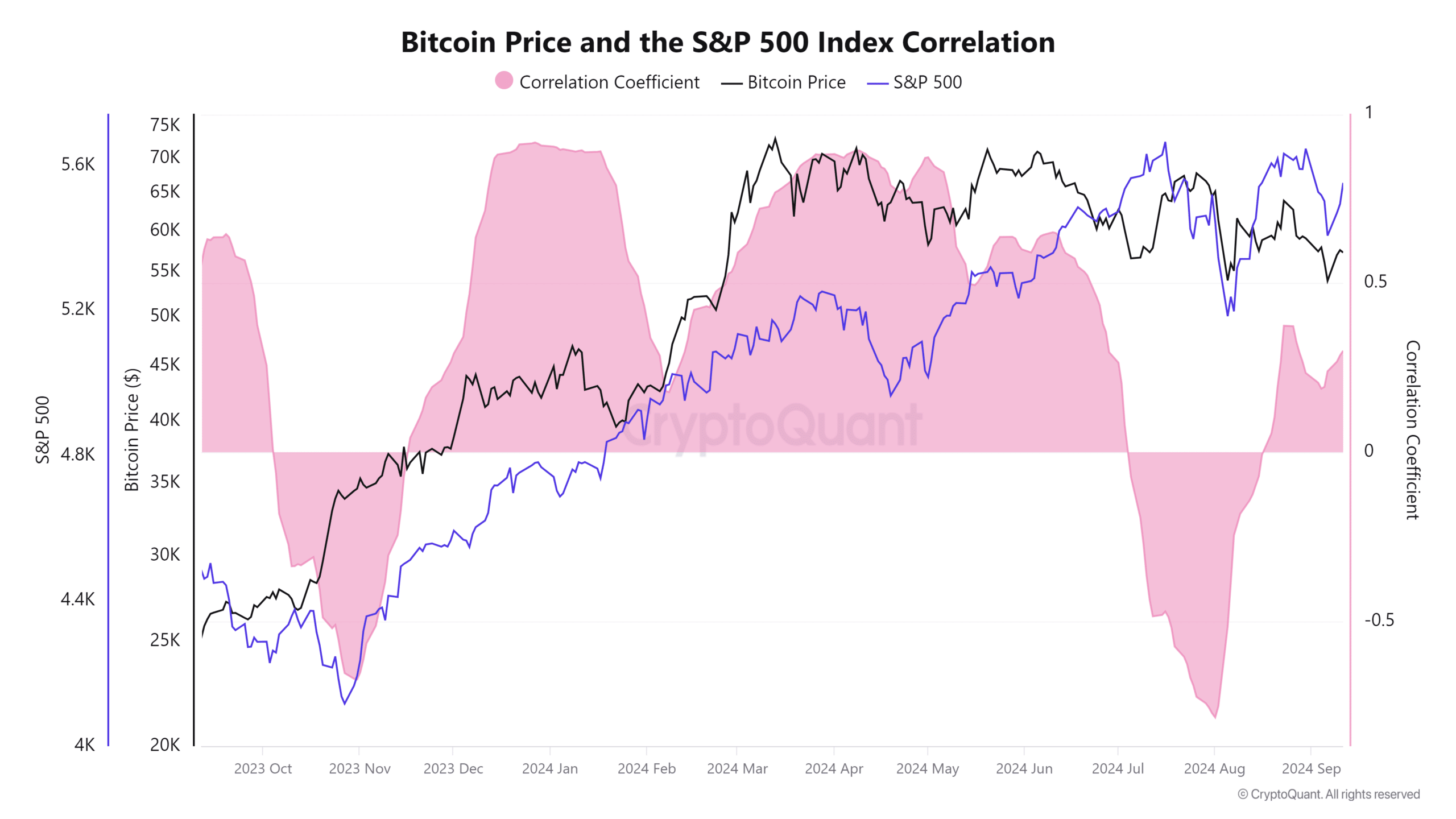

- There is a distinct correlation between Bitcoin and the S&P 500

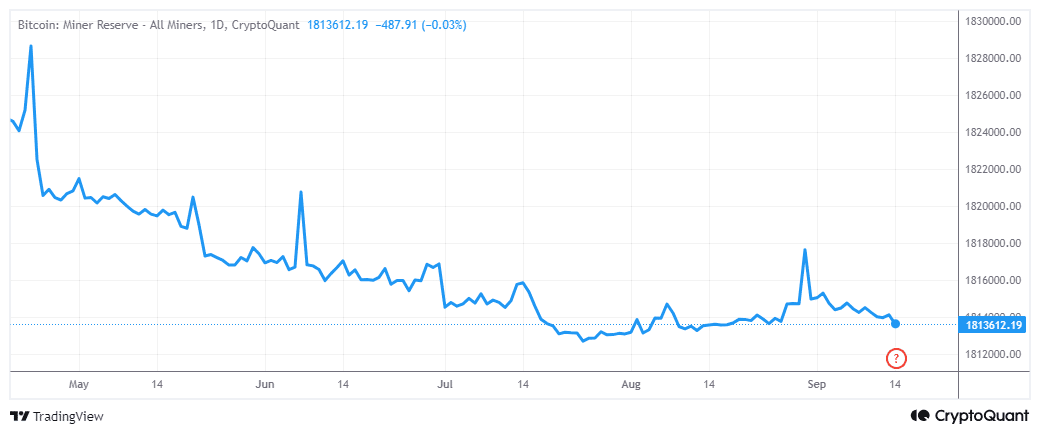

- Bitcoin miner reserves may be worth keeping an eye out for too

As a seasoned analyst with over two decades of market analysis under my belt, I have witnessed countless cycles and trends in the financial world. The correlation between Bitcoin and the S&P 500 is something that has caught my attention for quite some time now.

Bitcoin is frequently categorized as a “risky investment asset,” a label supported by the way people tend to buy it. A key feature of this categorization is that Bitcoin, in its historical performance, tends to mirror movements in the S&P 500.

Typically, the relationship between Bitcoin and the S&P 500 highlights investors’ diversification strategies in the risk-on sector. Nevertheless, there are situations where Bitcoin seems to lose its connection with the stock market. This was clearly seen during June and July, periods marked by unique factors like Bitcoin’s political influence.

As per recent findings, it appears that Bitcoin’s price movements are now mirroring those of the stock market once more. The correlation coefficient, which had reached its lowest point at the start of August, subsequently turned positive around mid-August.

In simpler terms, the anticipated common factor connecting many is the expectation of interest rate reductions by the U.S Federal Reserve in their upcoming FOMC meeting within the next 4 days. Generally, these expectations have pointed towards a significant decrease in rates. If this prediction comes true, it would be advantageous for riskier investments such as stocks and cryptocurrencies.

It’s widely believed that both Bitcoin and the stock market will react to the announcement. If the Federal Reserve chooses to implement substantial interest rate reductions, many experts predict a positive outcome will be probable. However, it’s important to mention that over time, the relationship between these two markets could weaken, particularly if Bitcoin experiences significant growth independently.

All eyes on Bitcoin miner supply

Regarding optimistic predictions, the market is actively seeking indications of a significant upswing happening soon. Interestingly, a recent Santiment update highlights that mining wallet balances could potentially serve as a robust hint for the start of the next big rally.

The amount of Bitcoin and Ethereum stored in mining wallets has been decreasing since mid-2024, but a recent slight increase may indicate an impending surge. This uptick could be a sign that a new bull market is on the horizon.

As a crypto investor, I find it crucial to closely monitor the reserve levels of miners. The latest assessment shows that Bitcoin miner reserves have been on a steady decline since April. However, there was a slight increase in July, only for it to reverse again and see an increase in outflows rather than inflows.

According to our previous examination, mineral flows have stayed near their lowest point for 2024. This suggests a strong possibility of a shift in these levels, given that we’re almost at the end of the year’s fourth quarter.

By coupling interest rate reductions and U.S elections, we might find the ideal mix of factors to spark another significant market event. A noticeable change in Bitcoin miners’ reserves, particularly a substantial rise, could serve as strong evidence that the next bull market is imminent.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-14 13:13