-

Analysts expressed views on BTC’s sensitivity to global liquidity conditions.

BlackRock’s Mitchnick saw BTC as a ‘risk off’ asset; Alden viewed it as a ‘risk on gold.’

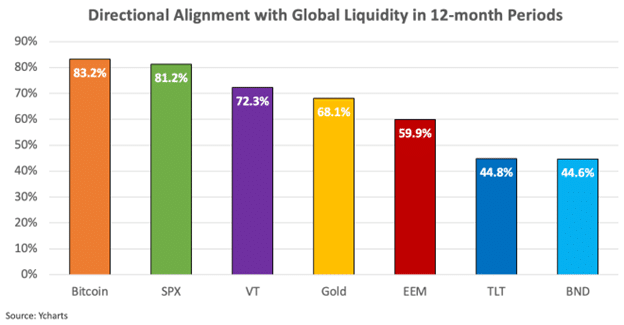

As a seasoned crypto investor with over a decade of experience navigating global financial markets, I have learned to keep a keen eye on macroeconomic conditions and their impact on digital assets. Based on the insights from analysts such as Lyn Alden and Robbie Mitchnick, it seems that Bitcoin can be categorized as a ‘risk-on’ asset for now, reacting 83% of the time to global liquidity conditions.

According to reports, Bitcoin (BTC) appears to be more affected by global liquidity situations compared to gold and other types of assets.

In the view of well-respected macro analyst, Lyn Alden, Bitcoin (BTC) tends to respond approximately 83% of the time to global liquidity situations, more so than any other asset.

“Bitcoin moves in the directional of global M2 83% of the time; more than other assets.”

BTC: A ‘risk on’ or ‘risk-off’ asset?

As an analyst, I’ve observed that U.S. equities, specifically the S&P 500 (SPX), exhibit a strong response to global liquidity conditions, ranking just behind the top asset in this regard. On the other hand, gold finds itself placed fourth among assets reacting to these conditions.

This suggests that Bitcoin (BTC) tends to thrive as a ‘risk-taking’ asset, delivering stronger performance when interest rates are at their lowest or during periods when quantitative easing is implemented.

That also suggests that BTC is less of a relative hedging asset than gold. Per Alden, BTC is ‘risk-on gold’ because it’s new sound money, but some capital allocators have limited understanding of it and treat it as a ‘risk-on’ asset.

She also pointed out that the link between Bitcoin (BTC) and other factors might persist for an additional 5-10 years, after which it may start behaving more like gold.

If it grows significantly, there’s a possibility it might lean towards a gold-like correlation, and that relationship isn’t too distant.

Speaking from my own perspective as a crypto investor, I find it intriguing that Robbie Mitchnick, the Head of Digital Assets at BlackRock, views Bitcoin (BTC) as a ‘risk-off’ and hedging asset. In simpler terms, this means that BTC could potentially thrive in times of economic instability or market turmoil. This perspective provides valuable context for understanding the role of digital assets like Bitcoin in an investor’s portfolio.

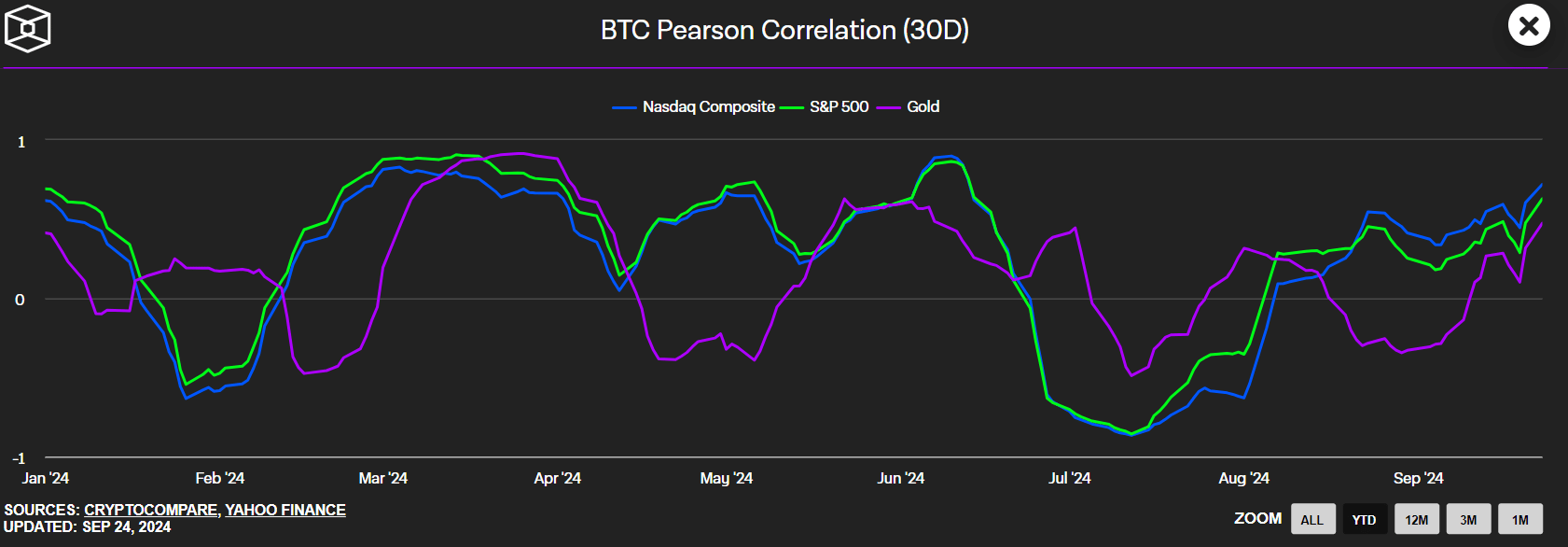

According to Mitchnick’s analysis, Bitcoin (BTC) and gold typically show minimal long-term connections with U.S. stocks. However, there can be brief and transitory instances where they display a positive value association.

Regarding Bitcoin, it’s often seen as a potential worldwide financial substitute…A scarce, universally accessible, decentralized asset that isn’t tied to any nation and carries no country-specific or counterparty risks.

According to Mitchnick, increasing inflation and investor anxieties over the financial stability of the U.S. government could act as significant factors fueling the growth of Bitcoin, positioning it as a ‘safe haven’ or ‘risk-off’ asset.

It’s been a topic of continuous discussion if Bitcoin (BTC) could be considered a superior form of money with greater growth possibilities than gold.

In the near future, Alden’s predictions appear more plausible since Bitcoin tends to behave as a ‘high-risk’ investment asset.

It’s worth noting that as the third quarter progressed, there was an increasing positive relationship between Bitcoin and U.S. stock markets, according to the Pearson correlation calculated for Bitcoin.

Instead, it’s possible that Bitcoin’s price fluctuations might reflect upcoming changes in the U.S. Federal Reserve’s monetary policy, rather than significant cryptocurrency events in the short term.

Essentially, the upcoming release of U.S. PCE (Personal Consumption Expenditure) data, scheduled for the 27th of September, is expected to significantly impact the volatility of Bitcoin.

Furthermore, the ongoing Chinese economic stimulus and anticipated monetary easing are likely to positively impact Bitcoin over the short-term period.

In other words, keeping tabs on this front could prove beneficial when it comes to developing a broader approach to risk management for those who invest in or trade Bitcoin.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-25 20:08