- Stacks has a short-term bullish outlook.

- Increased demand is necessary to break the token out of the three-month range formation.

As a seasoned researcher with years of experience navigating the dynamic landscape of cryptocurrencies, I find myself quite intrigued by Stacks [STX]. The recent bullish surge, propelled by a 22% increase since mid-September, is indeed captivating. However, the token seems to be stuck in a three-month range formation, with the $1.645 level acting as both support and resistance.

Over the past couple of weeks, there’s been a strong optimistic sentiment in the market, which has significantly boosted the value of STX tokens. Since hitting its low on September 16th, the token has experienced a surge, increasing by approximately 22%.

Beginning the second week of September, the price of Bitcoin [BTC] surged from approximately $54,000 to $64,500. This 20% increase in the world’s leading cryptocurrency has renewed optimistic feelings, even boosting the positive outlook for Stacks.

STX headed toward the range highs again

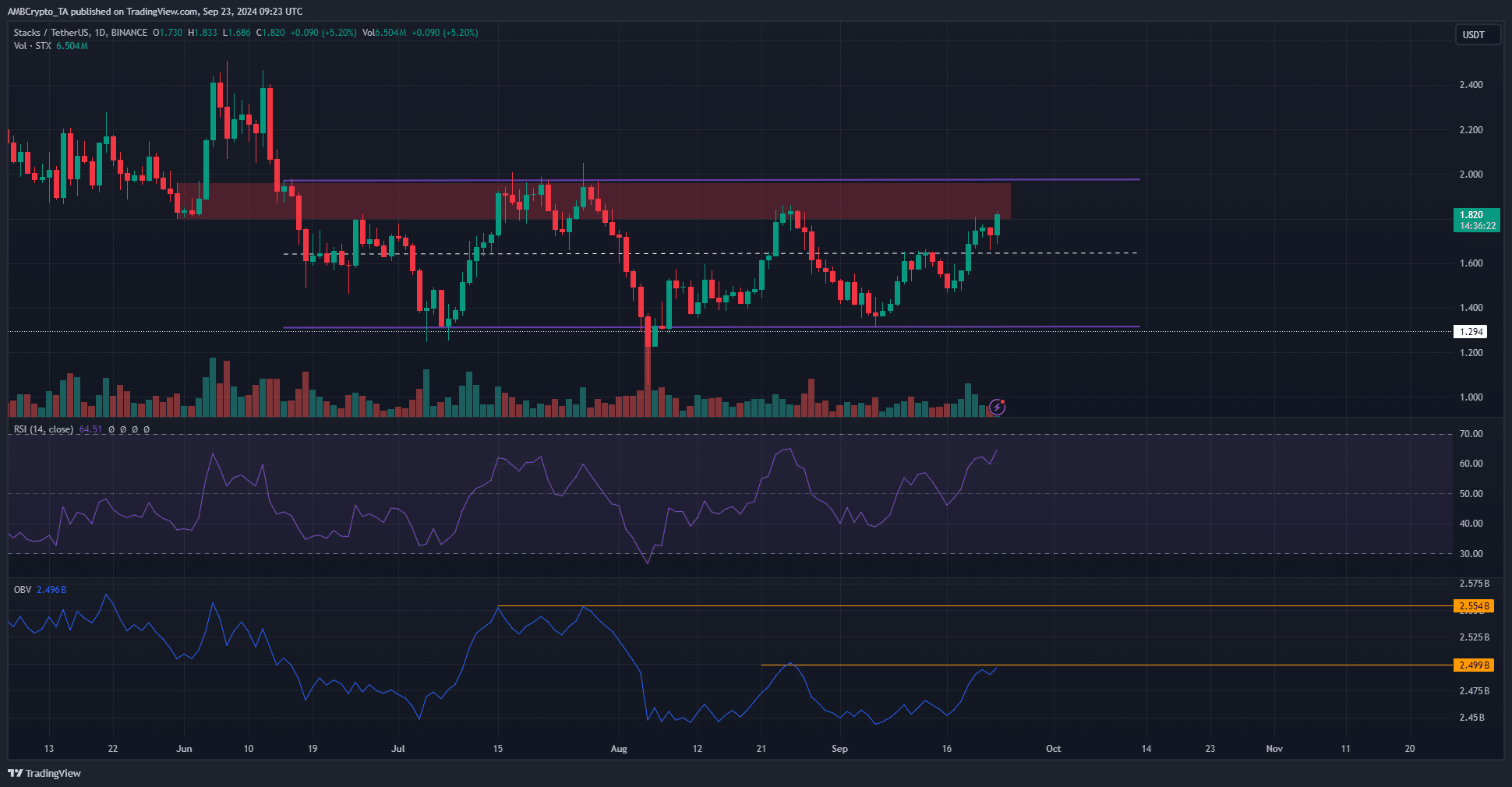

Over the last month and a half, or since early July, the value of Stacks has stayed within a specific band, with prices fluctuating between $1.32 and $1.97. During the previous three months, the midpoint at $1.645 has acted as both a support and resistance level for Stacks.

Previously in September, attempts by STX bulls to push the price beyond $1.645 met with resistance. However, the recent surge over the past week has turned that same resistance into a new support level.

Additionally, on the daily chart, there was a bearish pattern called a ‘bearish breaker block’ situated beneath the $2 level. This pattern significantly challenged any potential bullish advancement.

A retest of this resistance might not yield a breakout on this attempt either.

As a crypto investor, I noticed an optimistic daily Relative Strength Index (RSI), indicating a strong upward trend. Meanwhile, the On-Balance Volume (OBV) had reached a recent peak, serving as a formidable resistance level for the past month.

As an analyst, I noticed that while the buyers may have managed to breach certain levels, the On-Balance Volume (OBV) peaked locally in July and failed to exceed its historical range significantly.

Currently, a substantial increase in investment is required to drive Stack’s price above $2. Until such an inflow occurs, traders might find it beneficial to aim for the price extremes within the current range as potential target points.

Social sentiment witnessed a massive positive swing

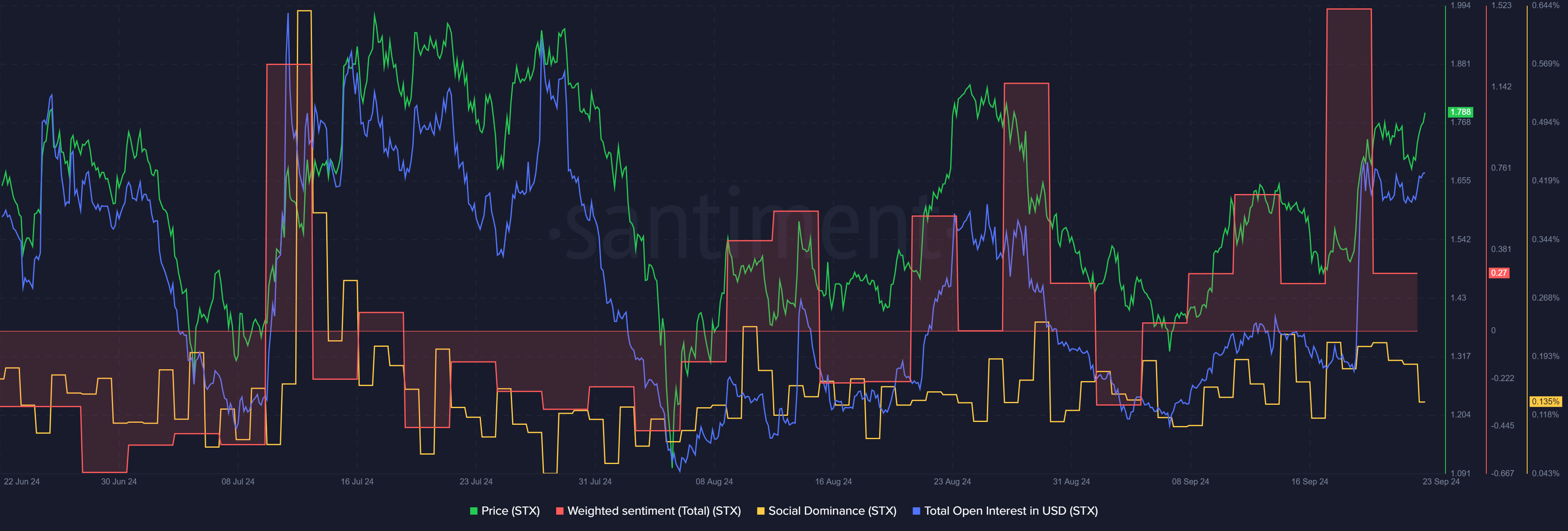

According to a study by AMBCrypto using data from Santiment, social media sentiment towards cryptocurrency has remained generally optimistic throughout September. However, the positivity peaked significantly last week, coinciding with the breakthrough of prices beyond the mid-level resistance.

Realistic or not, here’s STX’s market cap in BTC’s terms

It might be because the announcement of Stacks connecting to the Aptos network, which means Bitcoins can now be utilized within the Aptos network’s decentralized apps (dApps).

The rise in Open Interest also indicated bullish sentiment was rising in recent days.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-24 02:15