- Helium has recorded one of the highest gains in the market but has encountered a significant resistance hurdle.

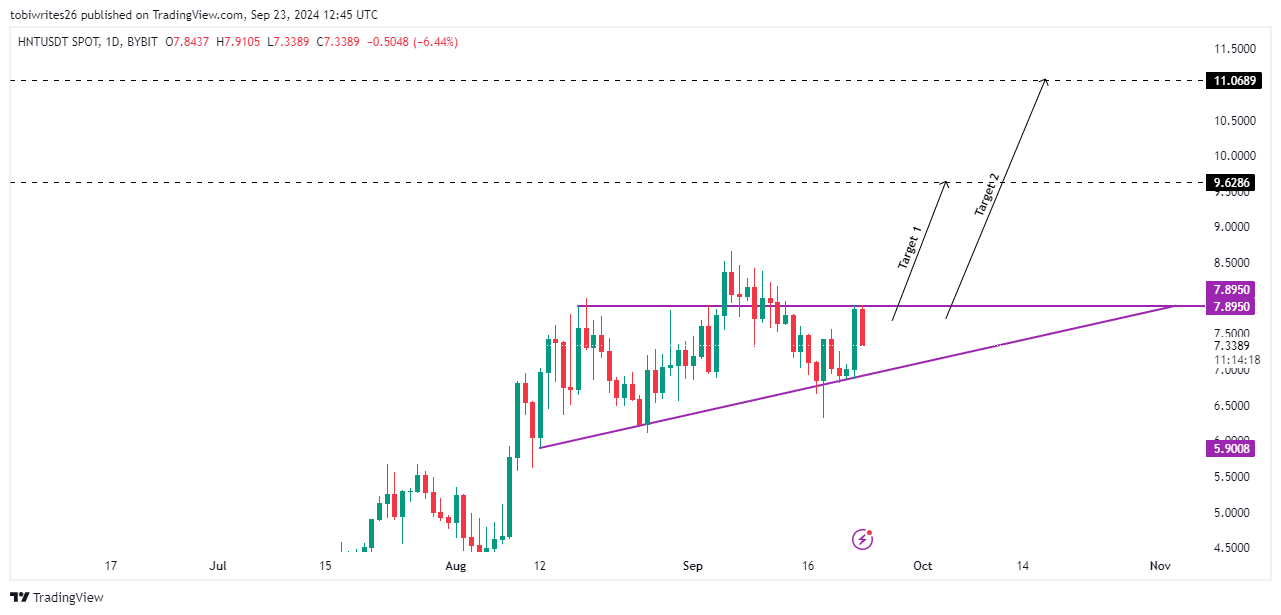

- This recent retreat from resistance is a strategic repositioning, as HNT traded within an ascending triangle, indicating a potential for an upcoming rally.

As a seasoned analyst with over two decades of market experience under my belt, I’ve seen my fair share of market patterns and trends. The current situation of Helium [HNT] is one that I find quite intriguing. Despite the recent retreat from resistance, HNT’s technical setup within an ascending triangle is a classic indication of a potential breakout to new highs.

Currently, Helium (HNT) is found in a pattern called an “ascending triangle” on the charts. This formation is created when there’s a convergence of horizontal resistance levels above it and a gradually sloping support line below. The presence of this structure could indicate a possible breakout towards higher prices, potentially reaching new record highs.

Even though this configuration, Helium (HNT) hasn’t been able to exceed the resistance point at $7.895, which has led to a slight reversal of its recent advancements.

In this pattern, it’s common for prices to pull back, usually dropping to the support area where they can build strength for a possible final surge.

In this potential development, HNT might consider reaching out to more ambitious price points that have historically shown high liquidity on its chart: approximately $9.628 and $11.068.

Helium bulls are active as key indicators confirm market strength

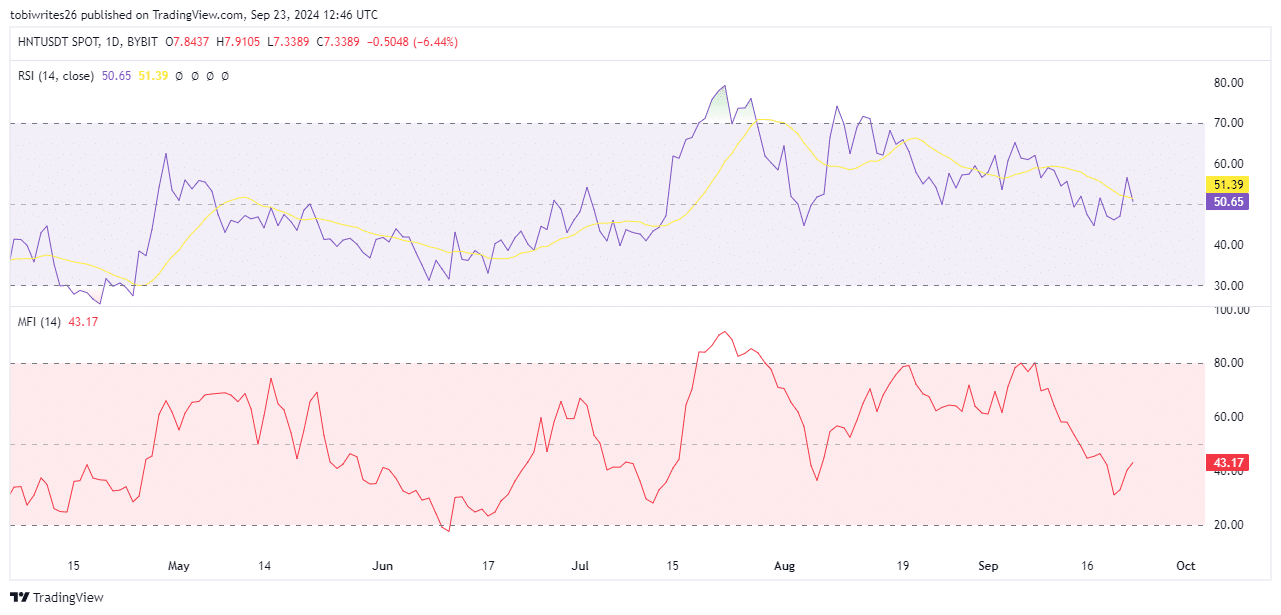

The presence of bulls in the market is confirmed by two major indicators: the Relative Strength Index (RSI) and the Chaikin Money Flow (CMF).

At the moment of check, the Relative Strength Index (RSI), a tool used to gauge the momentum and direction of price changes within a range of 0 to 100, stood at 50.65 for HNT. This suggests that HNT could potentially be poised for an uptrend.

Yet, the Relative Strength Index (RSI) showed a decline, hinting at a possible short-term drop preceding the expected rise, aligning with the current technical trend.

In much the same way, the Money Flow Index (MFI), a tool that quantifies the inflow and outflow of money associated with a particular asset, has significantly increased for HNT. This rise suggests that there is substantial buying activity or accumulation of this asset.

Triple-digit volume surge positions HNT as traders’ favorite

According to CoinMarketCap, the trading activity for HNT has significantly grown by about 136.5%. This surge suggests that traders are actively purchasing HNT, which in turn seems to be causing its price to go up as well.

Read Helium’s [HNT] Price Prediction 2024–2025

Furthermore, as reported by Coinglass, the Funding Rate continues to be positive, meaning that long traders are willing to pay an extra fee to keep their positions open. This suggests a high level of confidence in the market regarding potential future price increases.

If these favorable trends persist, it seems reasonable that HNT will keep moving upwards, aiming for its specified height.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Moana 3: Release Date, Plot, and What to Expect

- How to Get to Frostcrag Spire in Oblivion Remastered

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

2024-09-24 04:07