-

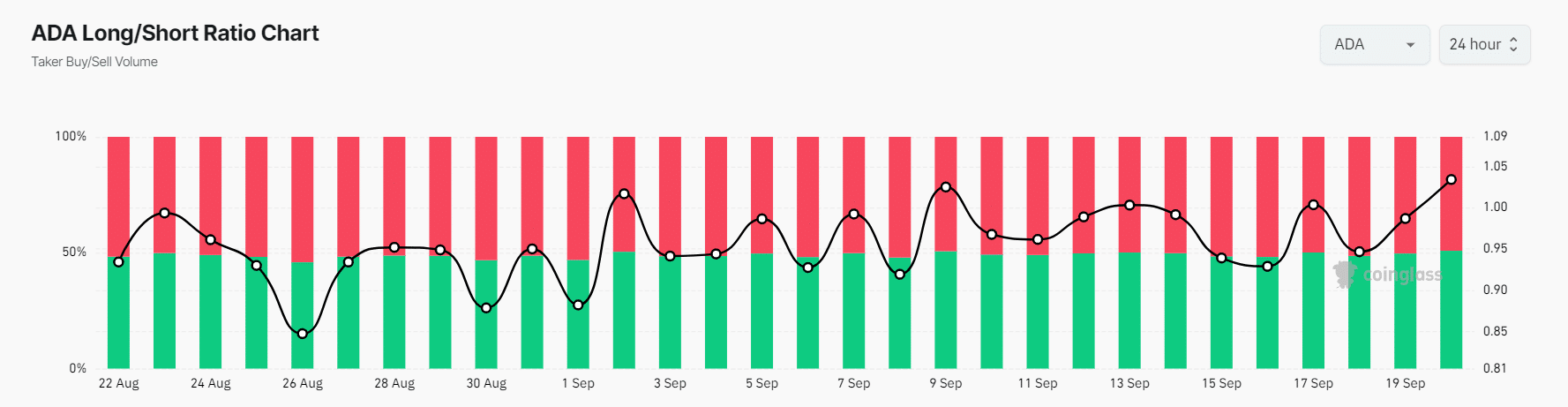

ADA’s Long/Short Ratio stood at the 1.034 level, indicating bullish market sentiment among traders.

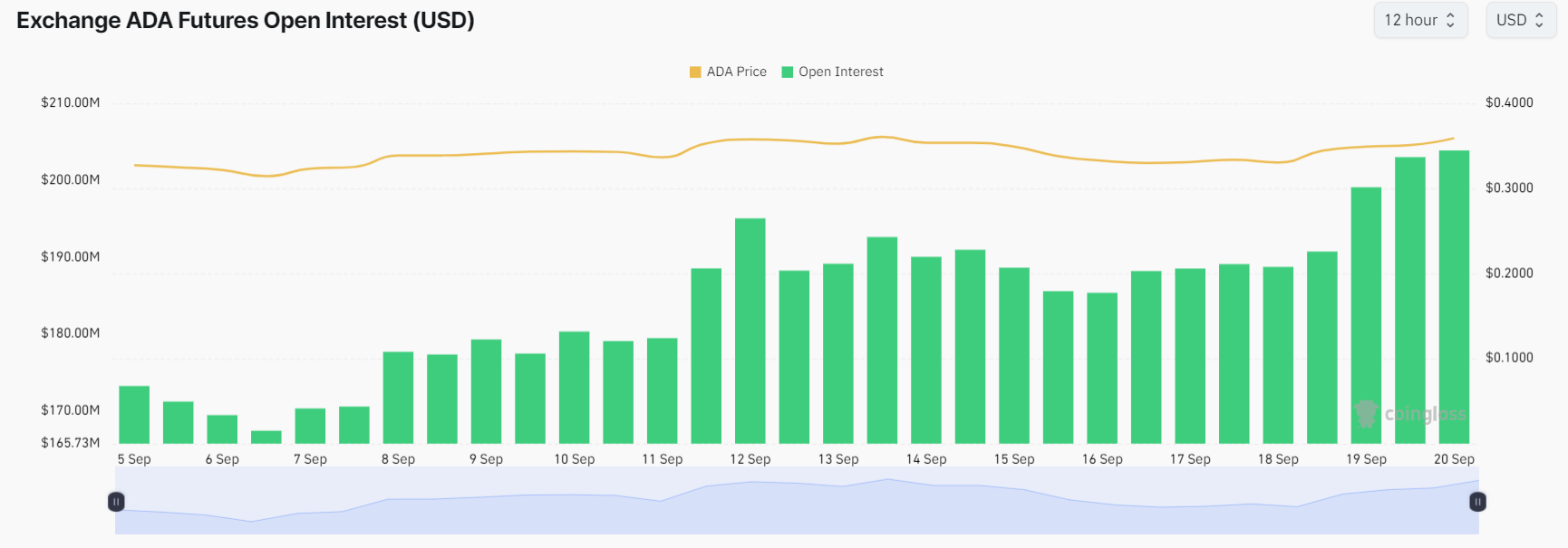

ADA’s Futures Open Interest increased by 8.5% and continued to rise steadily.

As a seasoned crypto investor with a knack for spotting trends and interpreting market signals, I find myself intrigued by the current state of Cardano (ADA). The recent surge in its price, coupled with the bullish on-chain metrics, paints an optimistic picture for ADA’s near future.

As the current market trend seems to be shifting, it appears that Cardano [ADA] is showing signs of a strong upward move, possibly triggered by an impending breakthrough and optimistic on-chain indicators.

Presently, there’s a change in the general market feeling, as prominent cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) are witnessing strong upward trends. Remarkably, Cardano is now mirroring this trend.

Cardano price momentum

Over the last three days, ADA experienced an increase of over 10%. Currently, it is being traded around $0.36, following a rise of approximately 3.8% within the past 24 hours.

On the other hand, over this timeframe, the trading activity decreased by 5%, suggesting less involvement from traders and investors as the market experienced a shift in direction.

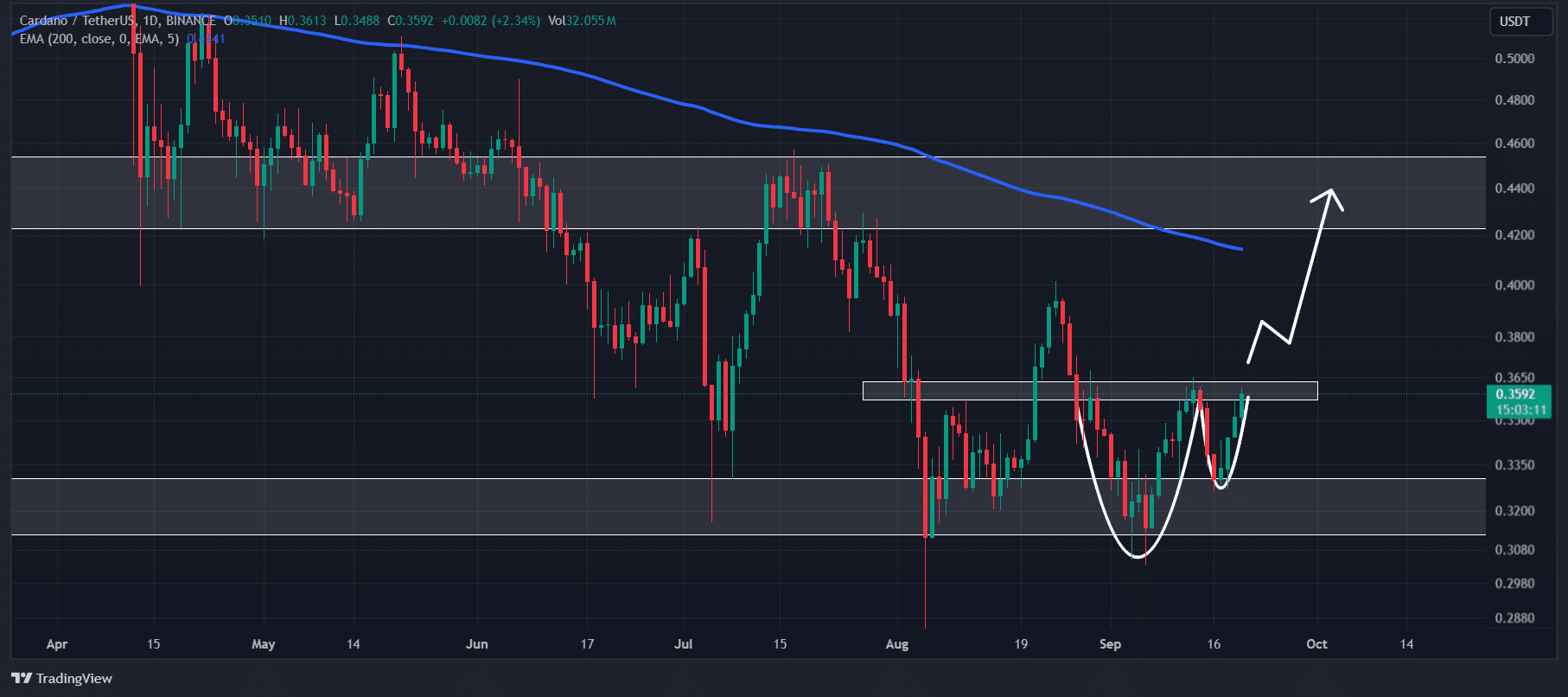

Although ADA experienced a significant increase in its price recently, it remains under the 200 Exponential Moving Average (EMA), suggesting that from a broader perspective, it is following a downward trend.

Technical analysts and investors often rely on the 200 Exponential Moving Average (EMA) to decide if a particular asset is experiencing an upward or downward trend.

Although showing a decline, Cardano (ADA) was close to the line of a potential bullish cup-and-handle formation at approximately $0.365 as of now. This pattern suggests a possible upward trend in the future.

Previously, ADA often encountered strong selling forces at this particular level, leading to price decreases or changes in direction.

Should the price of ADA surpass its current resistance level at around $0.367 and finish the day’s trading session above that point, there’s a substantial chance it could increase by approximately 20%, potentially reaching roughly $0.445.

Bullish on-chain data

The positive viewpoint is reinforced by data from blockchain analytics. At present, the long/short ratio for Cardano (ADA) on Coinglass stands at 1.034, suggesting a predominantly optimistic trading attitude among investors, signaling a potential rise in the market.

Additionally, ADA’s Futures Open Interest increased by 8.5% and continued to rise steadily.

As a financial analyst, I frequently observe that traders and I, ourselves, strategically build our investment positions by considering two key factors: a growing Open Interest and a Long/Short Ratio that surpasses 1.

Read Cardano’s [ADA] Price Prediction 2024–2025

At this moment, roughly 50.84% of leading traders are holding long positions, while around 49.16% have short positions. This suggests that the ‘bullish’ (long) side has a slight advantage in this asset.

Furthermore, ADA’s OI-Weighted Funding Rate was at +0.0096%, indicating bullish sentiment.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2024-09-20 20:07