-

ETH experienced weak demand amid Ethereum ETFs outflows, indicating investor disinterest.

Open Interest tanked, but top traders went long, indicating a possible shift ahead.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have seen many ups and downs, bull runs, and bear markets. The current state of Ethereum (ETH) has me scratching my head a bit.

Recently, there has been a persistent trend of withdrawals from Exchange-Traded Funds (ETFs) tied to Ethereum [ETH], contrasting earlier expectations that these funds might stimulate interest.

Several experts have noted this trend, and a few of them hypothesize that it might explain Ethereum’s recent downturn.

On September 17th, according to a report by Wu Blockchain, there was a peak in the net outflows for Ethereum spot ETFs amounting to approximately $15.114 million.

After analyzing the data from Ethereum ETFs, it was found that most of these funds experienced outflows rather than inflows throughout the week. In other words, there were more withdrawals than deposits in these ETFs during this period.

As a crypto investor, I’ve noticed that the outflows from Ethereum ETFs might have significantly impacted Ethereum’s recent market behavior. This trend aligns with the subdued overall sentiment in the crypto market, which in turn seems to have influenced a decrease in network activity on Ethereum.

It’s clear that investors are less enthusiastic about Ethereum (ETH), as its recent market movements suggest a more subdued performance compared to Bitcoin. While Bitcoin has surged by approximately 14% above its current monthly minimum, Ethereum has risen only around 7.7%.

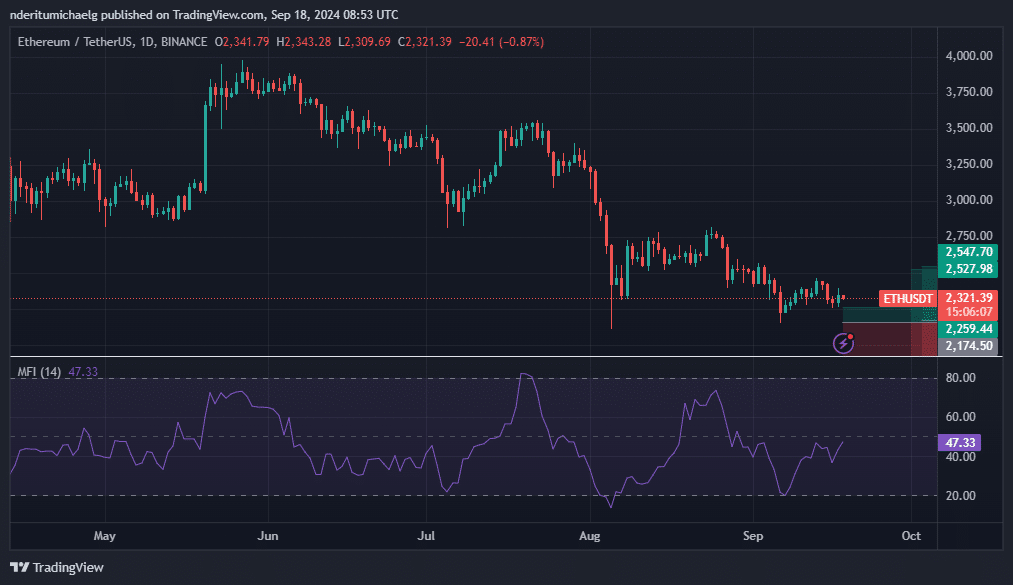

This highlighted the declining demand for ETH. The cryptocurrency traded at $2,321 at press time.

The Relative Strength Index (RSI) of ETH has been finding it difficult to exceed the 50% mark, suggesting weak bullish energy. Yet, its Money Flow Index (MFI) indicates a steady influx of funds towards the coin, although the quantities are relatively modest.

Can ETH deliver a strong comeback?

As a crypto investor, I can’t help but feel optimistic about a potential surge in the market. The recent struggles with Ethereum are a result of several converging factors: the withdrawal of funds from ETH-related exchange-traded funds (ETFs) and reduced on-chain activity. It seems we might be on the brink of something significant, but only time will tell.

Yet, a shift in these elements could spark strong demand once more, particularly if Ethereum Exchange-Traded Funds (ETFs) begin attracting substantial investments.

As a crypto investor, I find myself observing that the current price range of Ethereum (ETH) could be seen as a balanced territory. Yet, there’s an undeniable cloud of uncertainty hanging over it, which seems to be impacting its overall performance – not just in the traditional market but also in derivative segments.

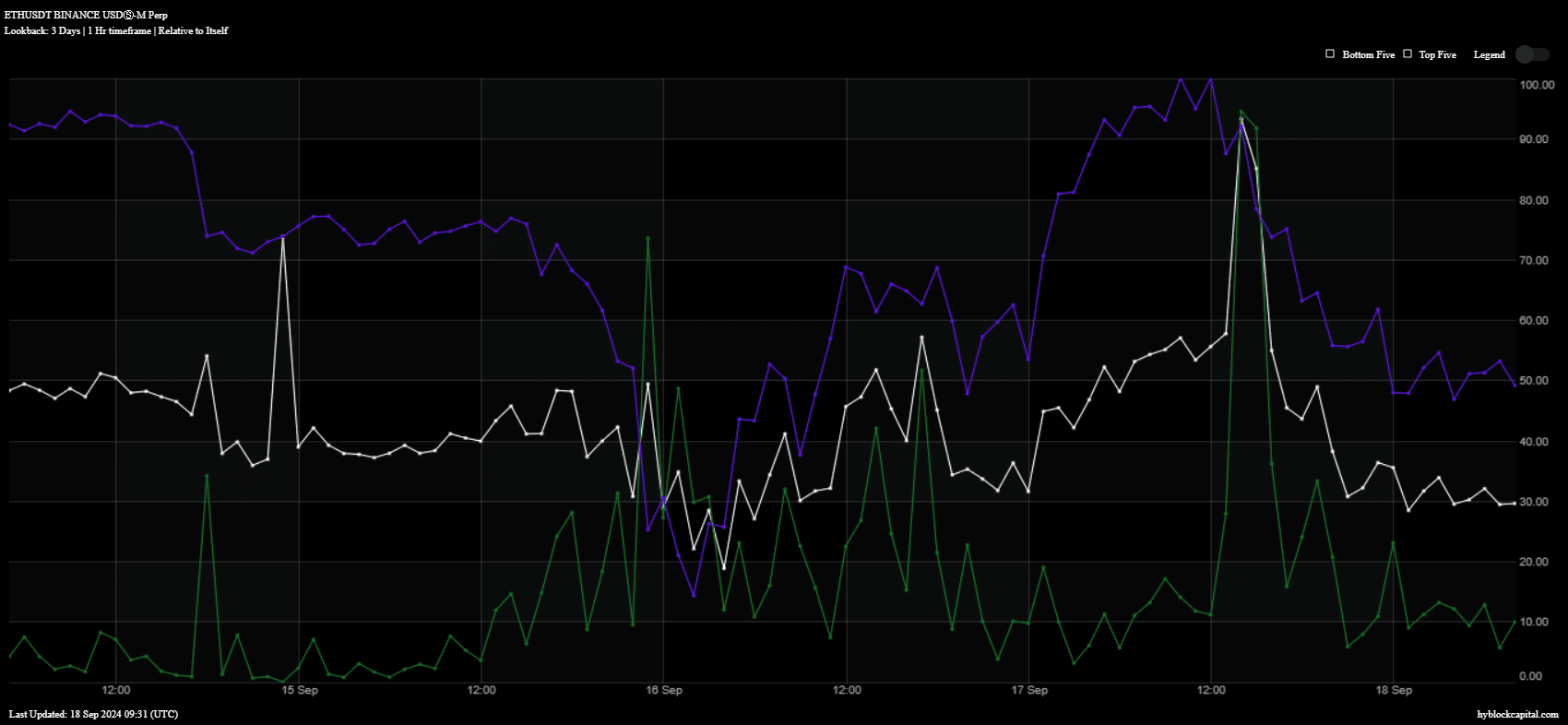

In the past day, the Open Interest (represented by blue) significantly decreased, while there was also a noticeable drop in buy volume (visualized as green) over the same timeframe.

Additionally, it appeared as if the strong results observed in ETH‘s performance might have been linked to potential manipulation by large traders, or ‘whales’. Notably, the number of long positions among leading traders noticeably decreased during the trading session on Tuesday.

However, it bounced back again, indicating that top traders are switching back to a bullish mood.

Read Ethereum’s [ETH] Price Prediction 2024–2025

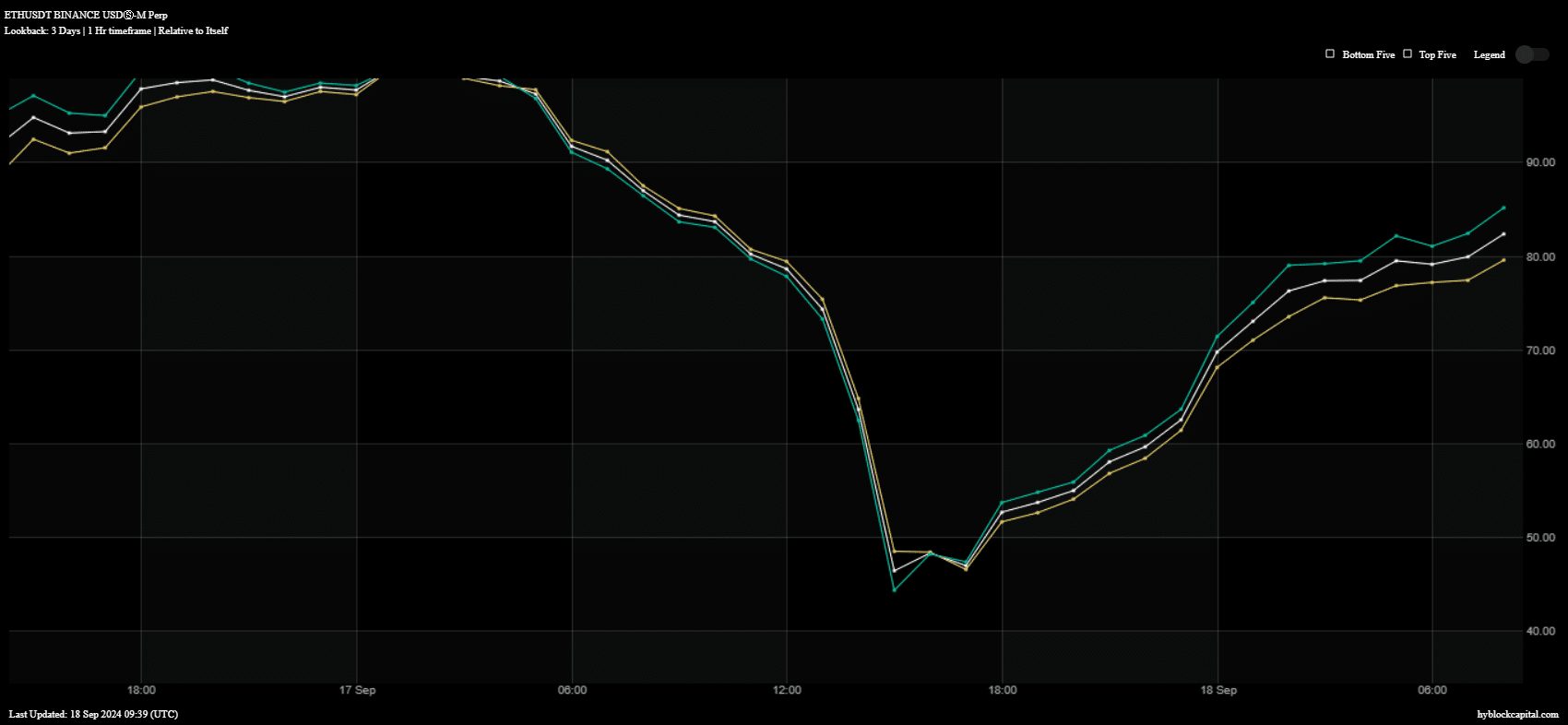

In the past 24 hours, there’s been a significant rebound for Ethereum held by top addresses (green ones) and worldwide (yellow) holders. This could indicate that Ethereum buyers might strengthen their positions heading into the weekend.

Nevertheless, the possibility depends on whether Ethereum (ETH) manages to gather sufficient demand and maintain a strong upward trend in its price movement.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-18 19:35