-

AAVE broke above a 2-year price range and could eye $200.

AAVE has outperformed its lending sector rivals and top DeFi blue chip tokens.

As a seasoned analyst with years of experience navigating the cryptocurrency market, I find myself impressed by Aave [AAVE]’s recent performance. Breaking above a 2-year price range and outperforming its lending sector rivals is no small feat, especially in today’s volatile market.

Despite the challenges faced by many other assets due to the turbulent market conditions at the beginning of the second half of 2024, Aave [AAVE] has managed to stand out, even surpassing some of its peers and showing remarkable resilience. In fact, it has performed slightly better than Bitcoin [BTC] when compared on a year-to-date basis.

BTC was up 42%, while AAVE YTD returns stood at 46% at press time.

Arthur Cheong, the creator of cryptocurrency venture capital firm DeFiance Capital, anticipates that the DeFi token will regain its previous record high following a breakthrough in price range.

Currently, $AAVE is reaching its peak price point since last May (2022) and appears to be escaping a two-year period of price stability. With this breakout, it’s likely that we will see an all-time high (ATH) reclaimed once more, which could further strengthen the resurgence of DeFi.

AAVE is bullish on the outlook

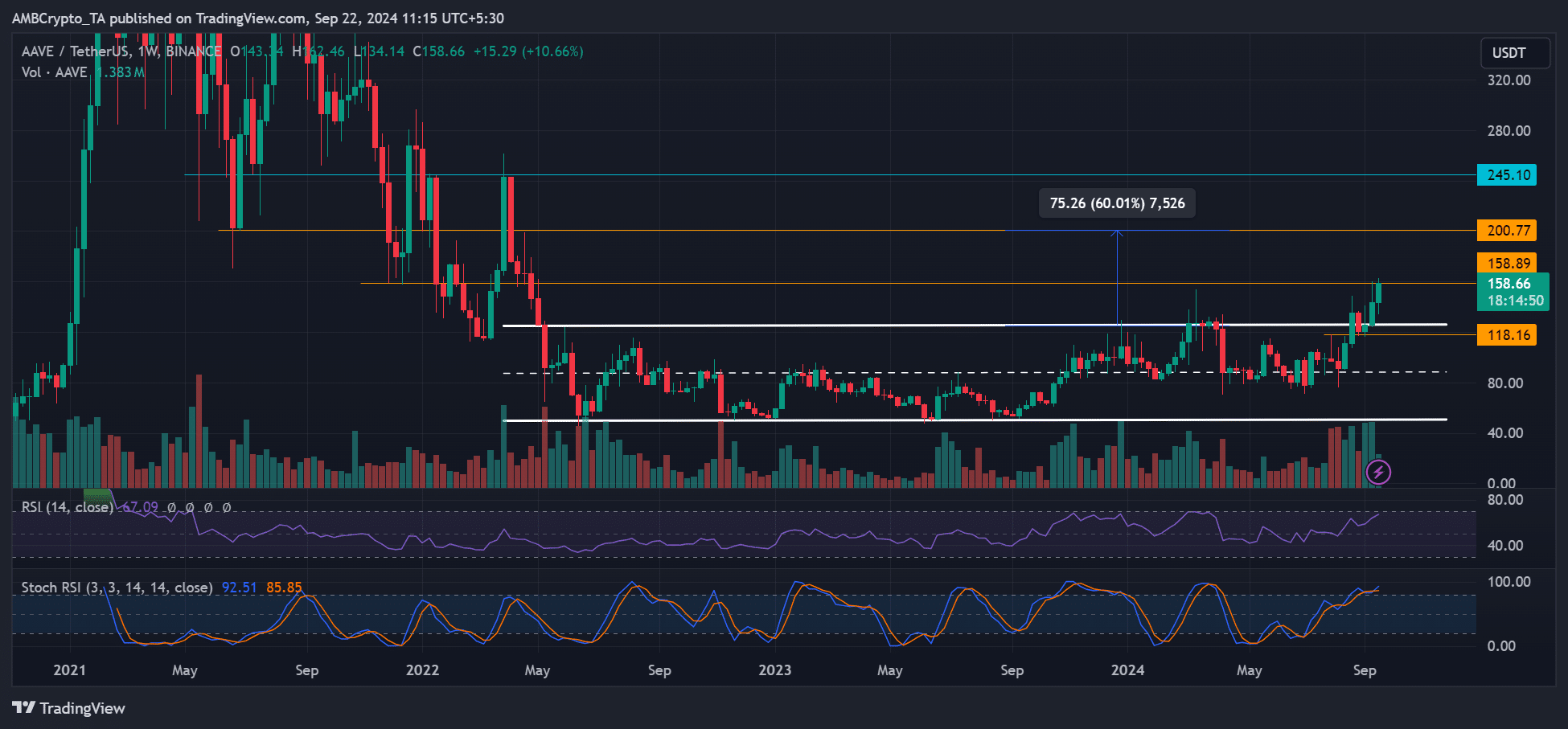

Starting in 2020, AAVE made its entrance and reached a record high ($668) during the most intense phase of the previous bull market in 2021. The recent surge beyond its two-year price range might propel this altcoin to approximately $200 over the intermediate timeframe.

Currently, when I’m writing this, the value of altcoin stands at approximately $158. This implies a possible 26% increase in its value could occur if AAVE recovers and reaches $200.

Regardless of the ‘overbought’ signals shown on technical charts, the renewed era of Decentralized Finance (DeFi) as discussed by Cheong is accelerating.

A recent Bernstein report highlighted a resurgence of the DeFi space and declining US bank rates as a positive catalyst for DeFi yield demand.

The analysis specifically highlights AAVE‘s robust prospects for growth and sound underlying values, suggesting it is well-positioned to capitalize on anticipated demand.

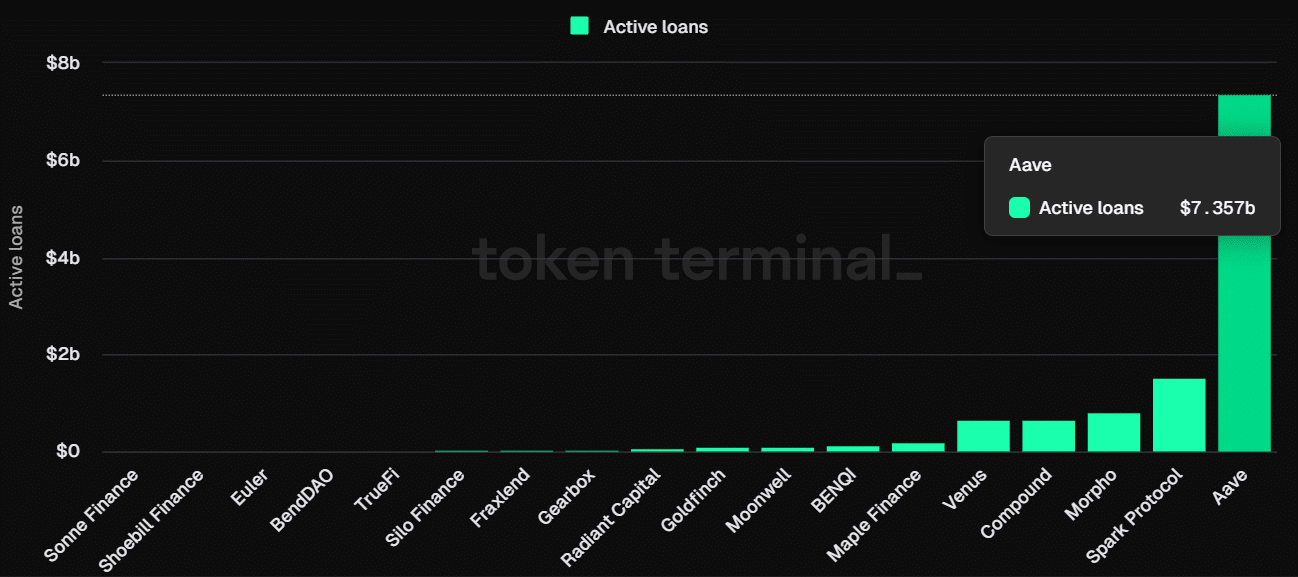

In the lending industry, AAVE led with the highest number of active loans, totaling approximately $7.35 billion, while Maker’s [MKR] Spark Protocol ranked second.

In early 2024, this figure had nearly doubled the initial $3.4 billion loan. This significant expansion highlighted the protocol’s progress, and the impressive performance was clearly demonstrated in the price graphs as well.

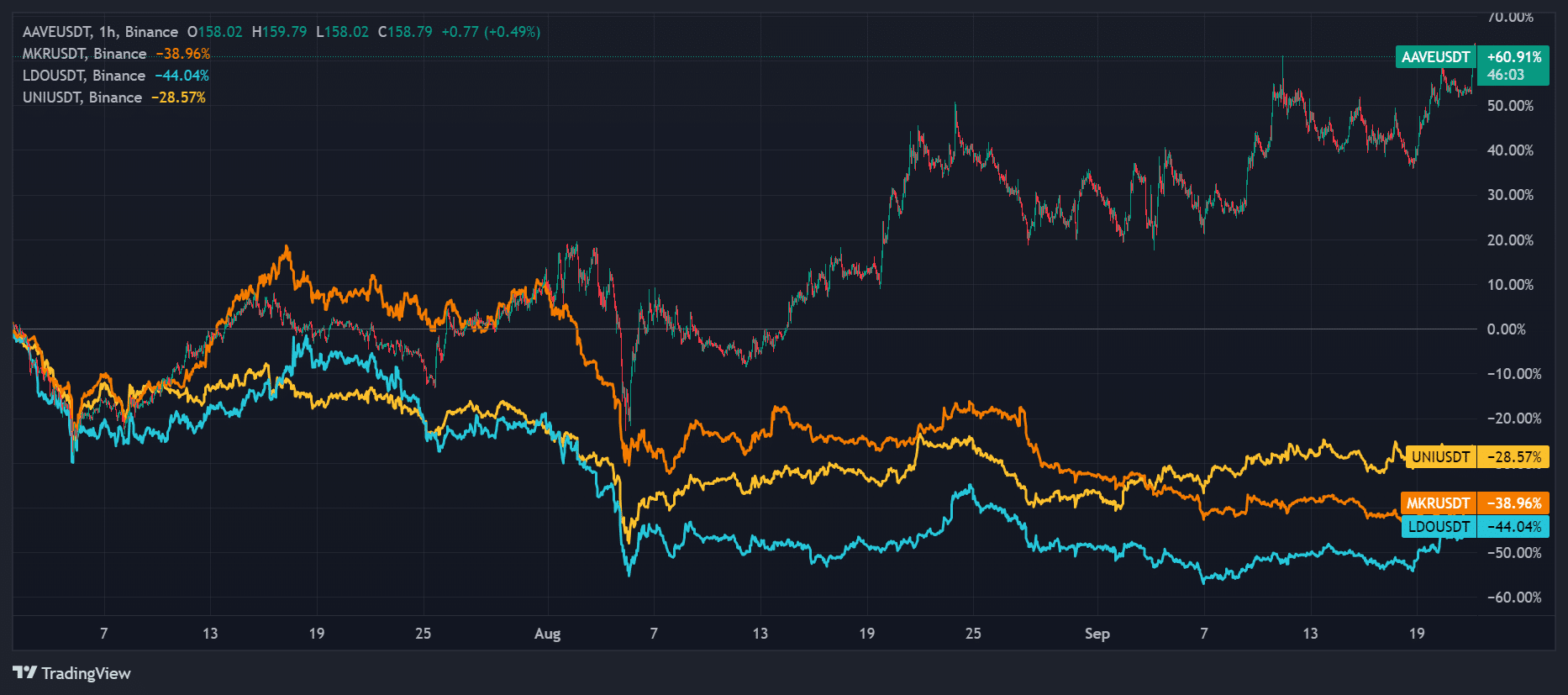

In the third quarter so far, Aave has experienced a 60% increase, whereas other lending sector players and leading DeFi token heavyweights have seen decreases.

Over the given timeframe, Maker (MKR) and Uniswap’s UNI token dropped by 38% and 28% respectively. However, it was Lido [LDO] that saw the most significant dip, with a 44% decrease in value during the same duration.

Notably, following the early August market downturn, AAVE appears to have separated itself from other assets. According to Messari research analyst Kinji Steimetz, this superior performance of AAVE can be attributed to a recent proposal for a change in protocol fees and a decrease in the excess supply.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-09-22 15:03