-

TIA is close to breaking a key price resistance.

Despite the price, more traders have taken short positions.

As a seasoned analyst with years of experience navigating the volatile world of cryptocurrencies, I find myself intrigued by the current state of Celestia (TIA). The token has shown an impressive resilience in the face of short-term volatility, displaying a strong rebound after a minor dip. Despite the recent decline, it’s evident that Celestia is on an upward trajectory, nearing a critical resistance level and outperforming many other coins in the market.

In the past week, Celestia’s price movement has been remarkably favorable, leading to a substantial increase in its overall market value.

Even though the cost is climbing up, the funding rate for Celestia continues to be below zero, implying a disparity between the feelings in the spot and futures markets.

Celestia shows positive trends despite recent decline

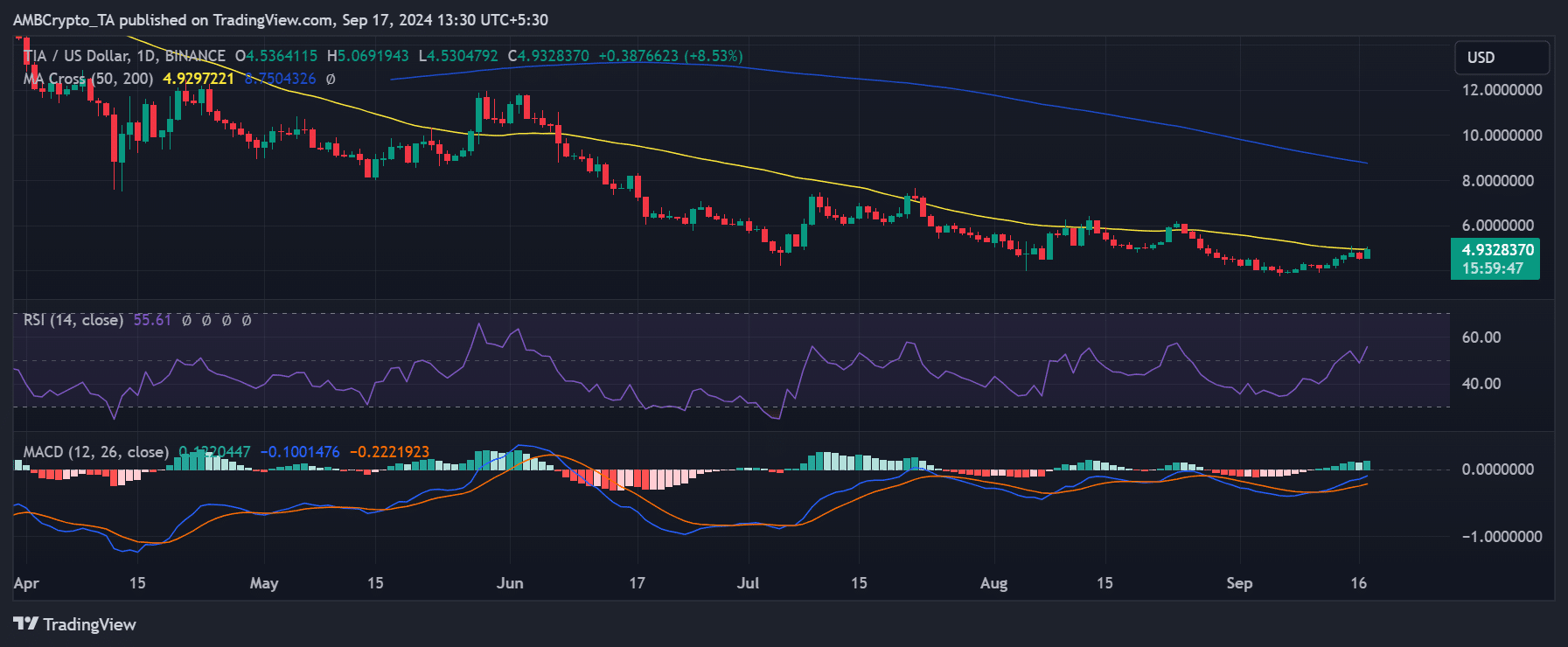

In the last few days, a daily review of Celestia shows an upward trajectory. Despite a dip of more than 5% during the previous trading day, which brought the price down to approximately $4.50, it’s been on an upswing since then.

As of this writing, Celestia has risen by over 8% and is trading at approximately $4.90.

The data also indicates that Celestia is nearing a key resistance level, which coincides with its short-term moving average.

Furthermore, it’s worth noting that Celestia has successfully crossed over the major hurdle represented by the neutral line in its Relative Strength Index (RSI). As the RSI moves closer to 60, this suggests a possible upcoming bullish trend.

Celestia among the top gainers with over 18% gains

As reported by CoinMarketCap, the digital asset Celestia (TIA) stands out as one of today’s top performers with a surge of more than 5% in the past 24 hours. This impressive growth positions TIA as the second-best gainer at present.

Over the past seven days, Celestia ranks as the third-highest gainer with an impressive 18% rise.

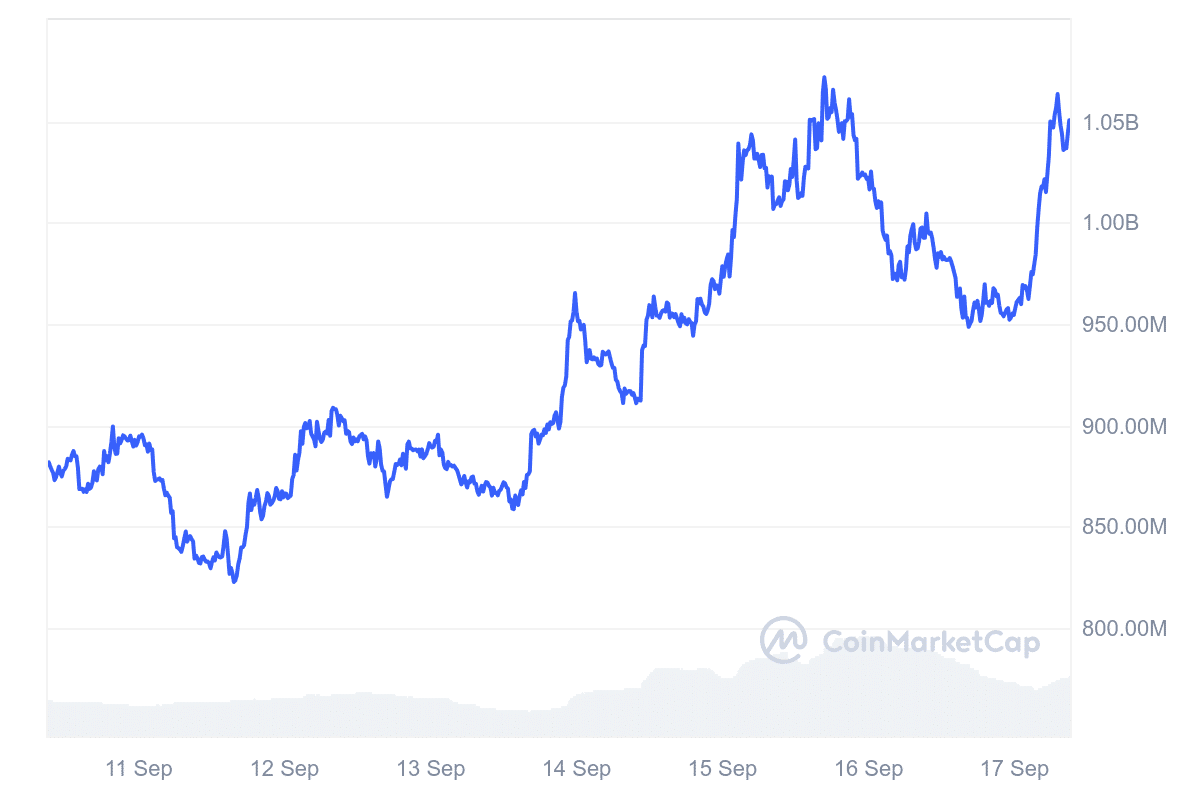

To elaborate, a study of Celestia’s total value in the stock market shows a substantial increase over the past week, climbing from around $879 million to more than a billion dollars.

Over the past 30 days, my analysis reveals that the company’s market capitalization has yet to surpass its value from a month ago, which was approximately $1.2 billion.

TIA’s positive price movements not reflected in derivatives

Although there’s been a recent upward trend in Celestia’s prices, the sentiment in its derivative market, as shown by Coinglass data, hasn’t followed suit with the same level of optimism.

Over the last several weeks, a review of the funding rate reveals that it’s been consistently below zero. This means that there have been more individuals selling rather than buying in these recent times.

As a researcher, I’m observing a pattern that indicates numerous traders are adopting a bearish stance towards Celestia, predicting a potential decrease in its price.

If the trading volume in the spot market keeps increasing and overpowers the opinions of traders in the derivative market, it’s possible that Celestia (TIA) may continue to see price increases, even though derivatives traders are forecasting a bearish trend.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-18 00:07