- Bitcoin could be on the verge of breaking out of its bullish flag pattern.

- Assessing the possibility of resistance build-up at critical level.

As a researcher with years of experience tracking Bitcoin’s price movements and market trends, I must admit that the current situation is both intriguing and challenging. The bullish charge over the past two weeks has been nothing short of impressive, but the question remains: can Bitcoin sustain this momentum and break through the critical $65,000 resistance level?

In the recent fortnight, Bitcoin (BTC) has made a strong, upward surge. Until recently, it was finding it difficult to gather sufficient energy for a prolonged rally or break through the $60,000 price barrier.

Currently, Bitcoin has surpassed its previous resistance level of $60,000 and continues to climb higher. At the moment of writing, the value of 1 BTC is $63,404, representing a significant increase of approximately 18.35% over the last two weeks.

As we approach the final 10 days of September, Bitcoin appears set to end the month with a gain if it maintains its current momentum. Yet, it may encounter some obstacles along the way, especially if it moves towards the next significant resistance area around $65,000.

Why $65,000 level is critical for Bitcoin

The fluctuations in Bitcoin’s (BTC) price from March up until now have shaped a bullish flag pattern. If this pattern continues as expected, it suggests an imminent surge or “bullish breakout.” Currently, the conditions appear favorable for such an event to occur.

If the price surges significantly beyond $65,000, it could potentially shatter the downward trend of lower highs we’ve noticed recently. Breaking this trend suggests that the price may embark on a new journey towards exploring unprecedented levels.

The recent reduction in interest rates could potentially serve as a trigger, stimulating the flow of funds that may ignite another surge in optimistic market trends.

Can the Bitcoin bulls maintain the current momentum?

It has been observed by Looksonchain that a group of five miner wallets, which have been in operation since 2009, have recently moved their Bitcoin. This could potentially lead to increased selling activity. The analysis suggests that approximately 250 BTC, equivalent to around $15 million, was transferred.

Bitcoin miner reserves continued to decline in the last 24 hours, reaching a 5-week low of 1.81 million BTC.

An increase in Bitcoins held by miners suggests faith in its continuous growth potential. Contrarily, the present situation suggests a lack of such confidence. This is also concurrent with increased risk on the largest trading platform.

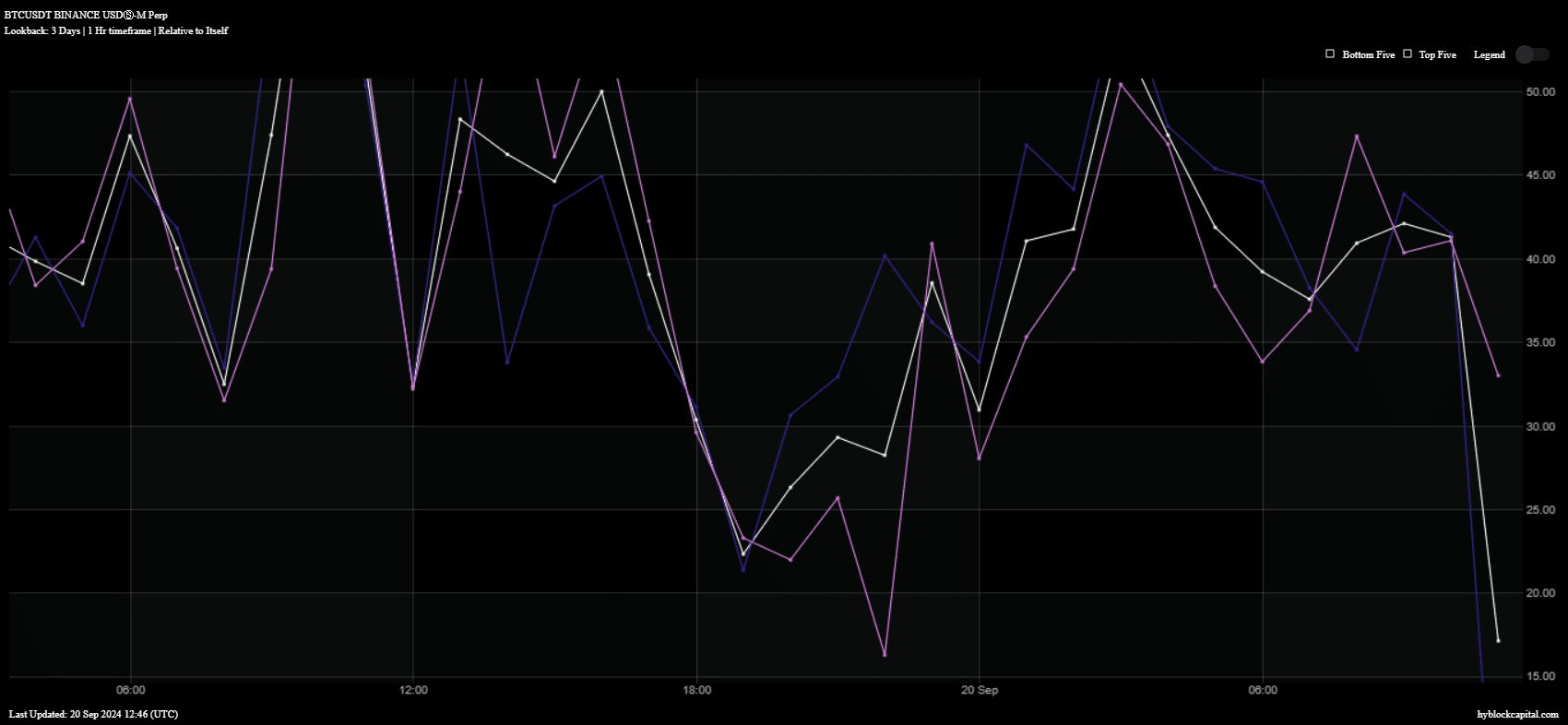

In the past 24 hours, there has been a significant decrease in bullish bets (net longs) on Bitcoin, suggesting that traders are less optimistic about its short-term price increase prospects.

HyblockCapital

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Even though both net shorts and net longs demonstrated a slight decrease, the former remained comparatively high. This pattern might suggest some hesitation or ambiguity about an impending market correction.

Those who own Bitcoins might interpret the current surge as an indication that a significant, long-term bull market is about to commence. Such a belief could lead them to transition from short-term swing trading to a long-holding (HODL) approach.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-09-21 13:11