- Dogecoin processed 1.93 million transactions for the first time since July.

- The press time market conditions suggested growing favorability and potential for further gains.

As a seasoned analyst with over two decades of experience in the cryptocurrency market, I find myself intrigued by the recent developments in Dogecoin (DOGE). The surge in transaction count to 1.93 million transactions, a figure not seen since July, is undeniably a positive sign. It indicates increased adoption and utilization of DOGE as a payment method or for transactions, which strengthens its network fundamentals.

Last week, Dogecoin handled approximately 1.93 million transactions, which is the most weekly transactions it has recorded since early July, as reported by IntoTheBlock.

For the past two months, we’ve seen a drop in the number of transactions, and unfortunately, the price graph for the memecoin hasn’t managed to spike during this timeframe either.

Over the last seven days, Dogecoin reached a peak of $0.108, coinciding with an increase in transaction activity.

The rise in transactions suggests a bright outlook for the Dogecoin network, but it’s still not yet reached the high points seen in February.

In this context, a rise in the number of transactions indicates that Dogecoin’s network is being actively used, thereby enhancing its underlying network structure.

Consequently, the rising activity suggests more people are adopting Dogecoin for transactions or showing renewed interest in it due to its user-friendly nature as a payment method.

Where will DOGE go next?

Based on the rising number of transactions, there seems to be a growing interest and use of Dogecoin (DOGE), suggesting an expansion in its popularity and possible future development – this is supported by on-chain statistics.

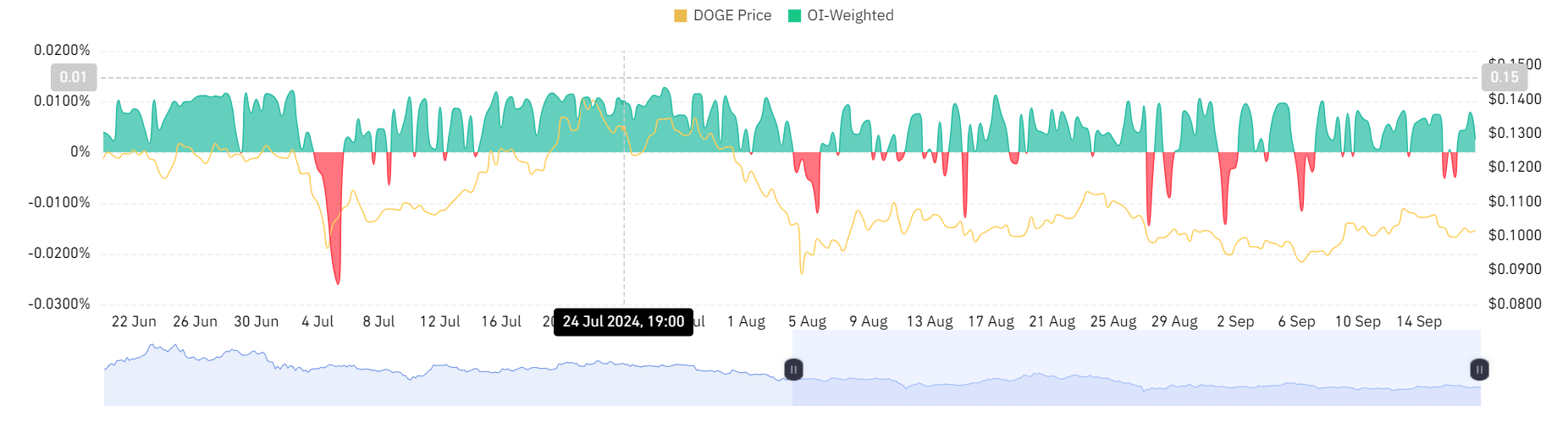

During this timeframe, the Funding Rate for Dogecoin, combined across exchanges, has predominantly been positive. This suggests that individuals holding long positions (betting on an increase in price) have generally been compensating those with short positions (betting on a decrease in price).

When an asset is like this, it shows increased investor confidence with the future potential.

This occurrence is reinforced by a favorable Overall Interested-Weighted Funding Rate, which implies that there’s more market interest in long positions compared to short ones since it indicates a greater demand for long positions over short ones.

This suggests a positive market sentiment.

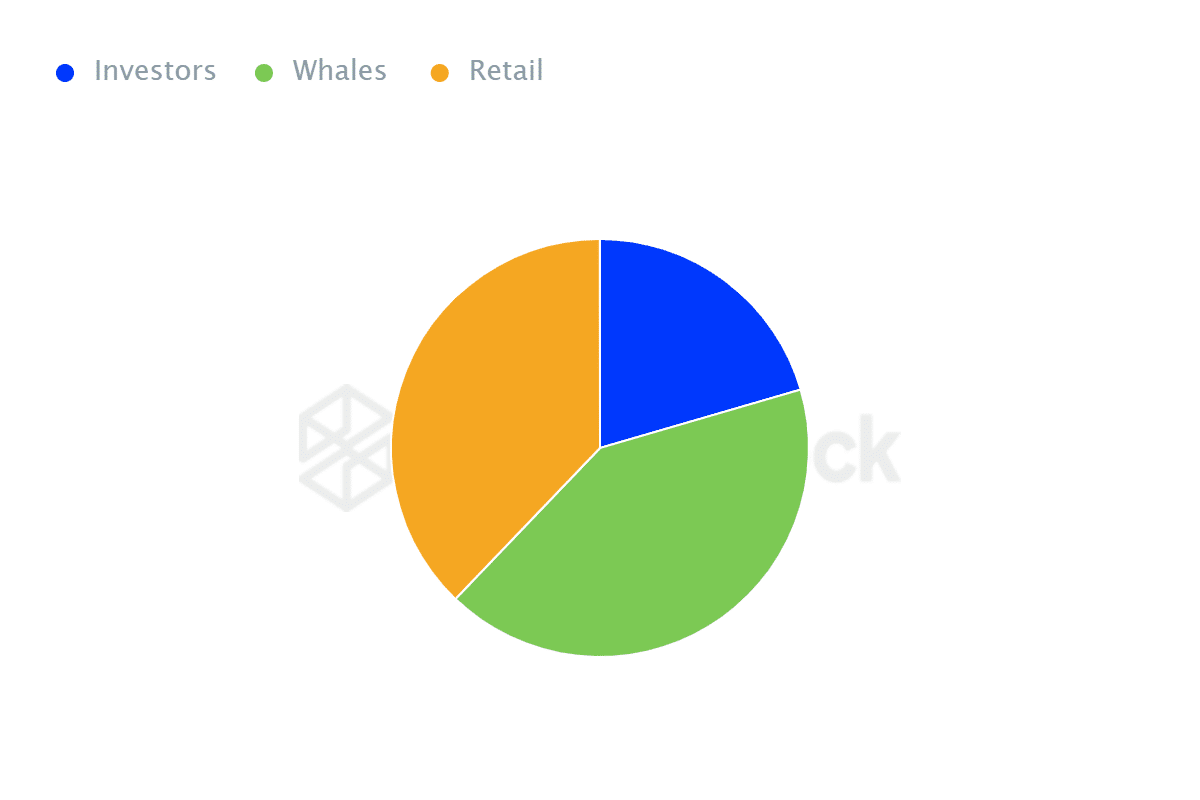

Over the past seven days, whale investors have significantly boosted their Dogecoin (DOGE) holdings. Currently, they control approximately 65.29 billion tokens, which represents about 65.29%, whereas retail traders account for roughly 37% of the total holdings.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

An increased ownership by whales contributes to market equilibrium since they seldom dispose of their assets due to fear, uncertainty, or doubt (FUD) related news. This trend suggests that the market is preparing for a promising future.

Furthermore, the increase in Doge’s transaction numbers indicates a growing interest and use of the meme currency. Under present market circumstances, it is likely that Dogecoin will attempt to surpass its $0.11 resistance threshold in the near future.

Read More

2024-09-19 01:43