-

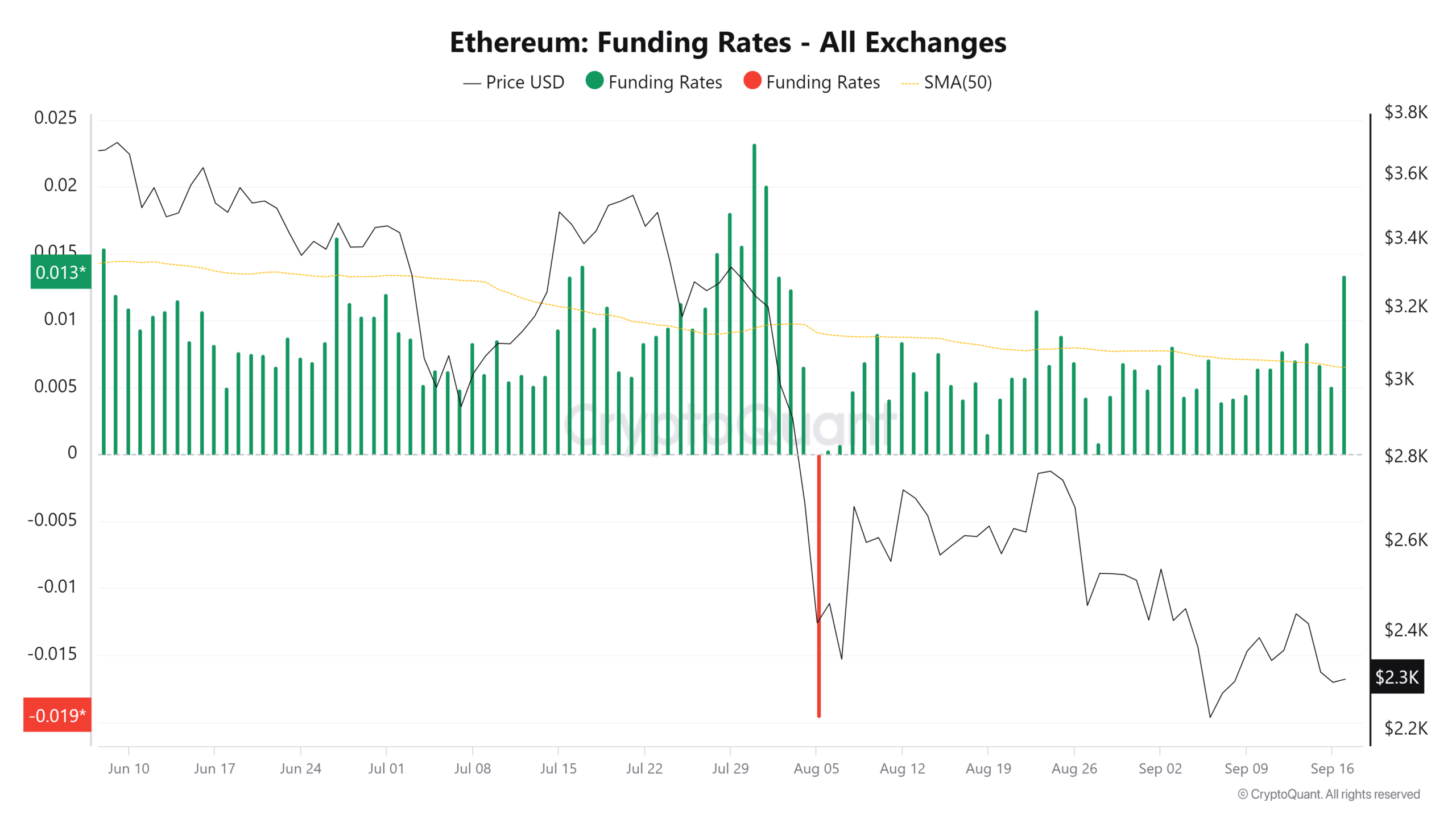

ETH saw its lowest Funding Rate of the year.

ETH is trading around the $2,300 price level.

As a seasoned researcher with years of experience navigating the complex and ever-evolving crypto landscape, I find myself closely watching Ethereum’s recent developments. The Funding Rate hitting its lowest point this year is undoubtedly a noteworthy event, indicating a bearish sentiment in the derivatives market. However, it’s important to remember that markets are like chameleons; they can change color quickly based on various factors.

The derivative market for Ethereum [ETH] has experienced a significant drop, suggesting a possible change in investor attitudes or expectations.

Yet, understanding the cause behind this decrease could result in varying interpretations, particularly when considering the impact of other elements like trading volume.

Ethereum’s Funding Rate declines

According to the latest findings from CryptoQuant, Ethereum’s Funding Rate reached its bottom for the year, suggesting a significant drop in the appetite among derivative traders to purchase Ethereum.

In futures trading, the Funding Rate serves as a vital tool that helps determine the expenses associated with maintaining long (buying) or short (selling) investments over a specific period.

In simpler terms, when the Funding Rate is negative, it indicates that short sellers are compensating long holders for maintaining their positions. This suggests a pessimistic or bearish outlook on the market, as short sellers are essentially betting that the asset’s price will decrease.

The decrease in ETH‘s Funding Rate, which has fallen to its minimum this year, suggests a reduction in interest for purchasing Ethereum using borrowed funds via derivatives. This potentially signals a downward trend in Ethereum prices over the near future.

A decrease in the Funding Rate suggests that traders in the derivatives market are less eager, potentially leading to more stress on Ethereum’s price.

A potential for Ethereum short squeeze

As a crypto investor, I’ve noticed that there seems to be a decrease in traders opting for long positions on Ethereum. If this trend persists and there aren’t enough spot buyers ready to soak up the selling pressure, the downward trend for Ethereum could potentially carry on.

However, while the low Funding Rate suggests a bearish sentiment, it also sets the stage for a potential short liquidation cascade. The negative Funding Rate could quickly reverse if spot buyers enter the market sufficiently.

Closing positions by short sellers due to this situation leads to a phenomenon known as a “squeeze,” where they are compelled to buy, thereby potentially raising the price.

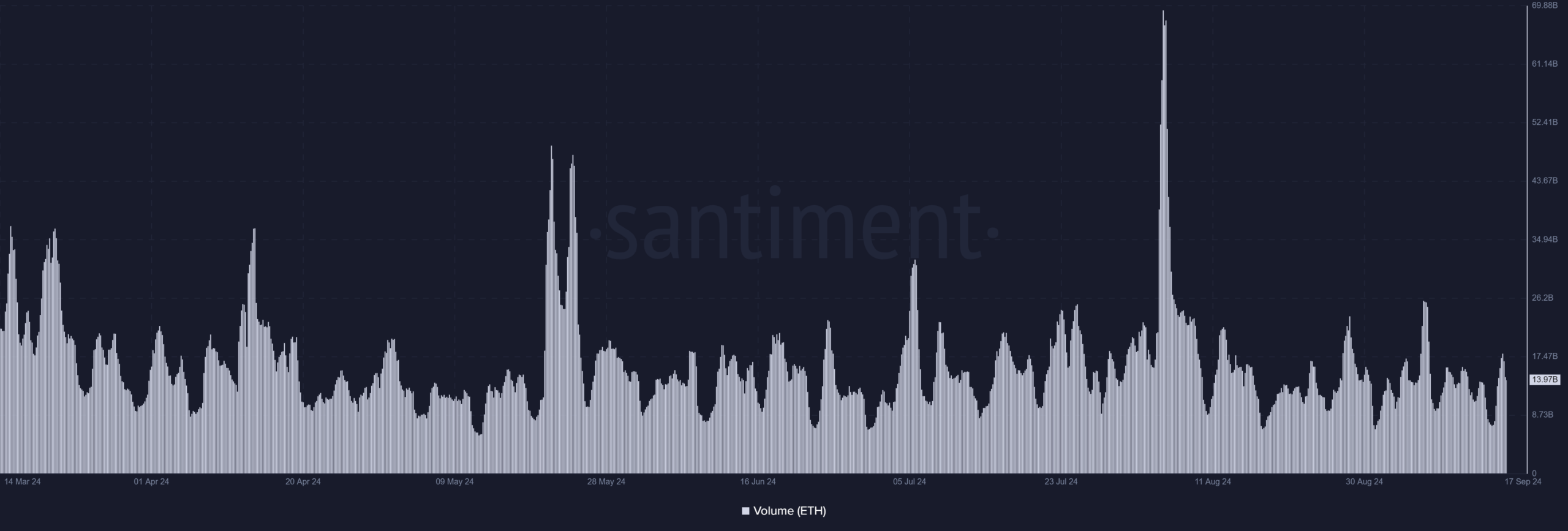

How ETH’s volume has trended

As an analyst, I’ve been closely examining Ethereum’s trading activity on Santiment, and I’ve noticed that the average daily volume has remained fairly consistent, hovering near the $14 billion mark over the past few weeks.

Maintaining a steady level of volume is vital for preserving price stability, particularly since Ethereum’s funding rate has plunged to its least favorable point in the whole year.

The spot volume for Ethereum has remained relatively stable, averaging $14 billion. This consistent volume has likely helped ETH avoid a more severe price decline.

Despite derivative traders showing pessimism through a negative financing fee, this situation persists.

If the trading volume of the spot market falls below the $14 billion threshold, Ethereum might experience greater selling pressure.

Read Ethereum’s [ETH] Price Prediction 2024-25

Given that the Funding Rate is currently at an all-time low, a decrease in spot trading activity could lead to decreased buying demand. This buying demand is crucial as it helps balance out the pessimistic mood prevalent in the futures market.

As a researcher examining the derivatives market, I’ve noticed that the present low Funding Rate indicates a predominance of short positions. This means that if the volume of spot transactions decreases, there might not be sufficient buying interest to counteract the selling pressure. Consequently, this imbalance could lead to downward price adjustments.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-18 04:08