-

ETH price surged by 14.5% over the last week.

Ethereum active addresses have hit 5 million over the past week as active buyers increased.

As an analyst with over a decade of experience in the crypto market, I find it fascinating to witness such rapid changes in Ethereum’s [ETH] price and activity. The surge by 14.5% over the last week is not just a blip on the radar but a significant move that has caught my attention.

After reaching its weekly low of $2,251 on September 16th, Ethereum [ETH] has been climbing steadily. At this moment, ETH is being exchanged at $2,641, which represents a 14.50% rise over the last seven days.

Prior to the uptick, Ethereum was on a downtrend trajectory over the past month.

Lately, there’s been a change in investor attitudes, leading experts to ponder if this upward trend signals a long-term recovery and what factors might be fueling its growth. Some analysts attribute the current rise to an influx of more active buyers in the market.

What market sentiment Says

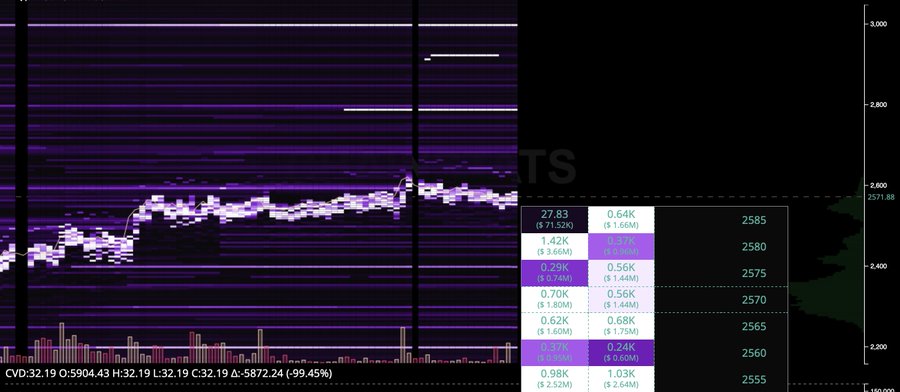

In their analysis, ChainStatsPro cited increased active buyers and spot limits bids.

Based on this comparison, it seems that sellers of ETH in the futures market continue to dominate as we look ahead, whereas the CVD remains unchanged. At the same time, offers and demands are building up at $2400 and $2790 respectively.

This implies that active investors are purchasing ETH at its current prices, indicating a rise in demand. Consequently, traders are strategically preparing to acquire ETH when its price drops to around $2400 and sell if it climbs up to $2790. These prearranged bids suggest an uptick in market action.

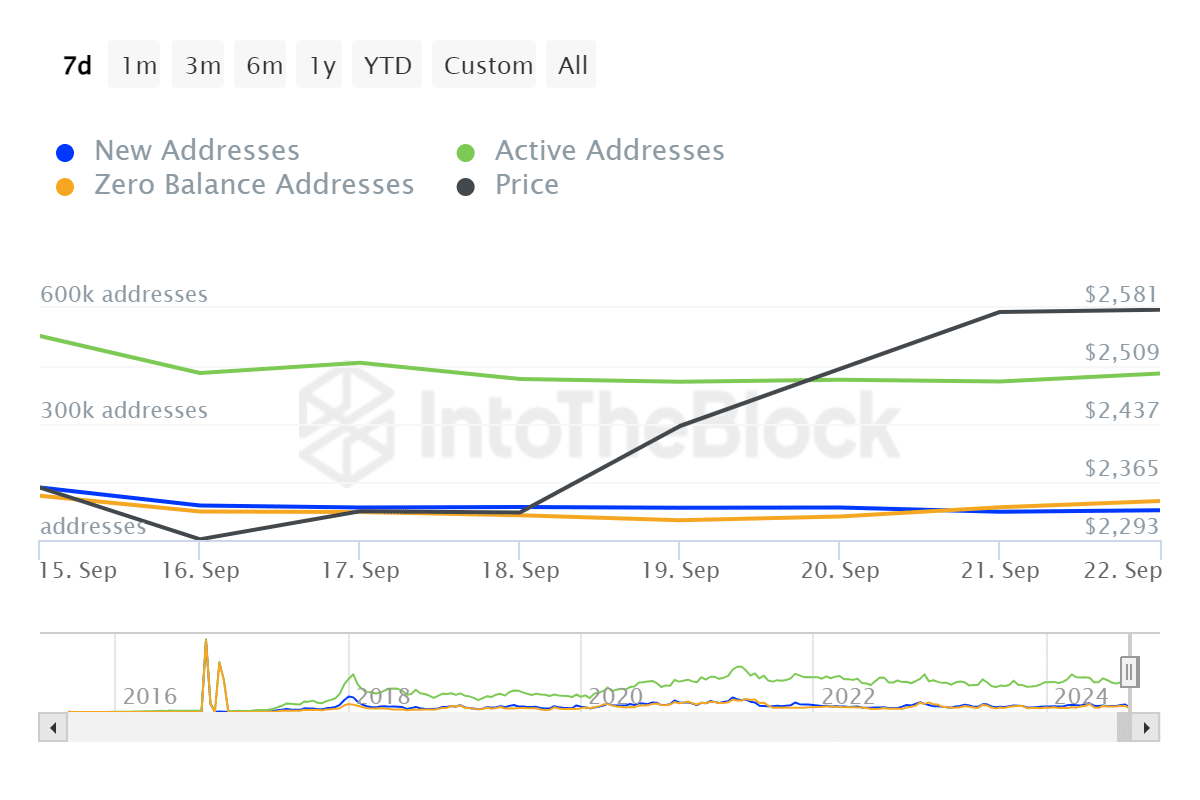

Examining more closely, we can see an upward trend in the number of active participants – both buyers and investors – who are placing limit orders in the market over the last week, as evidenced by the rise in the count of active wallets or addresses.

Over the past week, it’s been reported by IntoTheblock that there are now approximately 5 million active addresses on the network. This trend points towards an increase in transactions due to more users actively participating. Such an occurrence is often seen as a positive signal in the market because an uptick in active addresses tends to lead to higher prices, indicating a bullish market sentiment.

What ETH charts indicate…

According to ChainStatsPro, there’s been an increase in Ethereum transactions recently, which has led to a continuous rise in its value during the last seven days.

Initially, the surge in demand for purchasing Ethereum is being reinforced by a favorable Chaikin Money Flow (CMF), as of now. Specifically, Ethereum’s CMF stands at 0.28, signifying that investors are currently amassing the asset aggressively.

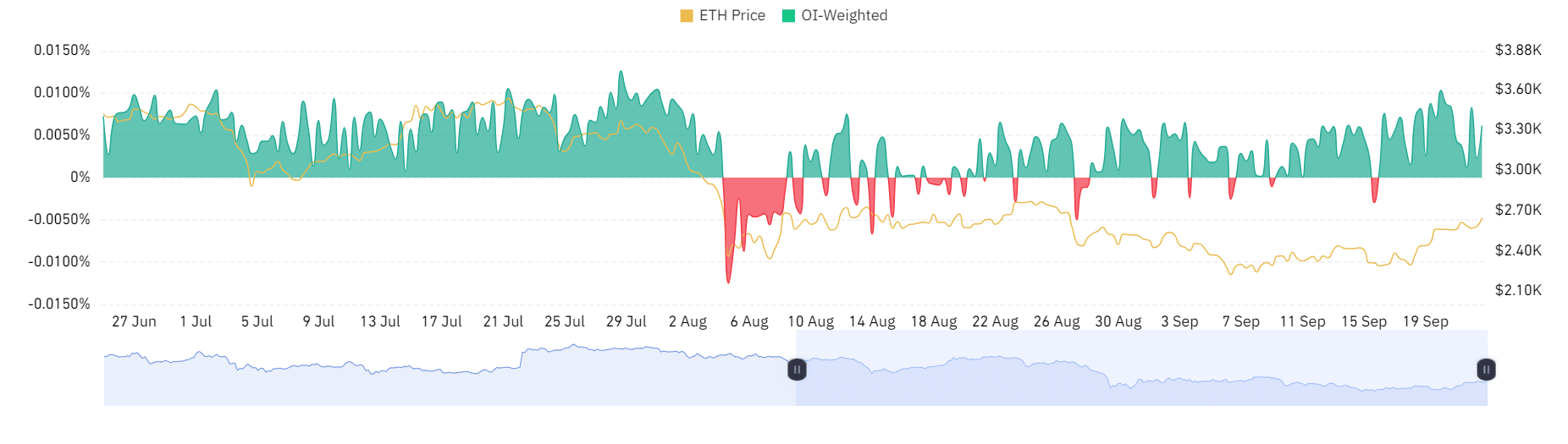

To sum up, the OI-weighted funding rate on Ethereum has remained positive during the last seven days. This positive rate suggests a higher demand for long positions, as those holding long positions are currently compensating those in short positions.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Consequently, according to ChainStatsPro’s observation, the number of active Ethereum (ETH) buyers is rising. This optimistic market atmosphere suggests that ETH could potentially see more growth.

If the current conditions hold, ETH will attempt a $2800 resistance level in the short term.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-23 21:11