-

APT benefits from strong technical indicators that signal a potential rally as it is projected to hit the double-digit mark at $10.41.

Investor confidence remains high as evidenced by significant capital inflows, with few indicators showing upward trends.

As a seasoned analyst with over two decades of market experience under my belt, I can confidently say that the technical indicators for APT are looking quite promising. The strong rally it has seen in the past week, particularly the 13.04% daily surge, is an undeniable sign of growing investor confidence.

Over the last seven days, the price of Aptos (APT) has increased significantly, with much of this growth attributed to a substantial 13.04% surge observed on a daily basis.

According to AMBCrypto’s analysis, these recent developments suggest a positive trend, as they point towards fresh bullish patterns that underscore the asset’s robust forward movement.

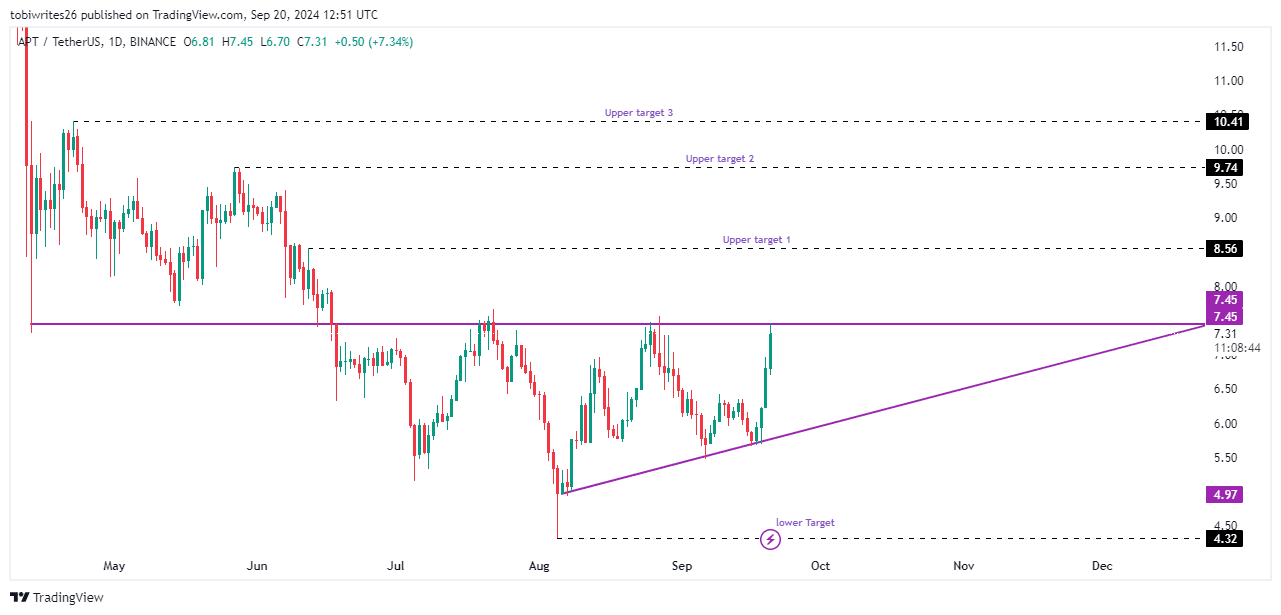

APT trades within an ascending triangle, eyeing key resistance levels

At the moment, APT‘s price is being contained within an upward-sloping triangle, a pattern that typically stimulates price increases. This structure is defined by a flat resistance level above and a gradually increasing support level below.

As an analyst, I’ve noticed a notable recovery in APT‘s price movement, having bounced back from a particular support line. Now, it seems to be edging towards the $7.45 resistance zone. If the buying momentum manages to outpace the selling pressure at this level, APT appears primed to break beyond this resistance.

After a successful breakthrough, the rally might continue towards significant price points at approximately $8.56, $9.74, and $10.41. At these levels, the price may find balance. On the flip side, if overall market trends are negative, APT could potentially drop back to around $4.32.

According to AMBCrypto, there are various signs pointing towards a continued upward trend for APT, which could help it break through the resistance barrier.

Indicators signal strong bullish momentum

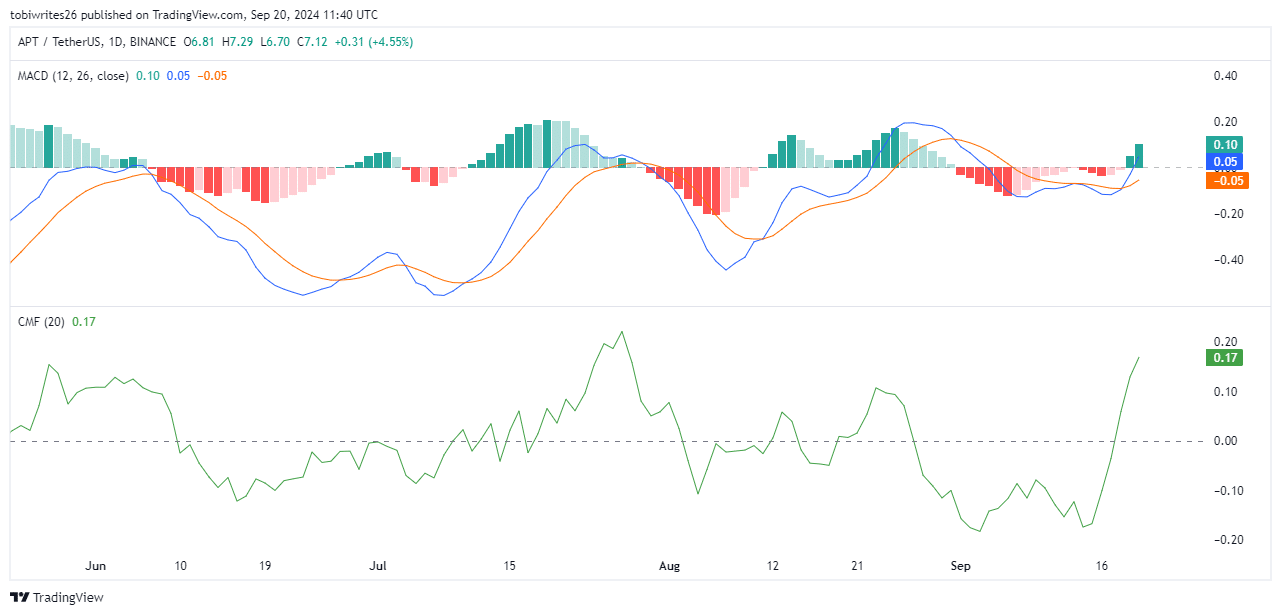

Currently, APT has reached a significant technological achievement called the “golden cross,” which occurs when the blue MACD indicator lines cross above the orange signal lines. Additionally, the MACD line itself stands at a positive 0.05 value right now.

In simpler terms, the “golden cross” typically suggests that the price of APT might keep increasing from its current point, as it’s often seen as a positive sign in trading.

Furthermore, the Chaikin Money Flow (CMF) – a tool that evaluates both price and trading volume to determine the movement of capital into or out of an asset – indicates that Asset Price Token (APT) is currently experiencing an accumulation period.

This phase is confirmed as the CMF value has risen to 0.18, reinforcing.

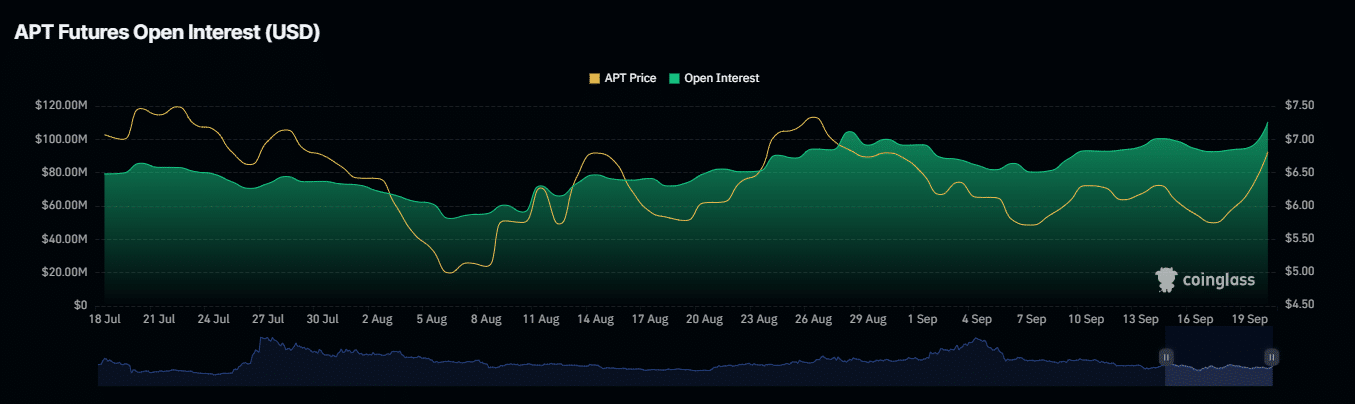

Open Interest in APT hints at strong buying interest

Based on data from Coinglass, there’s been a notable surge in demand for APT. In just the past day, Open Interest has grown by approximately 21.16%. This substantial rise suggests that investors are showing increased enthusiasm towards APT, with many traders actively buying up more of this asset.

Read Aptos’ [APT] Price Prediction 2024-25

The concept of Open Interest calculates the overall amount of unresolved derivative agreements, like futures or options, which indicates continuous participation in the market.

As an analyst, I’ve observed a significant surge in trading volume for APT, reaching as high as 54.04%. This robust increase indicates a heightened interest in this asset, suggesting that it could potentially fuel a rise in APT’s price due to the increased activity.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-21 09:11