-

XRP’s supply was tightening as large holders accumulate and ODL transactions increase.

Falling exchange reserves and bullish sentiment suggest potential for a price rally.

As a seasoned crypto investor with over a decade of market experience under my belt, I must say the recent developments surrounding XRP have caught my attention. The tightening supply due to whale accumulation and increasing ODL transactions suggests that we might be on the cusp of a price rally.

The amount of XRP circulating appears to be decreasing, with a large portion being channeled through Ripple‘s On-Demand Liquidity (ODL) pathways.

Concurrently, significant investors, often referred to as “whales,” are persistently amassing XRP, leading to a swift concentration of this cryptocurrency among institutional holders.

The buildup (of this) is reducing the amount that can be bought by regular investors, causing a sense of immediacy among those eager to invest in the market.

With fewer opportunities for retail involvement, an essential query arises: could this shortage boost XRP prices, or might it instead trigger price instability in the market?

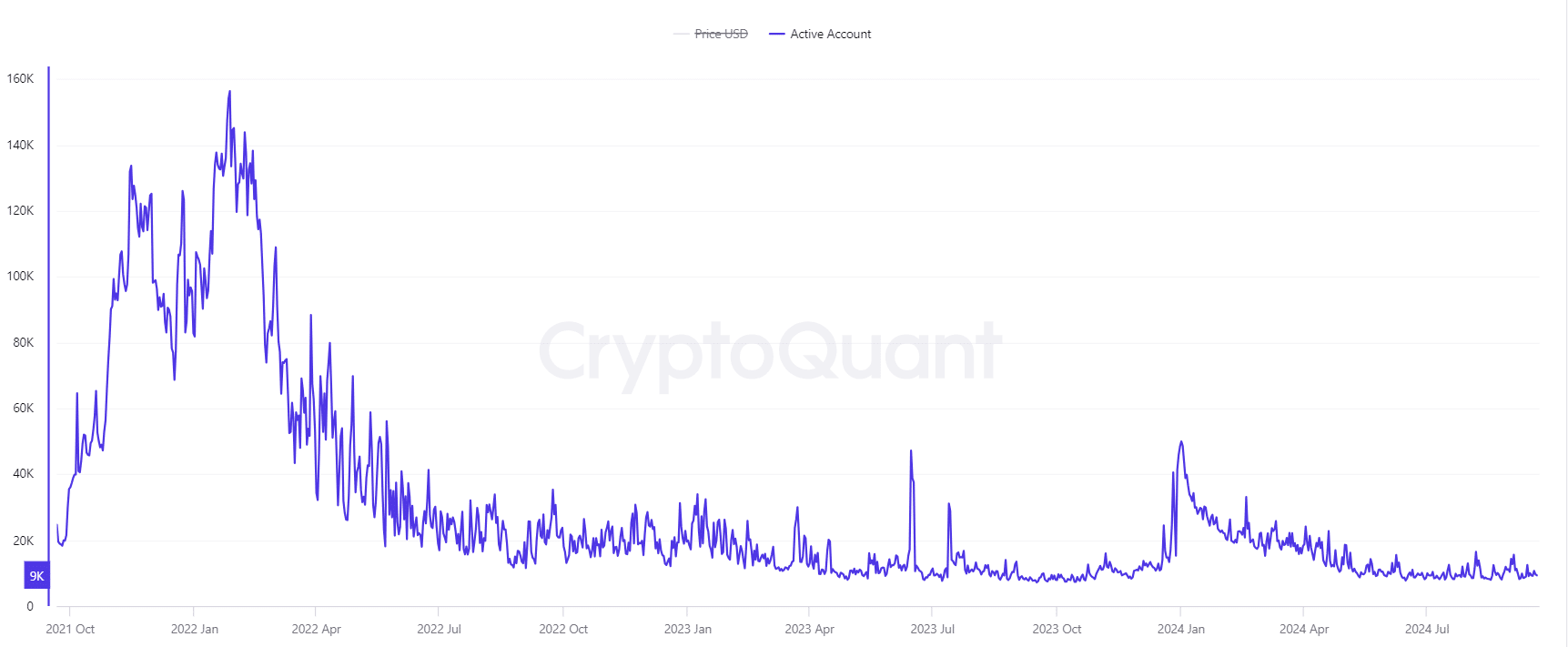

Are active addresses and transactions increasing?

The XRP network is exhibiting increased levels of usage, with a 0.97% rise in active addresses at the current moment, bringing the total to approximately 9,339.

Furthermore, it’s worth noting that the number of transactions is also climbing, showing a growth of approximately 0.98%, resulting in a total of about 1.6345 million transactions as per the data from CryptoQuant.

This increase suggests more people are getting involved and there’s a higher number of transactions taking place, which seems to show that major investors (whales) are transferring large amounts of XRP quickly. As transaction and account activity rise, the market appears to be preparing for a potential price increase due to an influx in supply.

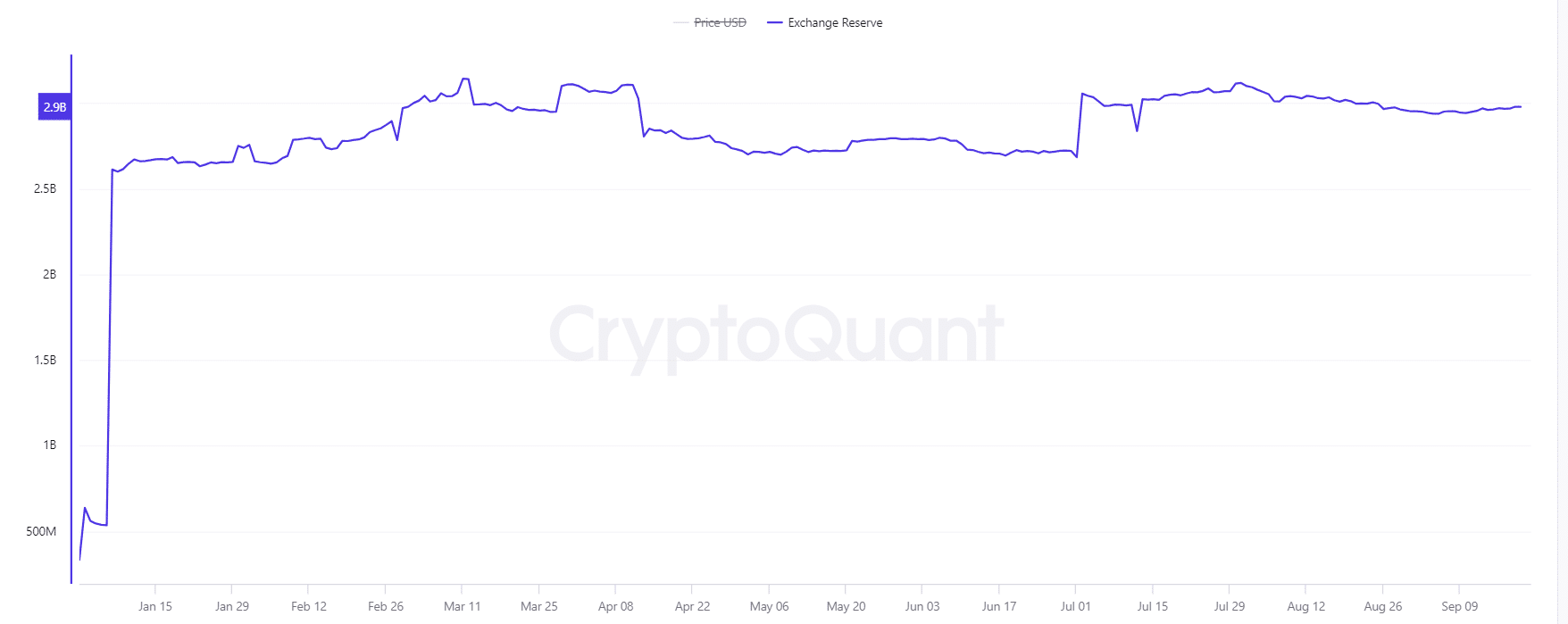

How is XRP exchange supply shaping market sentiment?

The amount of XRP held in exchanges for immediate trading is decreasing, with a weekly drop of 0.26%. This reduction usually indicates growing demand and less XRP available for trade, potentially causing an increase in price due to scarcity.

In the retail trading world, competition is intensifying due to larger investors continuously buying up available resources.

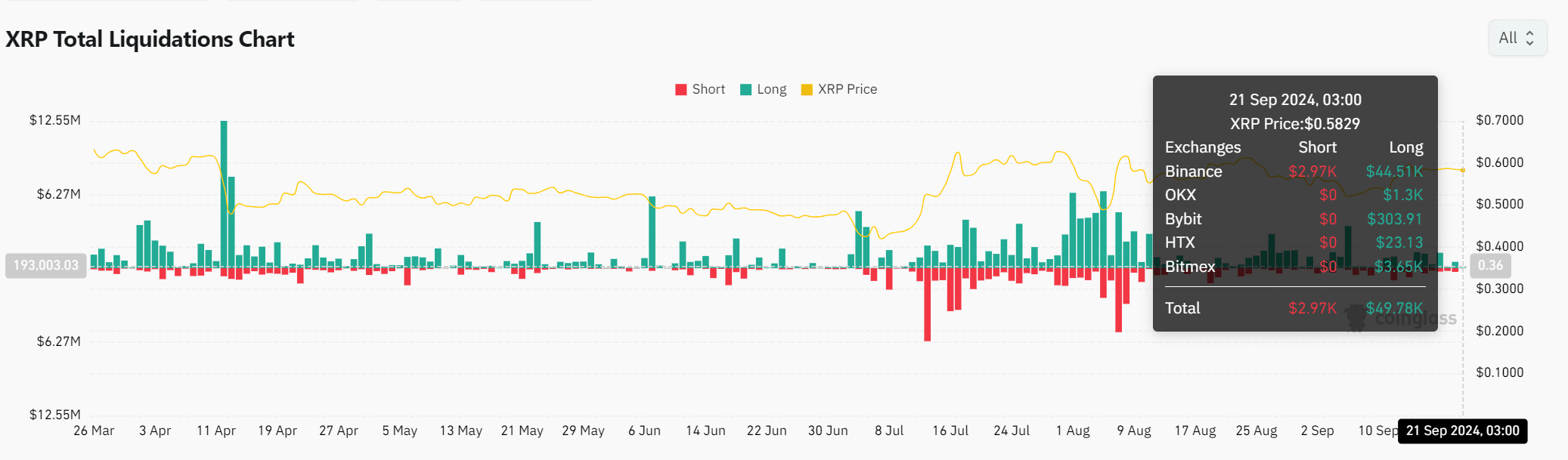

What does XRP’s liquidation data reveal?

The data on XRP‘s liquidation suggests the possibility of a scarcity in supply. On September 21, 2024, long liquidations amounted to approximately $49,780, vastly overshadowing short liquidations at around $2,970. This trend indicates that traders are predominantly optimistic about the price increase, as they’re heavily wagering on it.

As a researcher examining XRP‘s market dynamics, I have observed that its price may undergo significant swings due to a dwindling supply and an increasing number of long positions being held by investors.

Read XRP’s Price Prediction 2024–2025

Will scarcity drive XRP prices higher?

The fast hoarding of XRP by large investors (whales) and its growing adoption in On-Demand Liquidity (ODL) paths is making it harder for individual investors to acquire tokens. As the number of active addresses and transactions increases, while exchange supply decreases, the market situation seems to be favorable for a possible price spike.

On the other hand, the limited supply of XRP might lead to price fluctuations, underscoring the importance of quick action by individual investors.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-21 23:03