- Bitcoin bulls showed up in response to rate hikes as the market receives a confidence boost.

- Evaluating the risk of long liquidations as volatility makes a comeback.

As a seasoned researcher with over two decades of market analysis under my belt, I’ve seen my fair share of bull runs and bear markets. The latest Bitcoin price surge following the Federal Reserve’s rate cut announcement is a testament to the resilience and adaptability of this digital asset.

In a positive reaction, Bitcoin (BTC) showed signs of optimism following the Federal Reserve’s declaration about reducing interest rates by 0.5%.

As a researcher, I observed an intriguing phenomenon unfold in the cryptocurrency market this month. Following the reduction in interest rates, investors seemed to have taken a keen interest in Bitcoin. Their collective action drove up the price of Bitcoin, marking a historic milestone as it surpassed $62,000 for the first time during this period.

This aligns with earlier predictions as lower rates should stimulate liquidity in risky investments. However, the main curiosity now lies in understanding which direction the market will take next.

A bumpy ride ahead for Bitcoin?

Bitcoin’s anticipation is running high, given the current decrease in interest rates. Although this could potentially lead to further gains over the next few months, it also increases the likelihood of increased volatility.

Translation, more unexpected pullbacks and highly volatile price movements.

As a crypto investor, I can’t help but notice how sky-high expectations often fuel an increased optimism in the Bitcoin market. This heightened enthusiasm leads us to crave more leverage, which in turn increases our appetite for taking on more long positions. It’s important to remember that this increased activity could potentially result in even greater volatility for Bitcoin.

Meanwhile, whales and institutional players see this as open season for liquidations.

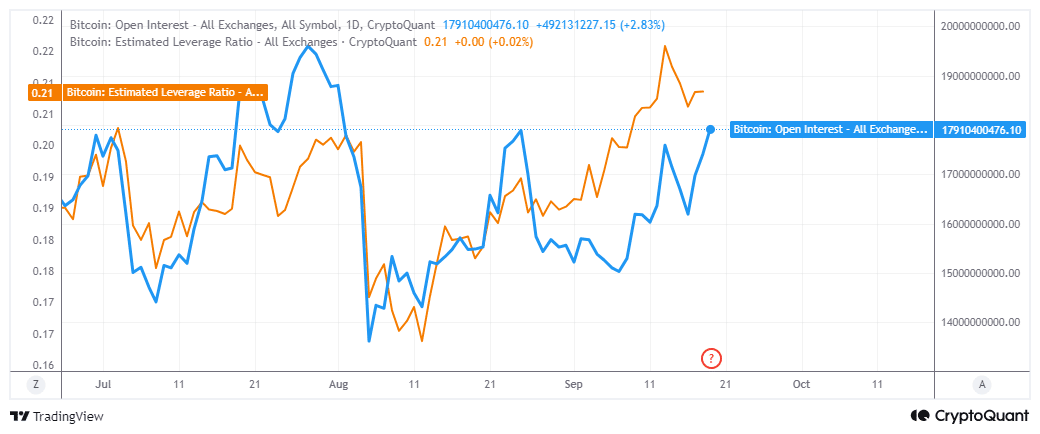

The market data aligns with our prior assumptions. To illustrate, the open interest has skyrocketed to its peak in the past seven weeks.

Since August, the calculated degree of financial leverage, represented by the leverage ratio, has been steadily increasing.

It has retreated a bit since September 13th, yet it’s ready to climb further due to the recent positive shift in market opinion.

Regarding the mood, it seems that the recent interest rate reduction announcement has influenced Bitcoin ETFs positively. On September 18th alone, there were approximately $52.83 million in inflows for Bitcoin ETFs.

A rise in positive investments into ETFs and anticipated infusions of liquidity could foster a robust increase in Bitcoin prices. Yet, this situation might equally lead to significant sell-offs and price corrections.

Assessing recent demand

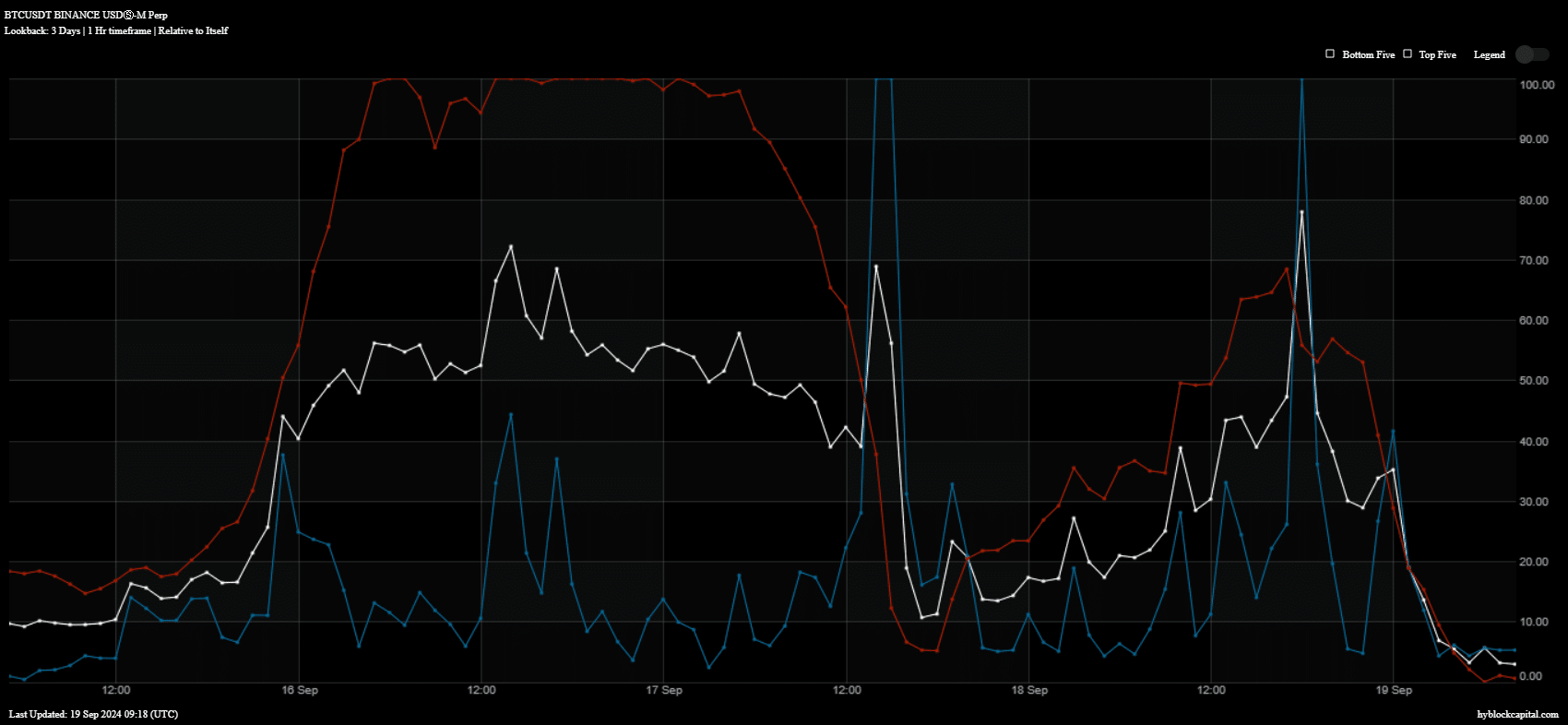

The danger of upcoming liquidations for Bitcoin remains high, as the latest influx of liquidity seems to have diminished. This is suggested by the drop in buy volume, clearly visible on the graph as a decrease from blue areas.

Additionally, we noted an increase in positions that could potentially face liquidation if the market experiences an unanticipated downturn, represented by the red bars.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Having a large number of heavily-borrowed long positions could potentially provide an opportunity for big investors (like whales and institutions) to influence market prices.

Even though there might be short-term drops, it’s anticipated that increased investment influx will likely propel Bitcoin prices upward over the next couple of months.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-09-19 19:35