-

Avalanche on the weekly and daily timeframe shows strength.

On-chain data of AVAX was looking good.

As a researcher with years of experience under my belt, I find the current state of Avalanche (AVAX) particularly intriguing. The recent development with ParaFi Capital tokenizing a portion of its $1.2 billion on the blockchain underscores AVAX’s growing influence in traditional finance.

As an analyst, I’m observing that Avalanche [AVAX] is extending its footprint into traditional finance, with ParaFi Capital planning to tokenize a segment of their $1.2 billion on the blockchain. This move aligns well with AVAX’s increasing momentum, as the market trends suggest possible further price increases.

At present, Avalanche (AVAX) is gathering strength inside a narrowing triangle formation known as a falling wedge, which emerged following the conclusion of its last bullish trend in April.

Keeping a close eye on the AVAX/USDT pair, analysts anticipate a potential surge if it breaks past the $28 barrier. Such a move might propel the price towards the $50 region, offering an estimated profit of more than 104%.

However, failure to break $28 might lead to a retest of support levels at $24.9 or $17.25.

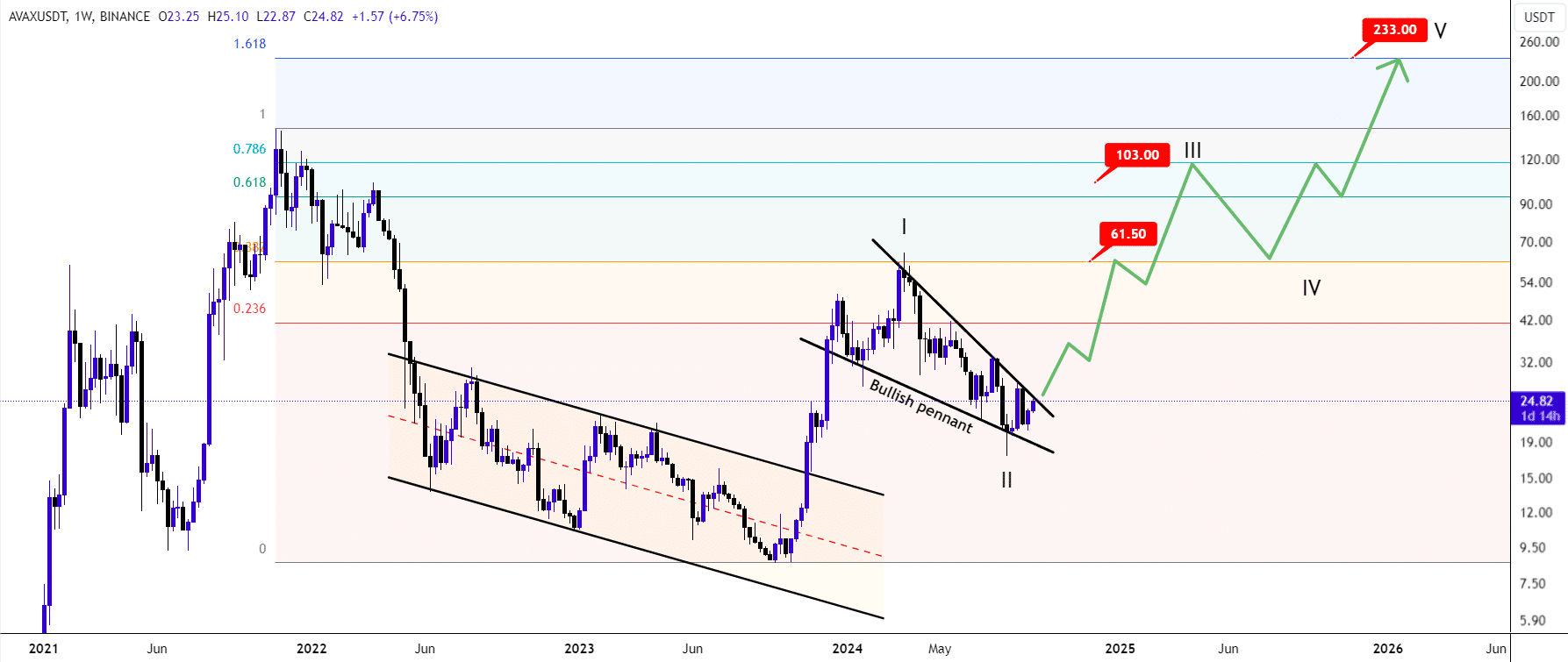

On a weekly basis, it appears that Avalanche (AVAX) against Tether (USDT) has concluded its second corrective phase. Additionally, the bullish flag formation, which is known as a pennant pattern, seems to have reached completion.

As a researcher, I anticipate that the subsequent development may represent the third bullish wave. This potential progression could extend towards the 0.618 to 0.786 Fibonacci levels, followed by another correction and subsequent upward momentum.

In simpler terms, the short-term goals are aiming for around $61.50, medium-term objectives are set at $103, and long-term aspirations reach as high as $233 for AVAX. This broader perspective indicates a positive or upward trend for AVAX, implying substantial potential for substantial growth in the long run.

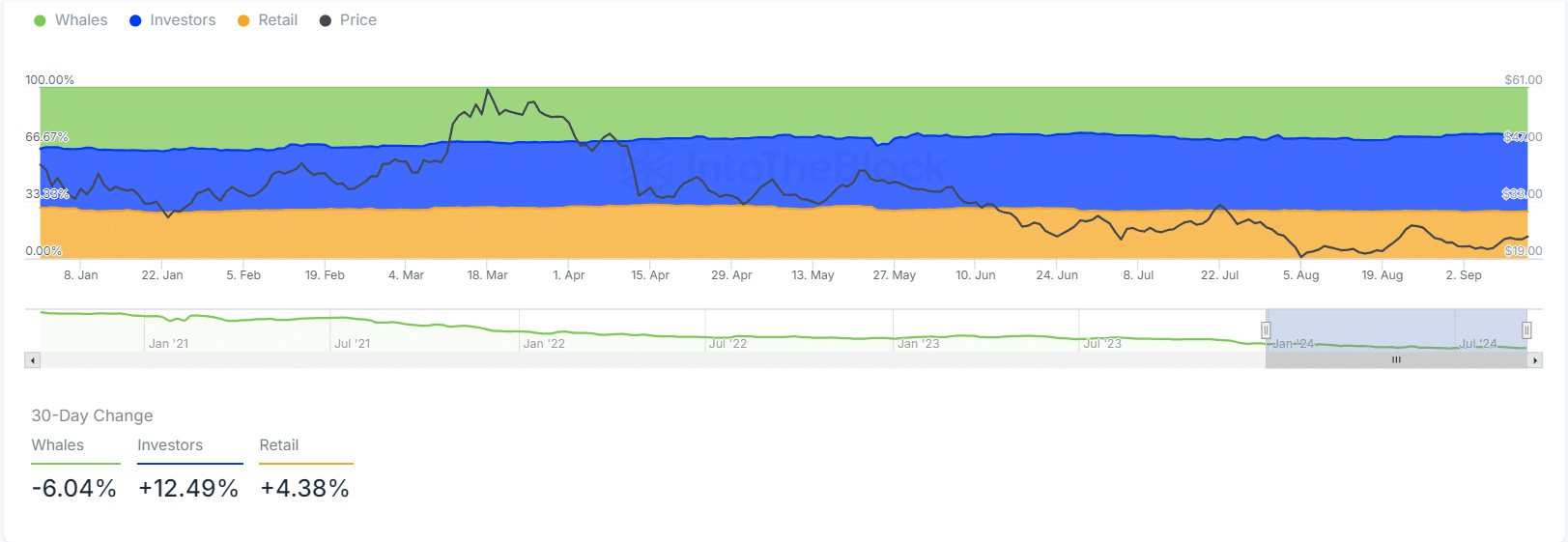

Historical ownership concentration

The latest on-chain indicators are pointing towards a positive trend for Avalanche. There’s been a 6% rise in staked AVAX, a 11% increase in DeFi Total Value Locked (TVL), and a 13% spike in stablecoins stored on the Avalanche blockchain.

These factors reflect growing confidence in the network.

Moreover, the distribution of historical ownership has experienced only slight adjustments. Notably, there’s been an uptick of 4.38% in retail ownership, while investor ownership has risen by 12%.

The drop in whale ownership was approximately 6%, yet the general outlook continues to be positive, supported by robust market activity.

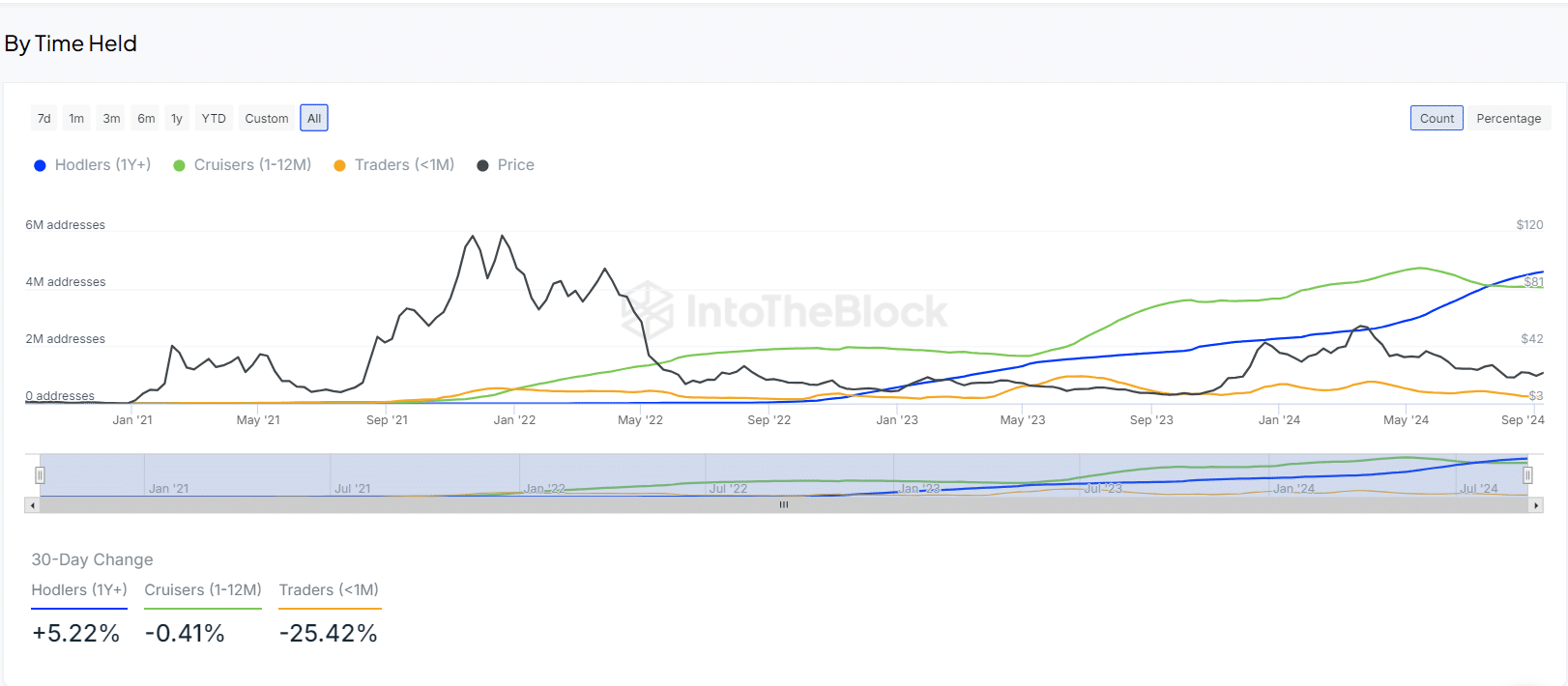

Avalanche addresses by time held

Furthermore, analysis of Avalanche tokens by time held reveals an increase in long-term holders.

Individuals who’ve owned AVAX for more than a year witnessed an increase of 5%, contrastingly, those who’ve owned it for between one to twelve months observed a slight dip of 0.4%.

As an analyst, I can express that I, myself, observe day traders tend to be more engaged and active within the crypto market. Specifically, when it comes to AVAX, these traders typically hold their positions for a shorter duration compared to long-term investors. This heightened activity results in increased on-chain transactions, contributing significantly to the overall network activity of AVAX.

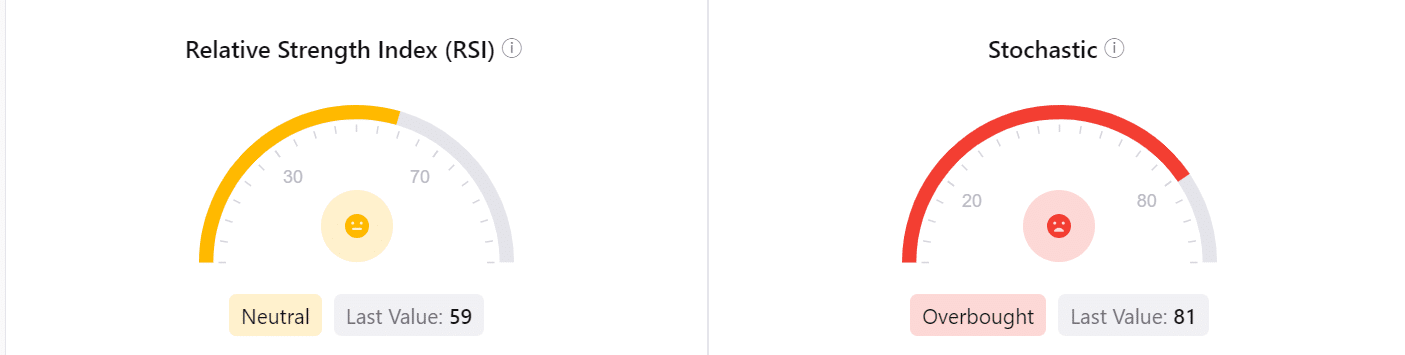

RSI is neutral

In simpler terms, the Relative Strength Index (RSI) currently shows a balanced or neutral level at 59, whereas the Stochastic RSI is at 81, suggesting that the market may be overbought, meaning it might have risen too much and could potentially correct itself.

Although an ‘overbought’ signal may sometimes indicate a potential reversal, it doesn’t necessarily mean that in the case of AVAX. Instead, it usually points to strong upward movement or bullish trends, especially when other signs don’t suggest an impending downturn.

Is your portfolio green? Check the Avalanche Profit Calculator

Traders view this as an optimistic sign for the price of AVAX moving higher.

Based on strong positive signs in technical analysis, blockchain activity, and investor ownership, it seems likely that Avalanche’s price will continue to rise in both the short and long run.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-09-15 14:16