- Aave outperforms Bitcoin but faces key resistance.

- The protocol’s fundamentals are looking good.

As a seasoned analyst who has weathered countless market cycles and navigated through the complexities of decentralized finance, I find myself quite optimistic about Aave’s current trajectory. While it’s true that the revenue models of DeFi blue chips are under scrutiny, Aave continues to outperform Bitcoin, a testament to its resilience and robustness.

Despite some uncertainties about the income structures of top-tier DeFi coins, Aave [AAVE] persists as a front-runner in the cryptocurrency sector.

In simpler terms, some experts propose that we should reassess the criteria for defining income and expenditure within decentralized networks, as these systems function differently compared to conventional businesses.

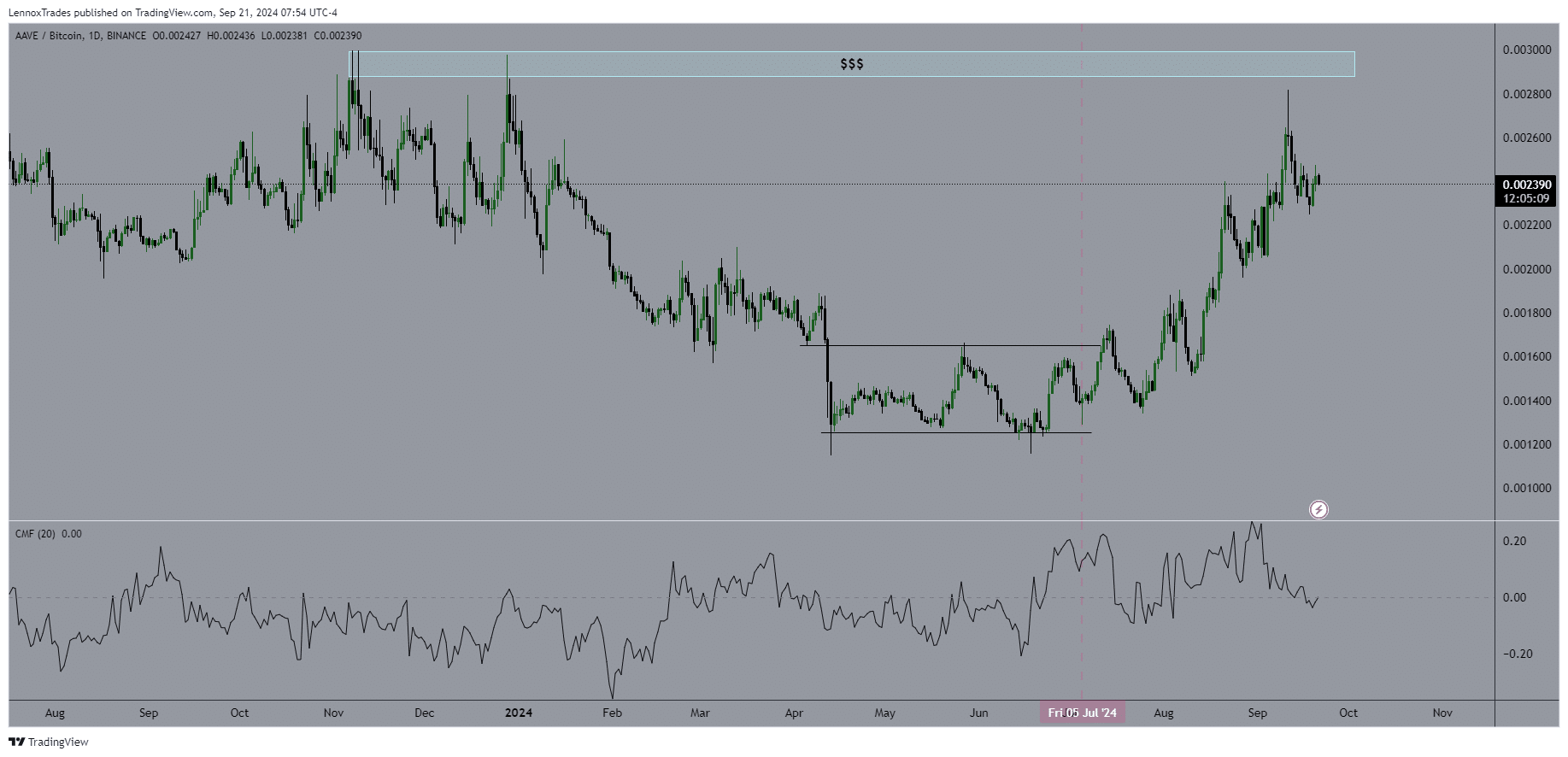

Despite maintaining an 800-day price range, the AAVE/USDT pair has unexpectedly surged recently, moving upward for the last two months and performing better than Bitcoin [BTC] within that timeframe.

Starting from June 18th, I’ve observed that the AAVE/BTC pair has been exhibiting higher peaks and troughs. However, it encountered significant resistance around the 0.003 BTC level, which led to a rejection. This rebuff, coupled with Bitcoin’s recent fluctuations, seems to have momentarily stalled the upward trajectory of the AAVE/BTC pair.

Aave’s growth trajectory is likely to persist given its robust foundations, but its correlation with Bitcoin could face challenges in the short term.

Moreover, the Chaikin Money Flow (CMF) suggests that traders are cashing out, resulting in capital leaving the AAVE/BTC exchange.

Nevertheless, its overall trend continues to be optimistic, particularly when compared to stablecoins. Analysts predict that it will outshine these stablecoins during the fourth quarter, with both AAVE and Bitcoin potentially experiencing significant growth.

This could be the start of a reversal of Aave’s BTC pair but is yet to be confirmed since…

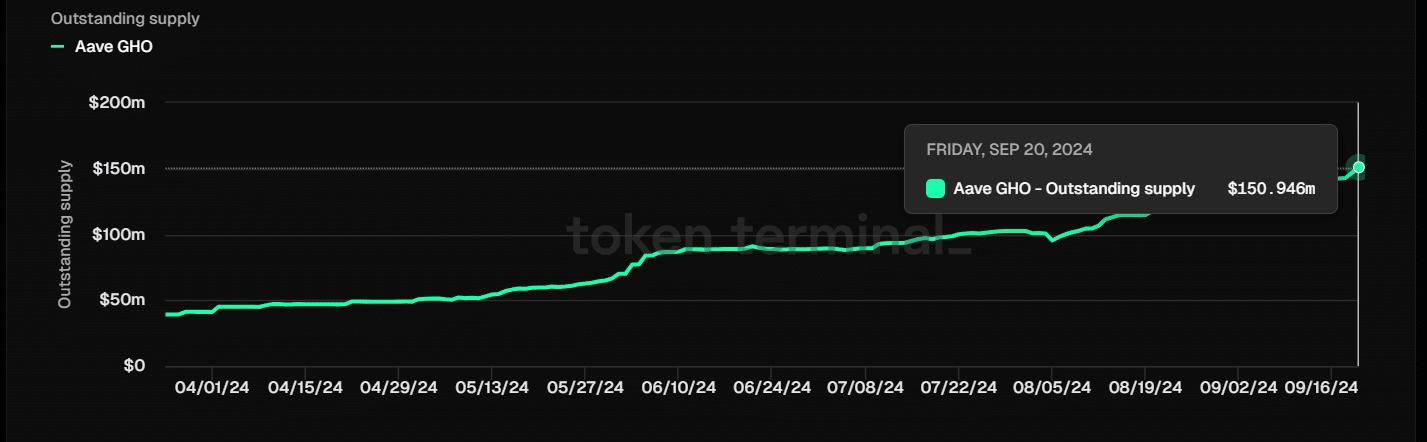

Aave’s stablecoin surpassed $150 million

One important factor driving Aave’s bullish momentum is its stablecoin, GHO. GHO has seen steady growth since its launch during a bear market, alongside Curve’s stablecoin (CRV).

By the early days of September 2024, the supply of GHO saw an uptick exceeding 6.7%, marking a significant achievement as it surpassed the milestone of over $150 million in total supply.

Although GHO boasts a smaller circulating supply compared to CRV, there’s potential for both digital currencies to experience substantial expansion.

With GHO’s ongoing expansion, it bolsters the overall resilience of the Aave network and enhances its prospects for sustainable development over time.

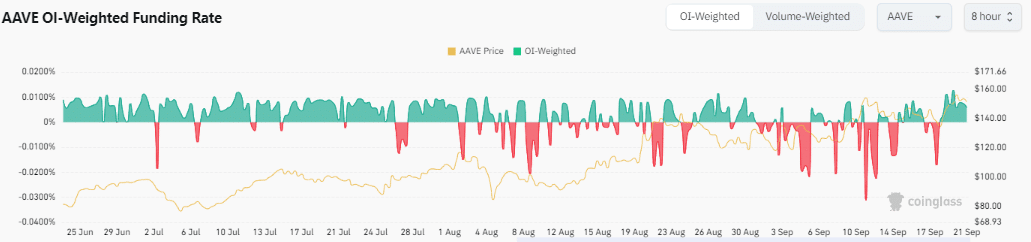

Positive OI-weighted funding rates

Furthermore, the OI-based funding rates show a positive outlook. At present, the rate is 0.0058%, suggesting that those who have taken long positions are compensating short sellers.

This indication points towards robust interest among buyers for Aave, which is consistent with its favorable price prediction. The increasing interest indicates that traders are confident that Aave’s price will escalate in the coming days.

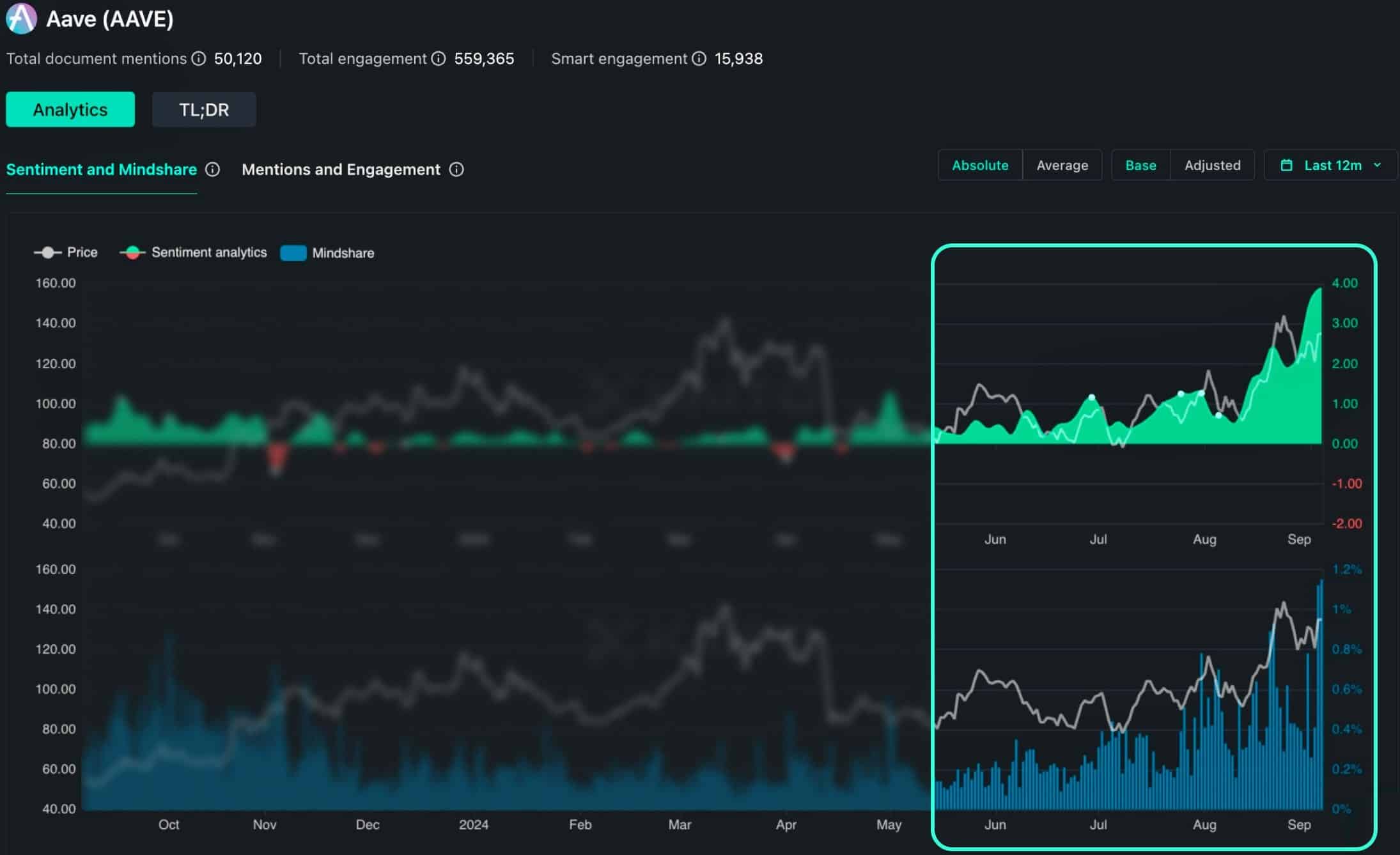

Sentiment & mindshare on the rise

To conclude, the public perception towards Aave is overwhelmingly optimistic as well. Evidence from the Kaito AI platform suggests an unprecedented level of positive sentiment associated with Aave.

Read Aave’s [AAVE] Price Prediction 2024–2025

As a researcher examining the horizon of Aave’s development, I see promising elements such as Trump integration, share buybacks, and the strategic Sky partnership that position Aave for continued expansion.

The general forecast for Aave looks robust, particularly compared to stablecoins, suggesting an increase in its value. It’s expected to maintain its strong performance within the DeFi sector, with potential price hikes on the horizon.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-09-22 14:16