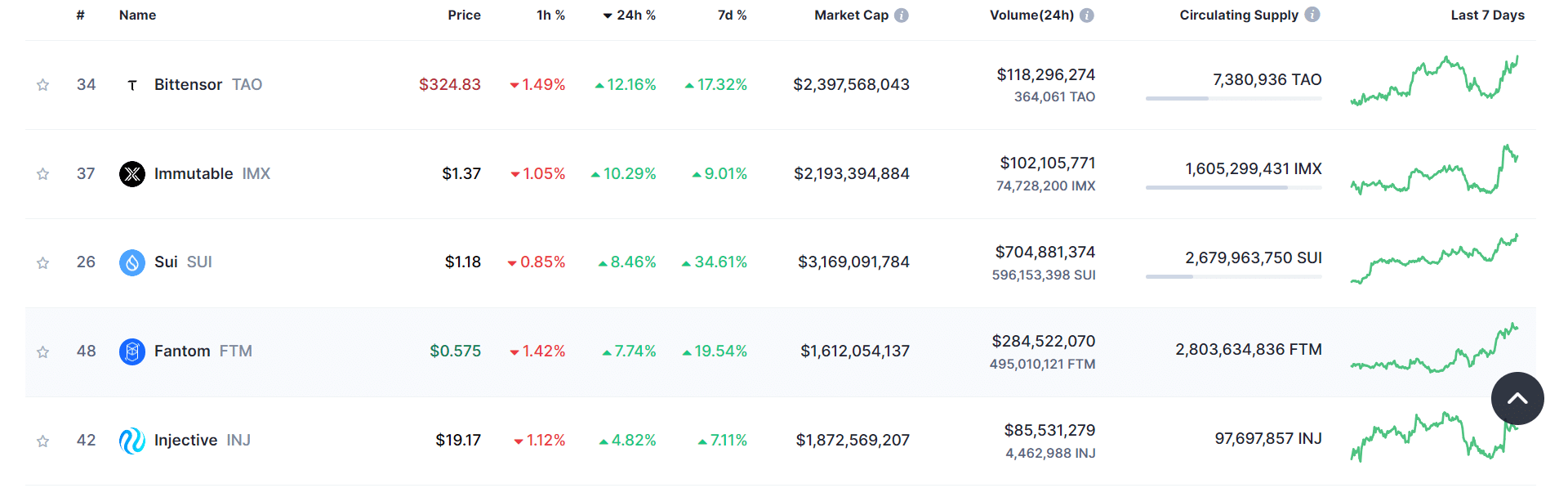

- BitTensor leading by gains for top 50 coins by market cap.

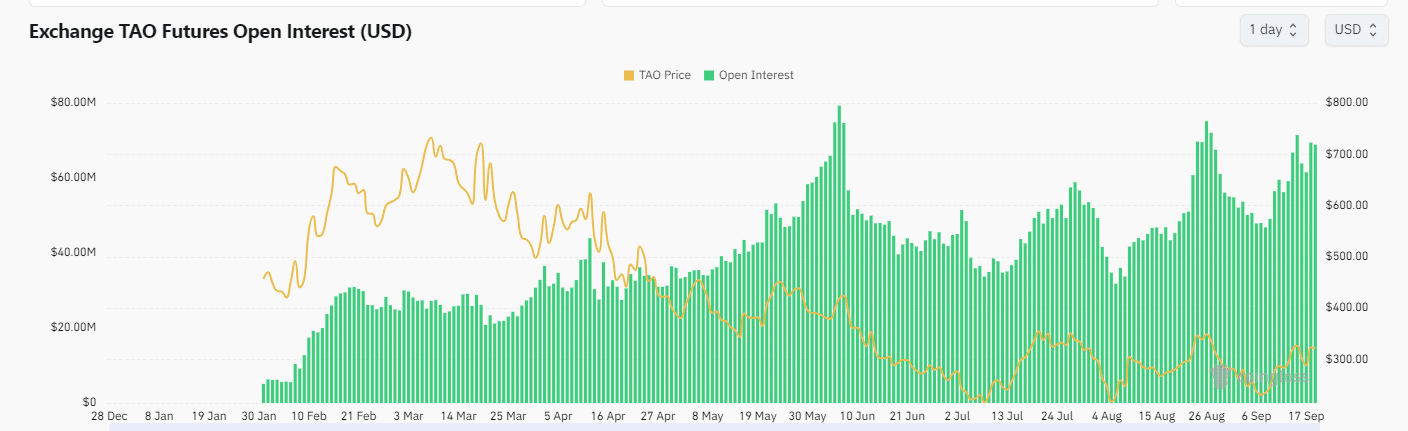

- Open interests approaching the all-time high.

As a seasoned researcher with a knack for deciphering market trends, I find myself intrigued by the recent performance of BitTensor [TAO]. With over 12% gains in the last 24 hours and leading the pack among top 50 coins by market cap, it’s hard not to be impressed.

In the rapidly advancing world of cryptocurrencies, BitTensor [TAO], an innovative AI-focused digital currency, is experiencing notable growth. This surge comes as the web3 landscape matures and expands within the blockchain ecosystem.

Over the past day, TAO cryptocurrency has surged by more than 12%, placing it as the best-performing coin in the top 50 coins with the highest market capitalization, as reported by CoinMarketCap at this moment.

Given current circumstances, it’s possible that TAO could outrank Fetch.AI (FET) as the leading AI cryptocurrency. This will depend heavily on the overall state of the market.

Notable corporations such as Nvidia (NVDA) have shared earnings exceeding expectations, collectively shaping the market with their insightful perspectives.

This development has led to increased optimism about AI-related cryptocurrencies since Nvidia is a major player in the artificial intelligence sector.

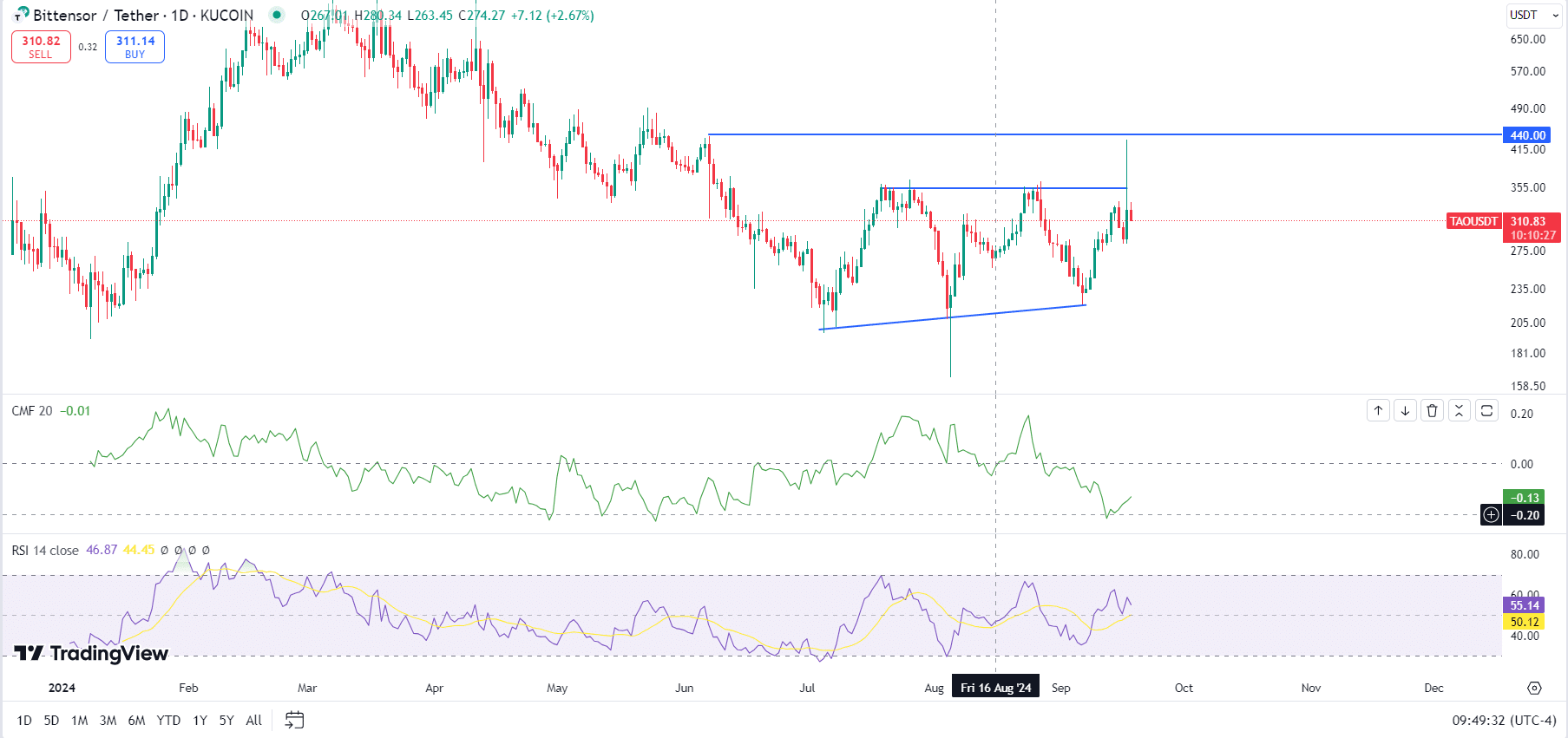

TAO price actions wicks to around $440

Over the last 24 hours, by the time news was released, TAO‘s value peaked at $440 on the Kucoin Exchange. However, this increase was quickly rejected, indicating a substantial amount of sellers at that price point.

Advancing from here might encounter a substantial barrier area. Generally speaking, wicks are perceived as voids that markets often aim to fill, so for BitTensor to fill this gap, it may need to ascend further.

It’s unclear if TAO/USDT will rise to fill this gap, as the price rejection suggests that sellers might still be in charge. However, it’s worth noting that TAO briefly spiked above $356, a level with significant liquidity due to previous highs at this point.

Moreover, the closing of the August 5th candle as a ‘hammer’ shape, characterized by a long lower wick and short upper one, indicates a growing trend of buyers taking control.

The consolidation of TAO/USDT within a specific range shows an uptrend as it displays higher bottoms, usually indicating a positive market sentiment. However, the Chaikin Money Flow, currently in the negative zone, suggests a potential shift that might push TAO’s price upwards, possibly triggering a reversal.

In simpler terms, the indicator known as the Relative Strength Index (RSI), when calculated over a 14-day moving average, has now turned optimistic. This adds more weight to the idea that there could be significant increases in value coming up soon.

Open interest nears ATH

The amount of ongoing contracts for BitTensor on major trading platforms is fast approaching its record level, currently standing at approximately $68.88 million when last checked, with each contract valued at around $322.

In terms of Total Automated Open Interest (TAO), Binance is at the front with a total of $29 million, while Bybit trails slightly behind with $18.6 million. Bitget and BingX follow closely with approximately $13.19 million and $5.54 million respectively.

Other exchanges like Coinbase, Kraken, HTX, and CoinEx show notable, but lower, open interest.

A robust surge in demand signals a positive outlook for TAO, implying it might be advantageous to stockpile TAO tokens now.

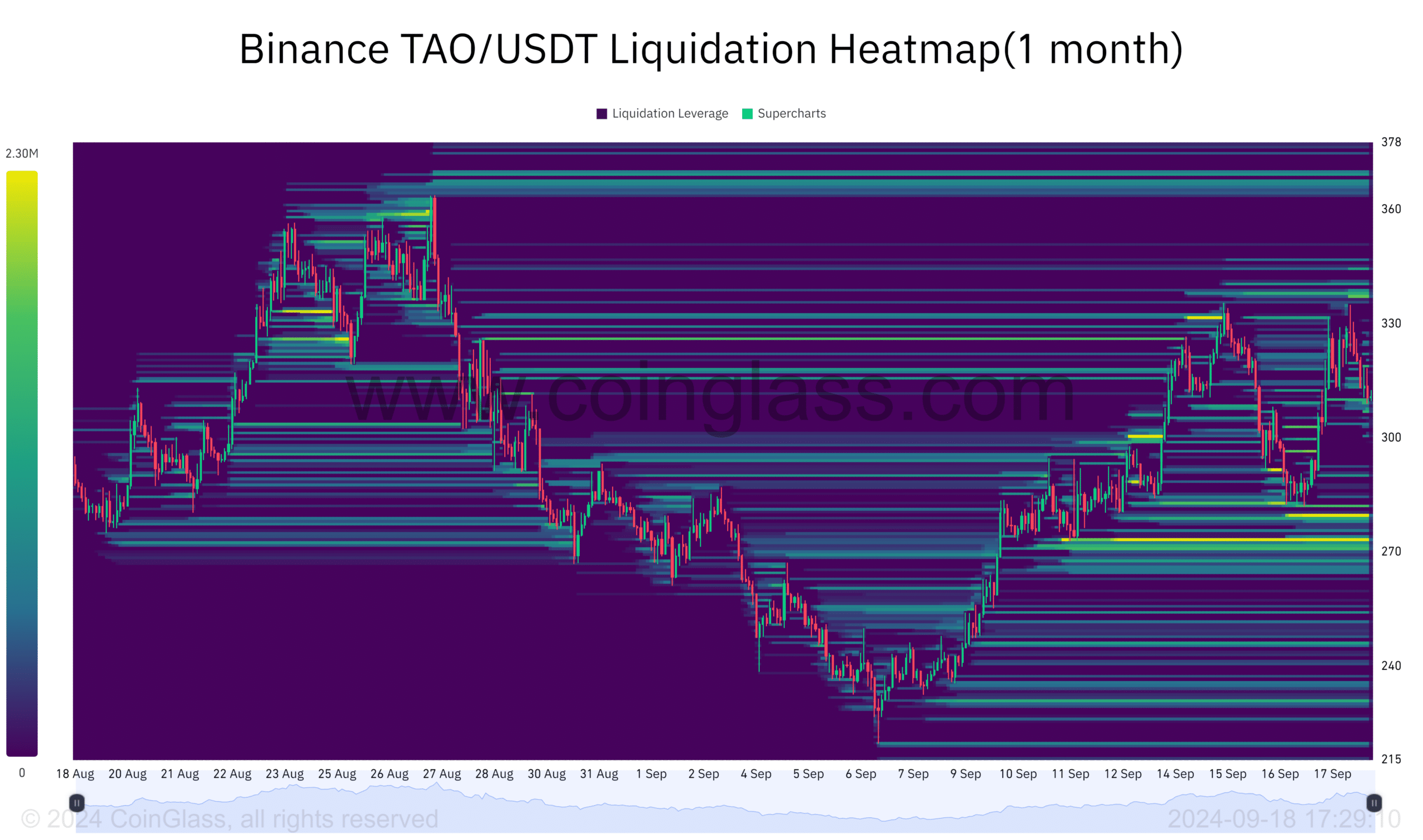

Liquidation heatmap

To conclude, looking at the liquidation map, various liquidation points indicate possible price fluctuations.

At the $366 price point, there’s a substantial amount, roughly $482,170, of short positions (liquidation leverage) that appear to be taken by traders who are pessimistic about BitTensor due to its recent price rejection.

Is your portfolio green? Check the TAO Profit Calculator

If the price falls below $280, there’s a total of $1,110,000 in liquidation leverage, and an additional $1,920,000 is at risk if it drops below $275.

If the value of TAA surpasses its current liquidity, this might stimulate a surge in optimistic trading and potentially elevate the TAA/USDT exchange rate.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-09-19 07:04