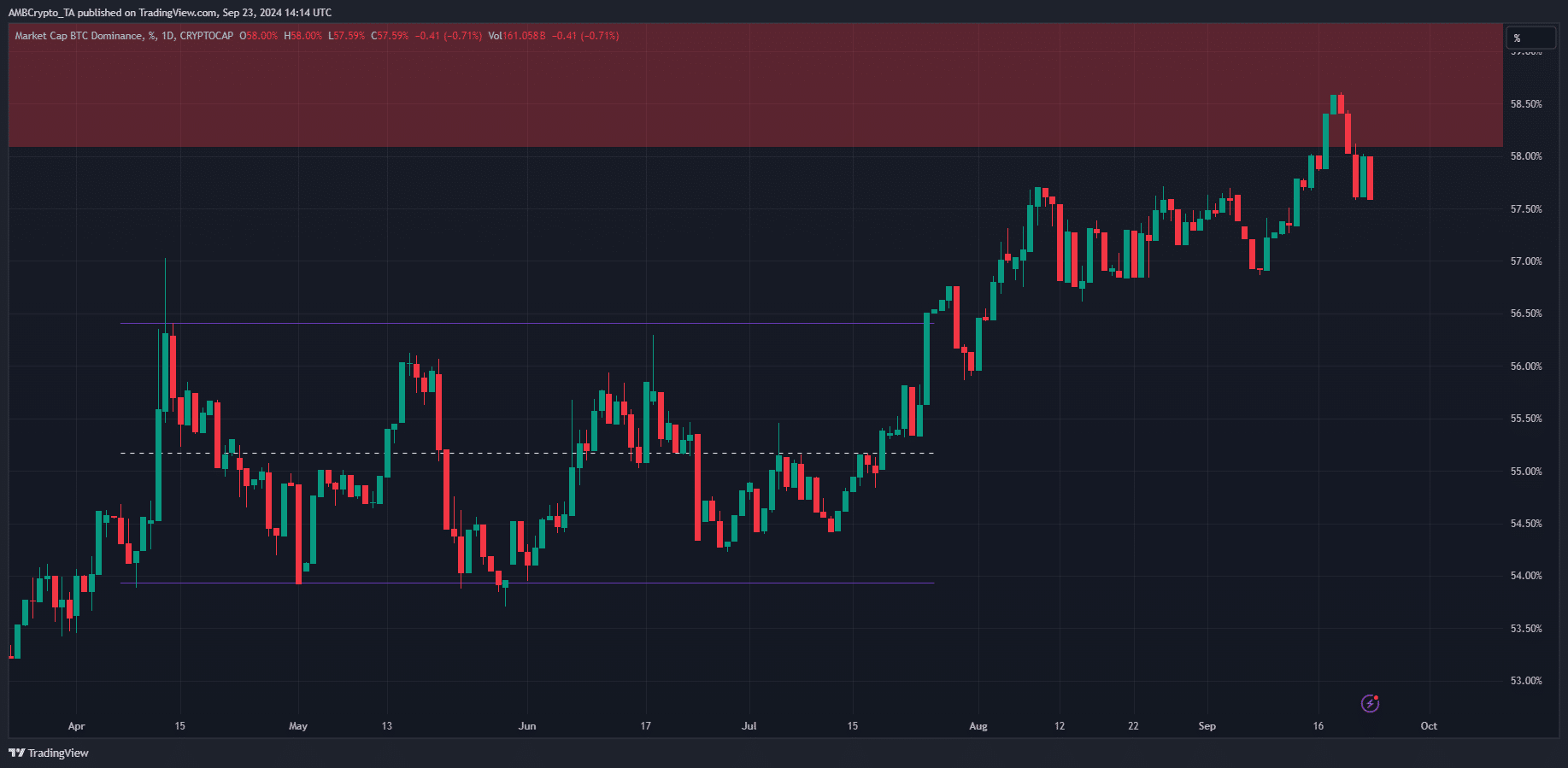

- The Bitcoin Dominance chart has reached a resistance zone.

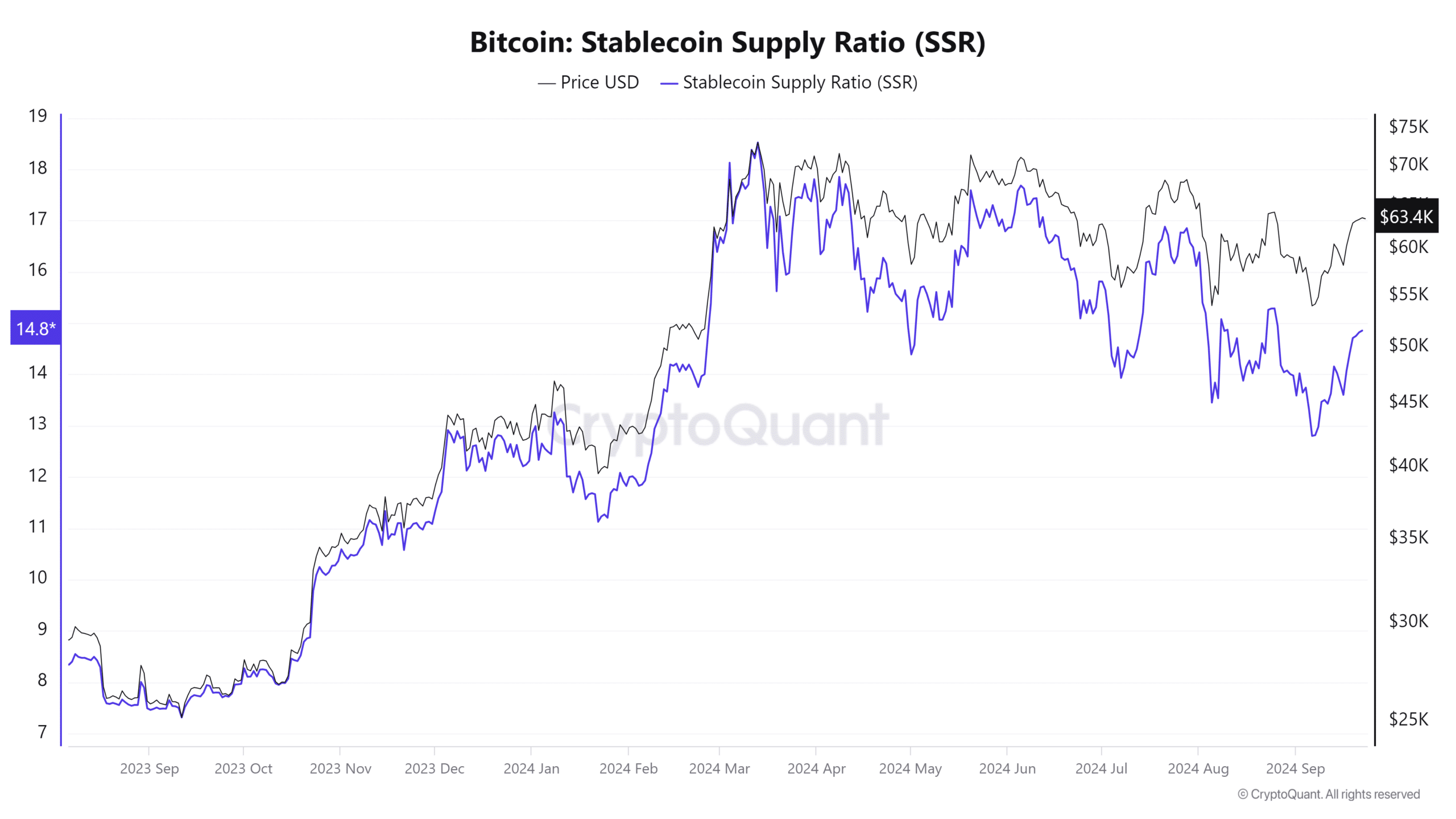

- The falling SSR metric agreed with the rising hopes of an altcoin season.

As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of bull and bear cycles. The recent surge in the crypto market has caught my attention, particularly the Bitcoin Dominance chart reaching a resistance zone. This is reminiscent of the classic wedge pattern I’ve seen in various asset classes throughout my career.

Starting from September 6th (Friday), the combined value of all cryptocurrencies has grown by approximately 20.33%. This surge took the market cap from $1,814 billion to $2,182 billion. A significant portion of this $368 billion growth can be attributed to Bitcoin [BTC].

As a researcher, I’ve observed an intriguing trend in the Bitcoin dominance chart. Initially, the metric increased from approximately 56.87% on September 8th, peaking at around 58.59% by September 18th. However, it subsequently retreated after encountering a resistance area just below the 60% threshold.

The significance of this resistance

As an analyst, I examine the Bitcoin Dominance (BTC.D) chart, which is a measurement of Bitcoin’s market capitalization in relation to the overall cryptocurrency market, encompassing top altcoins. An increase in BTC.D indicates that Bitcoin is outperforming the broader market, suggesting that it holds a more significant share of the total crypto space.

On X’s latest post, cryptocurrency analyst Ali Martinez pointed out that the dominance chart appears to be forming a rising wedge pattern, which might have reached its peak under the 60% resistance level. A decrease in Bitcoin’s dominance could signal funds moving towards alternative coins (altcoins).

Such a scenario might result in an “altcoin boom,” a time when long-term investors in altcoin initiatives stand to reap substantial profits.

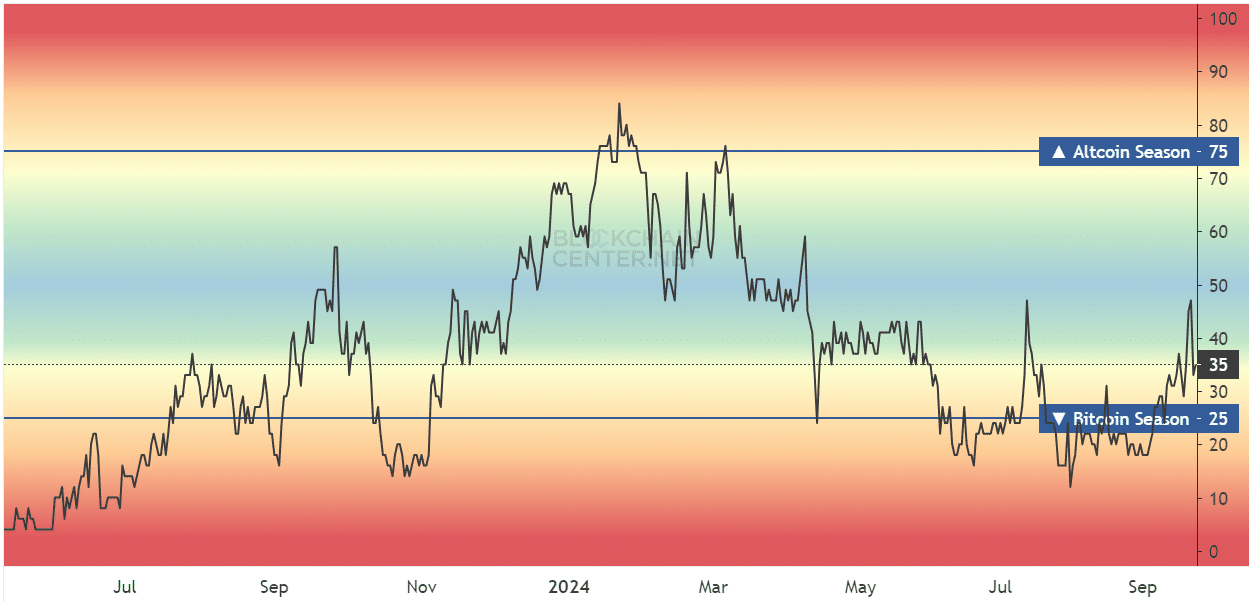

According to the Altcoin Season Index, we’re currently at a level of 35, but a score of 75 is what’s needed for an ‘altseason.’ For those invested in the cryptocurrency market over the long term, this increasing number could be seen as a positive sign.

Stablecoin clue that the market is ready for an altcoin season

It appears that the trend in the stablecoin supply ratio indicates a potential upcoming period where altcoins may gain more attention, often referred to as “altseason.” This is because the value of all stablecoins combined has been increasing compared to Bitcoin’s market cap, as shown by the descending pattern in the metric.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Consequently, this suggests that purchasing power in the market has grown. As a result, it’s plausible that prices might escalate throughout the altcoin market.

Nevertheless, the readings from this metric fall significantly short of the levels reached during the October 2023 lows that sparked the last rally.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-09-24 10:15