-

Ethereum ETFs struggled with consistent outflows, led by Grayscale’s ETHE, impacting overall net flows.

Despite ETF outflows, ETH price showed resilience, maintaining bullish momentum above the neutral RSI.

As a seasoned crypto investor with a knack for deciphering market trends, I find myself intrigued by the recent developments surrounding Ethereum ETFs. The consistent outflows from Grayscale’s ETHE have been a cause for concern, especially considering its significant impact on overall net flows. However, it’s essential to remember that the crypto market is notorious for its volatility and unpredictability, so I wouldn’t be surprised if these trends reverse themselves overnight.

Ever since their launch on the 23rd of July, Exchange-Traded Funds (ETFs) based on Ethereum [ETH] have found it tough to match the performance of their Bitcoin [BTC] counterparts. They’ve been unable to maintain a steady inflow due to persistent challenges.

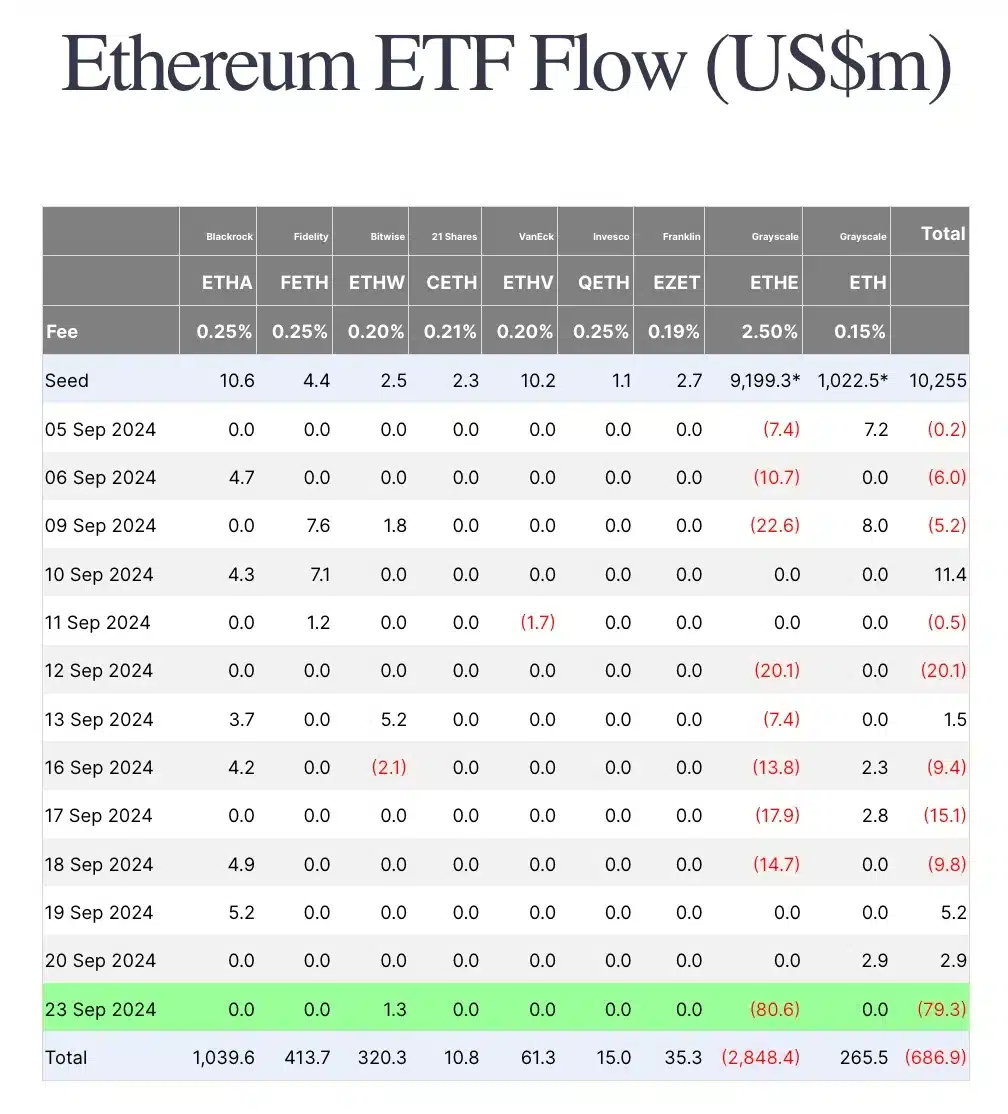

As a researcher, I’ve noticed an unexpected pattern with ETH ETFs. Rather than consistently attracting investments, they’ve been experiencing recurring withdrawals. This trend reached its peak on the 23rd of September, recording a significant daily outflow of $79.3 million – the largest single-day withdrawal since the 29th of July.

The recurring pattern in question has sparked debates and worries among cryptocurrency enthusiasts, leading them to ponder if Ethereum can halt this trajectory or if the ongoing exodus will persist as the primary trend.

ETH ETFs face massive outflows

The major withdrawals from Ethereum Exchange-Traded Funds (ETFs) are predominantly influenced by Grayscale’s ETHE, as it has recently experienced a substantial withdrawal of approximately $80.6 million.

Contrasting the situation, neither Blackrock’s ETHA nor any other ETF focused on Ethereum (ETH) showed any inflows during that particular timeframe. However, Bitwise’s ETHW was the only one to register a small inflow of approximately $1.3 million.

Upon a detailed examination of the data, it is evident that the majority of Ethereum ETFs typically don’t see much activity, with occasional influxes coming from ETHA and at times from Fidelity’s FETH and ETHW.

Consequently, the high rate at which ETHE is flowing out has caused the total net flow to fall below zero.

Total flow since launch — explained

On the 23rd of September, it was observed that ETHW had acquired a total of approximately $320 million in net purchases. Moreover, their Ether holdings surpassed 97,700 coins, which translates to an estimated value of around $261 million based on current market prices.

Furthermore, ever since it was first established, Blackrock’s ETHA has become the top Ethereum ETF in terms of investment inflows, accumulating a grand total of $1,039.6 million, surpassing all other similar funds.

Contrarily, Grayscale’s ETHE has experienced substantial difficulties, with a staggering total outflow of $2,848.4 million – a figure that surpasses the combined outflows of all other ETH-based ETFs, which cumulatively amount to just $686.9 million.

Community sentiment

This significant difference showcases varying attitudes and returns among Exchange-Traded Funds (ETFs) focused on Ethereum, illustrating the diverse opinions of investors.

Remarking on the same, an X user noted,

On September 23rd, the daily ETF data indicates a substantial withdrawal, primarily from the ETHE fund, with a reduction of approximately $80.6 million. This trend seems to imply that investors may be shifting away from Ethereum-centric ETFs.

Adding to the fray was another X user who said,

ETH price action

On the 23rd of September, Ethereum (ETH) showed strength as it increased by 3.02%, reaching a trading price of $2,656.39. This significant growth was noticeably different from the behavior exhibited by ETH exchange-traded funds (ETFs).

However, at press time, ETH was down by 0.75%, trading at $2,635.08 as per CoinMarketCap.

Significantly, the Relative Strength Index (RSI) stayed above the non-biased threshold of 59, implying that the positive trend is still in control, even with temporary setbacks.

It seems that these short-term drops might be temporary and should not obscure the generally optimistic view on Ethereum (ETH). This implies that the present downward trends may not signal a shift to a long-term bearish trend.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-09-24 20:08