-

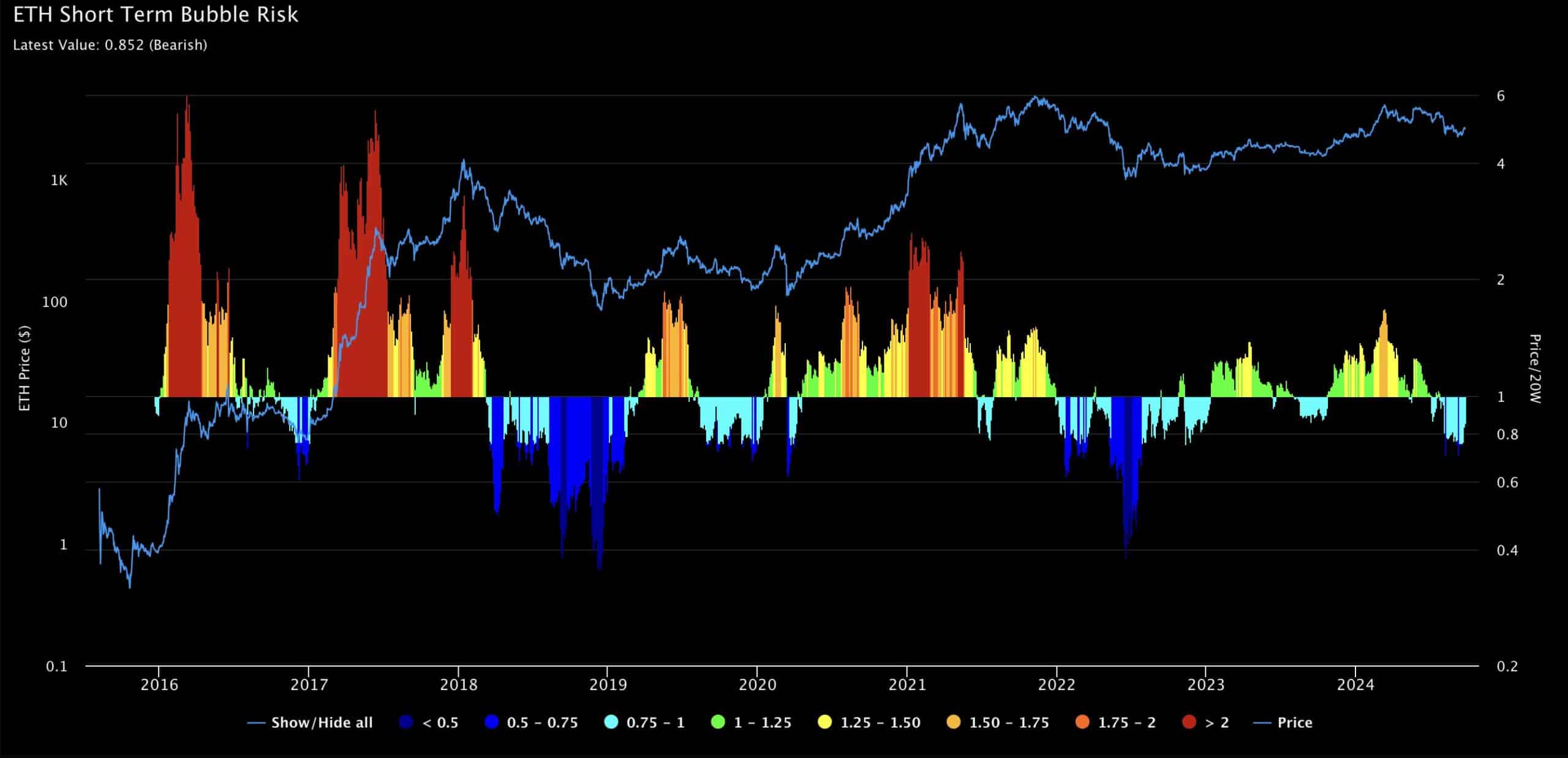

Ethereum’s short-term bubble risk signaled bearish sentiment.

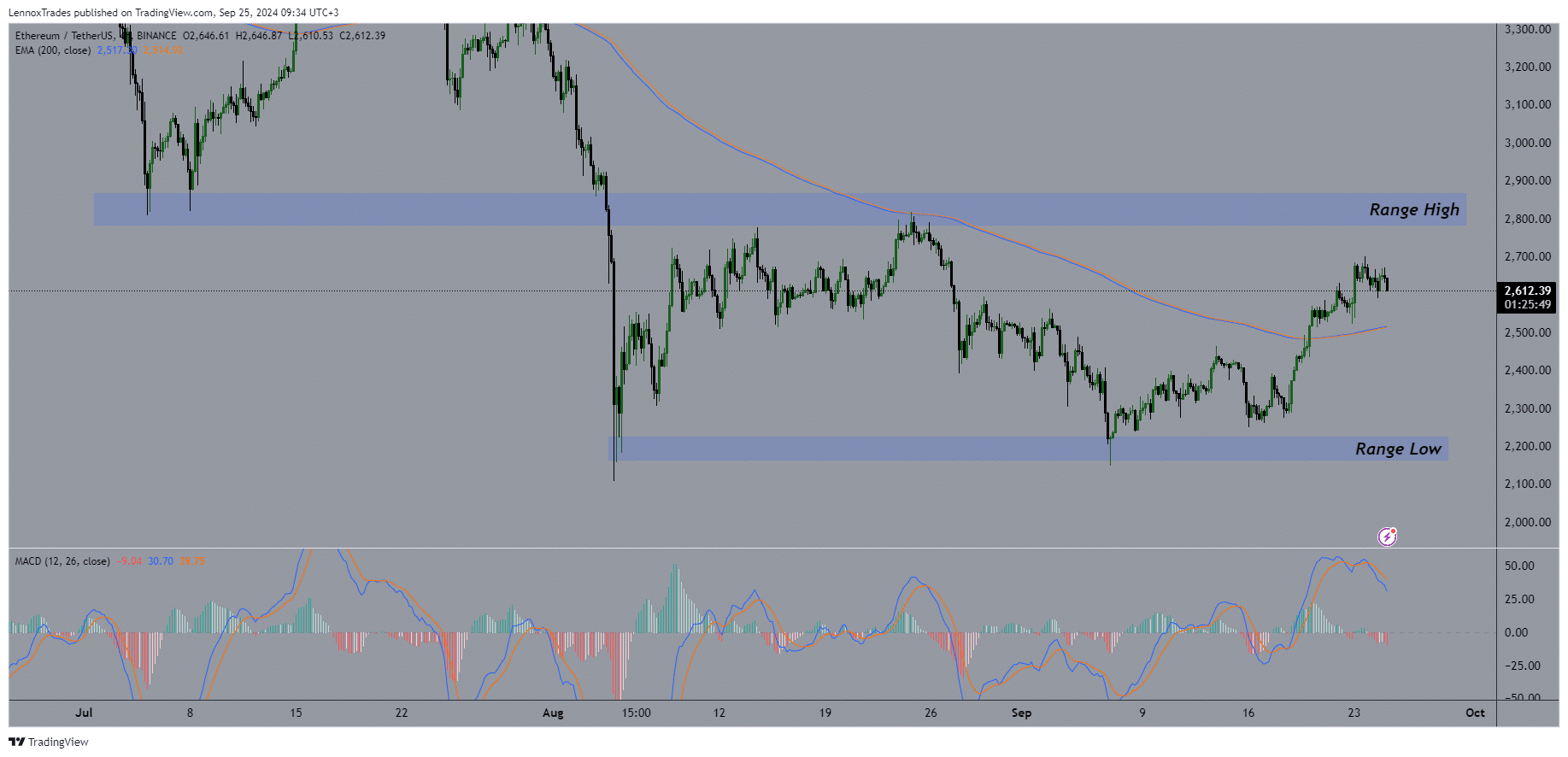

On the other hand, ETH flipped the 200 EMA on the 4-hour timeframe.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless bull and bear cycles. Observing Ethereum’s current state, I can sense that Q4 2024 is shaping up to be an exciting time for ETH investors.

As the fourth quarter of 2024 draws near, there are signs suggesting that the attitude towards Ethereum (ETH) in the market may become more optimistic and potentially bullish.

According to analysis by AMBCrypto, Ethereum may experience temporary price swings as its Short-Term Bubble Risk indicator has turned bearish.

This implies that a short-term adjustment or correction might occur soon, even though the general sentiment remains optimistic for the wider cryptocurrency market.

As a crypto investor, I find it hard to imagine an immediate shift towards a bearish outlook without any major market occurrences. At the moment, the optimistic vibe dominates, driving the conversation. As we approach Q4, the question that lingers is what the future holds for ETH, keeping us on our toes.

Ethereum in correction

By examining the ETH/USDT exchange, it appears that Ethereum has just surpassed its 4-hour 200 Exponential Moving Average (EMA), which is an essential signal for both short and medium-term tendencies.

At the current moment, the price had reached a peak of around $2,800, an important threshold for Ethereum (ETH). If it manages to surpass this level, it could potentially signal the end of the temporary downtrend that has been confirmed.

Should Ethereum surpass its current level, it might be indicative of a progression towards the $3,000 price point.

Yet, the MACD (Moving Average Convergence Divergence) indicator is suggesting a downward trend at present, as it indicates that the selling pressure is greater than the buying pressure, hinting that Ethereum may require additional time to build momentum for a potential bullish turnaround.

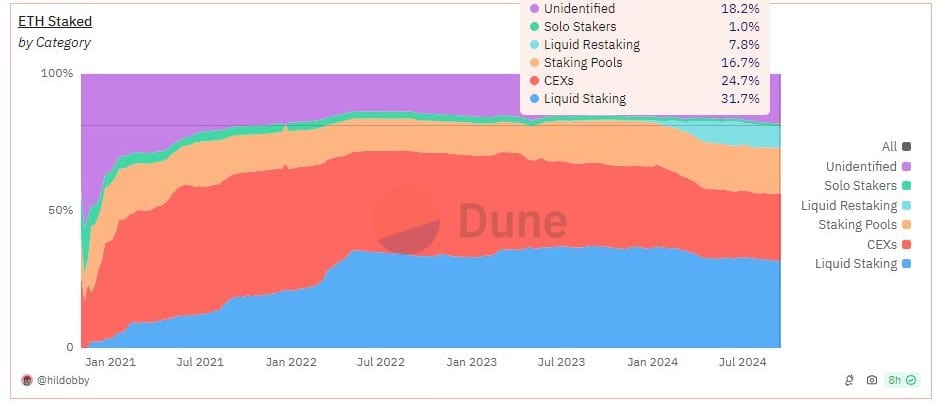

Buterin on solo staking in ETH

To enhance safety measures, the co-creator of Ethereum, Vitalik Buterin, has put forth suggestions aimed at minimizing possible weaknesses. These include deterring threats from corruption of major node operators and encouraging more independent validators (solo stakers).

Buterin’s post on X, formerly Twitter, read,

“Some thoughts on solo staking, what realistic value solo (+ small-business and community) stakers could provide to the network, and what changes L1 can make to better support solo stakers.”

Solo stakers are essential in maintaining Ethereum’s decentralization and censorship resistance.

Because they aren’t affiliated with big corporations, individual validators (solo stakers) tend to be less influenced by regulatory pressures, thereby reducing the risk of transaction suppression.

As an analyst, I too recognize the crucial part they play in thwarting the confirmation of transactions to a considerable extent, which is approximately 67%. This vital function serves as a robust line of defense, preventing malicious actors from seizing control of the network without suffering substantial consequences.

This development in ETH staking means that mitigating risk in staking would mean bullish for ETH.

Social dominance and trading activity

Moreover, data from Santiment shows that the market worth of Ethereum has surged back up to around $2,700, sparking increased enthusiasm for ETH on social media and trading sites.

The increased usage and borrowing of Ethereum (ETH) in digital wallets has reached a 7-week peak, indicating a potential increase in ETH’s value when the temporary downturn ends.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Ethereum continues to be poised for possible future expansion as it progresses through its current period of minor setbacks.

With an uptick in market action, especially noticeable enthusiasm on social media and trading platforms, it’s reasonable to expect that the price of Ethereum will continue to climb in the upcoming months.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-25 21:12