-

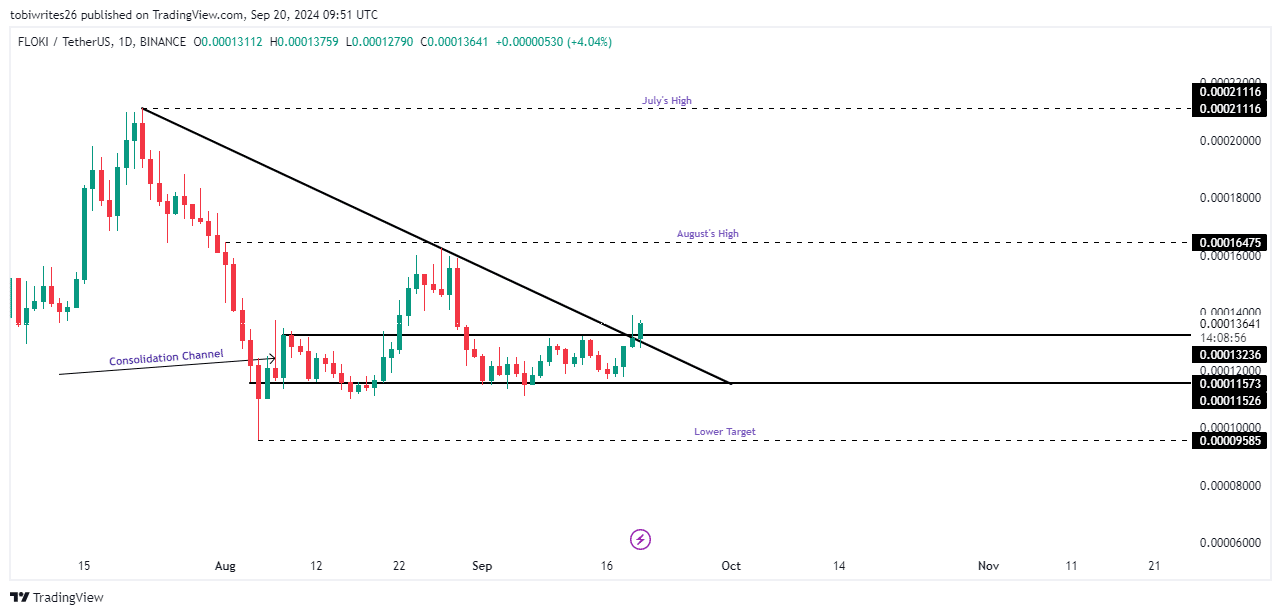

FLOKI has broken out from a bullish triangle pattern following a consolidation phase.

Should this uptrend persist, FLOKI could revisit its previous highs from August and July.

As a seasoned crypto investor who has navigated numerous market cycles, I find myself quite optimistic about Floki [FLOKI]. Over the past 30 days, it has consistently delivered returns, and its recent minor setback seems like just a temporary hiccup on the road to success.

For the last month, Floki (FLOKI) has consistently performed well, yielding a return of 8.49% to its investors.

Over the past day, there’s been a small reversal, dipping by 0.04%, which is unusual as it has typically been following a steady course.

It seems like the recent advancements suggest that FLOKI may lean more towards being bullish in the coming days.

Strong upside for FLOKI

FLOKI’s chart exhibits two strong bullish formations. To begin with, a bullish triangle structure emerged, characterized by distinct diagonal resistance and support levels.

Moreover, a unifying pathway, or channel, has formed inside this triangle, adding weight to the optimistic outlook.

Presently, FLOKI has managed to escape from both the bullish triangle and its consolidation range, highlighting the strong push in the ongoing market trend.

Should the bullish momentum be sustained, FLOKI could pursue its next potential targets.

The short-term goal is the center point of the bullish triangle, which is approximately 0.00016475. Following this, we might see a peak around 0.00021116, representing the highest points reached in August and July.

If momentum wanes, however, the price could retreat to the base support level at 0.00011573 and possibly further to 0.00009585.

FLOKI sees increased capital inflow

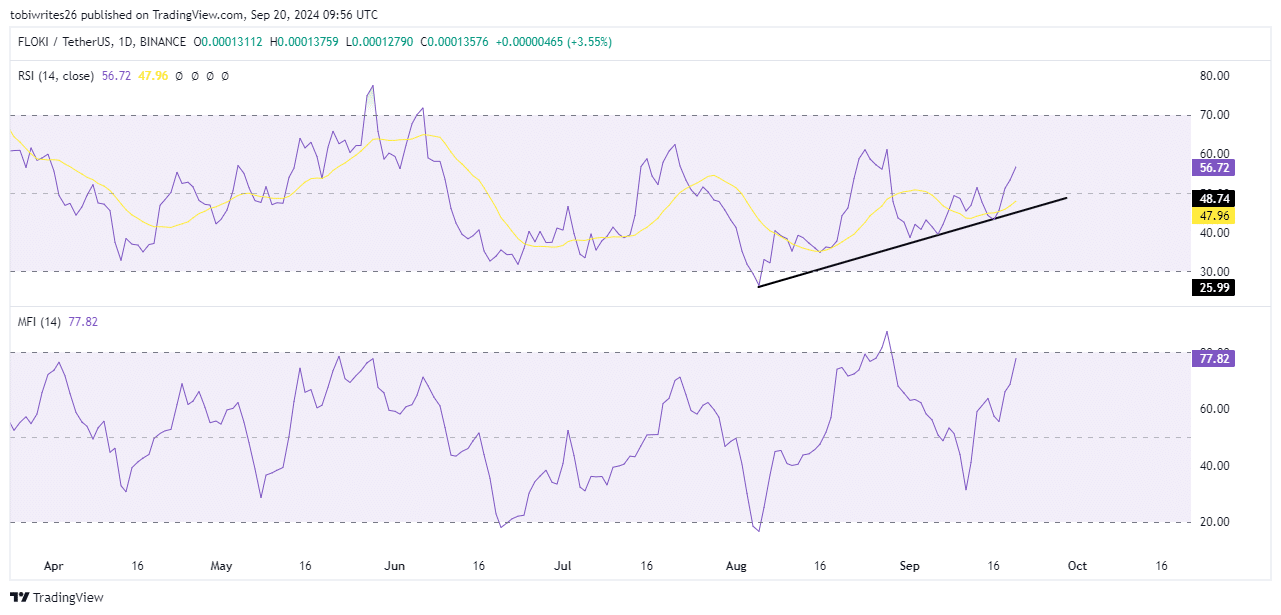

From my analysis perspective, at present, the Relative Strength Index (RSI) for FLOKI is currently reading 56.71, suggesting a sustained uptrend in its price movement.

The steady increase implies that traders are consistently purchasing FLOKI, which could potentially fuel more price advancement and maintain an uptrend in the long run.

Furthermore, the Money Flow Index (MFI) has been steadily climbing since September 17th, suggesting a substantial inflow of capital into FLOKI. This surge lends credence to a favorable, bullish perspective for the digital asset.

The Money Flow Index is a momentum indicator that tracks the flow of money into and out of an asset over a specified period, helping to assess the buying and selling pressure.

Traders remain active with FLOKI

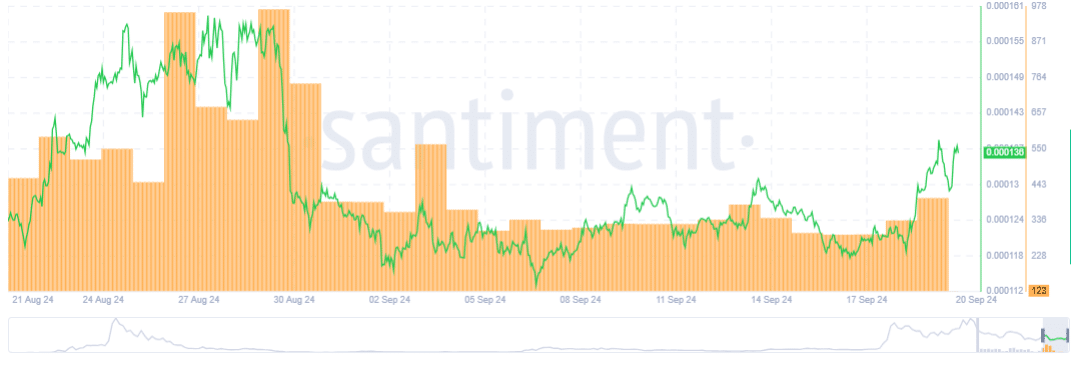

As per Santiment’s analysis, there’s been a significant increase in the number of active wallets dealing with FLOKI, suggesting that traders are consistently involved with this cryptocurrency.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

As this activity increases with increasing prices, it’s a clear indication of a positive outlook, or a “bullish” sign, for the asset. The continued upward trend implies that FLOKI could potentially keep rising as more trading periods progress.

In summary, the increasing impetus at its current high point is expected to push the value of FLOKI towards its maximum anticipated price of $0.00020994.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Quick Guide: Finding Garlic in Oblivion Remastered

- ANKR PREDICTION. ANKR cryptocurrency

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- K-Pop Idols

- LINK PREDICTION. LINK cryptocurrency

2024-09-21 01:11