As a seasoned analyst with over two decades of trading under my belt, I’ve seen bull markets rise and bear markets fall, but Dogecoin [DOGE] has consistently caught my eye due to its resilience and potential for long-term gains.

Dogecoin (DOGE) is maintaining its resilience, similarly to other digital currencies, as investors look forward to a potentially bullish Q4 due to the increased adoption and integration of blockchain technology within the financial sector.

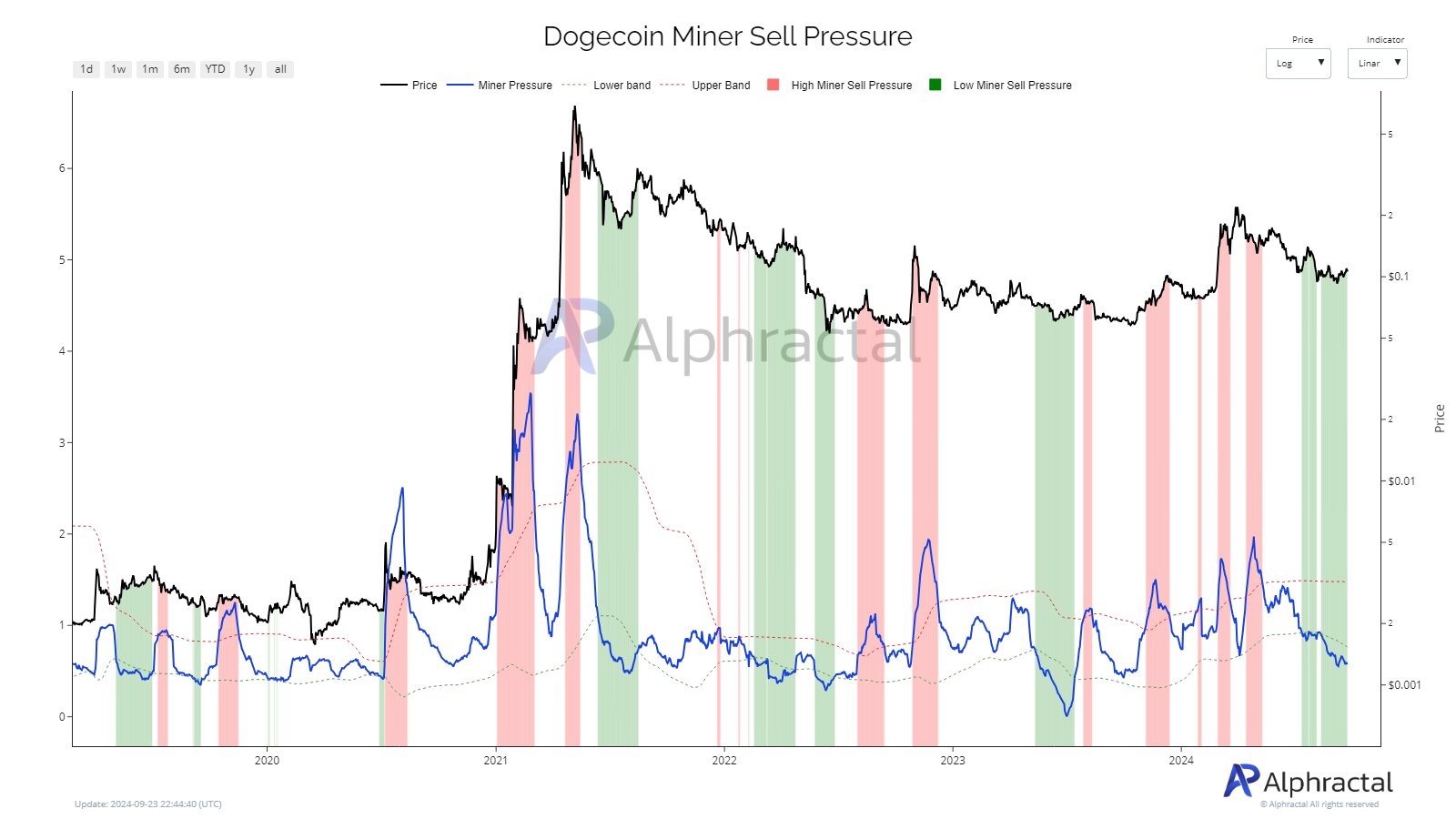

Dogecoin miners appear to be skillfully navigating the market by selling the coins they mine during price surges.

It seems like the sell indicators are taking their time to appear, suggesting that miners are keeping their Dogecoins for a longer duration before deciding to trade them.

A relatively light demand for Dogecoin could indicate an impending price surge, since tranquil phases like this have typically been followed by substantial increases in Dogecoin’s value based on past patterns.

Could DOGE be gearing up for a price spike?

Dogecoin’s long-term outlook

As a crypto investor, taking a close examination of the weekly Dogecoin chart suggests we might be on the brink of an expansion period. Historically, this phase repeats itself in every cryptocurrency cycle, lasting approximately 90 days and potentially pushing DOGE to reach unprecedented new peaks.

The chart indicates three consecutive weeks of green candles, supporting the idea of DOGE price growth. If this trend continues, a conservative estimate suggests DOGE could reach $0.15 by the end of 2024.

If historical patterns persist, Dogecoin (DOGE) may potentially rise to $0.5 by March 2025. In a bullish trend, it might even climb up to $0.75 by the end of the same year.

If you’re planning to hold Dogecoin for the long term, now might offer an advantageous buying opportunity since the price is hovering above a robust support level on larger time scales.

The rising level of this support suggests that the relatively light selling from Dogecoin miners might be a sign of tranquility before a potential storm, implying that a significant price surge could occur soon.

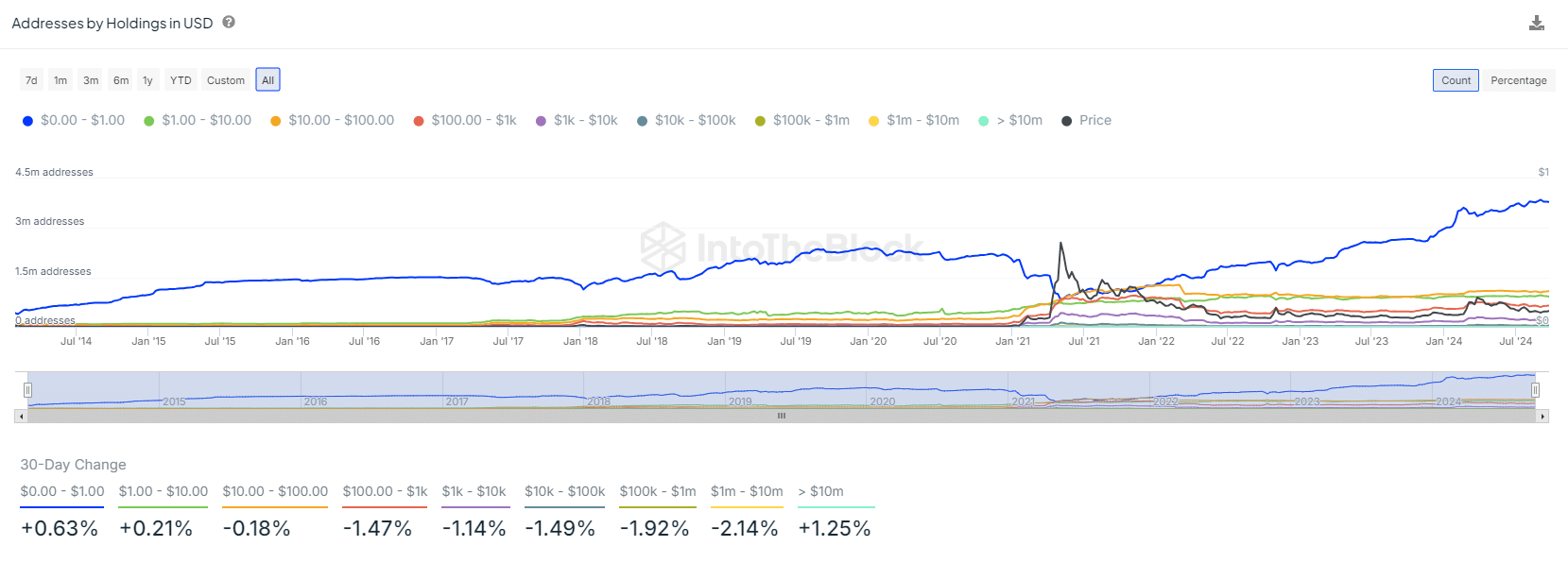

Balance by holdings looking good for whales

Large Dogecoin investors, owning more than $10 million worth of DOGE, have boosted their investments by a significant 1.25%. This surge in whale behavior suggests a growing optimism among these major investors about Dogecoin, strengthening its bullish perspective.

It suggests significant players are preparing for a potential price surge.

Despite minor drops in DOGE held by other categories, these changes have only a small effect overall. Since whales hold most of the circulating DOGE, their declines have less impact on the total market significance.

Nevertheless, it’s advisable for traders to tread carefully with Dogecoin (DOGE), making sure they have a well-thought-out plan before engaging in transactions.

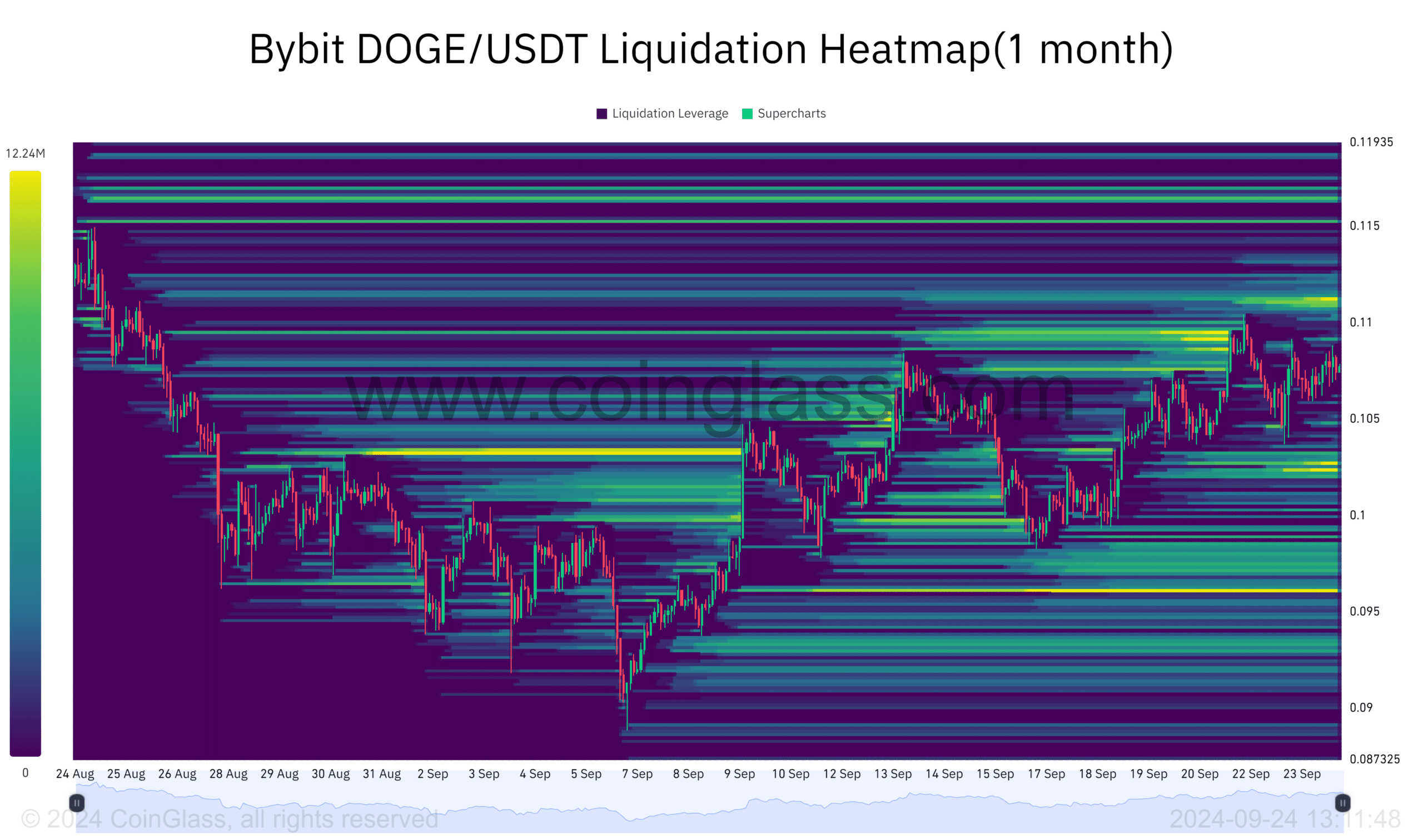

Key liquidation levels and price targets

Another factor to fuel DOGE’s upward movement is the significant concentration of liquidation levels above the $0.11 mark.

Approximately 30.93 billion Dogecoin is currently held in short positions by some whales within this particular area, according to a previous analysis by AMBCrypto.

As it becomes simpler to surpass these liquidation levels, the Dogecoin (DOGE) price might rise significantly due to an increase in short positions being forced to close.

As DOGE nears these points, traders might notice an uptick in market fluctuations. If DOGE manages to surpass these levels, it could potentially ignite a swift climb upward.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

It appears that the cost of Dogecoin might increase since there’s little demand for selling it, and large investors (whales) are still amassing Dogecoins.

Under the right circumstances and careful planning, Dogecoin could potentially experience another price surge. This is largely due to heightened whale activity and advantageous market situations.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-09-25 07:04