-

One analyst believes BTC is positioned to revisit its all-time high

Significant buying activity from large investors, other key indicators supported this trend

As a seasoned crypto investor with a keen eye for market trends and a knack for spotting whale activity, I’m cautiously optimistic about Bitcoin’s potential to reach new heights. The recent recovery and the significant buying activity from large investors have been noteworthy, and they seem to be supported by key indicators such as the rebound from a major support level and the convergence of levels that could propel BTC to the $66,000-mark.

The significant rebound in BTC‘s price as depicted on the graphs has caught attention, erasing earlier losses. Remarkably, it exhibits robustness across all timeframes, leading traders and investors to witness improved portfolio performance due to a 24-hour surge of approximately 3.42%.

Further expansion may be expected ahead, with indications pointing towards the possibility of reaching all-time highs again following a thorough examination.

Is $75,000 coming up next?

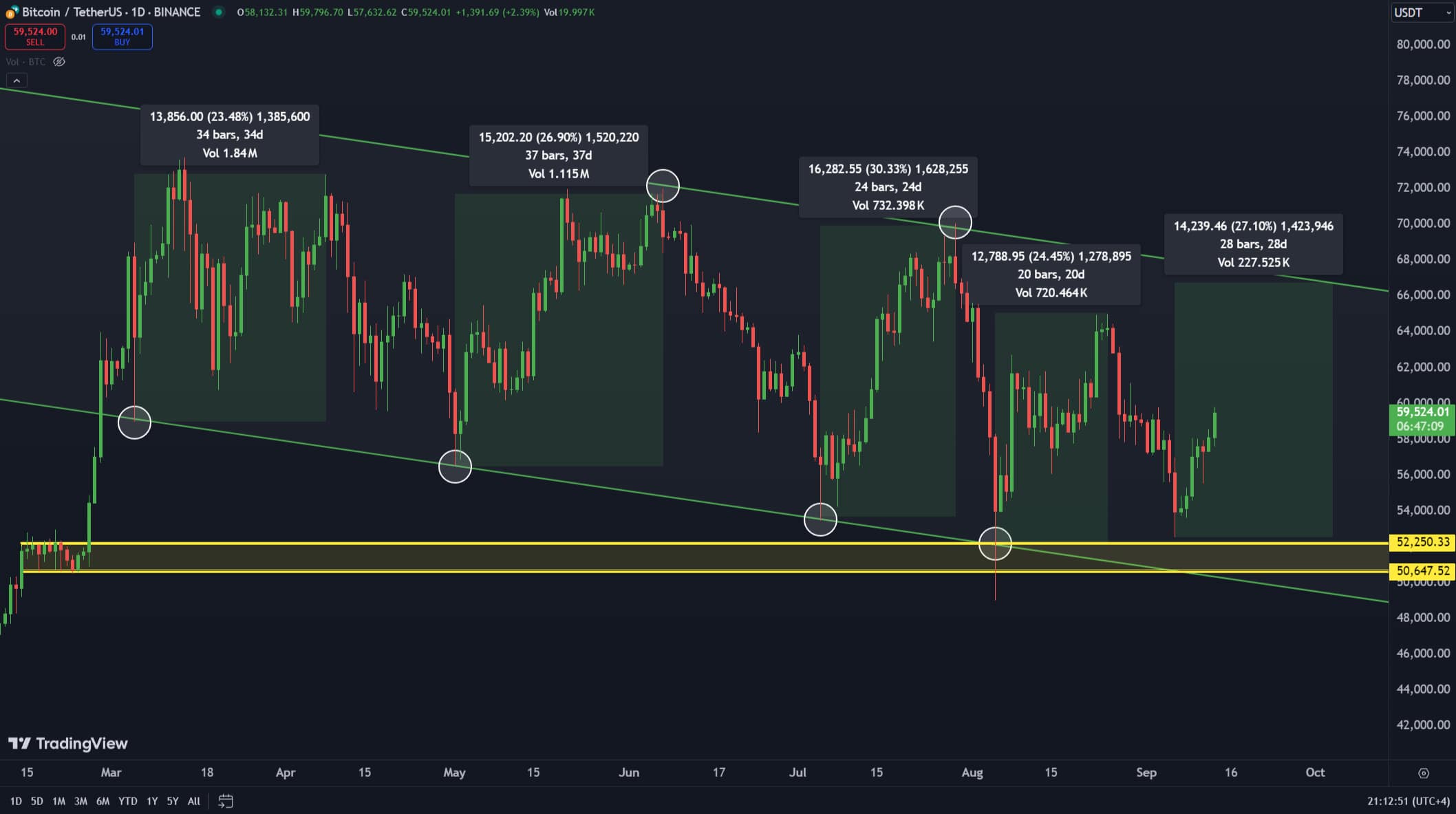

As per analyst Carl Runefelt’s analysis, Bitcoin‘s recent surge can be attributed to its bounce back from a crucial support area that ranges from approximately $52,250 to $50,647. This important level aligns with the base of the descending trendline within which Bitcoin has been moving recently.

On a price chart, when you see a channel that slopes downwards, it often suggests an upcoming price increase. This is because increased liquidity tends to push the asset’s price upwards.

As suggested by Runefelt’s analysis, the meeting point of these levels might potentially cause a surge in Bitcoin, amounting to approximately 27.10%. This could drive the price up towards the top boundary of the descending channel, roughly around the $66,000 level.

In another analysis by Runefelt, he observed that Bitcoin also formed a descending resistance line.

Breaking this line could lead to significant gains. Runefelt added,

“It [BTC] could go parabolic.”

Based on the levels shown on his graph, there’s a good chance this breakout might propel Bitcoin towards significant trading areas ranging from $72,000 to $74,000. There’s also the possibility it could go higher still, if the market maintains its current strength.

A spike in whale activity bodes well for BTC

Additionally, AMBCrypto found an increase in whale behavior, marked by substantial investments pouring into the market. This could potentially boost Bitcoin’s value as reflected on price charts.

A standout transaction was MicroStrategy’s acquisition of 18,300 BTC between 6 August and 12 September. The firm’s latest transactions brought its total holdings to 244,800 BTC – Meaning, unrealized gains of $4.71 billion.

Furthermore, it appears that other whales in the market are also making moves. Just recently, an investor bought 1,062 Bitcoins, bringing their overall Bitcoin holdings up to 10,043 BTC, which is currently valued at approximately $603.84 million.

As a crypto investor, witnessing a whale’s entry into the market like this serves as a beacon of restored faith in the asset we’re invested in, which happens to be Bitcoin (BTC) in this instance. This renewed confidence often sparks a surge in demand for the asset, fueling its potential growth.

Additionally, we’ve seen an increase in market fluidity due to the rise of stablecoins like USDC. As evidence, the U.S. Dollar Coin Treasury recently printed 50 million USDC and moved it to Coinbase, suggesting growing interest as investors seek to acquire more.

During this period, there was also a significant transfer of $30,950,165 from Coinbase Institution to Coinbase – Another sign of the underlying demand for liquidity to purchase tokens.

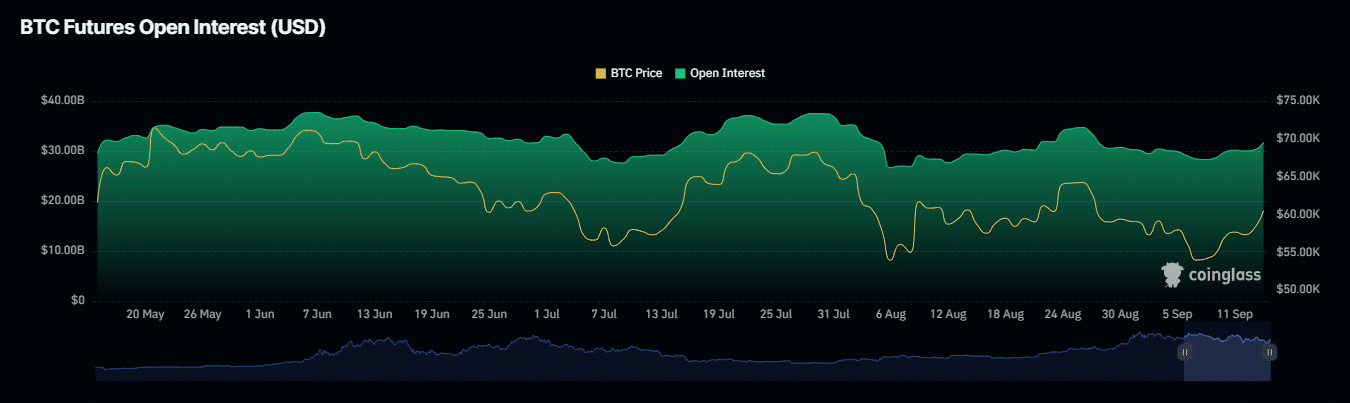

Over time, as whales continue their trading activities, retail investors are adopting similar strategies. Notably, as reported by Coinglass, the Open Interest in Bitcoin increased by 5.22%, reaching a staggering $31.72 billion at the current moment – this being its peak since early September.

If this pattern persists, it’s becoming more likely that Bitcoin prices will reach even greater heights.

A new high is close for BTC

In summary, the latest findings from Coinglass indicate that those who had speculated on Bitcoin’s price decrease (short traders) have experienced substantial losses.

Over a span of just 24 hours, approximately 89.7% of all open short positions on Bitcoin (BTC), worth around $48.81 million, were closed involuntarily as the price soared beyond $60,000. This strong upward trend implies that at present, there is a clear preference among traders for bullish investments over bearish ones.

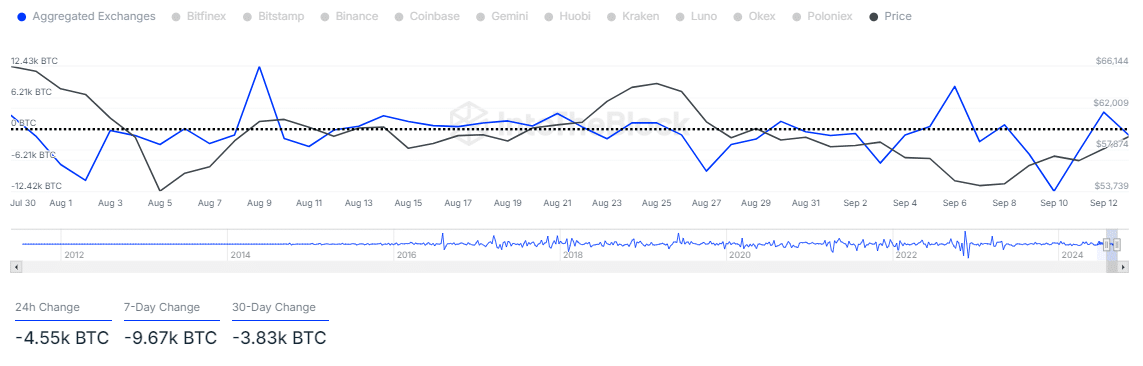

Furthermore, it’s worth noting that there has been a significant decrease in the amount of Bitcoin available on various trading platforms. Specifically, data from IntoTheBlock shows that over the last week, approximately 9,670 and 4,550 Bitcoins were withdrawn from exchanges.

When the amount of Bitcoin (BTC) listed on exchanges decreases, it usually results in a reduction of supply, which generally pushes the price of Bitcoin upward.

If these trends persist, Bitcoin might continue climbing in price as depicted by the graphs.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-15 08:08