-

CryptoQuant CEO Ki Young Ju also noted that whales are accumulating Bitcoin and we’re in the middle of the bull cycle.

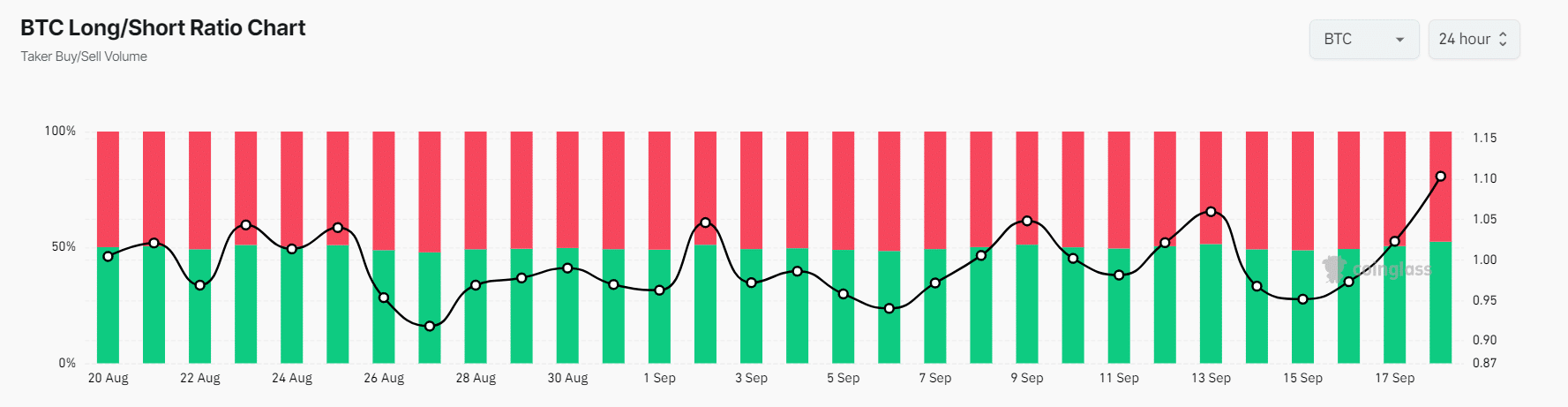

BTC’s Long/Short ratio currently stands at 1.1048 (a value of ratio above 1 indicates bullish market sentiment among traders).

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market swings and cycles. The recent accumulation of Bitcoin by whales and institutions, as evidenced by Galaxy Digital’s 4,491 BTC purchase and CryptoQuant CEO Ki Young Ju’s observations, paints a bullish picture in the midst of challenging market conditions.

As a market analyst, I’ve been closely observing the volatile nature of the cryptocurrency market, particularly Bitcoin [BTC]. Interestingly, large investors, such as Bitcoin ‘whales’ and institutions, seem to be seizing this opportunity by purchasing a substantial amount of Bitcoin, possibly capitalizing on the prevailing mood.

Lately, the general mood towards cryptocurrencies has been tough, as heavyweights such as Ethereum, Solana, and XRP have found it difficult to build up speed in their price movements.

Whales and institutional accumulation

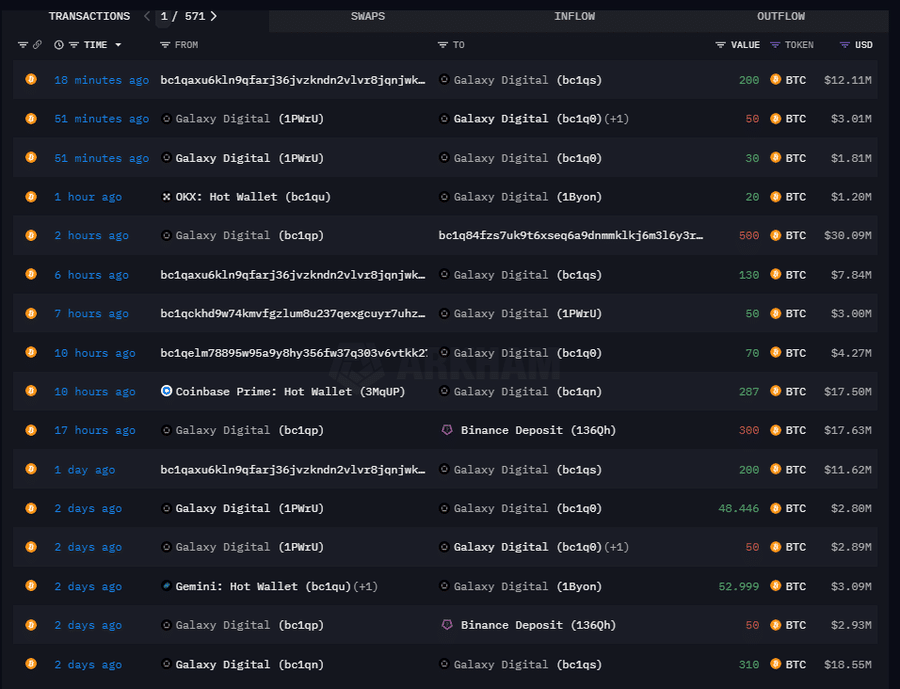

In a recent update (originally posted on X, which is now similar to Twitter), an analytics company focusing on blockchain reported that Galaxy Digital amassed 4,491 Bitcoins, valued at approximately $267.03 million, in just one week from platforms such as OKX, Coinbase, and Gemini.

With this recent accumulation, the firm now holds a massive 8,790 BTC, worth $532.38 million.

Apart from his previous post about topic X, the CEO of CryptoQuant, Ki Young Ju, has additionally provided evidence backing the similar viewpoint regarding Bitcoin whales. On another platform X, he pointed out an increase in Bitcoin being hoarded by these large-scale investors.

He added, “Six days of accumulation alerts in a row, primarily from custody wallet inflows. Nothing has changed for Bitcoin; we’re in the middle of the bull cycle.”

Ideal buying opportunity?

As an analyst, I find the ongoing accumulation of Bitcoin during these trying market conditions to be quite encouraging and could possibly indicate a prime moment for investment.

As a crypto investor, I’ve noticed that despite the strategic build-up by whales, Bitcoin seems to be maintaining its ground, showing signs of consolidation within the range of $58,000 to $60,000.

Currently, Bitcoin is close to being priced at around $60,550, and it has seen a significant price jump of more than 3.35% over the last day. Over the same timeframe, its trading activity has risen by an impressive 40%, suggesting greater engagement from traders.

BTC’s bullish on-chain metrics

As a researcher studying Bitcoin’s dynamics, I find that the on-chain indicators are signaling a positive trend for the cryptocurrency. Specifically, according to Coinglass, the Long/Short ratio is currently at an impressive 1.1048 – a value higher than 1 suggests that traders have a predominantly bullish sentiment towards BTC, which hasn’t been seen since August 2024 in terms of this metric.

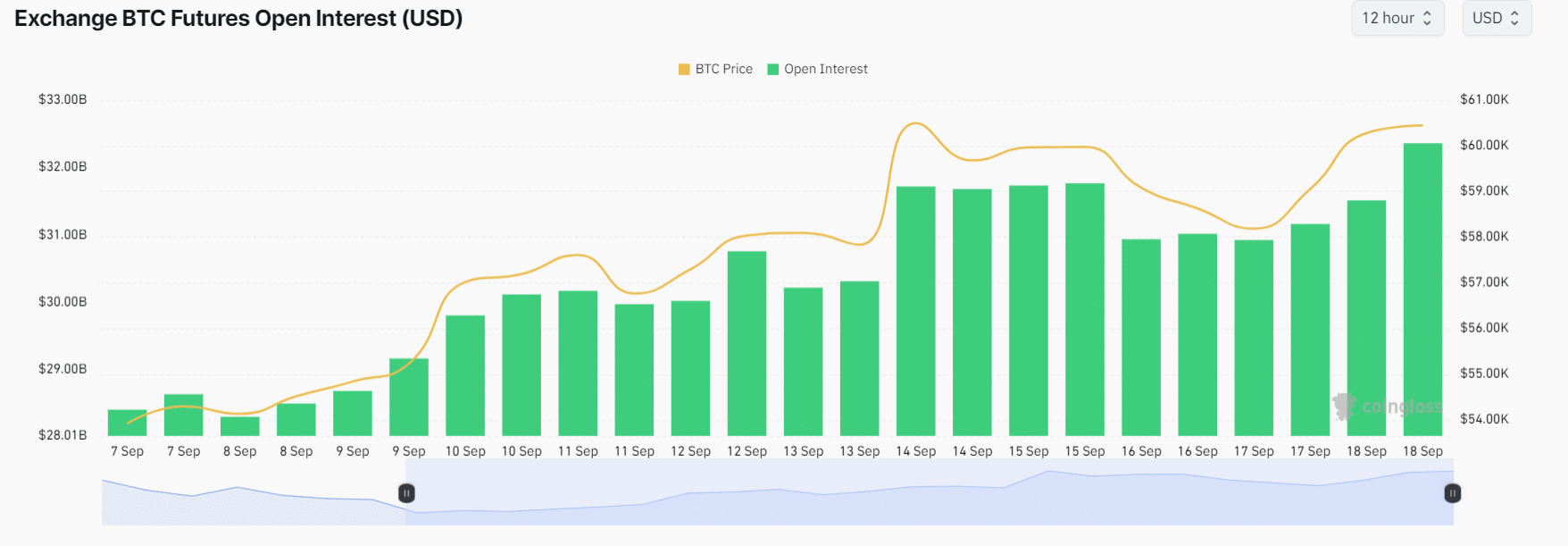

Furthermore, there’s been a 6% increase in open interest for Bitcoin over the past day, suggesting that more traders and investors are becoming involved, which is a positive sign for its future.

Read Bitcoin’s [BTC] Price Prediction 2024-25

At present, roughly 52.5% of prominent Bitcoin traders have taken a long position, compared to 47.5% who are in short positions. This suggests that the bulls appear to be regaining control over the cryptocurrency market.

Currently, the funding rate for Bitcoin’s open interest-weighted contracts is at a positive 0.0053%, indicating that traders and investors are generally optimistic about Bitcoin’s price movement, as this rate signifies a bullish outlook.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-18 19:03