-

DOGS’ breakout levels nears as adoption rises, sparking a potential 13% price rally.

Traders watch DOGS as bullish indicators and rising adoption hint at an imminent breakout.

As a seasoned analyst with over two decades of experience in the ever-evolving world of cryptocurrencies, I find myself intrigued by DOGS‘ current position. The coin’s recent listing on Coinbase and Binance has undoubtedly stirred up interest, but whether it will lead to a significant breakout remains to be seen.

Based on recent assessments, it appears that the meme coin known as DOGS, may be poised for a substantial surge in value, even amidst fluctuating market opinions.

Dogs (cryptocurrency) saw an increase in popularity as it was added to the Coinbase Futures exchange on September 19th, having previously been listed on both the Binance Spot and Futures markets.

This action positions the stock (or asset) of DOGS in a crucial situation, which could either intensify its ongoing price surge or subject it to additional selling pressure.

Recent price action and key levels to watch

At the current moment, the price of DOGS was at $0.0009937. Over the last day, there was a trading volume of approximately $376 million and a 1.23% increase was observed. However, over the course of the past week, there has been a 2.49% decrease in its value.

The coin’s market cap stood at $513,223,017 with a circulating supply of 520 billion DOGS.

In simpler terms, the price trend shows Dogs trying to break free from the low points around $0.00095, a significant area of support that has been tested on numerous occasions.

As a researcher analyzing market trends, my technical analysis suggests a possible 13% upward movement from the present levels, aiming for the one-hour price gap at approximately $0.00106.

Key support is noted around $0.00009160, a level where buyers have historically stepped in to maintain bullish momentum.

Resistance is seen between $0.00010200 and $0.00010600, with the next higher resistance zone between $0.00011200 and $0.00011400.

A breakout above these levels could trigger further upside, positioning DOGS for a notable move.

Importance of breakout levels near $0.00095

For the cryptocurrency DOGS, the $0.00095 mark held significant importance since it could serve as a springboard for further price increases. Maintaining above this level indicates robust demand from buyers, diminishing the possibility of a severe downturn.

Breaking below this zone, however, could expose DOGS to additional downside risk.

Investors are carefully observing the potential barrier near $0.00106. If this level is surpassed, it may signal a positive outlook and motivate more individuals to invest in the market.

The data from Coinglass derivatives showed a significant decrease of about 15.55% in trading volume to approximately $63.11 million, suggesting less active trading on the market.

On the other hand, there’s been a 5.31% rise in Open Interest, which has brought it up to $146.20M. This suggests that traders are showing more activity and involvement.

On significant trading platforms like Binance and OKX, the balance between long and short positions leans heavily toward long positions, indicating a generally positive outlook among traders.

DOGS breakout nears amid rising adoption

The bullish case for DOGS rests on the breakout from recent dips and the push toward the $0.00106 target.

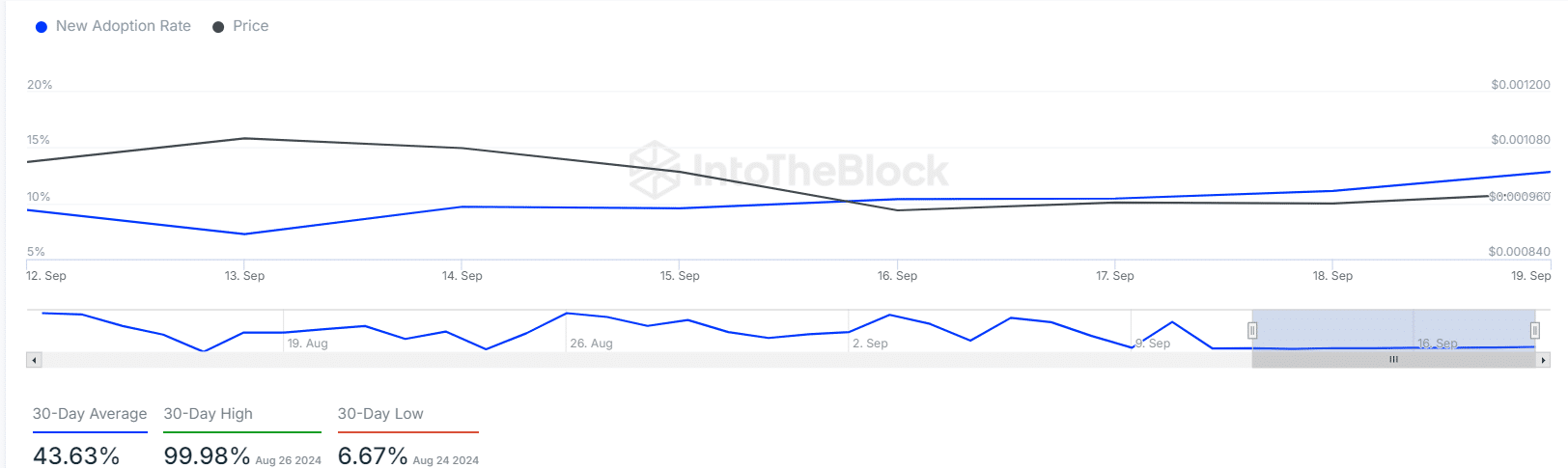

As an analyst, I’ve observed a rising trend in new user adoption within the blockchain network over the last week, according to data from IntoTheBlock, which adds credence to my optimistic outlook.

Currently, the 30-day average adoption rate is at 43.63%. However, recent trends suggest that the coin is seeing an increase in popularity, though it’s still shy of its previous highest adoption rates.

Read Dogs’ [DOGS] Price Prediction 2024–2025

Potential issues with this optimistic viewpoint could be that the anticipated price surge might not materialize (a failed breakout), or the volume of trades may not be sufficient to maintain the upward trend.

Regardless of varying opinions within the market, growing Open Interest and a significant number of long positions indicate that traders are preparing themselves for possible profits ahead.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-20 17:12