-

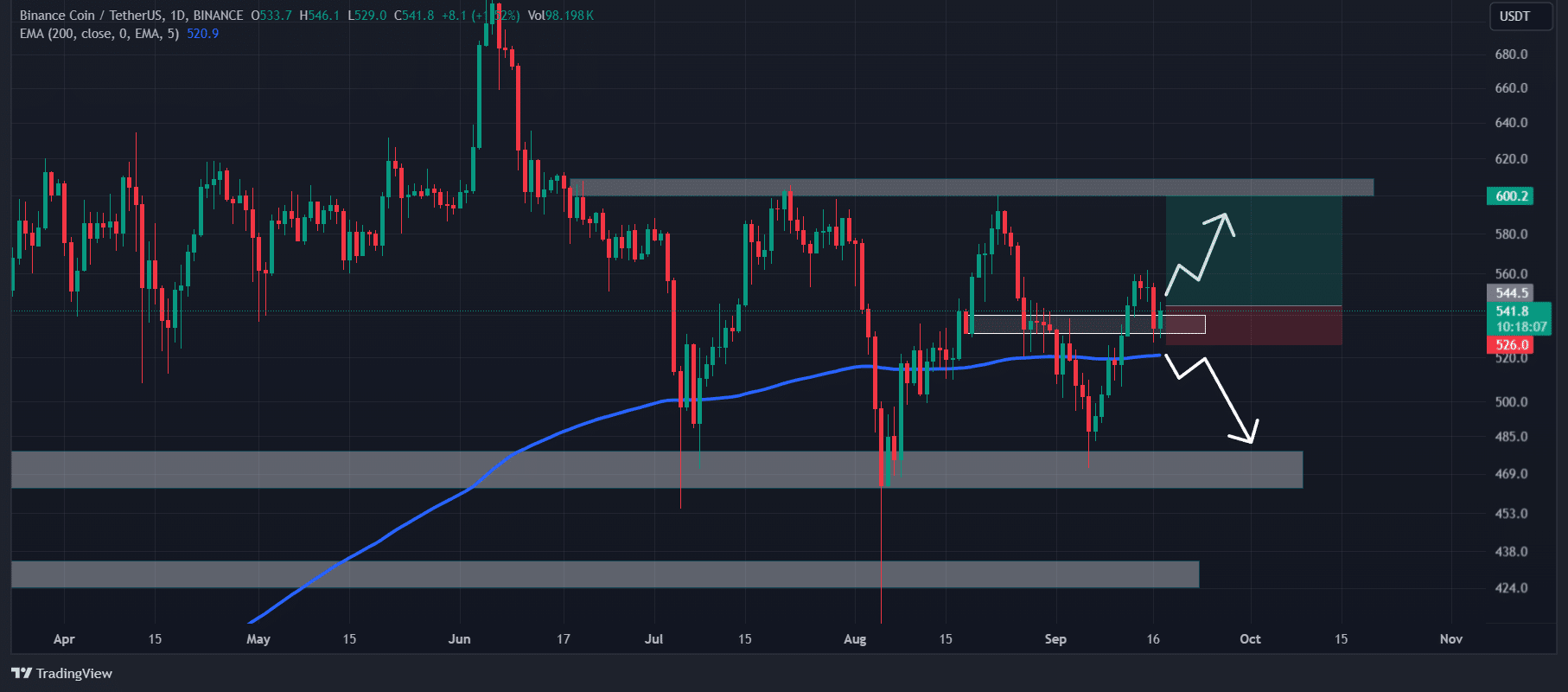

BNB could rise by 10% to reach the $600 level in the coming days.

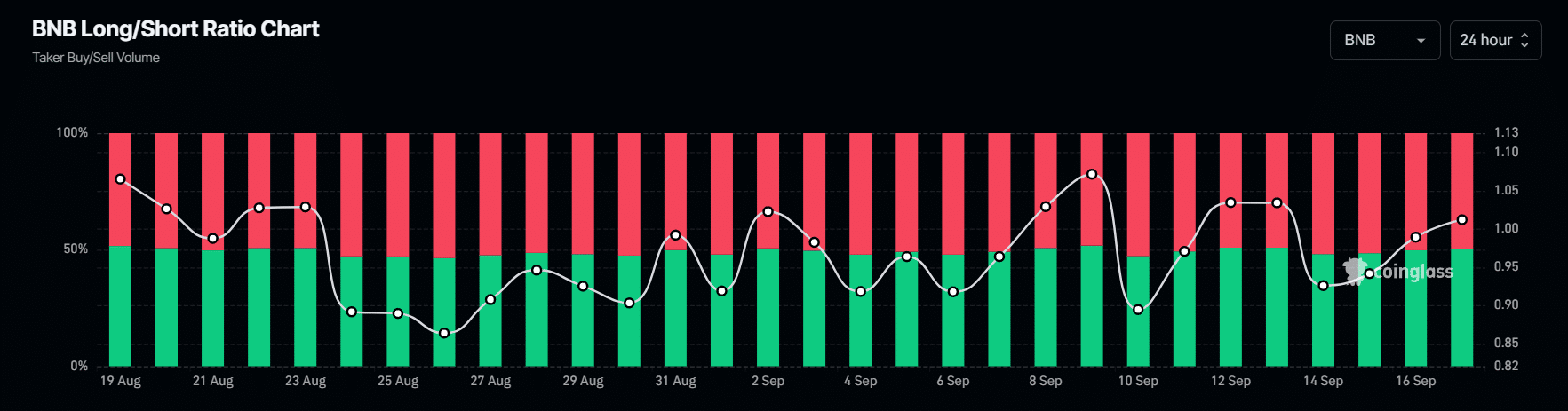

BNB Long/Short ratio currently stands at 1.031, indicating traders bullish market sentiment.

As a seasoned crypto investor with over five years of experience in this ever-evolving market, I find myself quite optimistic about Binance Coin (BNB). The recent price surge and strong technical indicators suggest that BNB could indeed reach the $600 level in the coming days.

On September 17th, Binance Coin (BNB), one of the top four cryptocurrencies globally, successfully tested its key breakout point at around $530. Now, it seems ready to generate positive price movements.

Despite other significant cryptocurrencies stumbling to pick up speed, Binance Coin (BNB) has seen a spike of more than 3.5% in its price. This rise suggests a possible forthcoming upward trend.

BNB price momentum

Currently, Binance Coin (BNB) is close to $545 per coin, and it has seen a significant increase of more than 3.5% within the past day, as shown by statistics from Tradingview.

Over that timeframe, the trading activity has dropped by 9%. This suggests a possible decrease in trader and investor engagement, which might be influenced by the prevailing market mood.

BNB technical analysis and key levels

Based on specialized technical assessments, Binance Coin (BNB) seems optimistic since it’s currently trading over its 200-day Exponential Moving Average (EMA), as observed on the daily chart.

Technical analysts and investors often rely on the 200 Exponential Moving Average (EMA) as a tool for identifying if a particular asset is experiencing growth or decline, i.e., whether it’s in an uptrend or downtrend.

On the 12th of September, Binance Coin (BNB) surpassed a significant resistance point. The current trend suggests that BNB has convincingly tested this level again.

Given the past trends in price movement, if the current upward trend persists, it’s quite likely that BNB will increase by approximately 10%, potentially reaching around $600 within the next few days.

If BNB‘s bullish momentum weakens and its price dips below $527, there might be a potential 8% drop, taking its value down to approximately $475.

Traders sentiments and ideal risk-to-reward ratio

As an analyst, I’d recommend a trading strategy that offers a beneficial 1:3 risk-to-reward ratio. The optimal moment to buy would be when the price surpasses $545. My target for this trade is set at $600, which represents a potential gain of $55 per share. To minimize losses, I advise setting a stop-loss at $525, ensuring that the maximum loss per share is only $20.

However, this trade will only be activated if BNB closes its daily candle above the $545 level.

Moreover, the perspective given by on-chain statistics reinforces this positive trend. The current BNB Long/Short ratio from Coinglass is 1.031, with a value greater than 1 suggesting that traders are generally optimistic about the market.

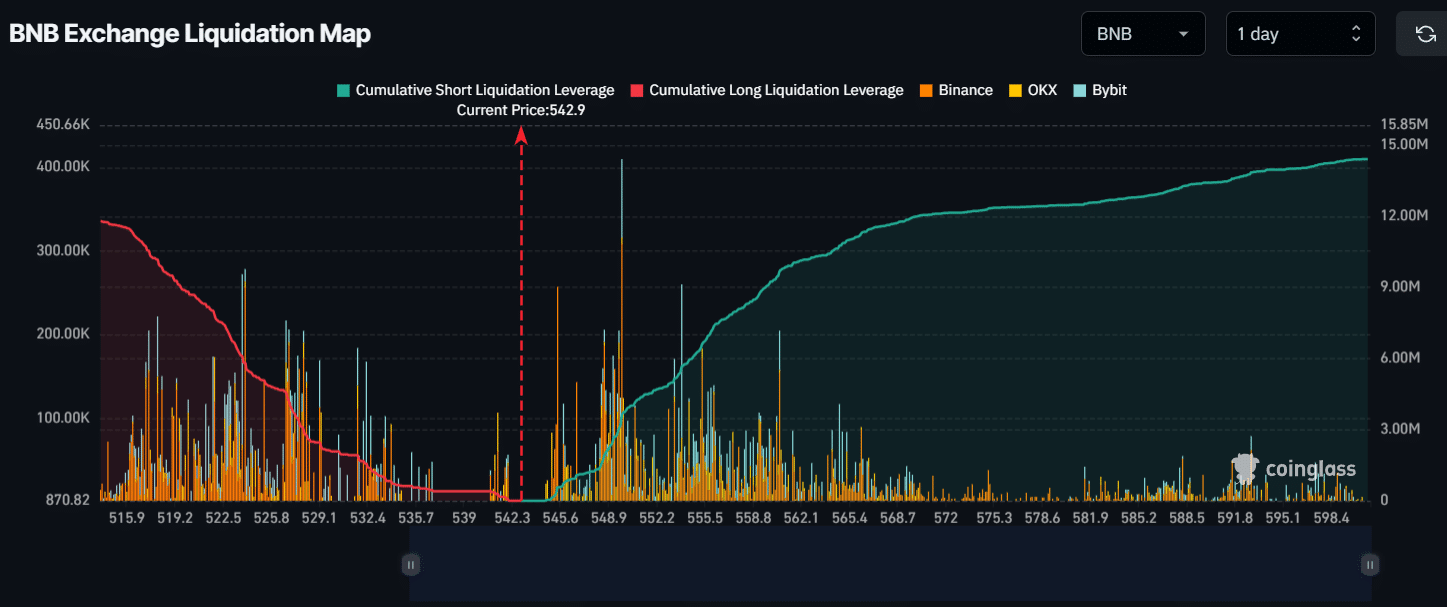

Major liquidation levels

At this moment, key selling points for cryptocurrency are around $524, while buying points are approximately $550. These levels are significant because traders currently hold excessive leverage there, based on data from Coinglass.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

If the positive outlook on BNB continues and its price climbs up to $550, approximately $3 million in short positions could be automatically closed.

If the sentiment reverses and BNB drops down to $524, roughly around $5.4 million in long positions might get closed out or liquidated.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-18 12:08