- Bitcoin could create a new all-time high in Q4 with a rally driven by multiple catalysts.

- However, profit-taking activities might continue to stifle the short-term rally.

As a seasoned analyst with over two decades of market experience under my belt, I find myself cautiously optimistic about Bitcoin’s potential to reach new highs in Q4. The political landscape, distribution of FTX credits, and MicroStrategy’s continued funding for Bitcoin purchases all serve as compelling catalysts that could fuel a bull run. However, it is essential to keep an eye on the broader macro factors and on-chain data to confirm a sustainable rally.

At the moment of reporting, Bitcoin (BTC) was trading at approximately $63,663, marking an 8% increase over the past week. With the final quarter of the year approaching, there’s much chatter that this leading cryptocurrency might be headed towards a fresh record high.

10x Research highlighted three crucial elements in their latest report, suggesting that Bitcoin might exceed $73,000 within the upcoming months.

On November 5th, we have the upcoming U.S. presidential elections. This significant political occurrence could potentially spark optimism in the financial markets. Additionally, the report indicates that distributions to FTX creditors might also trigger Bitcoin’s surge. This is because these payouts will line up with a growing market trend, as stated in the report.

Creditors associated with FTX are projected to disburse approximately $16 billion to customers over a period spanning from December 2024 to March 2025. Given this anticipated distribution, it’s likely that the market may move ahead of this expectation, potentially returning $5-8 billion back into the crypto market.

3rd Point: MicroStrategy recently secured additional funding, which they plan to use for buying more Bitcoin. This increase in available funds might lead to a significant rise in the demand for Bitcoin.

But despite the rumors, do larger market trends and on-chain statistics appear to be lining up to suggest a rising trend?

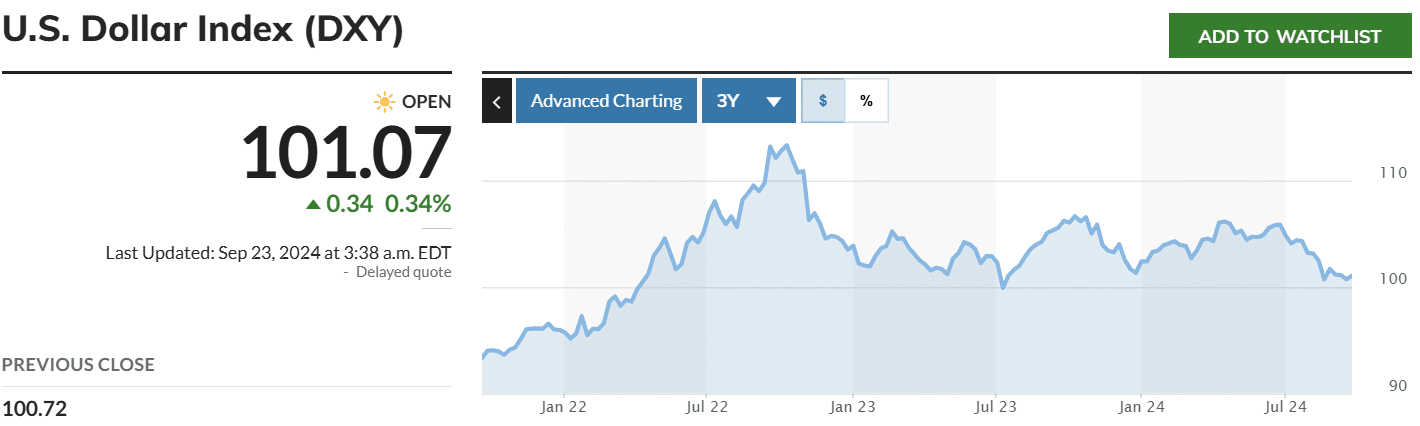

The dollar index is at range lows

Over the past few days, the U.S. Dollar Index (DXY) has shown a noticeable decline in its value. As of now, it’s hovering around 101, and it has been fluctuating between the levels of $100 and $101 since August.

The DXY measures the strength of the US dollar against other top global currencies. A decline in this index signals a weakening dollar, which in turn stirs positive sentiment around Bitcoin.

Historically speaking, when the DXY (US Dollar Index) weakens, Bitcoin tends to increase in value. Therefore, should the DXY drop below 100, Bitcoin might appear more appealing as a protective asset against inflation.

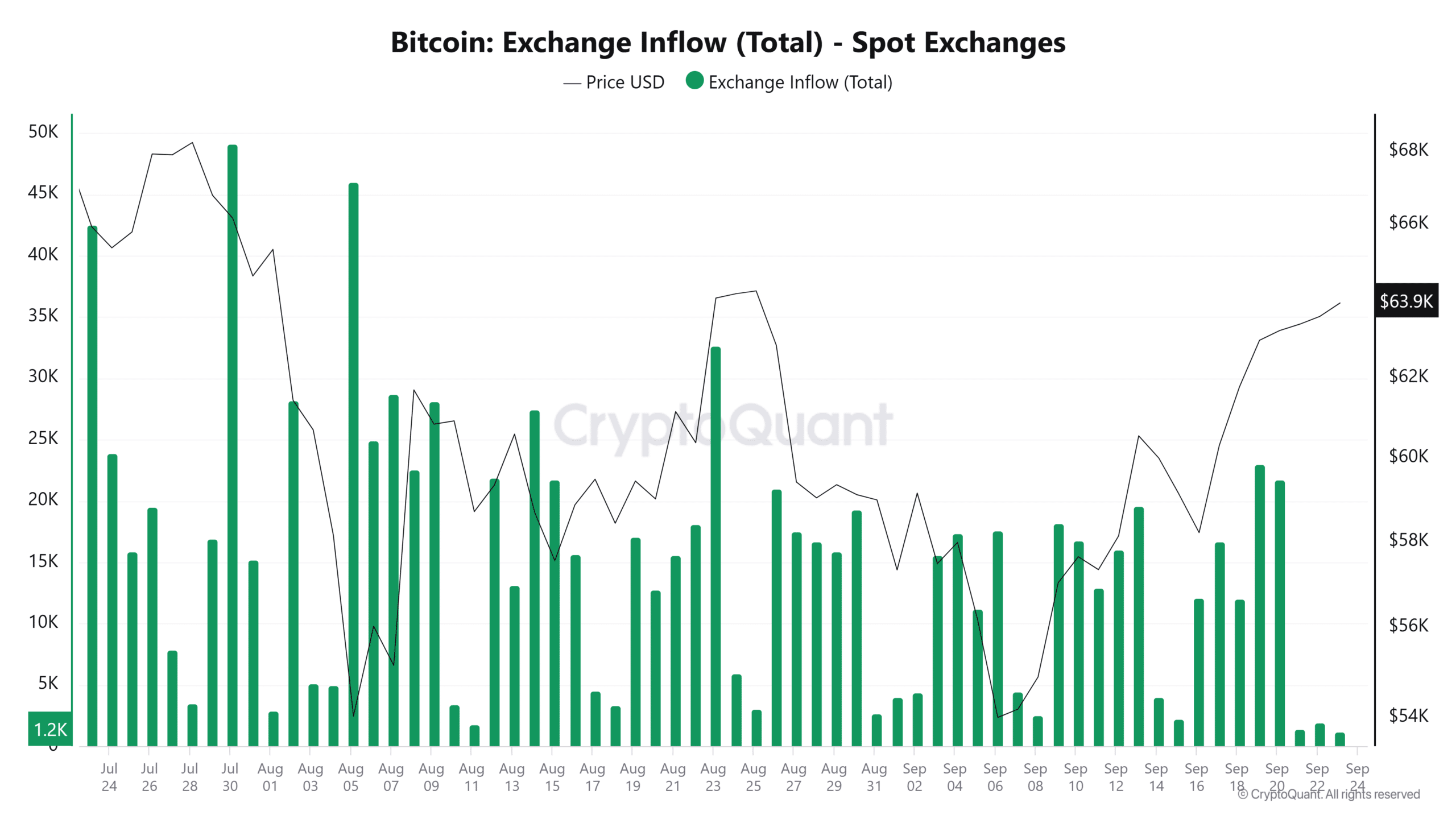

Bitcoin exchange inflows

Data from CryptoQuant shows that Bitcoin exchange inflows remained subdued over the weekend after a period of intense profit-taking.

This decrease indicates that traders might be growing more optimistic about Bitcoin’s upward trend and its potential to maintain prices above $60,000.

Keep in mind that weekdays usually see higher trading volumes compared to weekends. To verify if trading activity is decreasing due to profit-taking, it would be beneficial for traders to observe changes in the flow of data throughout the week.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

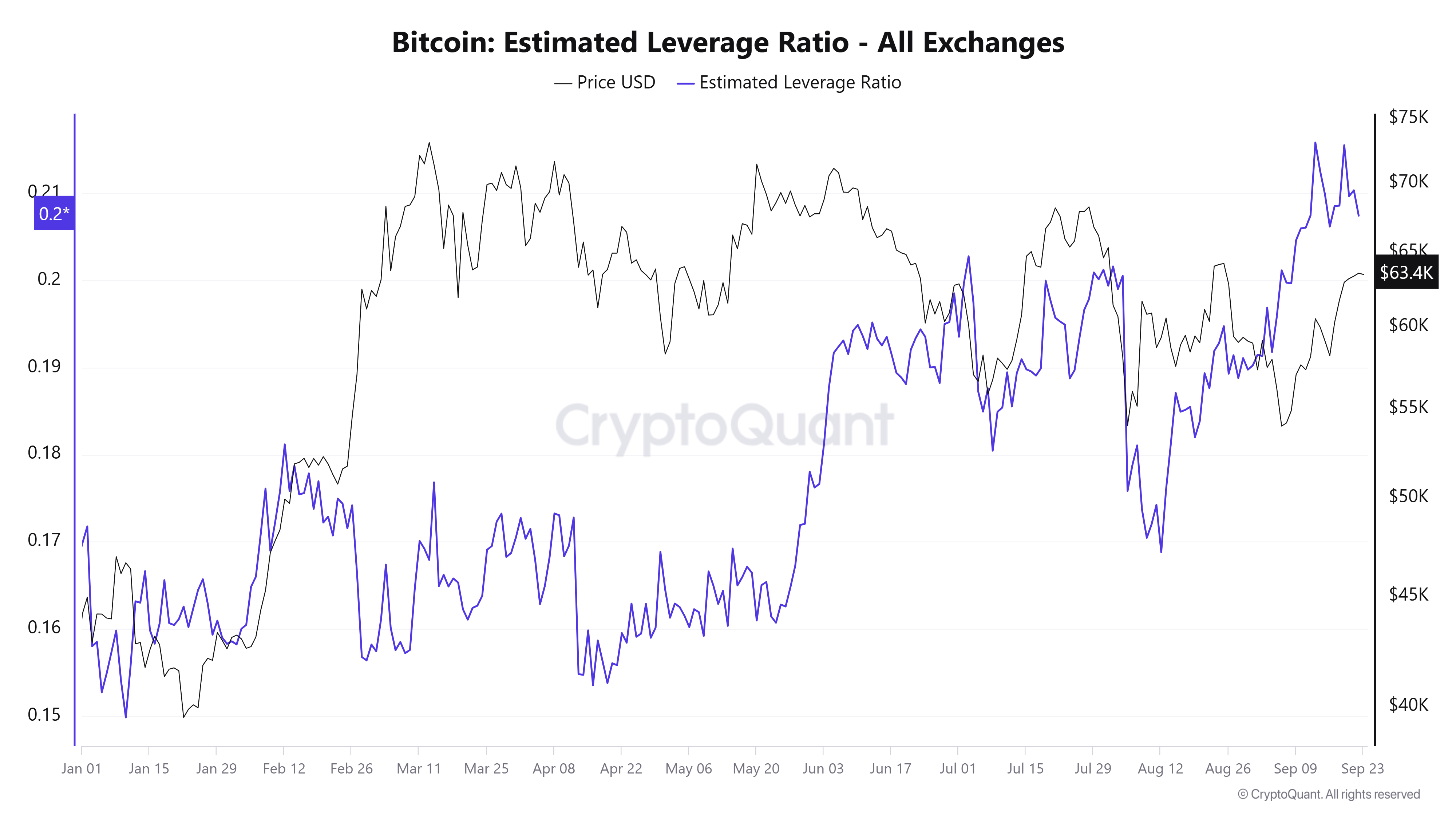

Moreover, the projected Bitcoin leverage rate has climbed significantly, reaching its peak so far this year.

An escalating level of borrowed capital used for Bitcoin trading (leverage ratio) often indicates increasing optimism among traders (bullish sentiment), as they expand their margin trades. Yet, an uptick in this measure might also signal approaching market turbulence (volatility).

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-23 16:08