-

Notcoin creators leveraged Telegram’s user base to create a community around the NOT token.

Key indicators show diminished potential for a price recovery despite Notcoin burning 233 million tokens.

As a seasoned researcher who has witnessed countless crypto projects come and go, I must say the current state of Notcoin (NOT) is giving me déjà vu. The creators’ attempt to leverage Telegram’s user base to create a community around the NOT token seems like a strategy straight out of a playbook filled with forgotten tokens.

It appears that Notcoin has shown indications of fatigue in the active market, as its value dropped by a substantial 31% over the past month. Based on technical analysis and on-chain data, the trend seems to suggest that this downward price movement may continue.

Weakening price strength

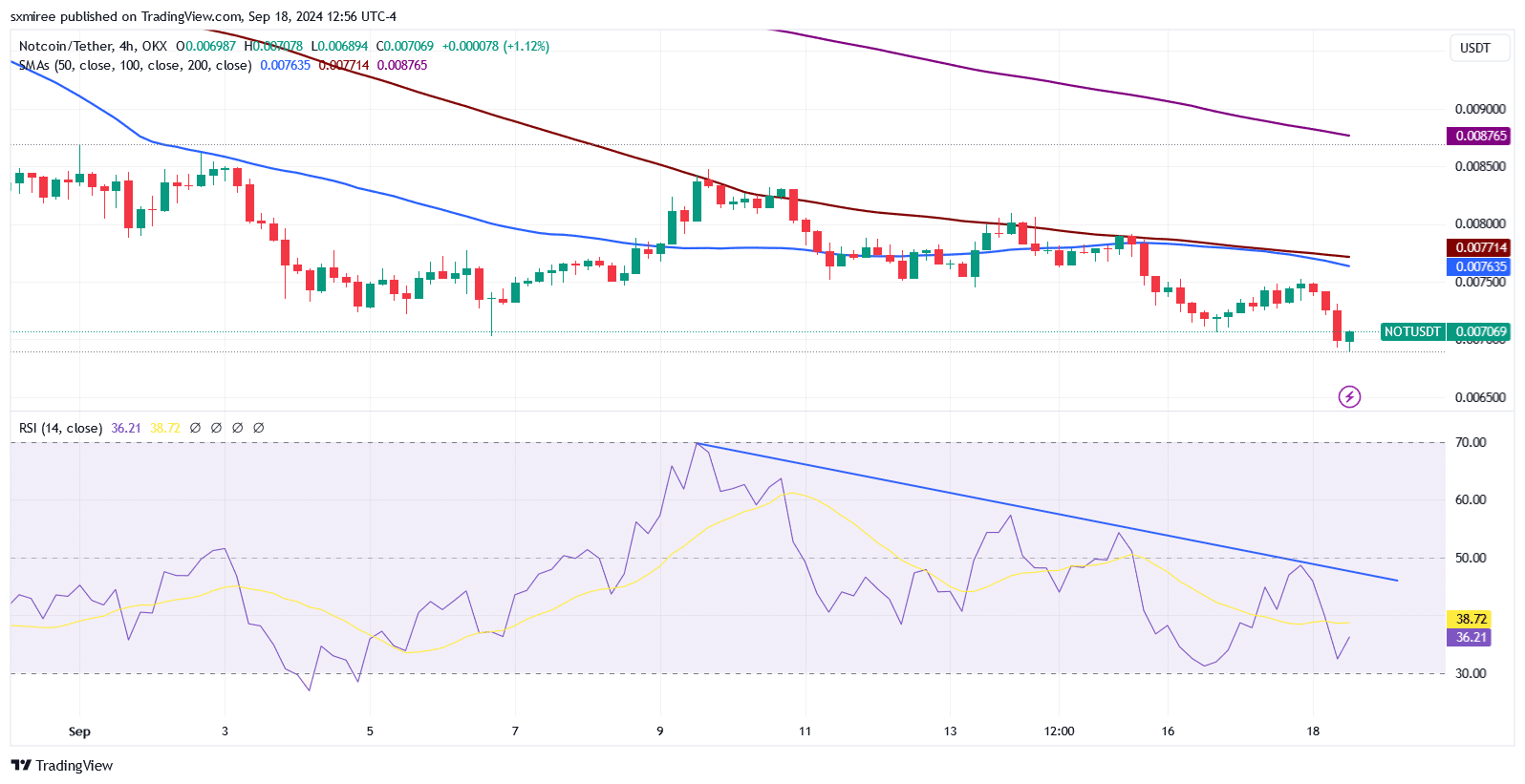

The 4-hour chart data from TradingView indicates that the Relative Strength Index (RSI) has decreased steadily since it reached a high, close to the overbought region, on September 9.

The decreasing 4-hour Relative Strength Index suggests that sellers have been exerting more influence on the market, potentially signaling upcoming drops in price.

Significantly, about two out of every ten Notcoin wallets are currently showing a profit, as revealed by statistics from IntoTheBlock. On the other hand, a large proportion of approximately two-thirds are experiencing losses at present prices.

At the price point of $0.0083, there seems to be significant reluctance, as approximately 171,780 wallets collectively hold about 3.59 billion tokens that have yet to turn a profit (or are “underwater”).

Declining network activity

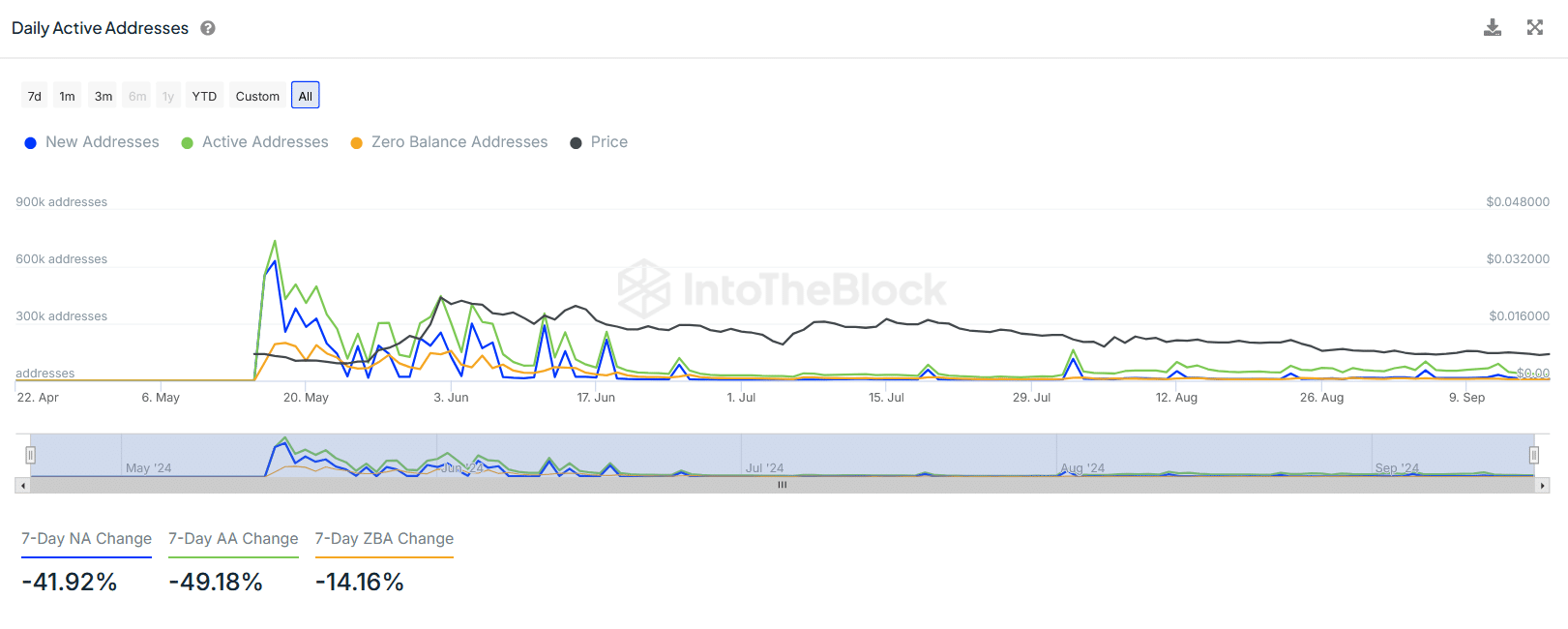

Strengthening the negative perspective, data from on-chain analysis shows a significant drop in activity within Notcoin’s network, suggesting that enthusiasm for the tapping-to-earn game is dwindling.

Over the past seven days, I’ve observed a significant decrease in the creation of new addresses on our network, amounting to approximately 41.9%. Simultaneously, the number of active addresses has experienced a steep decline, dipping by around 49.2% during the same period.

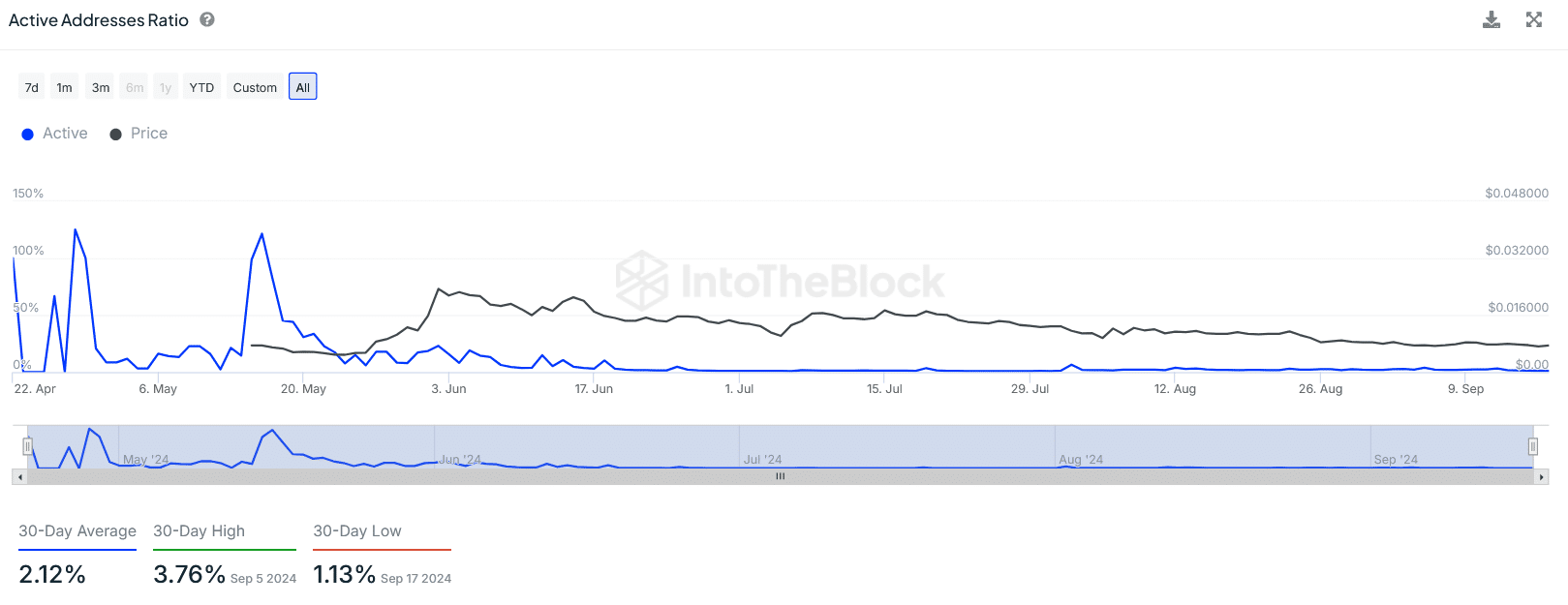

As a researcher observing trends, I’ve noticed that the active address ratio, which is usually presented as a percentage, has been on a downward trajectory throughout September. This suggests a gradual decline in user engagement.

On September 17, the proportion of active Notcoin addresses reached a 30-day low of 1.13%, marking a significant decrease from its 30-day peak of 3.76% that was observed on September 5.

Since September 13, the number of transactions on the network has been generally lower than 50,000 and dipped to a 7-day minimum of 41,230 on September 17.

As a researcher, I’ve noticed a significant decrease in the number of large daily transactions this month. The lowest point was reached on September 16, with only 3 such transactions taking place. This trend suggests less active participation from ‘whales’, indicating that even those with substantial resources are choosing to hold back.

NOT/USDT outlook

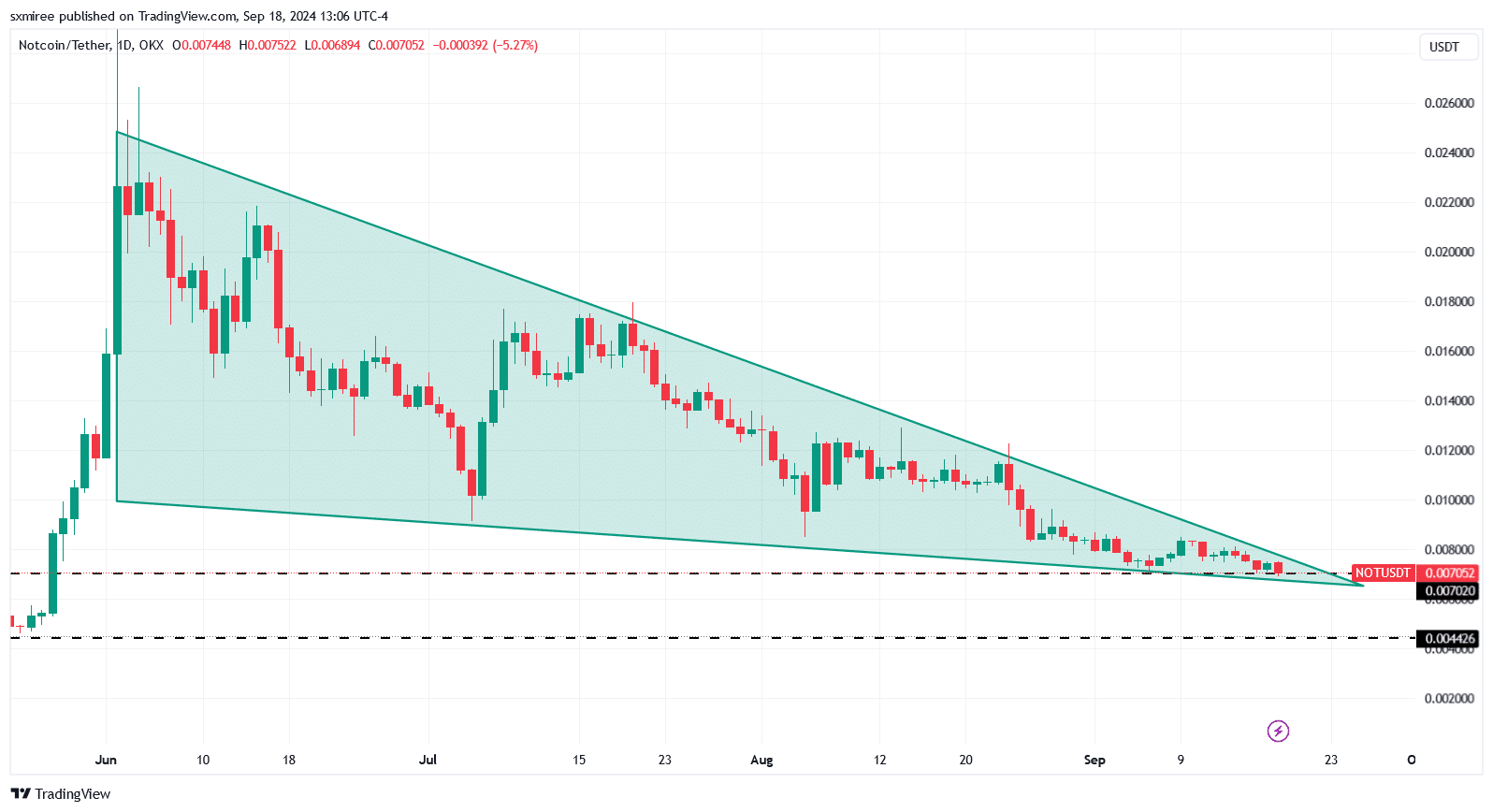

At the moment of writing, the price was slightly above the $0.0070 support level, and the next significant support can be found around $0.0044. The 1-day NOT/USDT chart indicates that the pair has been moving within a falling wedge pattern since June, consistently encountering new higher supports.

If demand remains low in the market, dropping below the current level of resistance might result in prolonged price decreases.

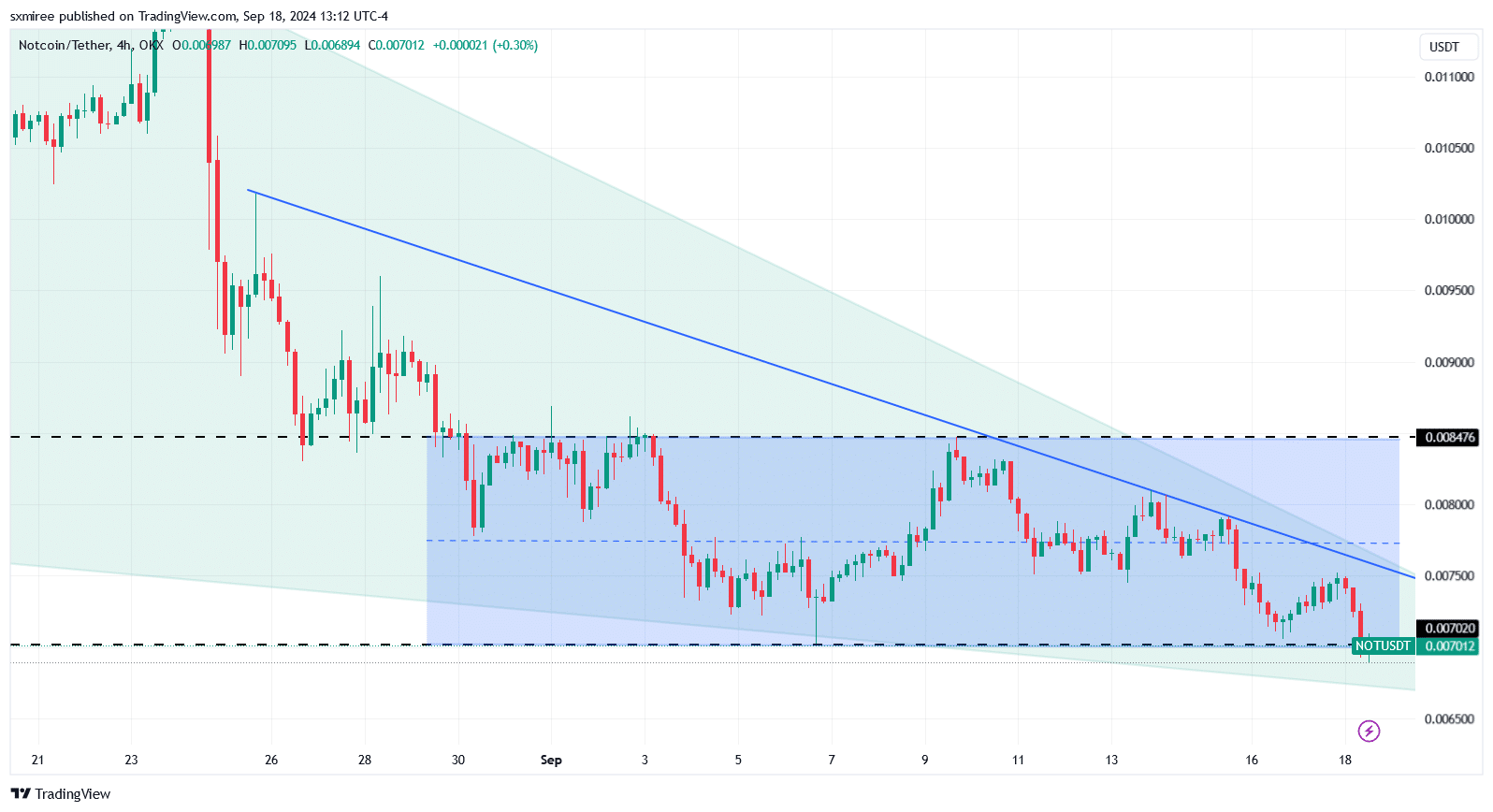

Focusing on the 4-hour timeframe, Notusdex’s price against USDT has remained stable within the range of $0.007 to $0.0084 since early September.

On September 17, the value of the pair climbed up to approximately 0.0076, only to be turned down and subsequently move in alignment with its latest trend, which has been characterized by a falling resistance line.

It’s worth mentioning that the relationship between Notcoin (NOT) and both Bitcoin (BTC) and Ethereum (ETH) has been strengthening over the past month, with a particularly strong correlation observed in recent times for Ethereum.

Read Notcoin’s [NOT] Price Prediction 2024–2025

According to IntoTheBlock’s recent data analysis, the 30-day relationship between NOT and ETH is currently at 0.81, edging closer to its peak correlation value of 0.85 observed on August 20.

As I delve deeper into my analysis, it appears that the relationship between NOT‘s price fluctuations and those of the leading altcoin is strengthening significantly.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-19 13:12