-

Whale accumulation of SUNDOG suggests increasing confidence, with recent purchases totaling over $2.5 million.

On-chain data supported the bullish sentiment, with short positions being liquidated amid rising price momentum.

As a seasoned crypto investor with battle-tested nerves and a keen eye for trends, I find the recent whale accumulation of SUNDOG intriguing. With two heavyweight transactions totaling over $2.5 million, these purchases suggest growing confidence in the token’s future potential.

Lately, the behavior of whales – significant investors – in the Sundog platform has sparked interest among financial observers. Two notable transactions have ignited discussions about what these moves might mean for the token’s upcoming trajectory.

One whale spent $2 million to acquire a large amount of SUNDOG in a single transaction, followed by another whale purchasing $500,000 worth, equating to 1.16 million tokens.

This notable purchases might signal growing optimism about the asset’s future value. Analyzing market mood, technical signals, and blockchain data can help determine if this positive trend is long-lasting.

Are whale purchases signaling long-term confidence in SUNDOG?

A rapid buildup of SUNDOG tokens among large investors indicates a growing confidence in the token’s future rise. Currently, its value is being exchanged at $0.3597, marking a 5.01% price surge over the last day.

This increase in value appears to align with substantial acquisitions, suggesting that major investors (often referred to as ‘whales’) might be preparing for a major price shift by strategically positioning themselves first.

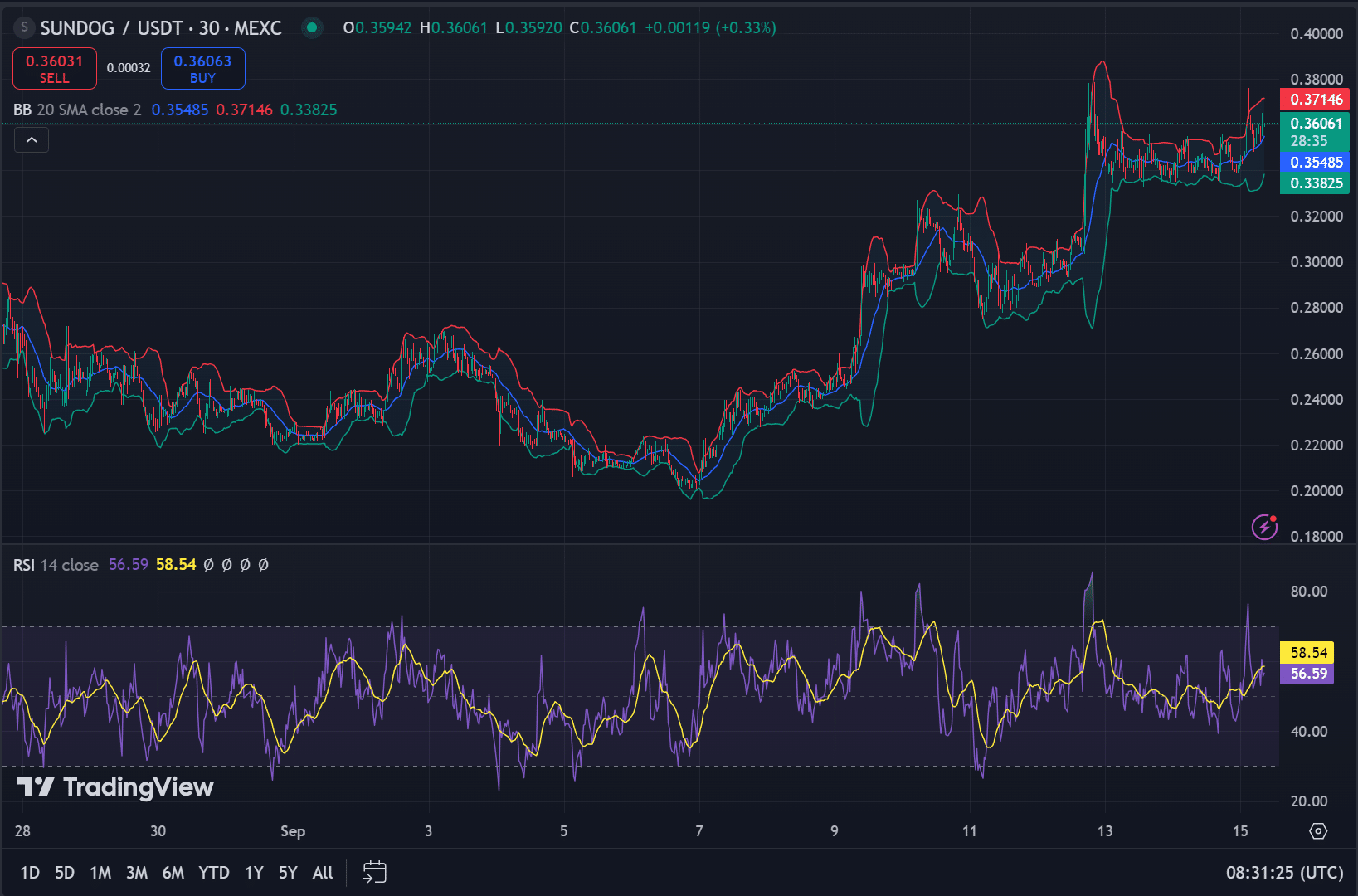

Based on the Bollinger Bands analysis, we’re witnessing heightened volatility as the price approaches the upper band ($0.37146), hinting that the bullish trend could persist. Conversely, the lower band at $0.33825 acts as a significant level of support.

Currently, the Relative Strength Index (RSI) stands at 58.54, slightly undershooting the overbought zone. This suggests that the token might continue its upward trend a bit more before it reaches the overbought levels.

What role does on-chain data play in this rally?

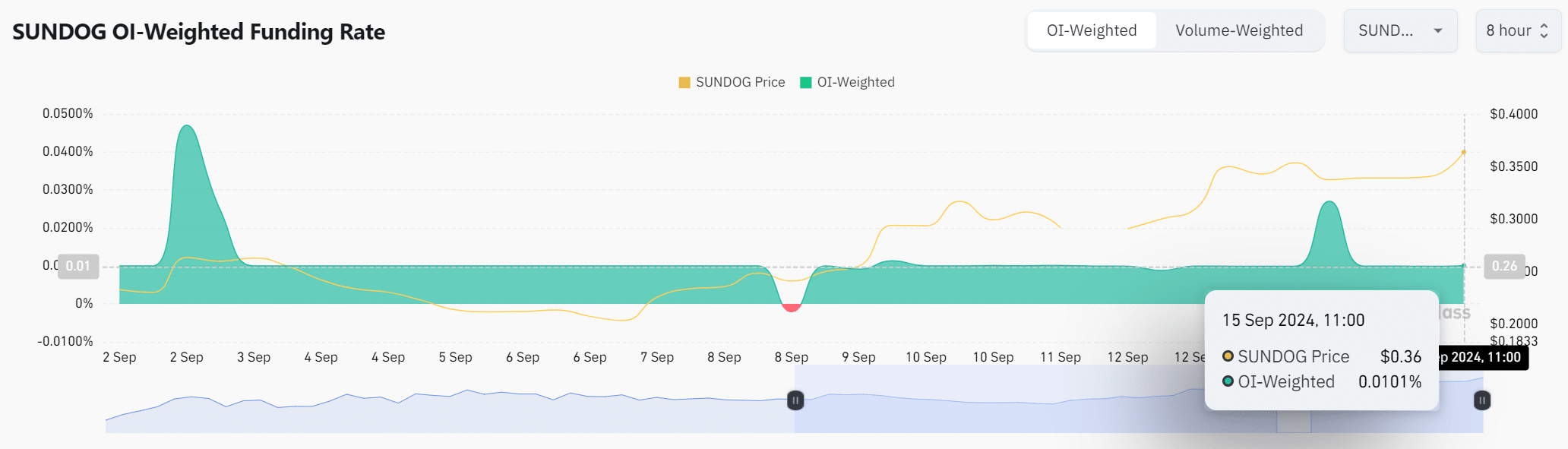

Measurements directly on the blockchain provide additional understanding of why SUNDOG has recently increased in value. The combined interest of traders, weighted by open interest, currently sets the funding rate at 0.0101%. This figure suggests a positive outlook as investors are willing to pay extra to keep their long positions active.

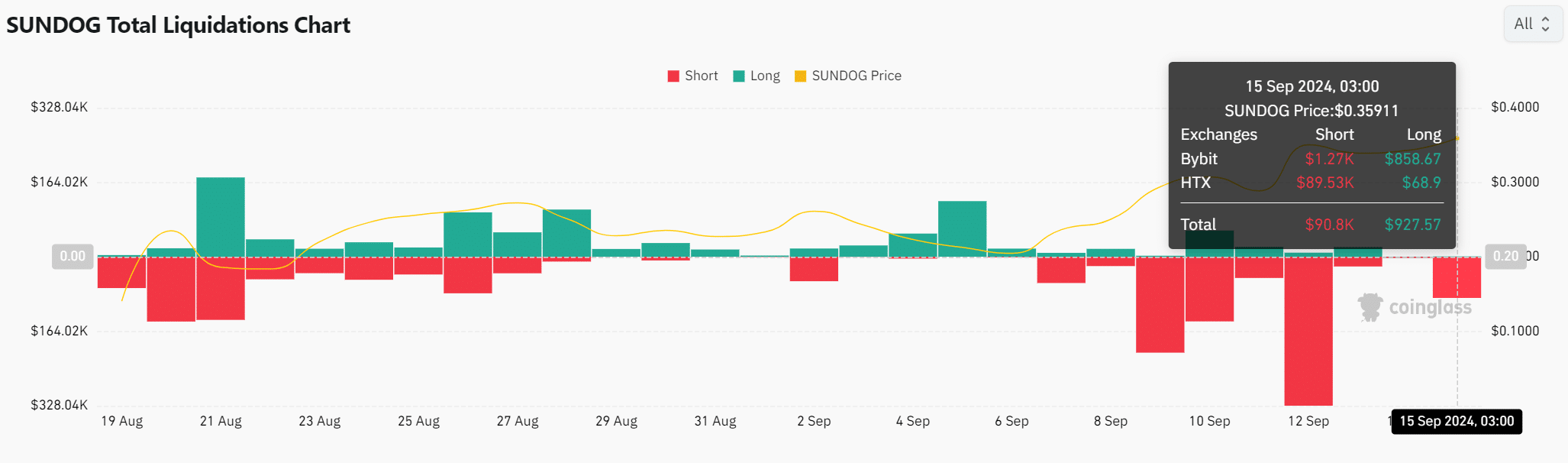

Moreover, the total liquidation graph shows that trades with a total value of $90,800 from the short position were eliminated, suggesting that pessimistic traders are feeling the pressure as the price keeps climbing higher.

On the other hand, just $927.57 worth of long positions have been closed, suggesting that optimism continues to fuel the upward trend in SUNDOG‘s price movement.

Will SUNDOG’s price continue to rally?

Based on Sun Dog’s current price trend and the accumulation of large investors (whales), it seems likely that the token might continue its upward trajectory in the near future. Still, it is crucial to keep an eye on the Relative Strength Index (RSI) as it gets close to overbought territory, and be prepared for possible market fluctuations within the Bollinger Bands.

While whale purchases indicate long-term confidence, the market’s response to sudden shifts in whale activity will be essential in determining whether the rally sustains.

For the time being, things look promising, but it’s crucial for traders to remain alert and watchful for any unexpected market fluctuations.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-16 09:11