- The DeFi market capitalization was $67 billion at press time.

- With the Bernstein prediction, the market cap could increase, getting close to its previous high.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous cycles of growth and contraction. The recent developments in the DeFi sector are particularly intriguing, given its potential for disruption and the unique dynamics at play.

Based on a recent study by Bernstein, it’s expected that Decentralized Finance (DeFi) will receive more focus from traders within the next few weeks.

Despite the industry not yet fully bouncing back from its 2022 troughs, current figures indicate a promising surge in the aggregated value held across various blockchain protocols, often referred to as Total Value Locked (TVL).

Meanwhile, traders are gearing up for changes in market conditions, it’s worth noting that Chainlink [LINK] and Lido Staked Ether remain at the forefront of the market.

DeFi set to attract more traders

According to a fresh analysis by Bernstein, there might be a surge in investor attention towards Decentralized Finance (DeFi) in the upcoming weeks.

Based on the analysis of experts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia, a possible reduction in U.S. Federal Reserve interest rates (between 25 to 50 basis points on Wednesday) might make returns from Decentralized Finance (DeFi) more appealing.

Despite the fact that the overall value locked (TVL) in DeFi is currently just half of what it was at its 2021 high, it has more than doubled from its lowest point in 2022, reaching an impressive $77 billion. Furthermore, the number of monthly users has increased three to four times since the market hit rock bottom.

The value of stablecoins has picked up speed again, currently standing at about $178 billion, and the number of monthly active users stays roughly around 30 million.

DeFi market cap sees decline, but…

As per information from CoinGecko, the present value of the DeFi market stands at around $68 billion.

Reflecting on the recent trends, I’ve noticed a steep downfall in the market since April. At that time, it boasted a market capitalization of approximately $116 billion. Regrettably, since then, we’ve witnessed some considerable losses.

According to Bernstein’s latest forecasts, it appears that the decentralized finance (DeFi) market capitalization might be set for a rapid recovery soon.

With increasing curiosity surrounding Decentralized Finance (DeFi), coupled with possible U.S. Federal Reserve interest rate reductions, there’s a strong possibility that the market could bounce back within the next few months.

Chainlink leads asset market

Based on information from CoinGecko, Link was the second most capitalized DeFi asset, trailing behind Lido Staked Ether.

In simple terms, Ether staked on Lido currently dominates with a market value surpassing an impressive $22 billion, while Chainlink (LINK) has a market cap of more than $6.4 billion. At the moment, LINK is being exchanged at around $10.60, showing a slight upward trend of 0.8%.

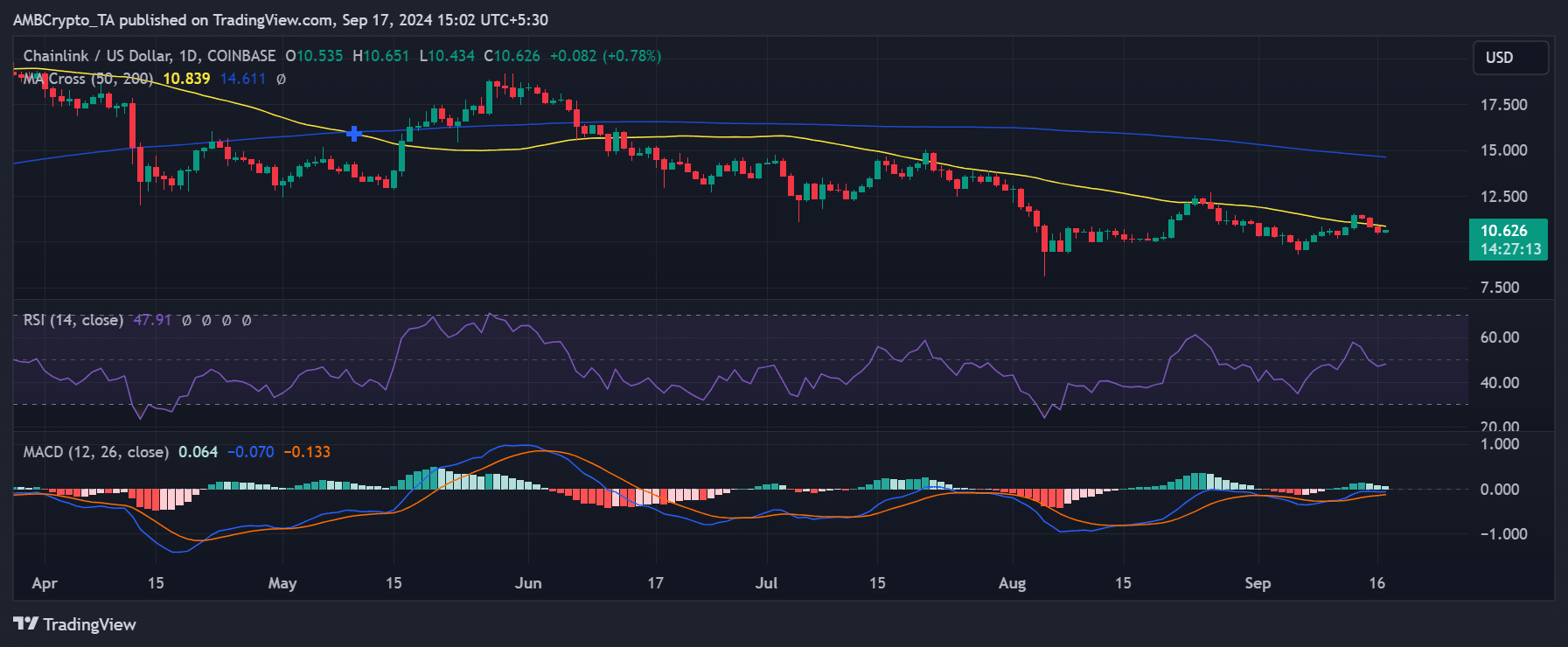

Although it has recently shown improvement, LINK had earlier seen a series of drops that caused it to dip beneath its immediate moving average, as signified by the yellow line.

On the 13th of September, it momentarily rose above the resistance level but failed to maintain the uptrend and dropped below the moving average again.

As a crypto investor, I’m eagerly anticipating the resurgence of DeFi, sparked by rumors of potential interest rate reductions and enticing returns. The sector seems ripe for a comeback.

Despite a notable drop in market capitalization since April, encouraging signs like a doubling of Total Value Locked and consistent user engagement suggest that a possible market recovery might be on the horizon.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-17 20:08