- Solana liquid staking market may witness monumental growth towards $18 billion in TVL.

- Exchange outflows pinpointed positive sentiment in the market, further reinforcing the bullish bias.

As an analyst with over two decades of experience in the crypto market, I have seen my fair share of bullish and bearish cycles. However, the current growth trajectory of Solana (SOL) is truly remarkable. The potential for its liquid staking market to reach $18 billion TVL is not just a possibility, but a strong probability given the recent influx of support from major exchanges like Binance, Bybit, and Bitget.

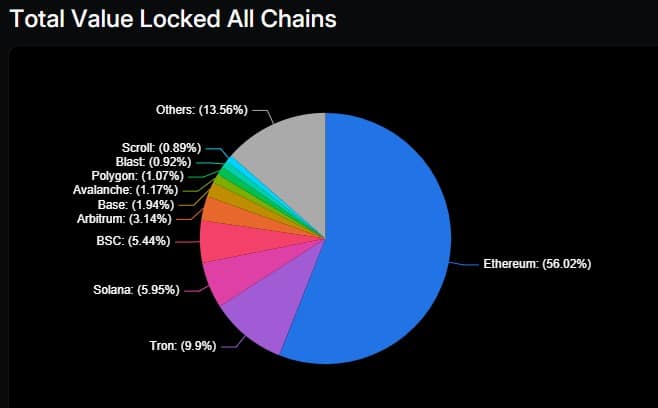

The value locked in Solana’s SOL is steadily increasing at a regular rate. As per a tweet from a well-known analyst, the market for liquid staking tokens might expand fivefold, potentially pushing Solana’s Total Value Locked (TVL) up to a staggering $18 billion.

The new liquid staking tokens from Binance, Bybit, and Bitget may accelerate the pace.

With an expansion in TVL (Total Value Locked), Solana gains enhanced security and market appeal, encouraging more investors. This growth could lead to a surge of liquidity within the network, stimulating and intensifying Decentralized Finance (DeFi) activities.

Whale activity pulls significant liquidity pools

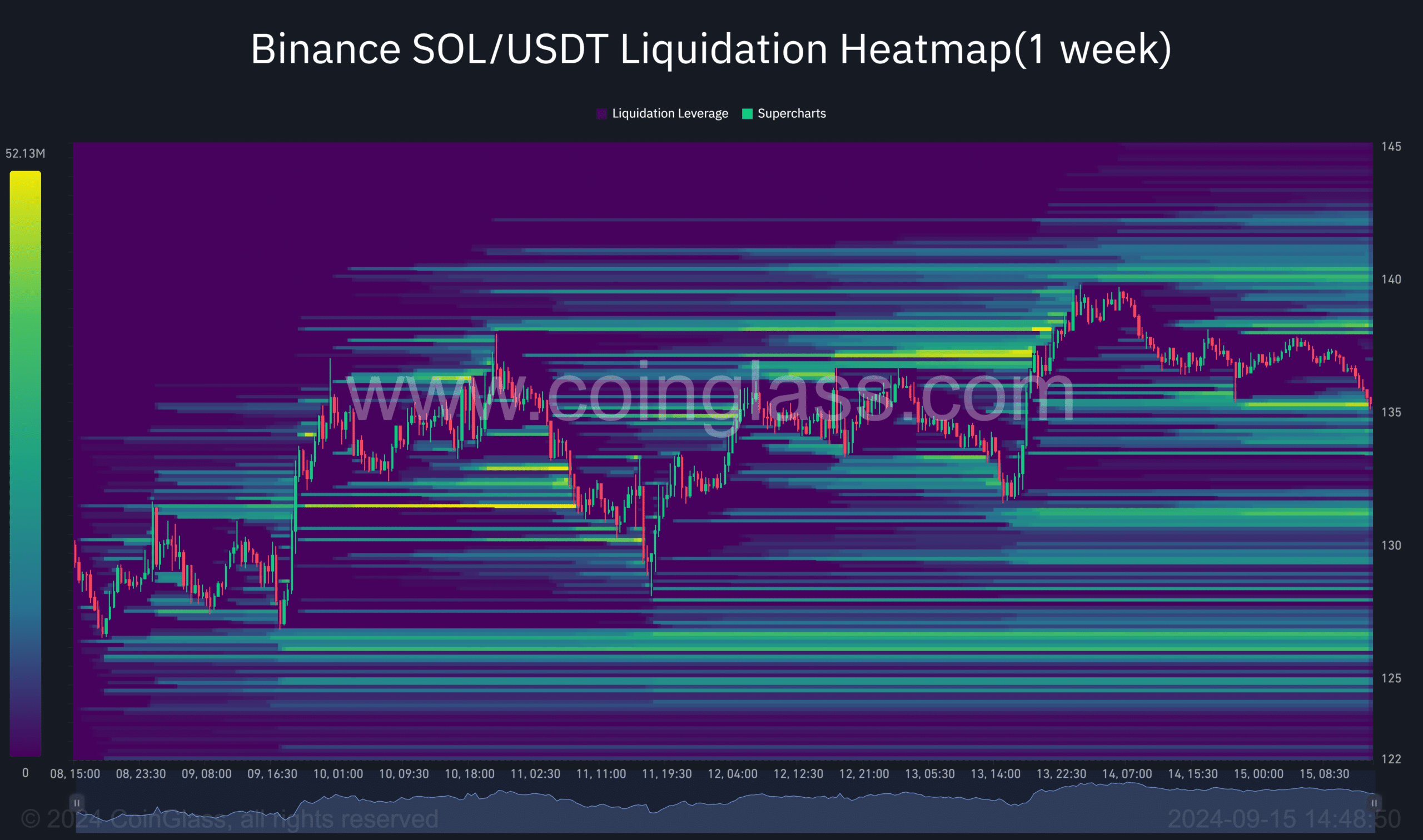

Building on the earlier mentioned rise in Total Value Locked (TVL), it’s worth noting that whale actions are still playing a significant role in Solana’s market dynamics. The data from Coinglass shows a liquidity pool of around $10 million at the $138 price point, as evidenced by the liquidation heatmap.

This signals a bullish bias as whales protect that price range.

As I delve deeper into the dynamics of Solana’s market, it appears that the growing commitment of assets within its protocols may lead to price stability or even an upward trend. The actions of whales, significant players in this space, seem instrumental in predicting future market fluctuations for Solana.

Solana exchange outflows flash bullish sentiment

Investors keeping their SOL instead of selling it indicates an increase in holdings. Furthermore, more Solana (SOL) is being committed to staking platforms, reducing the amount available for trading on exchanges. This reduction in liquidity could potentially lead to a surge in prices due to growing demand in the future.

As TVL grows, exchange outflows add to the bullish sentiment, pushing SOL higher.

Lately, the random RSI (Relative Strength Index) has shown a bullish overlap. This suggests that Solana may experience a strong uptrend in the coming days.

Read Solana’s [SOL] Price Prediction 2024-25

As a crypto investor, I’ve noticed that chart patterns suggest a significant level of support lies within the $135 to $138 range. This alignment seems to be due to the presence of strategic liquidity pools, which appear to have been established by whales in their investment strategies.

The increase in Total Value Locked (TVL) on Solana, primarily due to liquid staking and large investor actions, points towards an optimistic near future. As the flow of exchanges decreases, reducing selling pressure, it’s likely that Solana’s native currency (SOL) could see substantial growth in the short term.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-15 19:03