-

The triple bottom pattern suggested a potential breakout as ETH eyed the $3,500 resistance.

Exchange outflows and RSI levels pointed to a possible bullish move, but network growth remained flat.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I have seen my fair share of bull and bear markets. The current situation with Ethereum [ETH] is intriguing, to say the least.

In the year 2024, it seems that Ethereum [ETH] could experience a substantial surge, much like its growth spurt in 2021, as traders have identified a triple bottom pattern emerging.

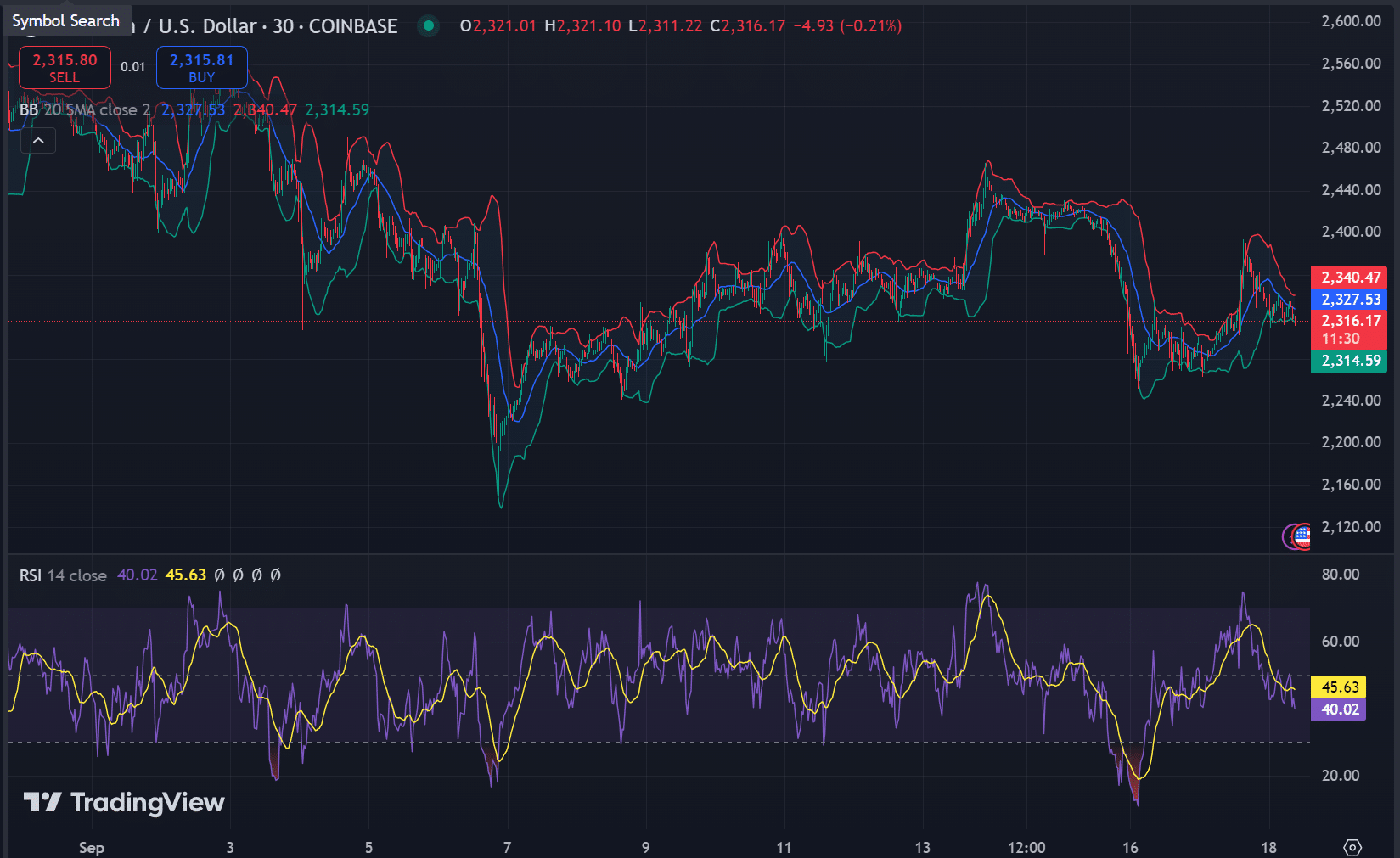

At the moment of reporting, Ethereum (ETH) was trading at approximately $2,314, showing a modest increase of 0.31% over the past 24 hours. This recent trend has fueled anticipation among investors that the fourth quarter might bring significant returns.

Can the triple bottom drive a bullish reversal?

In simple terms, the “triple bottom” is a widely recognized chart pattern that frequently signals an impending bullish reversal. For instance, in the year 2021, Ethereum exhibited this same pattern prior to experiencing a significant upward surge.

If Ethereum continues on its current path, surpassing the $3,500 mark might boost investor trust even more.

In order to show strong upward trend (bullish momentum), Ethereum needs to overcome significant resistance points. The initial barrier lies at approximately $2,800, and if it manages to clear this, it might lead to a potential test of $3,500.

What about ETH’s strength?

The technical analysis suggests a favorable perspective for Ethereum, as the Relative Strength Index (RSI) stood at 45.63, indicating that Ethereum is neither excessively bought nor sold at this moment.

According to the Bollinger Bands (BB), Ethereum’s trading activity suggests it has been moving within a confined area. However, there might be increased volatility coming up.

If we surpass the upper limit (of our current range), it might lead to a significant upward trend. Therefore, keep a close eye on these signals over the next few days as they may prove vital for anticipating this potential development.

Are exchange flows pointing to a rally?

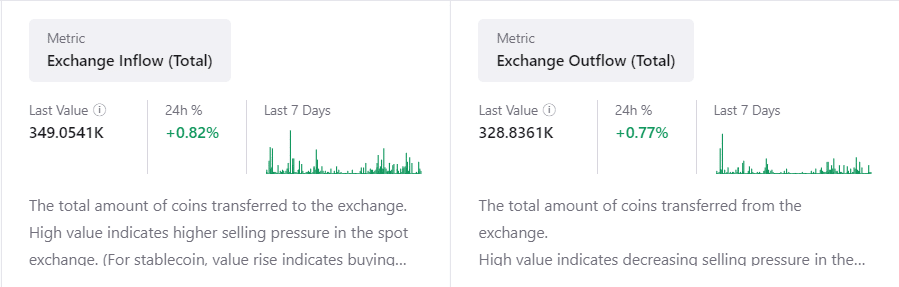

Exchange flow data showed mixed signals but lent toward a potential bullish move at press time.

In the past 24 hours, there’s been a 0.82% rise in the inflow of Ethereum (ETH) to exchanges, currently standing at approximately 349,050 ETH. This surge suggests that some traders might be looking to sell their coins since they are transferring them onto exchanges.

On the other hand, there’s been a 0.77% increase in outflows of Ethereum over the past day, amounting to 328,830 ETH as we speak. This suggests that a significant number of investors are choosing to keep their Ethereum off exchanges.

If outflows persistently increase, it might suggest a decrease in selling pressure and an increasing belief among investors that Ethereum’s value will continue to climb.

Network growth: Is Ethereum expanding?

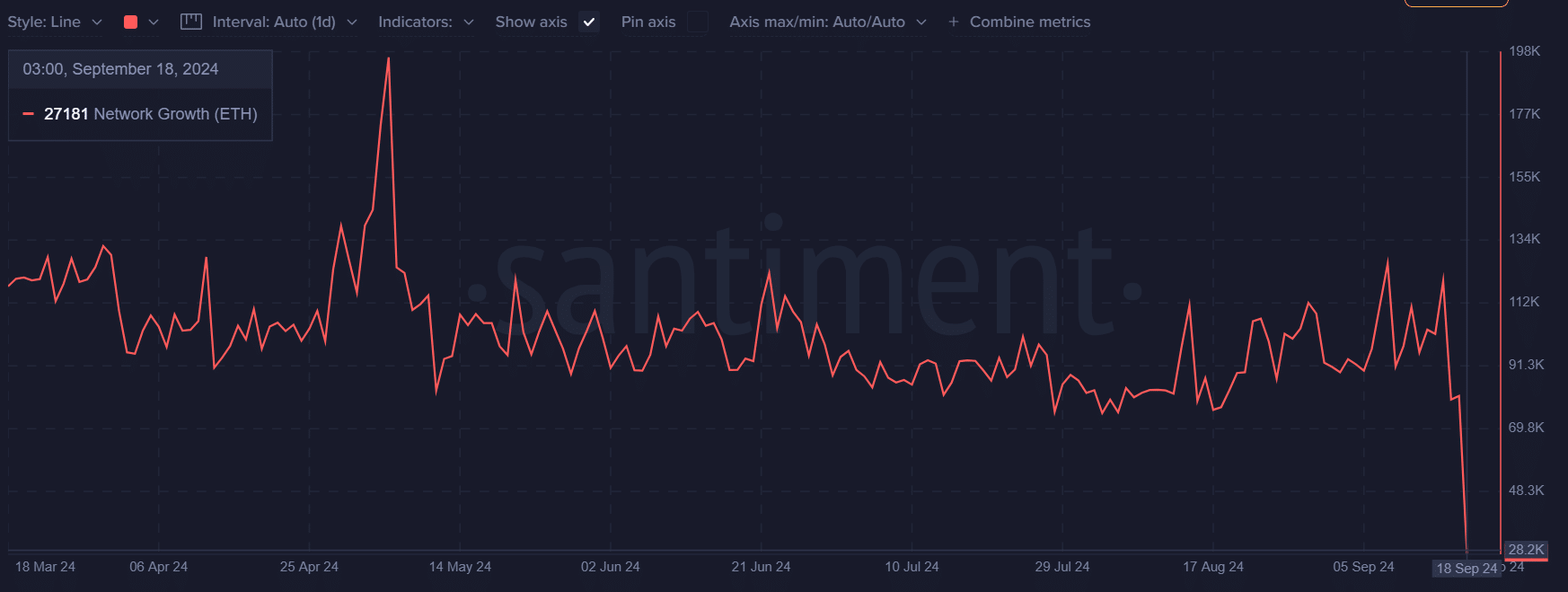

Over the past day, Ethereum’s network expansion has been moderate, with approximately 27,181 fresh accounts created, reflecting a growth of 0.24%. This was as of the press time update.

The neutral signal suggested that while Ethereum’s network is stable, it is not seeing a surge in new user activity.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Will Q4 deliver the breakout?

At a crucial juncture, Ethereum finds itself in an interesting position. On one hand, technical indicators such as the triple bottom, Relative Strength Index (RSI), and Bollinger Bands hint at an impending breakout. However, the expansion of the network and ambiguous exchange inflows call for a degree of caution.

In light of anticipated market turbulence, it seems probable that the fourth quarter will be decisive in determining if Ethereum manages to surpass crucial resistance points and reclaim the upward trend that fueled its impressive surge during 2021.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Elder Scrolls Oblivion: Best Thief Build

- Gold Rate Forecast

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Ludicrous

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

2024-09-19 01:12