- Trump survives a second assassination attempt, impacting both prediction and crypto markets.

- Bitcoin drops 3% post-attack, contrasting with its previous rally during an earlier attempt.

As a seasoned analyst with years of market observation under my belt, I find myself both astounded and intrigued by these recent events surrounding Donald Trump and their subsequent impacts on the prediction and crypto markets.

Surprisingly, presidential hopeful Donald Trump came close to experiencing another assassination attempt – this one occurring at his golf club in Florida.

The incident comes just two months after a previous attempt at a Pennsylvania rally.

Trump’s assassination attempt

Although Trump’s team has stated that he is unhurt and well, the occurrence has caused a stir in both prediction markets and the cryptocurrency world, leading to significant changes in market trends and projections for the forthcoming election.

Trump’s health was further confirmed by Vice President Kamala Harris, who took to X and stated,

“I’ve learned about the news of gunfire close to where former President Trump resides in Florida, and I’m relieved that he appears unharmed. It’s crucial for our nation to reject any form of violence.

Impact on Polymarket data

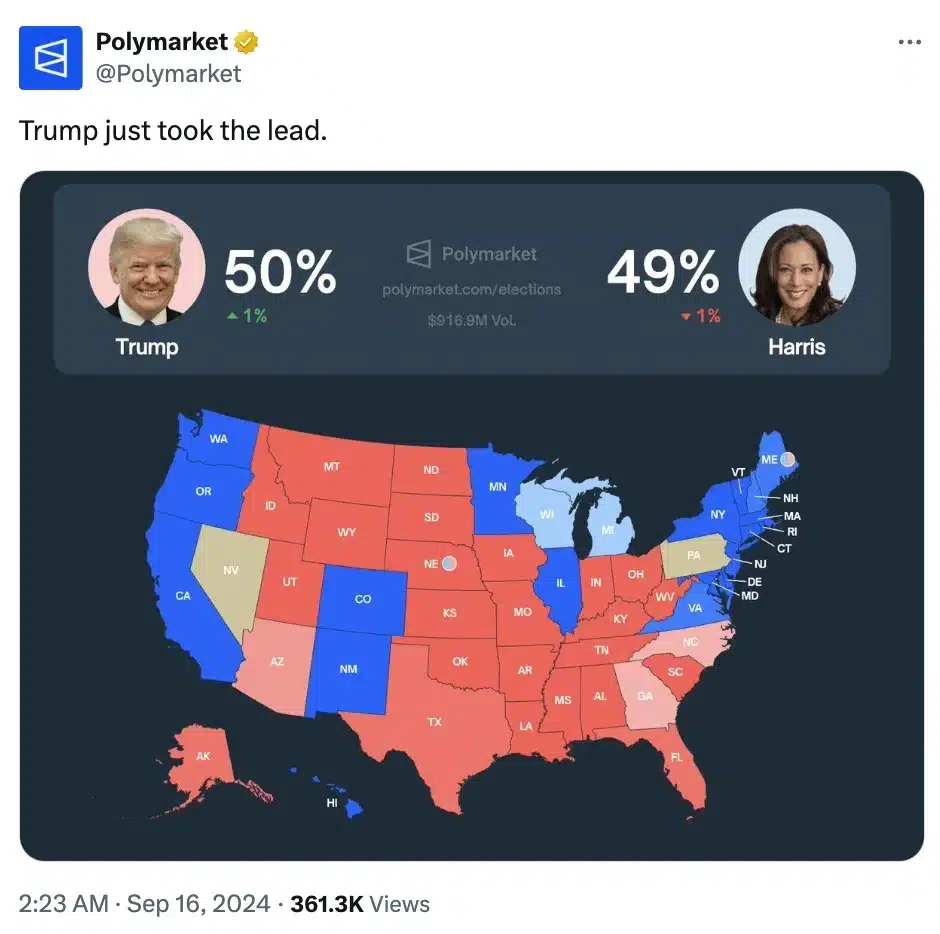

After the assassination attempt, Polymarket’s data indicated a noticeable change in the election polls. Currently, Trump is predicted to receive about 50% of the votes, while Harris trails closely with approximately 49%.

In contrast to the poll results following the debate, which saw Harris climbing up to 50% while Trump was at 49%, this situation represents a shift.

It appears that the assassination attempt had an equalizing effect, bringing both parties back to a balanced position again.

According to the latest Polymarket report, Harris maintains a 50% lead, whereas Trump’s position has shifted slightly to 49%. This adjustment underscores the continued fluctuations in voter opinions.

Impact on Bitcoin’s price

In response to the recent assassination attempt, there was a significant decrease in Bitcoin’s [BTC] price within the cryptocurrency market.

After the recent attack, Bitcoin experienced a 3% decrease in value. According to the most recent information from CoinMarketCap, its current status shows a drop of 2.67%. At this moment, it is being traded for approximately $58,592.

In contrast to the earlier assassination attempt that followed a surge in Bitcoin’s price, this time around, Bitcoin’s ascent was noticeably absent. Previously, it had spiked dramatically, breaking through the $60,000 barrier and reaching over $65,000 during its upward trajectory.

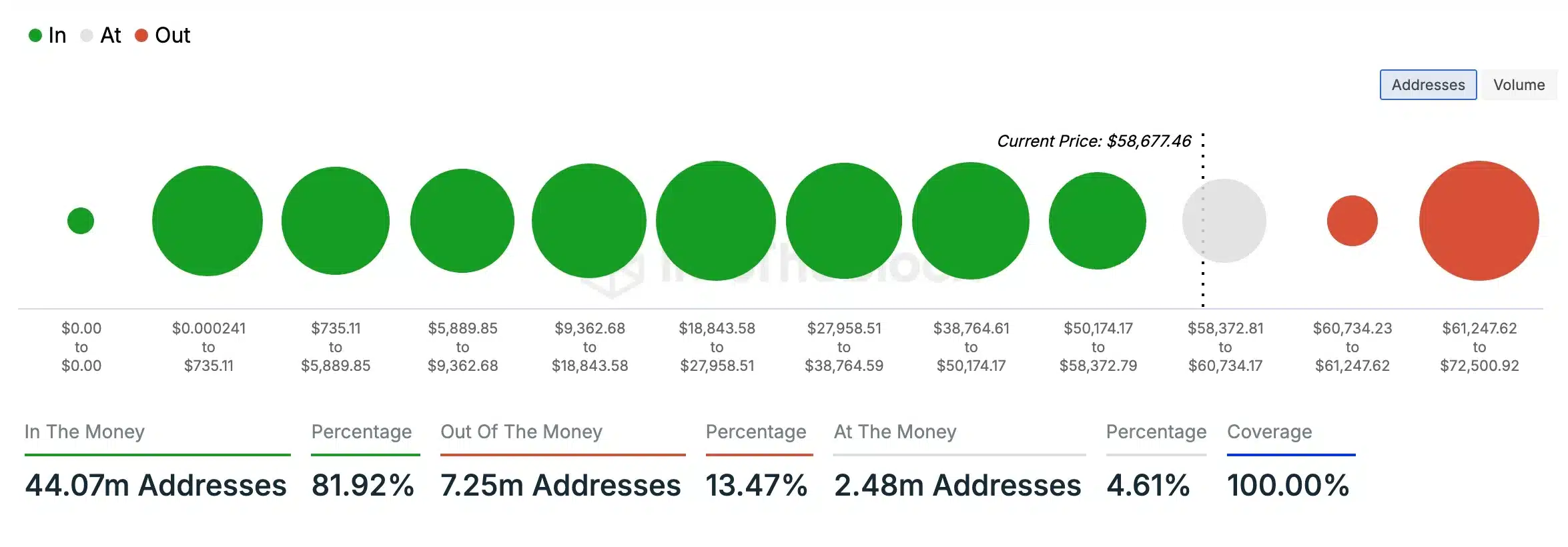

As per AMBCrypto’s analysis using data from IntoTheBlock, approximately 81.92% of Bitcoin owners found themselves in a profitable position at that moment, since the current value of their Bitcoins exceeded what they initially paid for them.

Conversely, approximately 13.47% of owners discovered that the value of their Bitcoin was lower than what they initially invested.

This trend suggests that Bitcoin may be gearing up for a bullish shift in the near future.

Furthermore, the meme cryptocurrency associated with Donald Trump, known as MAGA, experienced a decrease of 11.71% on its daily charts after the latest assassination attempt.

Compared to the significant increase of 40.81% that occurred within a day following the initial launch, this current dip presents a markedly different scenario for the MAGA coin.

Meanwhile, the ETF market, that received inflows worth $263.2 million on the 13th of September according to Farside Investors, might experience some consequences in the wake of the assassination attempt.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-16 14:32