-

A high hash rate and minimal fees reinforce Litecoin’s reputation as a better alternative to Bitcoin.

Litecoin price action against Bitcoin has weakened, though, as reflected by the falling LTC/BTC ratio.

As a seasoned crypto investor who has weathered multiple bull and bear markets, I’ve seen my fair share of altcoins come and go. However, Litecoin [LTC] stands out as one that’s consistently delivered on its promises, making it a staple in my portfolio.

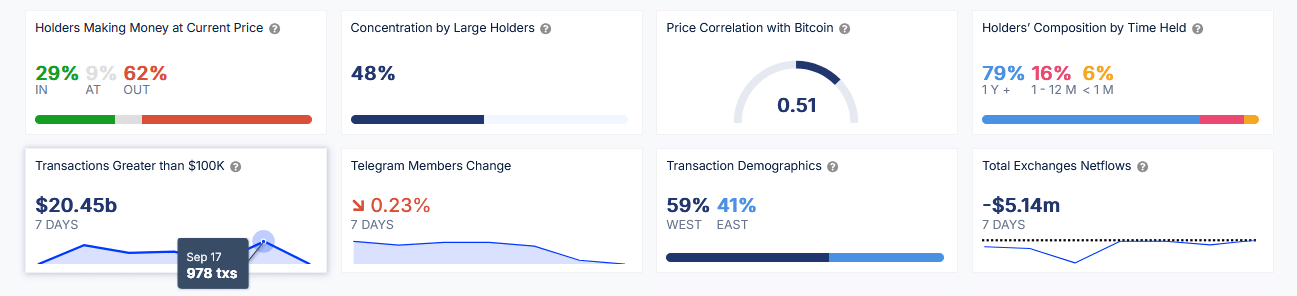

Over the past four weeks, there’s been a significant increase in substantial transactions on the Litecoin [LTC] network, indicating rising attention from big-time investors.

Over the past few weeks, I’ve been observing an unusual surge in whale activity on the network. This increase has been consistent since late August, coinciding with a rise in social dominance.

The latest data from on-chain resource IntoTheBlock indicates that transactions valued above $100,000 over the last week amount to approximately $20.45 billion. This substantial figure is worth noting, particularly when considering Ethereum‘s comparable transaction volume of $24.95 billion during the same timeframe.

As a crypto investor, I’ve noticed an uptick in the number of large daily transactions. Last week of August, there were approximately 830 such transactions, but during the first week of September, this figure surpassed 1,000. Over the last seven days, it has remained above 850, reaching a peak of 978 on September 17.

An increase in significant transactions suggests increased action from big players such as institutional investors, potentially impacting the immediate trading environment. This trend might lead to a surplus of market liquidity, possibly resulting in price stability and reduced short-term market volatility.

Network health: Hashrate and transaction fees

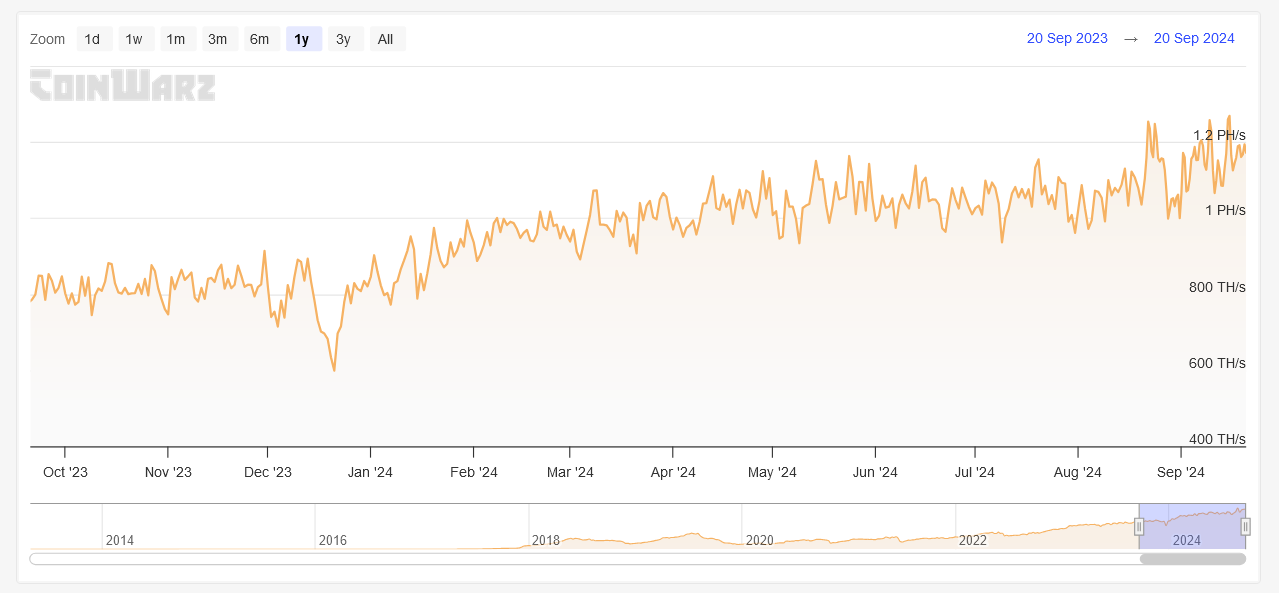

Regarding its network performance, Litecoin consistently showcases robust foundations. Since September 14, the hashing power within the network has remained persistently above one quadrillion hashes each second.

At block number 2,759,493, the Litecoin network’s hash rate was measured at approximately 1.19 Petahash per second (PH/s), and the network’s difficulty level stood at around 41,089,116.87.

A strong increase in hash rate indicates a good state of the network’s well-being and safety, as it bolsters faith in the network’s ability to withstand potential assaults.

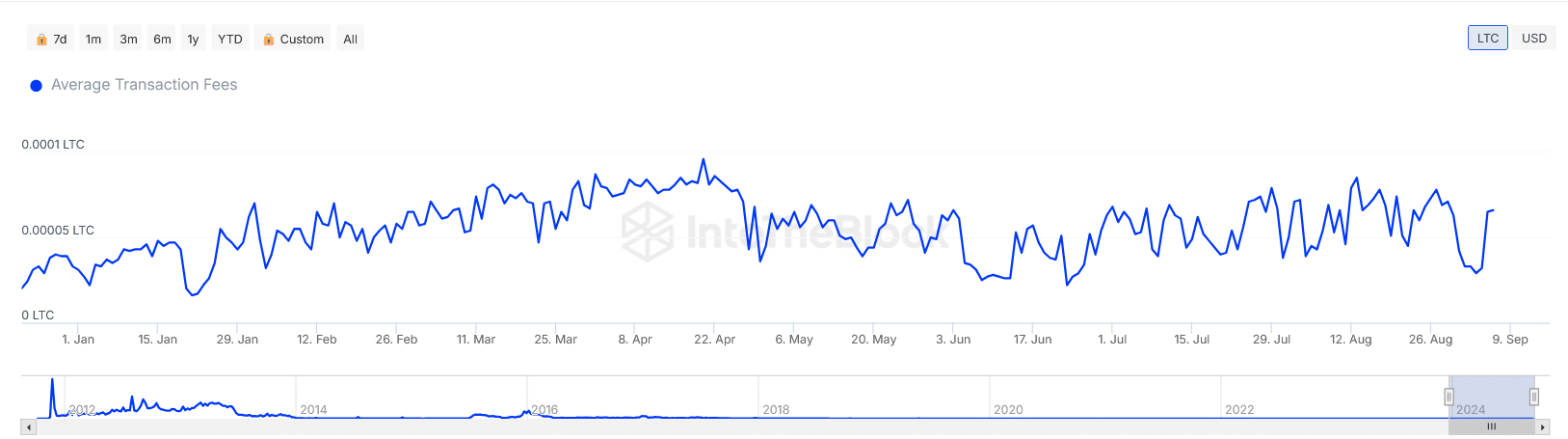

Furthermore, Litecoin continues to hold its position as an affordable platform for transactions, thereby reinforcing the idea that it serves as the “silver” counterpart to Bitcoin’s “gold.

The daily average transaction fee has consistently stayed under 0.0001 LTC (less than $0.01) throughout the year.

Choosing this platform is appealing due to its affordably priced transaction costs, which make swift, budget-friendly transfers possible, particularly when other networks become overloaded with high traffic.

Litecoin’s rapid processing speed significantly reduces the risk of double-spending, making it highly suitable for transactions. According to a recent study conducted by CoinGate, Litecoin represented approximately 12.3% of all transactions in August, ranking it second after Tron and ahead of Bitcoin.

LTC price action and correlation with BTC

Litecoin (LTC) was trading at $65.95, having moved 4% higher in the past 7 days. Despite strong network and transaction metrics, Litecoin has struggled relative to Bitcoin.

Read Litecoin’s [LTC] Price Prediction 2024–2025

The comparison between LTC (Litecoin) and BTC (Bitcoin), the leading cryptocurrency, indicates that Litecoin’s performance is lagging behind Bitcoin as their ratio has been decreasing, suggesting a less favorable trend for Litecoin.

As an analyst, I’ve observed a significant trend in Litecoin (LTC) over the past month. The correlation between LTC and Bitcoin has grown from 0.46 on September 6 to 0.51 at present. This close association, common among many altcoins, indicates that LTC’s price fluctuations are more influenced by Bitcoin’s movements rather than distinct catalysts shaping its own trajectory.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-21 12:07