As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I’ve learned to keep my eyes open for promising opportunities amidst the chaos. And let me tell you, Cardano [ADA] has been one of those shining beacons in a sea of red.

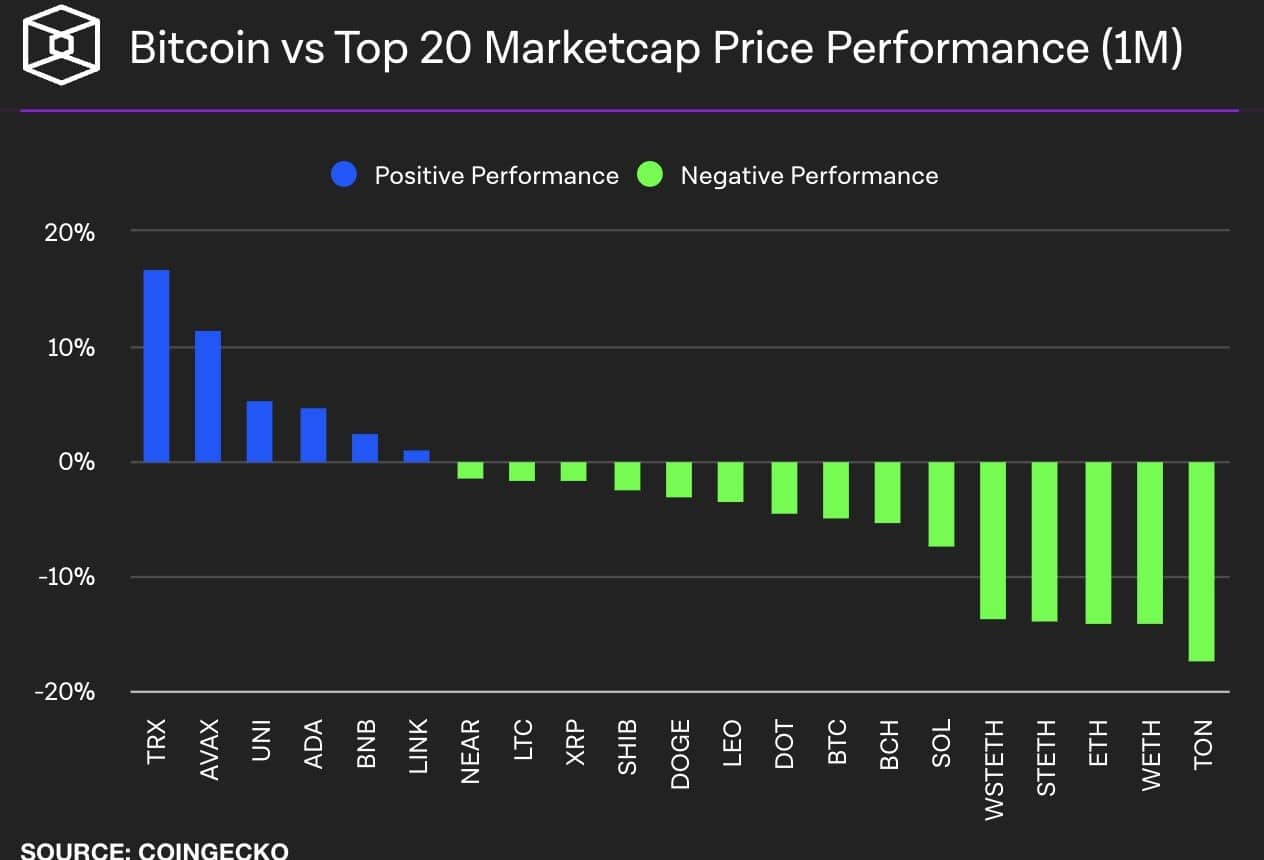

In recent times, Cardano [ADA] has demonstrated remarkable resilience, managing to surpass Bitcoin [BTC] in terms of performance during the month of August.

One way to rephrase that sentence could be: “ADA‘s impressive results compared to Bitcoin are a notable achievement, placing it in the group of the top five cryptocurrencies that exceeded Bitcoin’s performance.

The superior performance indicates that Cardano could potentially increase in value further, approaching the end of this year.

ADA price action forms triple bottom

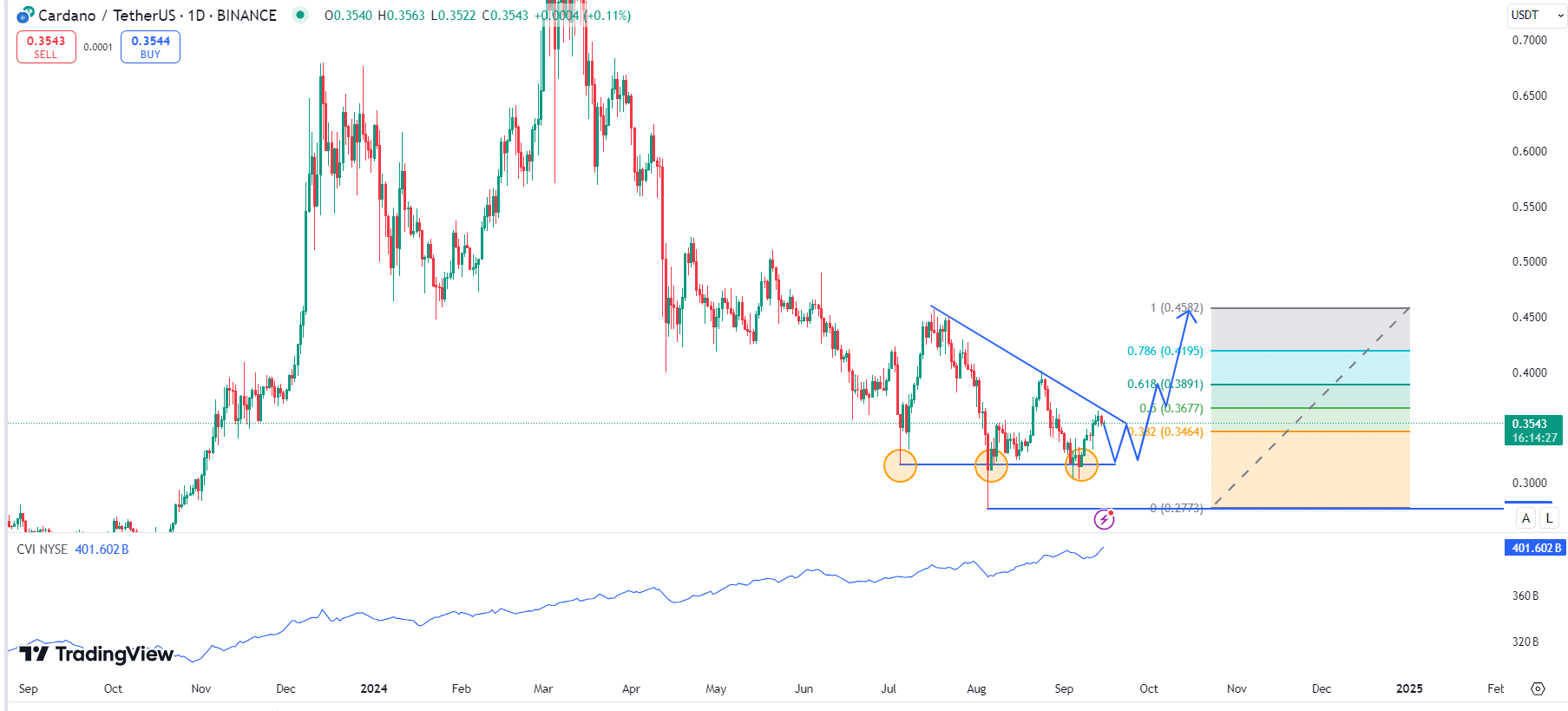

Looking closely at the daily trends of Cardano’s price suggests a possible bullish scenario might be developing. The cryptocurrency seems to have established robust support near $0.32, forming what appears to be a triple-bottom chart formation.

On August 5th, when the market took a dive, the initial contact with that level was made, and further interactions at that same level only served to strengthen it, suggesting a robust foundation for Cardano.

Moreover, ADA is forming a triangle structure, where the three-pronged bottom serves as its base. The falling trendline has held back recent price peaks, yet if ADA breaks out above this pattern, it might surge upwards.

Employing the Fibonacci retracement indicator, if Cardano (ADA) persists in staying above the halfway point of its recent price drop, this could indicate a change in investor feelings and disprove the present bearish perspective that has prevailed over the last five months in the market.

Breaking through the $0.37 mark and maintaining this upward trend would provide stronger evidence for a bullish change in direction.

As a crypto investor, if the price were to hit the 100% Fibonacci retracement level around $0.45, it would signify a full turnaround from the recent bearish trend we’ve been experiencing, indicating potential bullish momentum ahead.

Furthermore, the total volume index continues to rise consistently, now standing at approximately $401 billion. This suggests active market engagement and lends credence to the argument that ADA prices could potentially increase.

Addresses by time held

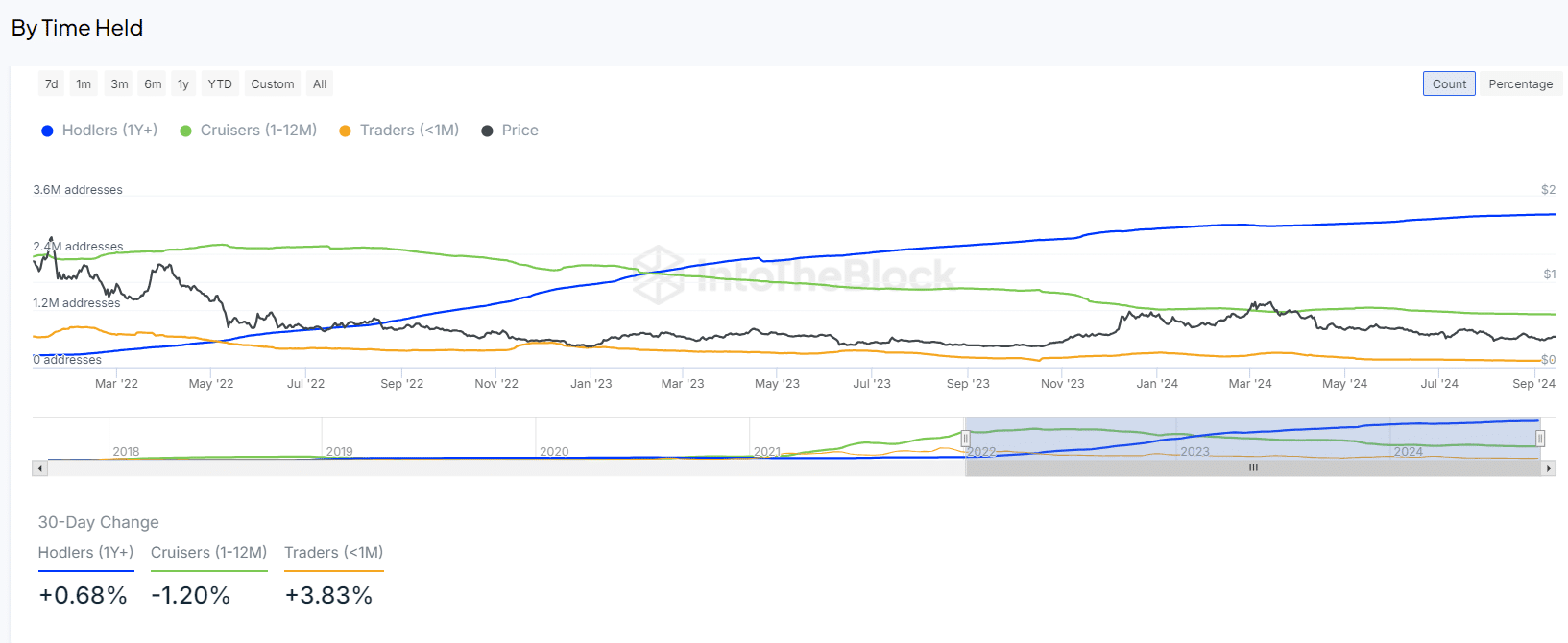

By examining on-chain data, specifically the duration of ownership among addresses, it’s clear that the long-term investors of Cardano (ADA), often referred to as “Hodlers,” are expressing a sense of confidence and hope for the project’s future.

Individuals who’ve held onto ADA for more than twelve months are consistently growing in number, showing faith in the value of this asset.

In the last month, there’s been a minor increase of 0.68% in the data related to long-term holders, but those who held for fewer than 30 days experienced a more significant surge of 3.8%, indicating a rise in activity for short-term investments.

Cardano open interest

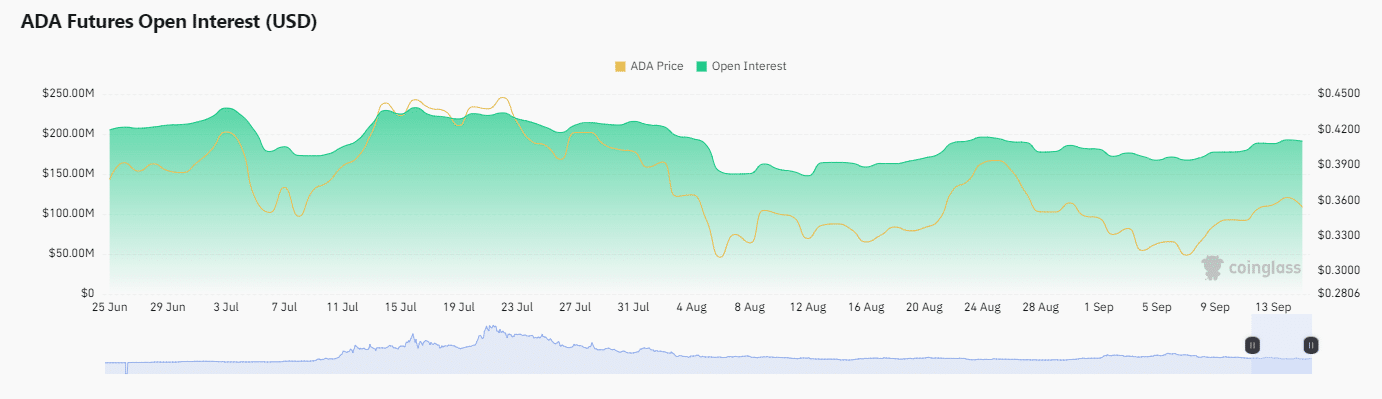

The amount of ongoing commitment or investment in Cardano’s futures contracts, specifically at the $0.35 price point, continues to hold steady at approximately $190.98 million.

The consistent level of open interest indicates that traders continue to have faith in ADA, as there are no major ups and downs, which might indicate a decline in trader involvement.

Since June 2023, as per Coinglass, the open interest chart indicates a steady pattern, suggesting a continuous increase in investor focus on amassing ADA.

Is your portfolio green? Check the Cardano Profit Calculator

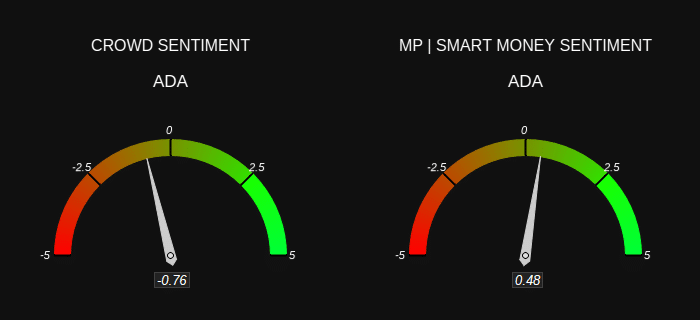

ADA market sentiment

Ultimately, opinions about Cardano’s market trends are split. Although the common public tends to be bearish towards ADA, the more knowledgeable investors seem optimistic about it.

historically, it’s often the case that savvy investors predict market trends better than the general public, who tend to jump in too late. Given this disparity, it might be worthwhile to look at investing in Cardano (ADA) now, as the market seems to be improving.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-16 04:08