- The Ethereum weekly close above $2,496 would be an encouraging sight.

- The long-term downtrend meant a price recovery could be delayed by holders seeking to exit at break-even.

As a seasoned researcher with years of experience tracking cryptocurrency markets, I find myself constantly analyzing various metrics to gain insights into the direction and potential of different digital assets. When it comes to Ethereum [ETH], my perspective is somewhat nuanced.

Ethereum (ETH) surpassed $2,500, yet the declining trend over the last two months persists. Important levels of interest on extended timeframes are at $1,949 and $2,496.

According to an analysis by CryptoQuant’s Burak Kesmeci, a weekly closure surpassing the $2,496 mark would be favorable for Ethereum bulls, as the chart lines were derived from Ethereum’s price drop from $4,807 to $1,067 that started in November 2021, indicating a downward trend.

The TD Sequential indicated a buy signal for Ethereum (ETH), but while AMBCrypto examined other statistics related to Ethereum, not all of these indicators were overly optimistic.

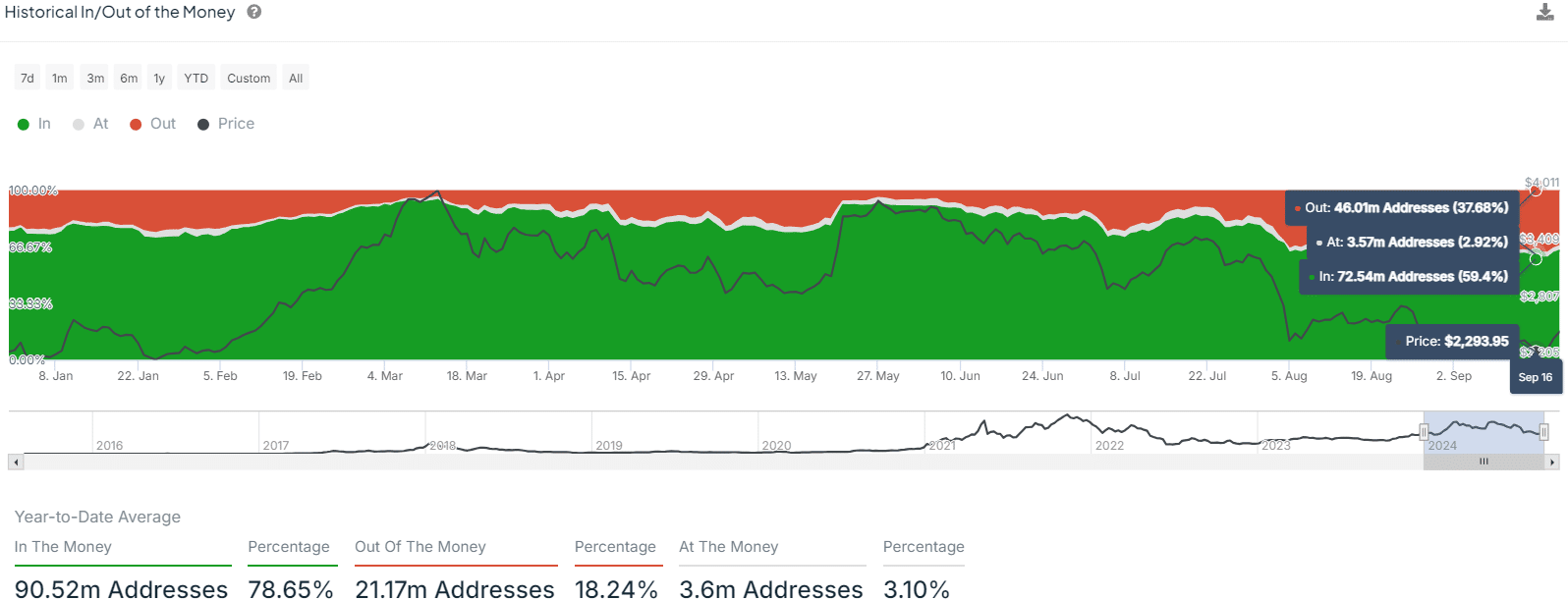

Historical in/out of the money lowest in 2024

On September 16th, 2024, the data regarding whether a wallet was “in the money” or not hit its lowest point. At that time, roughly 59.4% of all wallets fell into the category of being “in the money.” However, by the 20th of September, this percentage increased to 64.4%.

2024 saw the smallest proportion of funds held at these addresses during that year. Just over two weeks ago, Ethereum (ETH) was being traded at approximately $2,300.

At the beginning of the year, Ethereum [ETH] was trading at around $2,250. This suggests that its growth throughout the year has been minimal, particularly when contrasted with Bitcoin [BTC].

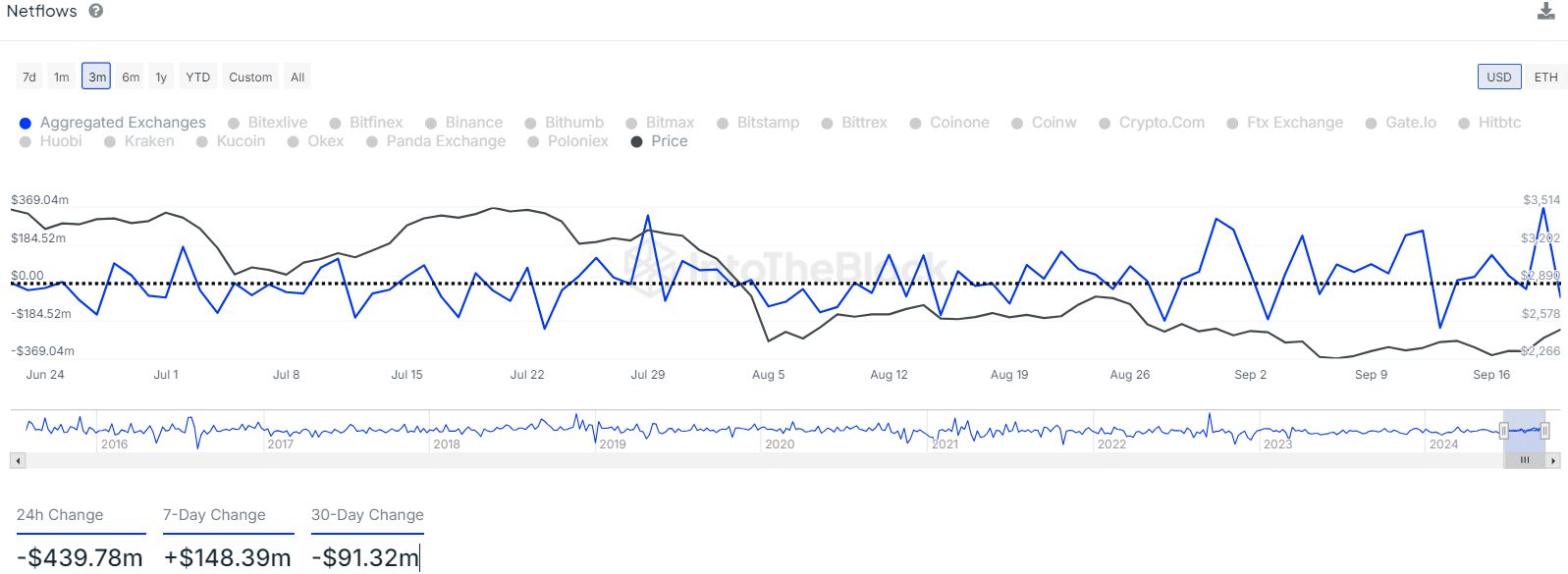

Over the last 24 hours, there was a $439 million withdrawal of Ethereum from exchanges, as indicated by the netflow metric. However, the 7-day and 30-day trends showed more moderate changes, suggesting that the flow of Ethereum in and out of exchanges has been fluctuating.

Generally speaking, there’s a steady buildup happening, albeit at a gradual pace. Investors are eagerly anticipating a significant surge in demand during Q4 of 2024.

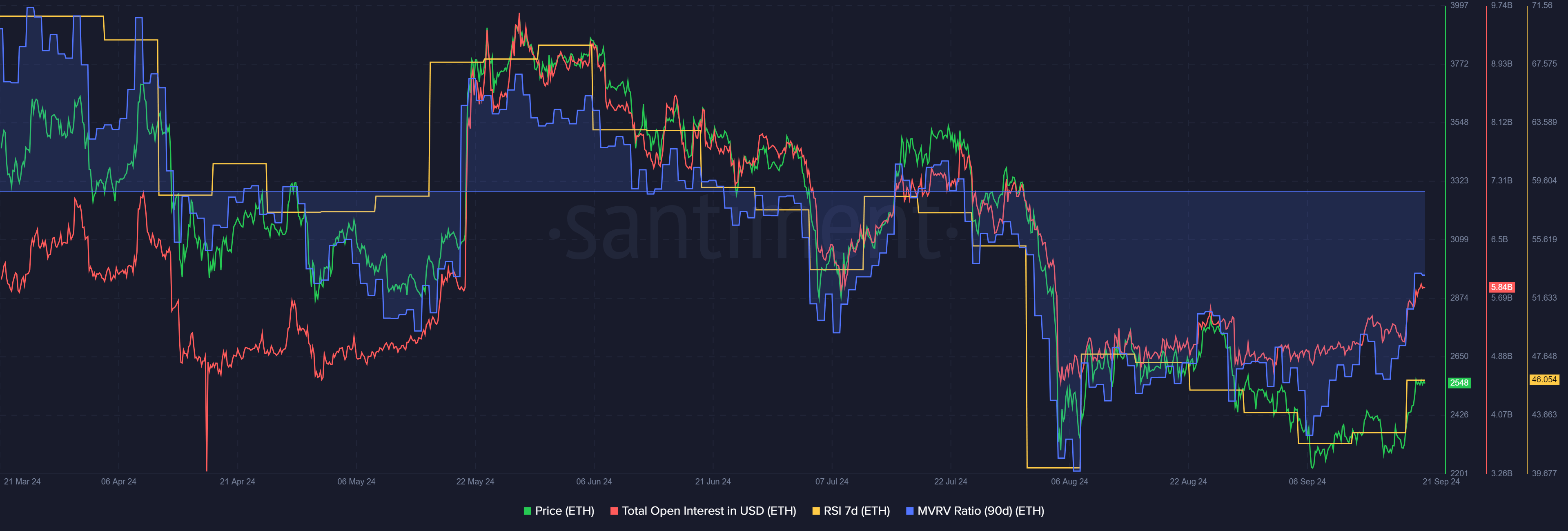

Gauging momentum and ETH holder sentiment

As a crypto investor, I found myself grappling with significant losses over the past three months, as the MVRV (3-month holder’s value to market value ratio) stood at a steep -8.45% on September 21st. This was a challenging period, especially after the sharp downtrend in June that took many of us by surprise, pushing the metric down to a staggering -27.98% on August 7th.

Read Ethereum’s [ETH] Price Prediction 2024-25

This suggests that it might be challenging for Ethereum to experience quick price increases because some of its owners might choose to sell the asset during a surge, aiming to exit at the same cost they bought in.

Over the last month, Open Interest has been consistently rising, indicating a surge in speculative trading activities. Meanwhile, the 7-day Relative Strength Index (RSI) stood at 46, suggesting that the weekly trend was bearish but poised to potentially turn bullish soon.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-09-22 05:11