-

SOL saw relatively muted interest from traders during the weekend pump

However, Santiment deemed the lag as a bullish cue for the altcoin

As a seasoned crypto investor with over a decade of experience, I must admit that I’ve seen my fair share of market fluctuations and trends. When I saw SOL lagging behind during the weekend pump, it initially raised some red flags for me, given my background in technical analysis. However, upon closer inspection and considering Santiment’s insightful take on the matter, I find myself leaning towards a bullish stance on SOL.

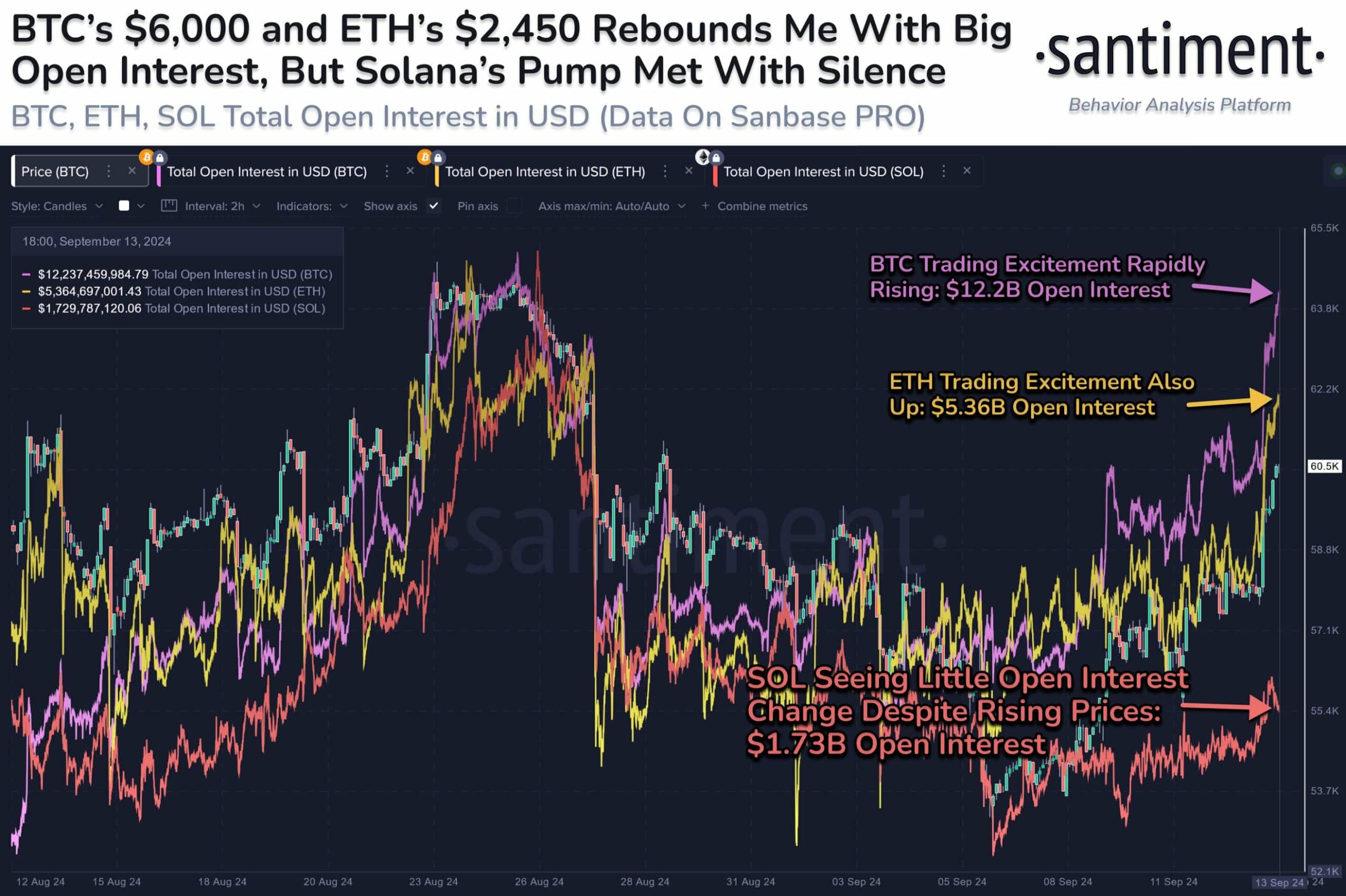

Friday’s market rebound saw varied interest from traders among Bitcoin [BTC], Ethereum [ETH], and Solana [SOL]. SOL trailed others in Open Interest (OI) rates, which track interest from Futures traders and overall liquidity injection. SOL saw only $1.7B in OI, compared to BTC’s $12B and ETH’s $5.3B.

Yet, as per Santiment’s analysis, this delay might serve as a positive signal for SOL, suggesting potential bullishness.

On the contrary, Solana hasn’t seen much of a recovery beyond $140. This could be a positive indicator for SOL, suggesting that enthusiastic traders are focusing their attention elsewhere.

Speculators positive about SOL

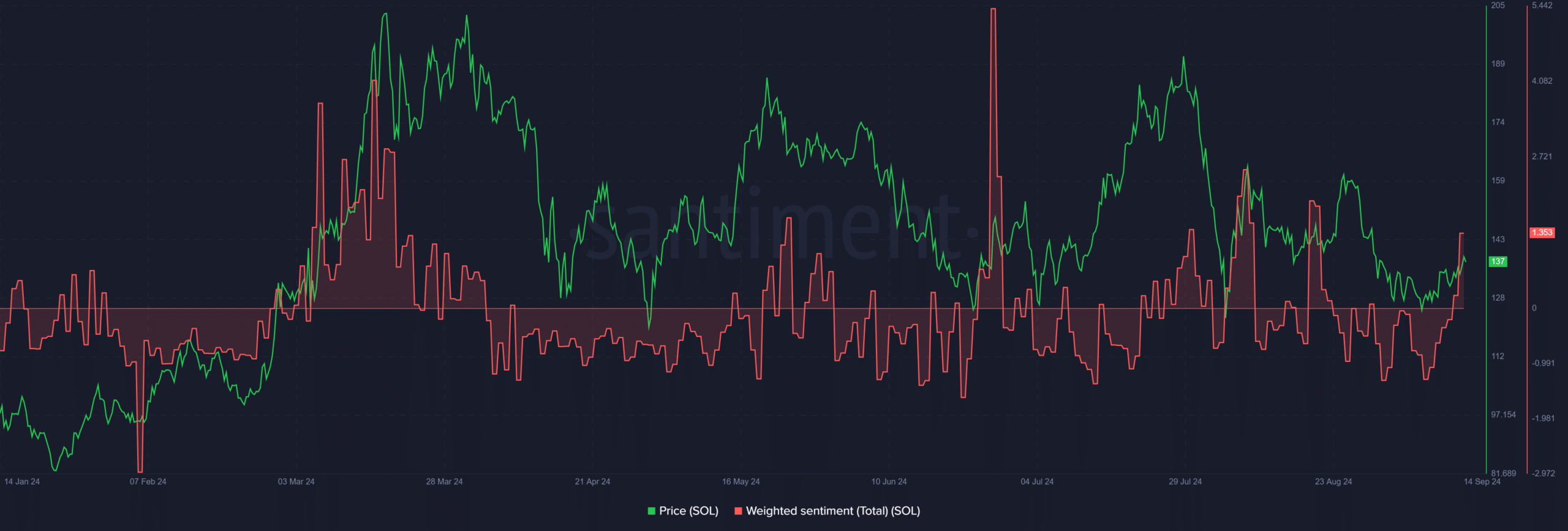

Over the weekend, I noticed that even my Solana (SOL) investments managed to bounce back, pulling it away from the negative sentiments that had been lingering. As I’m typing this, there’s a palpable optimism among crypto speculators about SOL, a feeling not felt since late August.

From my perspective as an analyst, while there seems to be a strong belief in significant future price growth, the shorter-term charts appear to tell a different story at this moment.

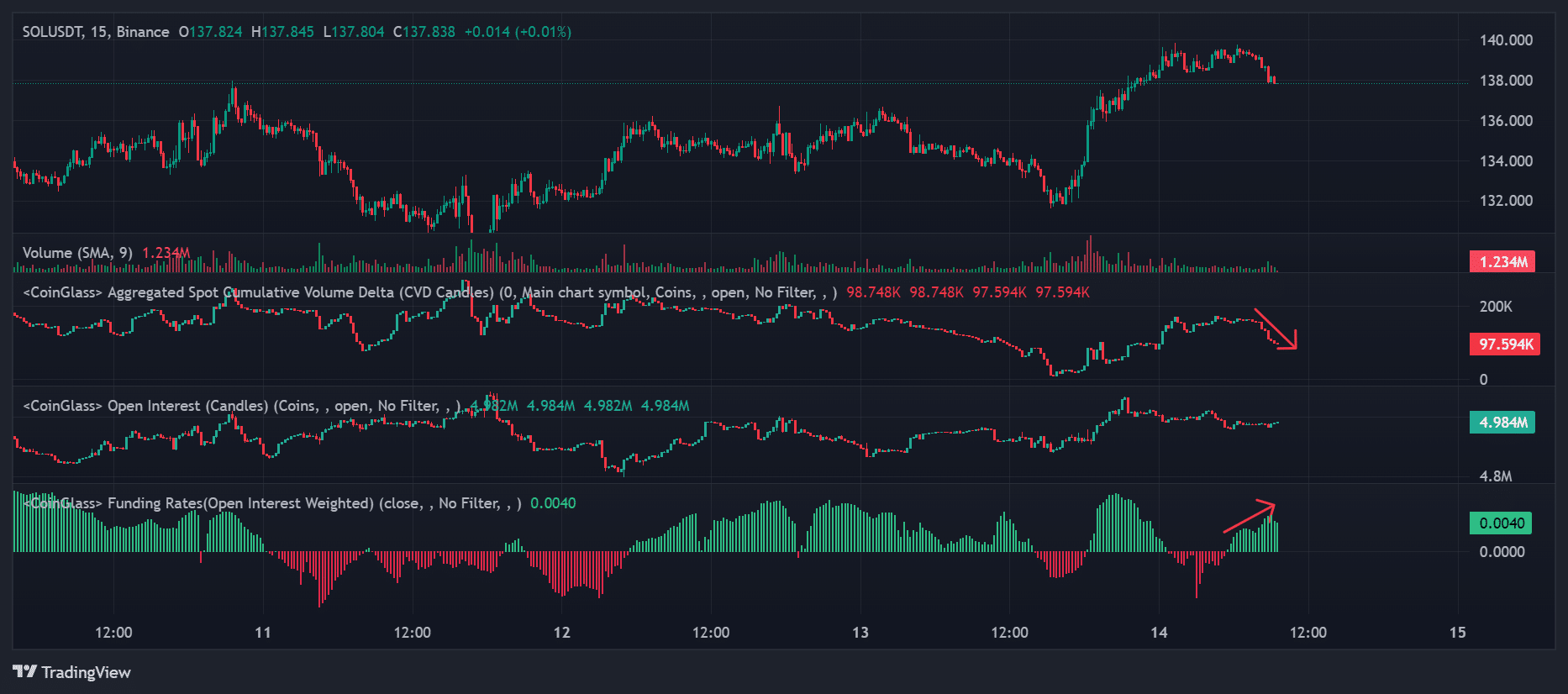

To put it simply, the overall Spot Cumulative Delta (CVD) decreased, suggesting that the number of SOL shares being sold exceeded the number being bought. This increase in selling activity could be attributed to a rise in short selling as SOL approached $140.

Meanwhile, the OI (Open Interest) stayed constant, indicating that certain traders were placing bearish wagers on the altcoin throughout the weekend.

Furthermore, the funding rates varied, demonstrating the potential for short positions to disrupt an otherwise robust upward movement beyond $140 on weekends.

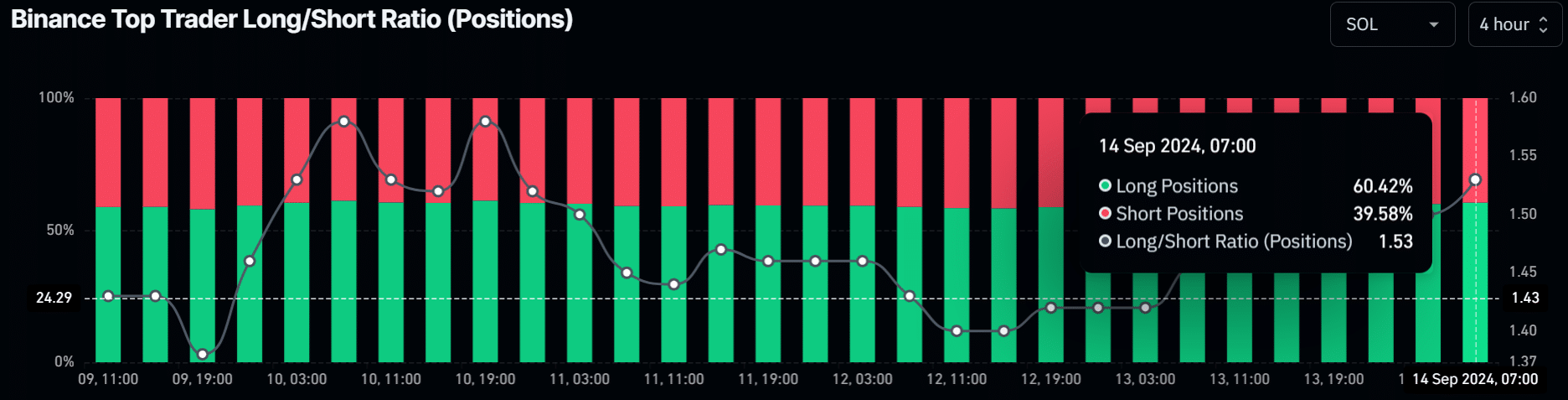

Despite the short bets from retail traders, smart money on Binance doubled down on long positions. In fact, according to Binance Top Trader Long/Short Ratio, long positions accounted for 60% of all positions.

Although this demonstrated a high conviction for SOL’s upside potential, it could also mean a hedge for spot positions.

Currently, SOL‘s worth is estimated at $137, representing a 7.5% increase over the past week, having peaked at $139.8 during this month.

Next week is shaping up to be an exciting time for the altcoin. Not only will there be a potential bullish shift due to the anticipated Federal Reserve rate cut on the 18th of September, but also, Solana’s BreakPoint 2024 event may add more fuel to its momentum.

The gathering is scheduled for September 20-21 in Singapore, and it’s known for triggering a surge in prices. Notably, it’s an occasion where insights from the Solana system are frequently disclosed by industry insiders.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-09-14 20:07