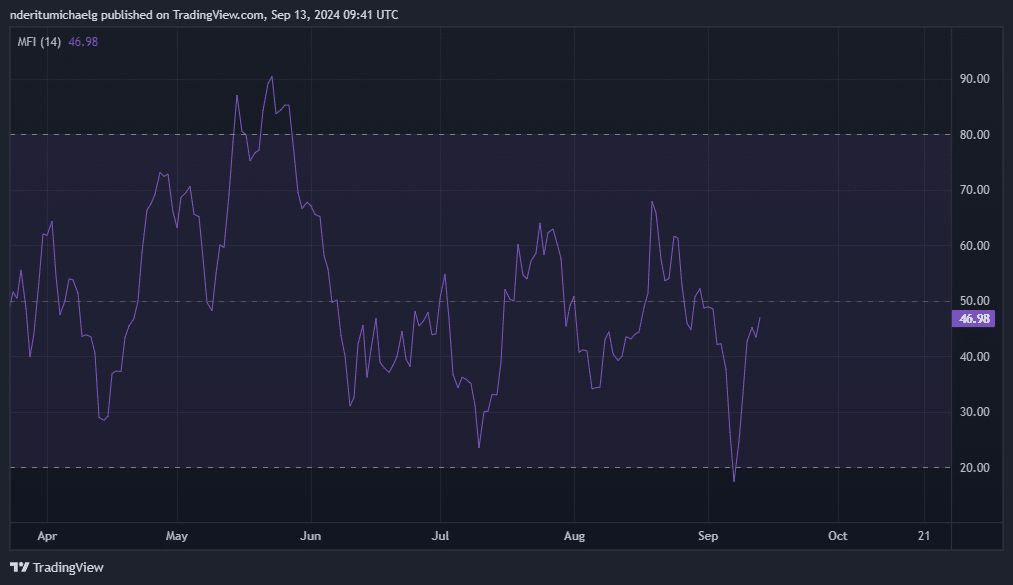

PEPE’s price movement showed a significant bullish signal on the graphs. The price dropped to successively lower levels from mid-August until the beginning of September’s first week. At the same time, the RSI was forming higher peaks, leading to a situation known as a “bullish divergence.” This pattern typically indicates a positive outlook for any asset.

Following this development, it’s likely we’ll witness a PEPE swing low, potentially leading to a substantial rise. Notably, the price has moved near its lowest point in four months, an area where there was previously robust demand.

Is PEPE’s demand falling?

there was a gradual build-up that led to a slight increase, as indicated by the Money Flow Indicator which rebounded from an oversold state at the beginning of the week.

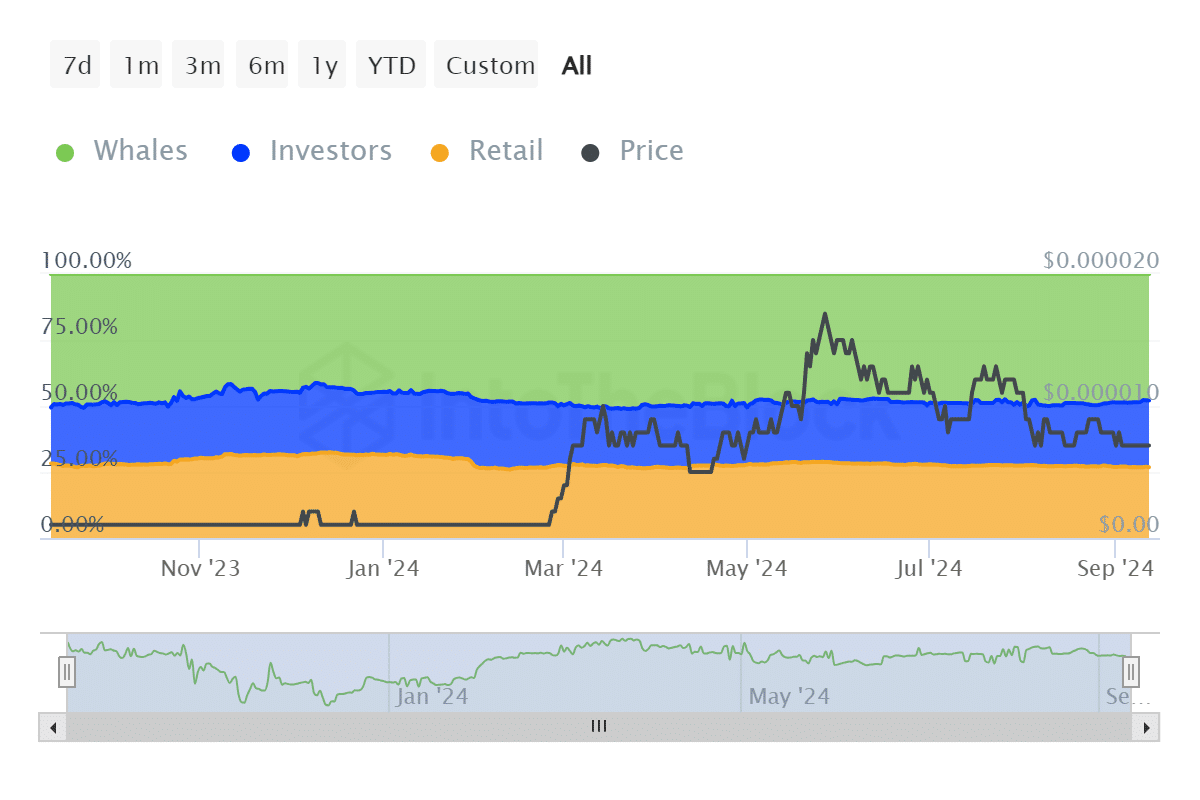

Despite the buildup, demand has remained rather subdued. Interestingly, a closer look at the blockchain shows that large investors, or ‘whales’, haven’t been actively participating as expected. Data from IntoTheBlock further suggests that whales have reduced their ownership of PEPE tokens since early September.

On September 1st, whales were in possession of approximately 203.27 trillion units of PEPE. However, their holdings have decreased since then, now standing at around 200.24 trillion PEPE. This could be the reason why PEPE, the memecoin, has been finding it challenging to build up a bullish momentum.

During the given timeframe, the historical data showed a slight decrease in retail holdings, going from 112.52 trillion PEPE to 112.08 trillion PEPE. However, there was a positive increase observed in the investor category, growing from 102.22 trillion PEPE to 105.75 trillion PEPE over the same period.

In simpler terms, it’s possible that PEPE memecoin continues to hold some appeal. However, due to a decrease in interest from large investors (whales) and typical buyers (retail), PEPE may be experiencing setbacks in the immediate future.

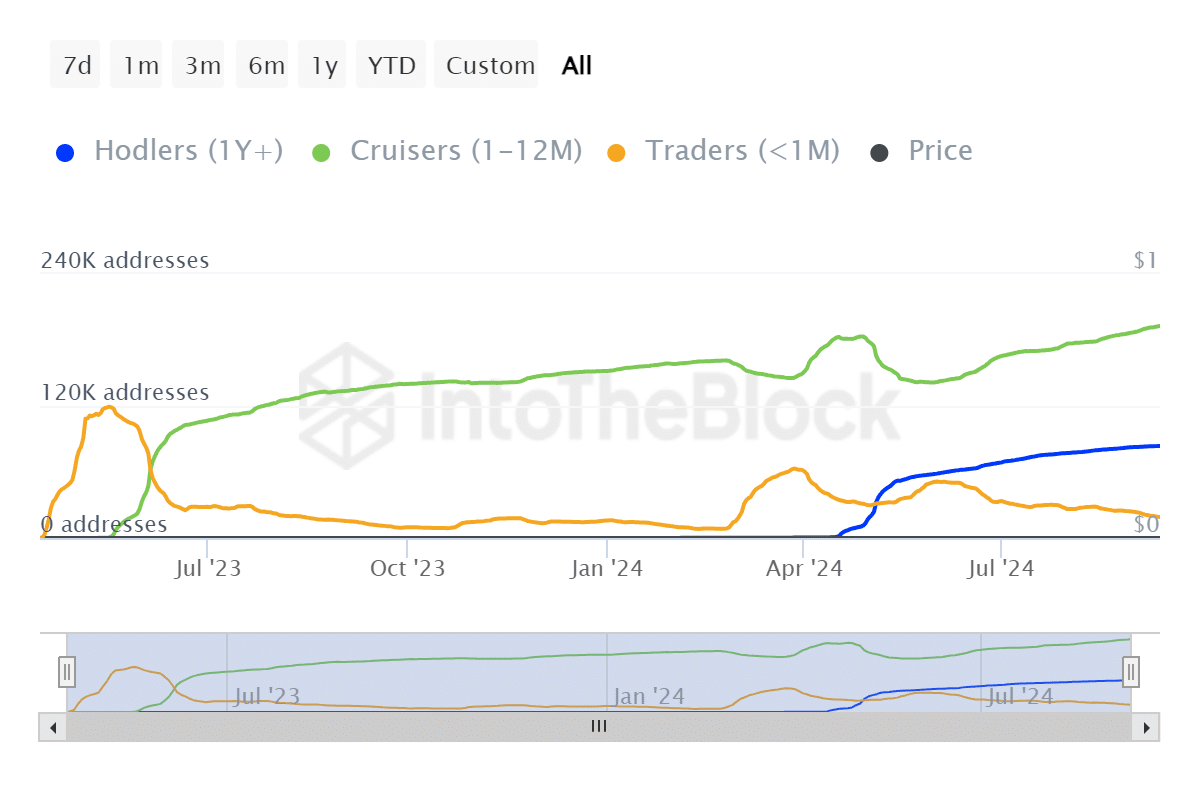

Regarding its long-term outlook, an alternative measurement – the number of PEPE addresses over time – indicates that holders are nearly reaching a historical high of 83,710 addresses. Additionally, short-term traders, or those frequently entering and exiting positions (cruisers), have also surged to approximately 192,790 addresses.

Since June, there’s been a significant decrease in traders involved with PEPE, returning to levels similar to those before its February rally. This indicates that PEPE is shedding weak investors. Consequently, an increase in traders might occur if PEPE experiences a volatility spike. At present, though, the memecoin is likely to face weak demand.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2024-09-14 11:03